This report studies autonomous vehicles that transport passengers on short distances, and delves in the product solutions, operational services, and major players in this market.

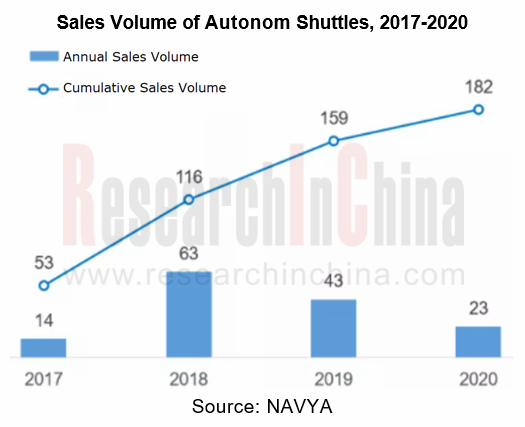

The development of autonomous shuttles slows down

Many companies, including start-ups, Tier 1 suppliers and automakers (like UISEE, Baidu, Bosch, Continental, Dongfeng, Yutong, etc.), will launch autonomous shuttles when trying to develop and test L4 technology, so as to verify the reliability of their autonomous driving solutions.

Among them, Navya and EasyMile, which are the first to enter the autonomous shuttle market, perform mediocrely.

In fact, the smart sensor configuration of L2+ passenger cars has been developing at an amazing speed, and suppliers such as Baidu have applied L4 technology to the L2+ market. L4 autonomous shuttles have developed slowly in the past two years. Although new players have flooded to the autonomous shuttle market, the development momentum herein is obviously not as good as that of the ADAS market and the autonomous driving market for special vehicles (such as autonomous driving in agriculture, mines and ports).

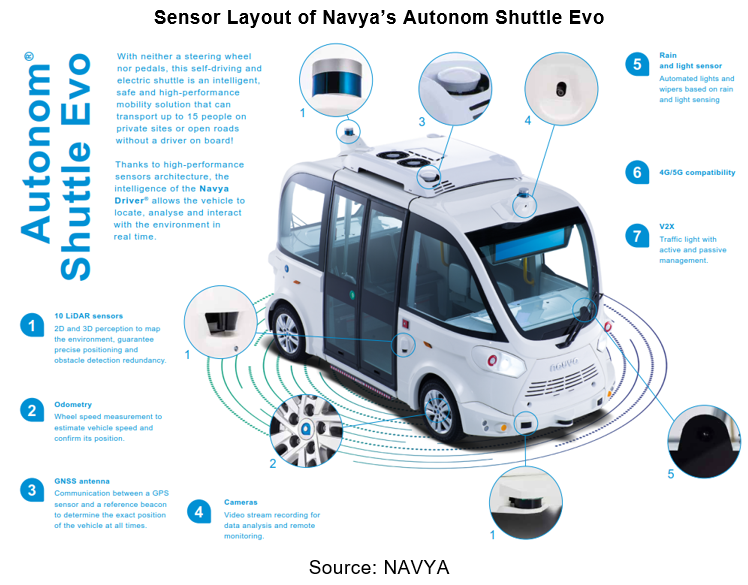

In terms of sensor configuration, autonomous shuttles lag behind the most cutting-edge passenger cars.

For example, Navya’s autonomous shuttle --- Autonom Shuttle Evo uses a lidar + front/rear view camera solution to enable L4 autonomous driving featuring capabilities such as straight driving, turning, U-turning at intersections, autonomous obstacle avoidance, and fixed site parking. It also supports background remote control.

Baidu’s autonomous shuttle Apollo adopts a fusion solution of lidar + radar + front/rear view camera + surround view camera + ultrasonic radar to independently complete a series of driving capabilities such as autonomously exit from parking spaces, following cars, avoiding obstacles, turning/turning around, stopping at stations, etc.

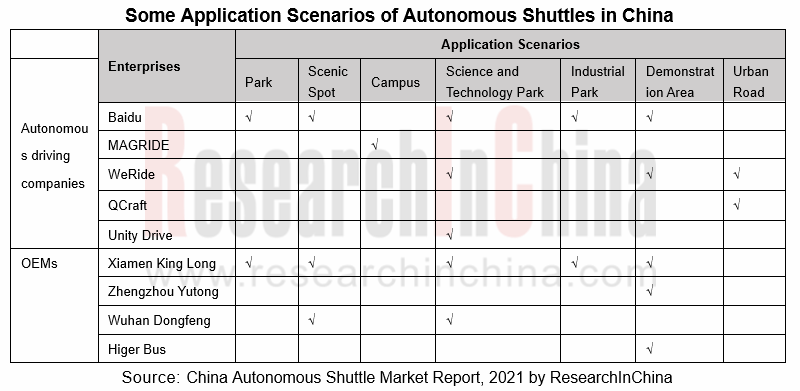

The autonomous shuttle market in China is obviously more booming than abroad

Autonomous shuttles mainly operate in parks, scenic spots, campuses, science and technology parks, industrial parks, demonstration areas and other closed/semi-closed or relatively simple mixed traffic environments, where there are a few vehicles and pedestrians and vehicles run slowly. These scenarios are a good starting point for fast realization and commercialization of autonomous driving.

