Our recent report Global and China Automotive Seating Industry Report, 2020-2021 highlights the following: development history of automotive seating, industry pattern, market size, supplier relationships, “CASE” (Connected, Autonomous, Shared, Electrified) and cooperation dynamics of major automotive seat manufacturers, and ten trends for automotive seating industry in an upsurge of CASE.

Automotive seat is the interior component that occupants contact for the longest time during the ride. Since the world’s first automobile came into being in 1885, automotive seat has evolved for over a century from a simple component into a practical tool offering comfort and safety.

Global automotive seating market is dominated by American, European and Japanese brands.

In 2019, North American, Japanese and European seat manufacturers commanded around 50%, 14% and 11% of the global market, separately. China’s automotive seating market is grabbed by foreign companies such as Adient and Lear and their affiliates and Toyota Boshoku, or foreign-funded joint ventures, which together sweep more than 60%.

Ten trends for automotive seating industry amid CASE

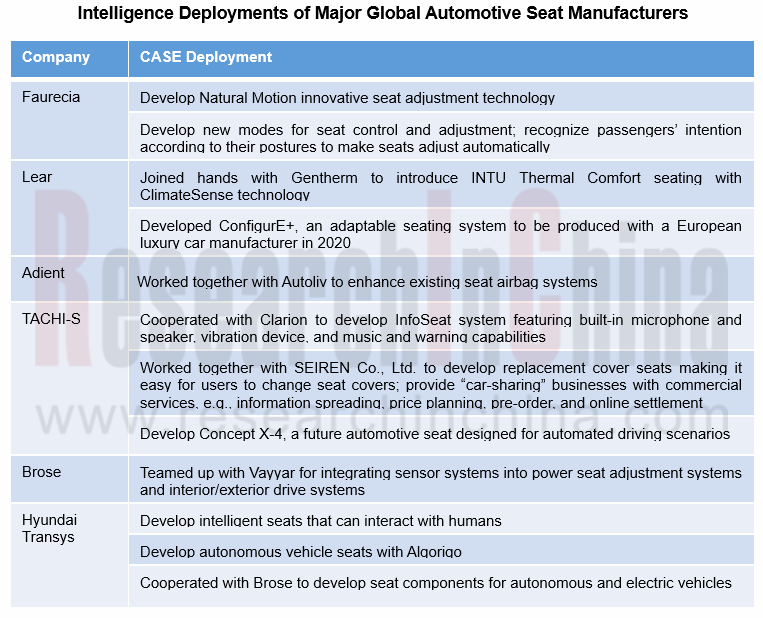

Under the development trend of CASE, the tide of software-defined cars is unstoppable. However, software cannot define everything about vehicles. Traditional auto parts manufacturers still have many core technologies, which cannot be replaced by emerging auto-making forces, such as automotive settings. Seat manufacturers have also made a lot of intelligent improvements to seats according to the development needs of intelligent connected vehicles. We summarized the ten development trends for automotive seating industry amid CASE boom.

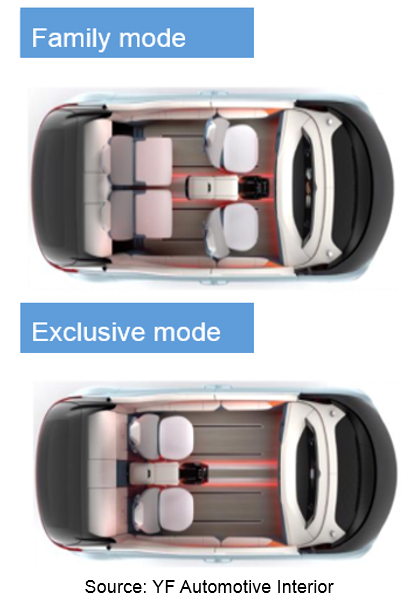

Trend 1: Multi-scenario Application

In future, autonomous vehicle cockpit will be a mobile space for office, living and entertainment, so seat needs to transform for different application scenarios. An example is the next-generation reconfigurable seating concept Magna showcased at CES 2019. Users can reconfigure seats via their smartphone APP, with reconfigurable modes including vehicle sharing, long journey, and autonomous shared mobility.

