Huawei CASE (Connected, Autonomous, Shared, Electrified) Layout and Strategy Research Report, 2020

Research on Huawei's CASE (Connected, Autonomous, Shared, Electrified): Who is the main rival of Huawei in automotive engagement?

Huawei showcased its automotive products at Beijing International Automotive Exhibition 2020 (Auto China 2020) held in Beijing from September 26 to October 5, 2020, where Huawei’s ambition in CASE can be clearly seen.

It is generally believed that Bosch is to be the real competitor of Huawei’s automotive involvement.

Huge gap between Huawei and Bosch in automotive business

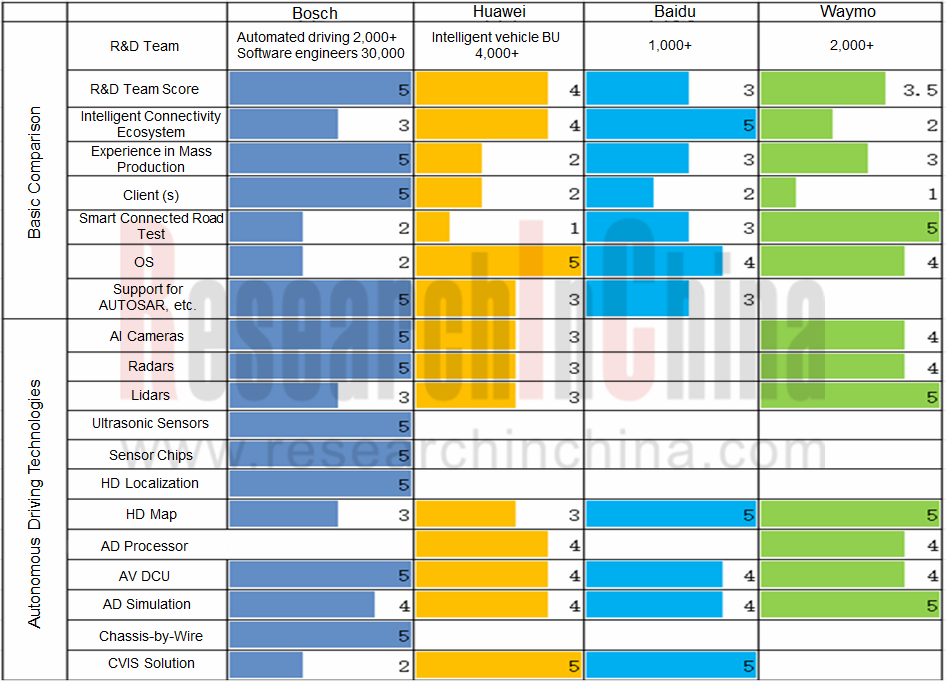

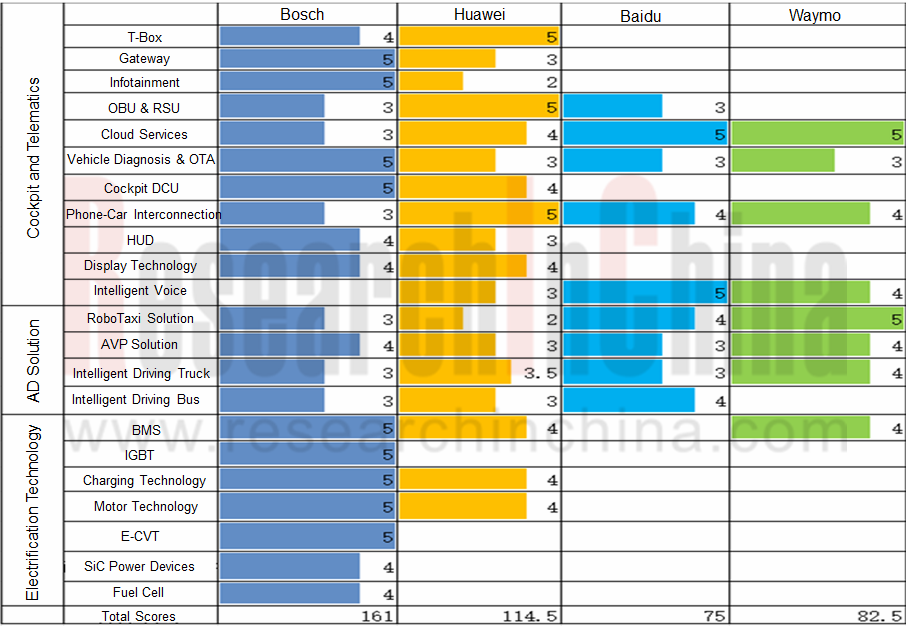

ResearchInChina singles out 41 CASE indicators and compares them to assess such players’ CASE capabilities as Bosch, Huawei, Baidu, and Waymo.

