Research on Commercial Vehicle ADAS: Truck ADAS is a Stagnant Market and Bus Welcomes CVIS

Commercial Vehicle ADAS Industry Report, 2020 highlights ADAS use by leading bus and truck OEMs and status quo of commercial vehicle ADAS suppliers.

Commercial vehicle (incl. bus and truck) are easy to cause accidents on account of large size, more blind spots and driver’s fatigue. ADAS functions like emergency braking system, lane keeping system, and driver monitoring system are however effective solutions to fewer accidents.

Commercial vehicle ADAS by function can be divided into warning, control and connection types. ADAS features for connectivity are advanced driver assistance capabilities coming out with the progress in intelligent transport, smart city and vehicle telematics technologies, and still under improvement.

Commercial Vehicle ADAS Delivers Single Functions and Lags Behind Passenger Car ADAS in Development

Commercial vehicle model update is far slower than passenger car due to relatively low total sales. Commercial vehicle ADAS offers single functions and falls behind passenger car ADAS in application.

Take China’s passenger car market as an example, L2 models have seized over 15% of total sales, compared with L2 trucks which are just spawned. Zhu Qixin, the general manager of FAW Jiefang, argues that L2 trucks will be promoted from 2021 to 2023.

ADAS capabilities on mass-produced trucks are led by ACC, AEBS, LDW, DMS, FCW and blind spot monitor (BSM).

The new Mercedes-Benz Actros is the world’s first series produced truck enabling L2 autonomy at all speeds. In September 2020, Daimler released its fifth-generation emergency braking assistant Active Brake Assist (ABA 5). With synergy between radar and camera systems, if ABA 5 recognizes the danger of an accident with a preceding vehicle, a stationary obstacle or a pedestrian that is either oncoming, crossing, walking in their own lane or suddenly stopping in shock, an optical or acoustic warning can be issued to the driver first. If the driver does not respond adequately, in a second stage the system initiates partial braking with 3 meters per second – around 50 percent of the maximum braking power. If the threat of a collision continues, ABA 5 can execute automatic maximum full-stop braking within the system limits. Under certain preconditions it actively supports the driver in the longitudinal and lateral guidance of the truck and can automatically maintain the following distance, accelerate and steer.

In late 2019, “Zhitu Pilot”, an intelligent driving assistance system for FAW Jiefang J7 high-class intelligent heavy truck, made a debut. The system offers such ADAS features as lane keeping system (LKS), ACC, AEBS, driver fatigue detection and forward collision warning (FCW). For hardware, the vehicle is added with radars and cameras, with price not much higher than Jiefang J7 general version.

At the end of 2019, Shaanxi Automobile Group Co., Ltd. unveiled Delong X6000, a heavy duty truck packing ADAS functions like LDW, DMS, environmental monitoring system, ACC and AEBS.

A combination of factors are behind slow application of commercial vehicle ADAS, one of which is the restriction from drive-by-wire chassis. It is easier to use ADAS for warning while applying ADAS functions for control requires chassis-by-wire open enough and lower threshold. WABCO and Knorr are the two key Tier 1 suppliers of commercial vehicle steering and braking systems. Chinese commercial vehicle OEMs are also awaiting mature homemade chassis-by-wire solutions. Examples include Zhejiang Vie Science & Technology Co., Ltd. whose chassis-by-wire solution is being tested.

In Light Bus Market, ADAS Functions Help SAIC Maxus Outrun JMC Transit in Sales.