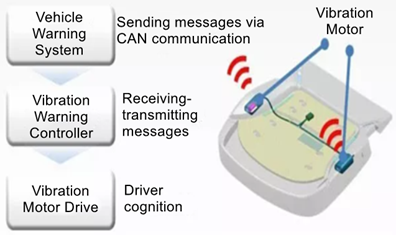

Trend 2: Integration with ADAS

In future, automotive seat that plays a crucial role in vehicle safety will integrate with ADAS to deliver more driving assistance capabilities. Examples include InfoSeat, an automotive seating system TACHI-S and Clarion co-developed and launched in 2019: when the vehicle travels too close to the front vehicle or the driver is drowsy, the vibration device installed in the seat will send a vibrative warning to occupants.

Trend 3: Intelligent Control

At present, CASE is reshaping the automotive industry. Facing the disruption in automotive industry, seat manufacturers race to double down on intelligence deployment by way of such as cooperation and independent development. Future intelligent seats can not only provide comfortable experience but learn to “know” what passengers want with AI technology and adjust and control themselves without any active operation. For instance, the fusion of sensors and seats makes seat control mode change from conventional button to intelligent control methods, e.g., APP, gesture control and intention perception.

Trend 4: Intelligent Monitoring

In future, automotive seat will also act as a “health manager” that can monitor heart and breath rates. Examples include HiRain Technologies’ intelligent automotive seating system with the ability to intelligently monitor health, heart and breath rates, and temperature.

Trend 5: Personalization

As well as function intelligence, personalized design holds a trend for automotive seat, helping users to create a more private interior space. In the case of gender-targeted design, ambient lamps are used to build exclusive private sound areas.

Trend 6: Modularization

Automotive modular platform that helps automakers reduce cost, development time, vehicle weight and fuel consumption will be well-welcomed. For example, Brose’s complete seat modular structure allows for higher uniformity of motors in size for quick response to different customers’ needs for—any drive for basic capabilities such as adjusting length, height, seat tilt and backrest tilt, serving as an efficient supplement in comfort and safety.

Trend 7: Application of Intelligent Surface

As intelligent cockpit booms, decorative, functional intelligent automotive surface attracts ever more attention from industry players. Examples include BWM Vision iNext, a concept car fully demonstrating which direction intelligent automotive surface will head in. iNext allows users to operate the infotainment system by interacting with and tracking symbols on seat or side panel woven fabrics with their fingers, which replaces traditional buttons and touch screen control capability.

Trend 8: Replacement Cover Seat

The growing awareness of hygiene and disinfection in car comes with popularity of car sharing and current pandemic. The emergence of replacement cover seat will be an efficient way to reduce the spread of viruses and bacteria and better protect the health of occupants.

An example is the replacement cover seat co-developed by TACHI-S and SEIREN Co., Ltd. Users can replace seat covers as they like in any time. For car sharing, corporate LOGO or QR code can be printed on the cover of the seat in support of offering commercial services from information spreading and price planning to pre-order and online settlement.

Trends 9: Lightweight

Seats make up 6% of vehicle curb weight, and 5% of total vehicle cost, the second highest share among all components. Lightweight seats are an effective solution to vehicle energy conservation and emission reduction. Reducing the weight of seats lies in use of lightweight seat frames or complete seats.

Trends 10: Zero Gravity

Statistics shows that in autopilot mode, the comfortable recumbent mode (zero gravity) gives users the greatest pleasure. A zero gravity seat is a boon for them to feel less tired during the journey. For example, in June 2020 Yanfeng Automotive Interiors introduced XiM21, a self-developed intelligent cockpit featuring a zero gravity seat that affords a large angle tilt, integrates with massage function and lets passengers relax their body and mind with fragrance from the hidden air outlet.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...