Judging from final scores, Bosch in possession of 30,000 software engineers stays far ahead of other peers. Bosch is scheduled to lavish €4 billion into autonomous driving (AD) between 2019 and 2022, with the rising number of 2,000 AD engineers in 2019 to 4,000 ones till 2022. It is conceivable that Bosch as the leading CASE vendor will be hardly challenged within five years.

In respect of hardware, the top four emerging Chinese automakers select Bosch, and embrace BAT (Baidu, Alibaba, Tencent) as concerns software and application ecosystem.

The traditional OEMs like SAIC, Great Wall Motor, Geely and BYD have established own intelligent connectivity subsidiaries successively, attempting to develop core systems such as domain control unit (DCU), underlying layer and mid-layer software independently.

Actually, the traditional OEMs’ engagement in the development of core systems makes Tier-1 suppliers (struggling to find a new position, and most of whom are in the red with gloomy prospects) ever less viable.

The traditional automakers are desperately seeking for a transition as competition pricks up. As long as a Tier-1 supplier makes a success in a case of product use for a carmaker, there will be an inrush of orders from other automakers. For instance, Desay SV’s orders from Changan Automobile and Chery come of its multi-screen cockpit solution availability onto Leading Ideal ONE

Although with a complete product matrix, Huawei’s most products except T-Box, V2X and MDC platform have not been spawned yet. Huawei is painfully aware of a rather high threshold for access to the automotive sector, in readiness for no profits in six years.

Huawei has BAT (Baidu, Alibaba, and Tencent) as the realistic opponents

Huawei is inferior to Bosch whatever customer relationship, technical accumulation, R&D input or experience in mass production. So, Huawei is still not competent enough to threaten Bosch.

Like BAT, Huawei is just a peripheral supplier for mainstream passenger car makers, with production cooperation still in cockpit and telematics.

Goosed by vibrant players like BAT, China stays two years or three ahead of foreign countries when it comes to cockpit and Internet of Vehicle (IoV) technology application. Based on this, Huawei and BAT are turning to be the suppliers of incremental components.

As the development route of cooperative vehicle infrastructure system (CVIS) prevails in China, there is a huge Chinese market of road side perception and decision systems for intelligent transportation and smart roads. It’s just a matter of time to foray into vehicle with enough experience in roadside perception and decision since it hardly poses any threat to Bosch for the moment.

In this sense, Huawei has the realistic competitors in the recent years such as BAT and HikVision that are absorbed in cooperative vehicle infrastructure system (CVIS).

How will Huawei win out?

By referring to rivalry in the process of featured phones to smart phones, the vast majority of startups and tier-2 suppliers in the intelligent connected vehicle (ICV) field will be predictably eliminated in cut-throat competition, and only three or five of them will survive and there will be an oligarch in the intelligent vehicle computing platform market then when components will be standardized, plug and play alongside a thriving software application ecosystem.

Huawei is ambitious to be an ultimate winner, with strides in autonomous driving integrators and commercial vehicle manufacturers already.

It is with the help of Huawei MDC platform that Momenta and HoloMatic developed HWP and AVP solutions for passenger cars; that CiDi (Changsha Intelligent Driving Institute Ltd.) developed intelligent heavy truck solutions; that Neolix developed self-driving delivery system; that DeepRoute.ai developed the solution for container trucks at ports; that i-Tage Technology Co., Ltd. and WAYTOUS developed autonomous mining truck solutions.

In early 2019, Yutong Bus signed a memorandum of understanding (MOU) with Huawei about building a bus automated driving computing platform by leveraging Huawei’s MDC technologies and its automated driving technologies for buses.

In April 2019, FOTON joined forces with Huawei in developing commercial-scale intelligent driving computation platform for production models inclusive of heavy truck, medium truck, light truck, pickup, bus and van.

In May 2019, FAW Jiefang inked a deal with Huawei about joint efforts in 5G-enabled telematics, intelligent driving, rich communication suite (RCS), cloud services, among others.

In June 2019, JMC Group signed a strategic cooperation agreement with Huawei about collaborating on automotive electrification, intelligence, telematics and the technologies concerned.

In July 2020, Yutong Bus signed a contract with Huawei about joint efforts in fields like telematics platform development, intelligent driving, new energy, intelligent public transport and smart sanitation vehicle whilst pushing ahead with project implementations in a plurality of commercial vehicle scenarios.

Overall, Huawei’s automotive business route is to first encroach on the peripheral markets and then encircle the key markets. Huawei helps the ecosystem partners massively use MDC platform and impress clients with the superiority of its computing platform and ecosystem to other computing platforms, offering air support from 5G and C-V2X technologies as well as governmental demonstration projects and ‘1+8+N’ all-scenario strategy.

Huawei needs to succeed first in commercial vehicle and special vehicle fields and then acts as a full supporter for two to three Chinese passenger car makers (like BAIC Motor and BYD) from whom it makes handsome sales, with a possibility of access to the supply chain of influential passenger car makers. Only acceptance from the leading OEMs can Huawei MDC become one of the mainstream intelligent vehicle computing platforms on the Chinese market. This will take about five to eight years.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...