Flying Car Research: The prospect is promising. Creator of Google self-driving cars turns to track of flying cars

ResearchInChina released Global and China Flying Car Industry Report, 2020-2026, analyzing eVTOL ((Electric Vertical Takeoff and Landing) from the perspective of status quo, trends, business models, financing, the layout of major players, and product solutions.

Compared with traditional cars and aircrafts, eVTOL has gradually materialized, featuring zero emission, low cost, point-to-point low-altitude flight (short mobility time without geographical restrictions), vertical take-off and landing, land and aerial applications. For example, EHang 216 with multi-rotor electric vertical take-off and landing is used as an ambulance in the coronavirus crisis.

Investors favor urban air mobility (UAM). The total financing of the three unicorns exceeds USD1.5 billion

By 2030, 60% of the population will migrate into cities, which may pose enormous pressure on urban ground transportation. By then, the demand for urban aerial short-distance mobility will increase significantly. Morgan Stanley predicts that the flying car market will reach USD320 billion by 2030.

Flying cars have been favored by many investors due to the broad application prospects. Larry Page, cofounder and CEO of Alphabet, Google’s parent company, was among the first to recognize their potentials, personally funding three companies, Zee Aero, Opener and Kitty Hawk. Particularly, Sebastian Thrun, Google's self-driving team founder turned CEO of flying vehicle startup Kitty Hawk. This indicates the trend of the mobility market: the future transportation may develop in the sky.

Among the three flying car unicorns, Joby Aviation is from the United States, Volocopter and Lilium are from Germany. Joby Aviation has raised the overwhelming USD820 million. Volocopter has announced the signing of their Series D funding round, and its investors include Geely, Daimler, Geely, Daimler, DB Schenker, Intel Capital, etc.

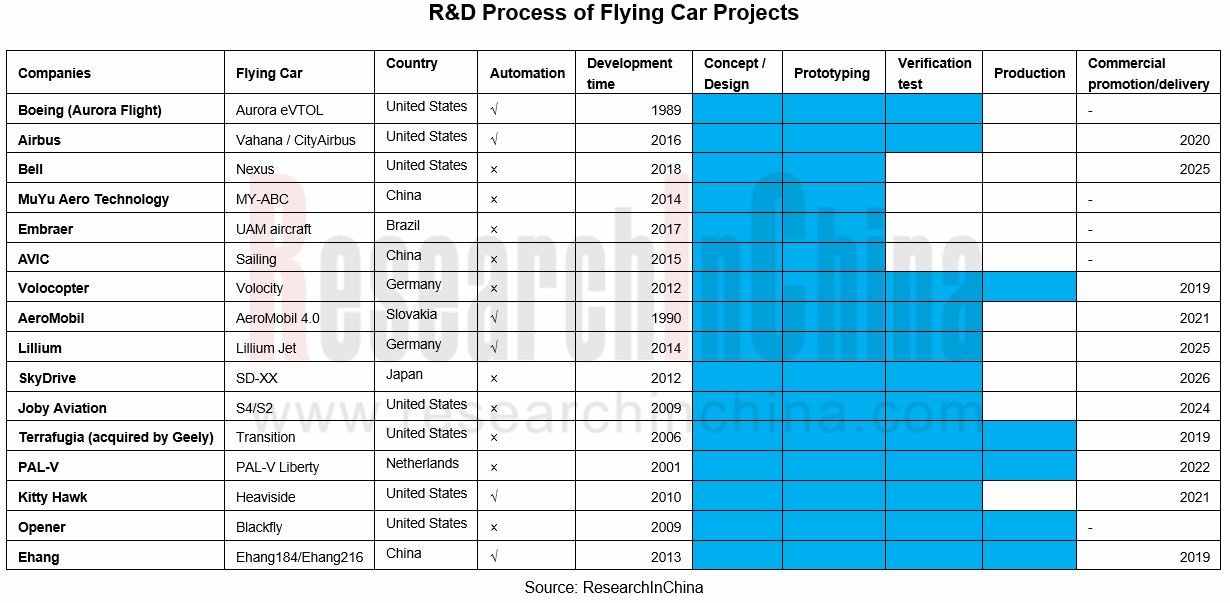

Currently, 5 flying car models have been mass-produced. Electrification and autonomous driving are the mainstream

American companies (accounting for nearly 50%) are the most enthusiastic about developing flying cars, followed by Chinese companies. Many companies aim to materialize flying cars around 2025. Five flying car projects have seen mass production, and 38% have realized automation.

Automotive technology and aviation technology are merging with each other. Benefiting from the development of automotive electrification, flying cars have a progress in endurance. For example, Airbus Vahana eVTOL has a range of up to 50 kilometers, which basically enables urban short-distance mobility.

Amid many participants, Geely, Xpeng, Hyundai and other OEMs have deployed the market

Currently, traditional airlines such as Boeing, Airbus, Bell, etc. have embarked on flying car projects. Technology companies follow suit. For example, Uber has established Uber Elevate to develop flying taxis with 9 partners including Embraer, Aurora Flight Sciences, Jaunt Air Mobility, etc.

The CEO of the OEM Xpeng recently stated that it will build flying cars in 2021. Geely completed its acquisition of the US flying-car startup Terrafugia, and invested in Volocopter, a German electric flying taxi R&D company, demonstrating its ambition to deploy UAM. Recently, Transition (TF-1), a subsidiary of Geely, obtained the world's first special airworthiness certificate from the Federal Aviation Administration (FAA), USA.

The United States, Germany, China, South Korea, Japan and many other countries have paid attention to the concept of flying cars, and many of them have formulated UAM development plans. Affected by favorable policies, insufficient urban road traffic space, autonomous driving and the development of 5G communication technology, flying cars are expected to become an important way of smart mobility in the future.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...