ResearchInChina has recently released Automotive and 5G Industry Integration Development Report, 2020, demonstrating the status quo and trends of the automotive 5G industry, the 5G promotion by industry alliances, operators, and OEMs, as well as 8 application scenarios of 5G cars, etc.

Report Highlights

Industry alliances promote automotive 5G demonstration projects

Industry alliances promote automotive 5G demonstration projects

Operators take the lead in promoting 5G infrastructure construction

Operators take the lead in promoting 5G infrastructure construction

OEMs scramble to launch 5G models

OEMs scramble to launch 5G models

5G in 8 typical automotive application scenarios

5G in 8 typical automotive application scenarios

5G is an important condition for the realization of autonomous driving, during which the shorter the time it takes for the sensor from monitoring road conditions to commanding the vehicle’s "brain" to respond, the higher the safety of autonomous driving. Therefore, it poses requirement of high reliability and low latency on the communication network.

The 5G network will promote the rapid development of the connected collaborative autonomous driving technology in China. In November 2020, the General Office of the State Council issued New Energy Vehicle Industry Development Plan (2021-2035), proposing to boost the synergy of electrification, interconnection and intelligent technology. Local governments are aggressively accelerating the deployment of 5G communication base stations and C-V2X roadside equipment, propelling the upgrading of intelligent roads, encouraging and guiding the assembly of vehicular wireless communication terminals, and fueling the coordinated development of intelligence and connection.

The development of 5G in the automotive industry requires coordination and cooperation among governments, operators, automakers, Tier1 suppliers, and Internet companies. At present, all parties (mainly industry alliances, operators, and OEMs) are pushing 5G automotive testing, demonstration and application projects to prepare for the large-scale application of 5G in the automotive industry.

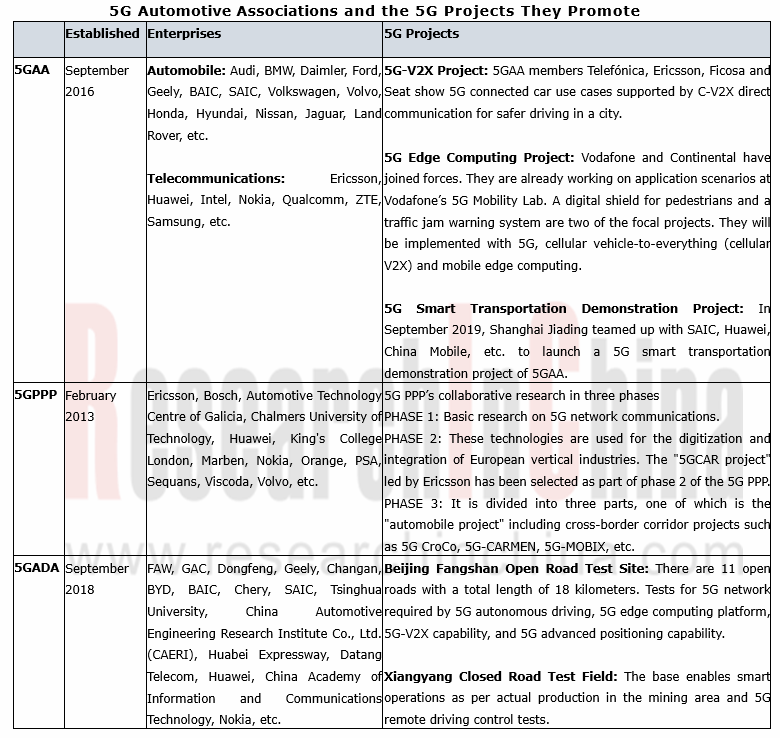

Industry alliances promote automotive 5G demonstration projects

Industry organizations/alliances that promote automotive 5G projects include: 5G Automotive Association (5GAA), 5G Infrastructure Public Private Partnership (5G PPP), and China 5G Autonomous Driving Alliance (5GADA), etc.

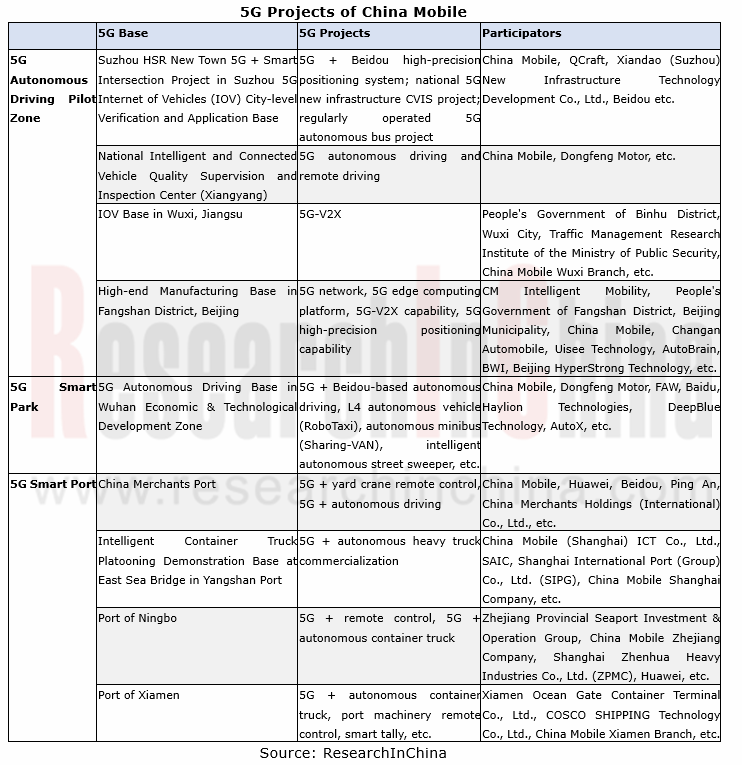

Operators take the lead in promoting 5G infrastructure construction

5G operators are vigorously implementing 5G Telematics and autonomous driving. For example, China Mobile is enforcing the 5G+ plan to further prompt the innovative application of 5G in the automotive field. In order to accelerate the development of 5G autonomous driving business, China Mobile has given great attention and support in terms of operating system, R&D and construction efforts, ecological cohesion, etc. China Mobile has formulated a "3+1+N" strategy, namely three advanced networks, a core platform and multiple application scenarios, so as to empower the quick realization of autonomous driving in China and maintain a leading position in the world.