The autonomous shuttle market in China is obviously more booming than abroad. Baidu’s autonomous shuttles are available in the most scenarios. "Apollo" jointly created by Baidu and Xiamen King Long since 2018 has landed in 35 parks in 28 cities of China. In addition, autonomous driving startups (such as MAGRIDE, WeRide, and QCraft) as well as OEMs (like Xiamen King Long and Zhengzhou Yutong) are actively embarking on this market.

Navya: Global autonomous shuttle sales volume will reach 12,600 units in 2025

The autonomous shuttle market tends to develop more slowly, but it represents a typical scenario for autonomous driving and still attracts more and more players to join. According to the investor report released by Navya in January 2021, the global autonomous shuttle sales volume will reach 12,600 units by 2025, with a market value of EUR1.7 billion.

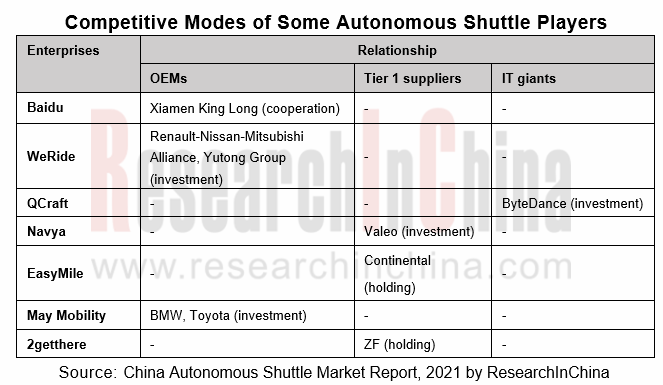

The autonomous shuttle market will thrive sooner or later, but the crucial problem is who can survive the difficult time. At present, autonomous shuttle enterprises are trying to find successful development paths through various forms of cooperation. We have summarized two paths as below.

Path 1: Autonomous shuttle enterprises and OEMs/Tier1s team up to complement advantages

Autonomous shuttle players --- autonomous driving startups, OEMs (buses, passenger cars) and Tier 1 suppliers s have their respective advantages:

- With full-stack layout capabilities in autonomous driving solutions, autonomous driving startups provide L4 autonomous shuttles through OEM cooperation or AM modification.

- Some OEMs use their own vehicle manufacturing capabilities to pre-install and integrate autonomous driving software, algorithms, sensors, etc., and directly embark on actuation.

- The capabilities of Tier1 suppliers in software & hardware layout and system integration cannot be underestimated.

The cooperation between autonomous driving startups, OEMs and Tier1 suppliers is conducive to achieving complementary advantages and enhancing competitiveness.

In March 2021, GM Cruise acquired Voyage, a self-driving car startup that focused on operation in retirement communities. The cooperation will merge Cruise’s engineering and software capabilities with Voyage’s presence in the retirement community market to launch bombshells.

Path 2: Expansion of scenarios and technical service capabilities

Autonomous shuttles have something in common with autonomous logistics vehicles and autonomous taxis in terms of technical solutions, featuring relatively low thresholds to different scenarios.

The French company Navya, which initially engaged in autonomous shuttles, launched Autonom Cab, a driverless taxi, in 2018.

After completing the layout in autonomous taxis, WeRide has dabbled in the autonomous buses and autonomous logistics successively.

In early 2021, WeRide and Yutong jointly built Mini Robobus, and started the normalization test in Guangzhou International Bio Tech Island and Nanjing Eco Hi-Tech Island. Mini Robobus will spread to Zhengzhou, Wuhan and other cities for normalization tests, and it will be commercialized in 2021. Mini Robobus is designed for urban open roads to gradually break the limits of the park scenario and blur the boundary with RoboTaxi.

In March 2021, WeRide acquired MoonX. They will collaborate in business. MoonX, which focuses on autonomous logistics vehicles, is expected to help WeRide realize its expansion in the field of unmanned logistics.

In addition to the above two paths, there must be other paths. Under the background of unclear business models, the expansion, cooperation, mergers and acquisitions of autonomous shuttle companies will occur constantly.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...