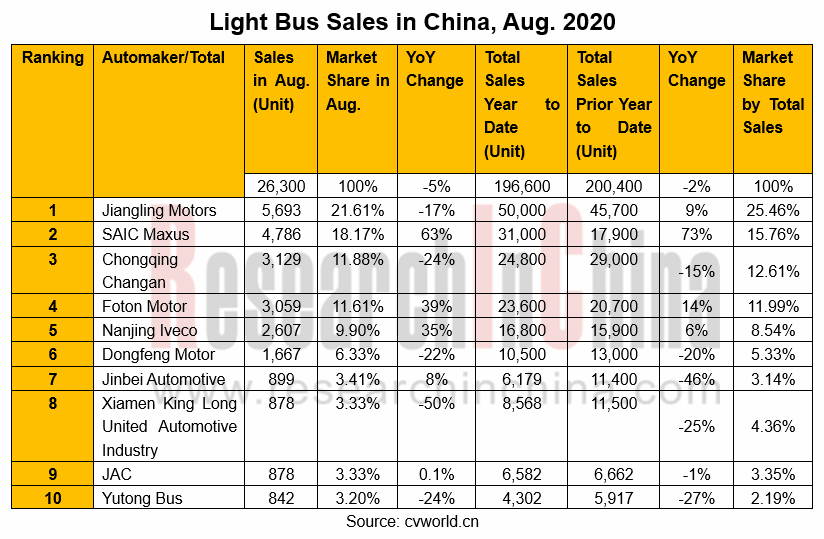

In the first eight months of 2020, 197,000 light buses were sold in China, down 1.9% from the prior-year period. In August, SAIC Maxus enjoyed the biggest growth of up to 63% in sales, while Jiangling Motors suffered a 17% slump.

Besides excellent power performance, better ADAS configuration of SAIC Maxus also helps a lot.

Maxus V90 configured with ACC, AEB, LDW and FCW offers capabilities like blind spot monitor and lane change assist (LCA). Bosch ESP version 9.3 provides active safety protection that rivals high-class cars. Maxus RV90 C using V90 chassis has such safety and comfort configurations as smart start/stop, ACC, AEB, LDW, streaming media rearview mirror, LED automatic headlamps, and automatic wiper.

JMC Transit currently offer just minimum security configurations such as Bosch ABS+EBD+ESP version 8.0 and packs reversing radar but without backup camera. LCA, LDW and FCW are also unavailable.

To narrow its ADAS gap with others, Jiangling Motors Corporation (JMC) rolled out Transit Pro (pre-sale price range: RMB168,800-RMB239,800) at Auto China 2020, a model projected to be launched on market on December 6. The new-generation Transit Pro carries MobileyeQ4 chip and related ADAS package, iFLYTEK Feiyu 2.0 intelligent connectivity system, electrical power assisted steering system (EPAS), and Bosch ESP version 9.3, a standard configuration for full range of the model.

Intelligent Buses Fit into Cooperative Vehicle Infrastructure System (CVIS) and Intelligent Transportation Roundly

Due to buses often running on the fixed road routes, intelligent buses are getting into CVIS and intelligent transportation, for which the leading bus manufacturers are racing to roll out the solutions.

In September 2020, Yutong Bus unveiled WITGO intelligent mobility solution which is already available in the Zhengdong New Area of Zhengzhou City, Henan Province, China, and which is intended to build urban intelligent mobility and transportation systems around which efforts are being made in six aspects including smart cars, smart roads, smart stops, unmanned field berths, cloud-based platform, and automatic charging. Yutong’s intelligent bus U12 has the capabilities (L3 autonomy) like automated acceleration/deceleration, automated steering, CVIS, passing at crossroads via automatic recognition of traffic lights, automatic pull-in, and automatic parking, and it packs such features concerning intelligent connectivity as 360-degree around view system, collision mitigation control system, driver behavior monitoring, parking brake, hill-start assist control, and prevention of mistakenly stepping on the accelerator.

In 2020, King Long (Suzhou) launched a new strategy with the aim of being a provider of intelligent transportation system solutions. Its solution incorporates four parts, i.e., intelligent buses, intelligent bus stops, intelligent operation, intelligent mobility. The ADAS of King Long Azure is provided with fatigue monitor system, driver monitoring, autonomous emergency brake, lane departure warning, electronic rearview mirrors, 360° around view system, to name a few.