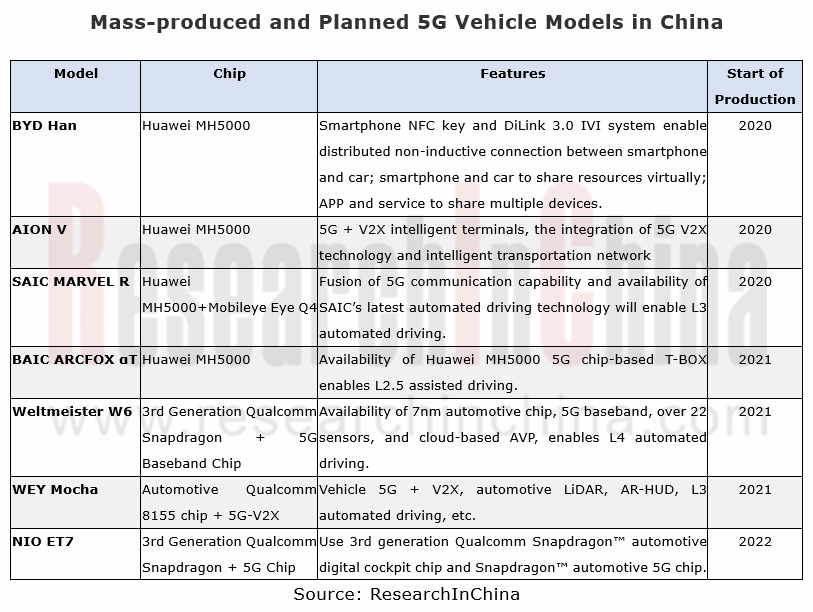

OEMs scramble to launch 5G models

With the introduction of commercial and automotive 5G chips, automotive OEMs have launched 5G models successively. In June 2020, BYD launched Han equipped with Huawei’s 5G technology. In November 2020, GAC NE unveiled AION V equipped with GAC Aion 5G V2X vehicular intelligent communication system and Huawei Balong 5000 5G communication chip. In November 2020, SAIC R started the pre-sale of the 5G smart electric SUV MARVEL R.

As OEMs scramble to launch 5G models, it is estimated that more than 50% of new cars will be equipped with 5G vehicular terminals.

5G in 8 typical automotive application scenarios

The report summarizes and analyzes 5G technology and application in 8 scenarios: test area/demonstration area, smart expressways, platooning, valet parking, remote control and remote driving, low-speed autonomous driving in the park, autonomous heavy trucks in the park, and smart buses. This article briefly introduces two of these scenarios.

Application of 5G on smart expressway

Compared with the complex road conditions in urban areas, the traffic environment of expressways is relatively closed and simple, symbolizing one of the typical scenarios where 5G intelligent connectivity technology and solutions are applied first. Smart expressways will gradually establish a complete infrastructure monitoring system and an intelligent road network operation perception system through 5G intelligent networking, Beidou, Internet of Things, cloud computing, big data and other technologies. The construction of smart expressways supporting 5G has become a key part of the new infrastructure.

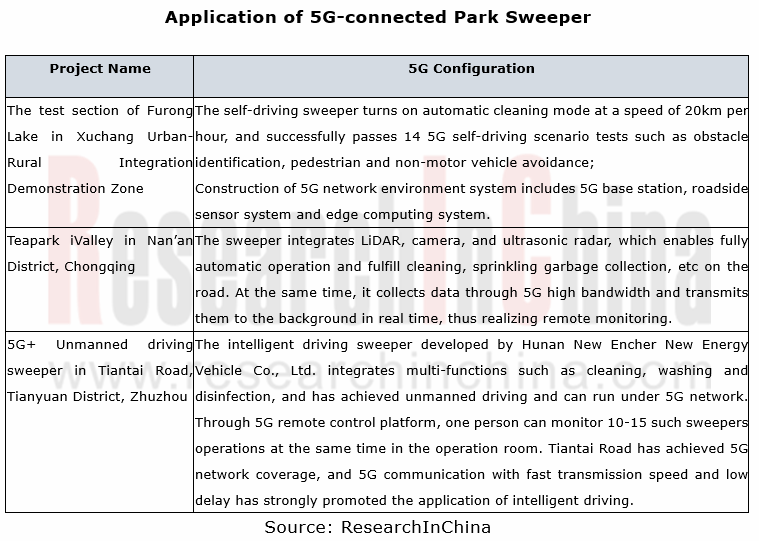

Application of 5G in low-speed autonomous driving in the park

For example, an automotive smart antenna and a 5G remote driving smart gateway enable a park sweeper to connect 5G network, thereby realizing fully automatic autonomous driving, multi-sensor collaborative cloud management, omni-directional video surveillance, remote takeover, intelligent scheduling, and one-click summon and other functions.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...