In August 2020, Zhongtong Bus publicized its ‘smart road + smart bus + cloud-based platform’ and started the road test of the 5G-enabled intelligent driving Zhongtong bus in Qingdao city, Shandong province. It is reported that the bus carries interactivity, autonomous cruise and CVIS features enabling recognition of traffic lights, precise arrival at stops, emergency avoidance, forward crossing warning, etc. Also, the 5G-enabled Zhongtong bus is mounted with many cameras and radars like two 16-channel lidars at the A-pillar to detect forward and side objects, millimeter-wave radars to detect the range from objects in front of the bus, and a total of 12 ultrasonic sensors for parking at low speed and obstacle warning. What’s more, the 5G-enabled intelligent bus is in harness with intelligent public bus network platform that is a fusion of alcohol detection, one-click alarm, driver fatigue monitor, 8-channel video surveillance, collision warning, vehicle crisis instrument, gyroscope, 360-degree around view, electronic rearview mirrors and other advanced devices for information exchange between humans, cars and roads.

For bus ADAS, the China Safety Coach Assessment Programme (C-SCAP) was rolled out in May 2018, an appraisal system structured around braking safety, stability safety, structure safety, and protection safety, among which the braking safety involves three items, i.e., braking performance, ABS performance and AEB performance; the stability safety contains the four items, i.e., control stability, roll stability, ESC performance, and LDW performance; extra points are for the three items inclusive of driver monitoring system, intelligent speed alert, and three-point belts.

Breakthroughs Have Been Made by the Providers of ADAS Technology Solutions in Commercial Vehicle Market

The highly fragmented commercial vehicle market is accessible in different ways for the Chinese ADAS solution providers.

The G5 device launched by AIDriving is a DSM+ADAS all-in-one which is basically used for transportation of general goods and hazardous chemicals. As yet, AIDriving has provided ADAS services for hundreds of thousands of commercial vehicles.

ADASPLUS accessed to the aftermarket by offering SDK services with ADAS capabilities and through collaborations with intelligent onboard solution providers and brand vendors, and its software poses a less demanding on chip compute by means of model compression and hardware acceleration technologies. Up to date, there are nearly ten million users of ADASPLUS’s aftermarket products (led by smart rearview mirror).

Most AEB is largely the brake with ‘a direct press’, a poor feeling for the driver and even a hidden danger to vehicle on special occasions like the vehicle transporting steel pipes and hazardous chemicals. For this, Soterea veteran in commercial vehicle braking algorithms joins forces with logistics companies, freight platforms and end users for joint development of products and upgrading, and it finalizes the brake strategy ‘first warning, then deceleration, and last braking’ (for a steady brake and a good driving experience) after getting algorithms ever optimized with the feedback from the driver.

JIMU Intelligent, Maxieye, and Smarter Eye have made progress in vision algorithms and outperformed Mobileye in some capabilities.

JIMU Intelligent has started massive deliveries to the Chinese bus manufacturers such as King Long (Suzhou), Golden Dragon Bus, Shanghai Shenlong Bus (Sunlong), China Youngman Automobile Group, Yinlong Energy, and Shanghai Wanxiang Automobile.

Maxieye is superior in the AEBS market and has formed a partnership with the OEMs and Tier-1 suppliers like Zhengzhou Yutong Bus, Great Wall Motor, BAIC Foton, KING LONG, Anhui Ankai Automobile, HOWO, Tsintel Technology, Kormee, and Zhejiang Vie Science & Technology.

Smarter Eye is rooted in stereo vision with breakthroughs in both height limit and binocular AEB, and with its products as of end-2019 having been found on the buses running in a dozen cities.

China Satellite Navigation and Communication Co., Ltd and Hangzhou Hopechart IoT Technology boasting a large number of clients about commercial vehicle telematics are vigorously branching out to commercial vehicle ADAS. The suppliers of such sort stay inferior to the startups (expertise in algorithms) as concerns single-car intelligence, but are quite competitive in terms of cooperative vehicle infrastructure system (CVIS) and intelligent transportation projects.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...