Autonomous Driving Simulation Research: Foreign giants build closed-loop simulation platforms, while domestic companies focus on the construction of scenario library

In the development of high-level autonomous driving, the importance of simulation testing becomes more and more apparent. From 2020 to 2021, both foreign and domestic companies stepped up the layout in the field of autonomous driving simulation.

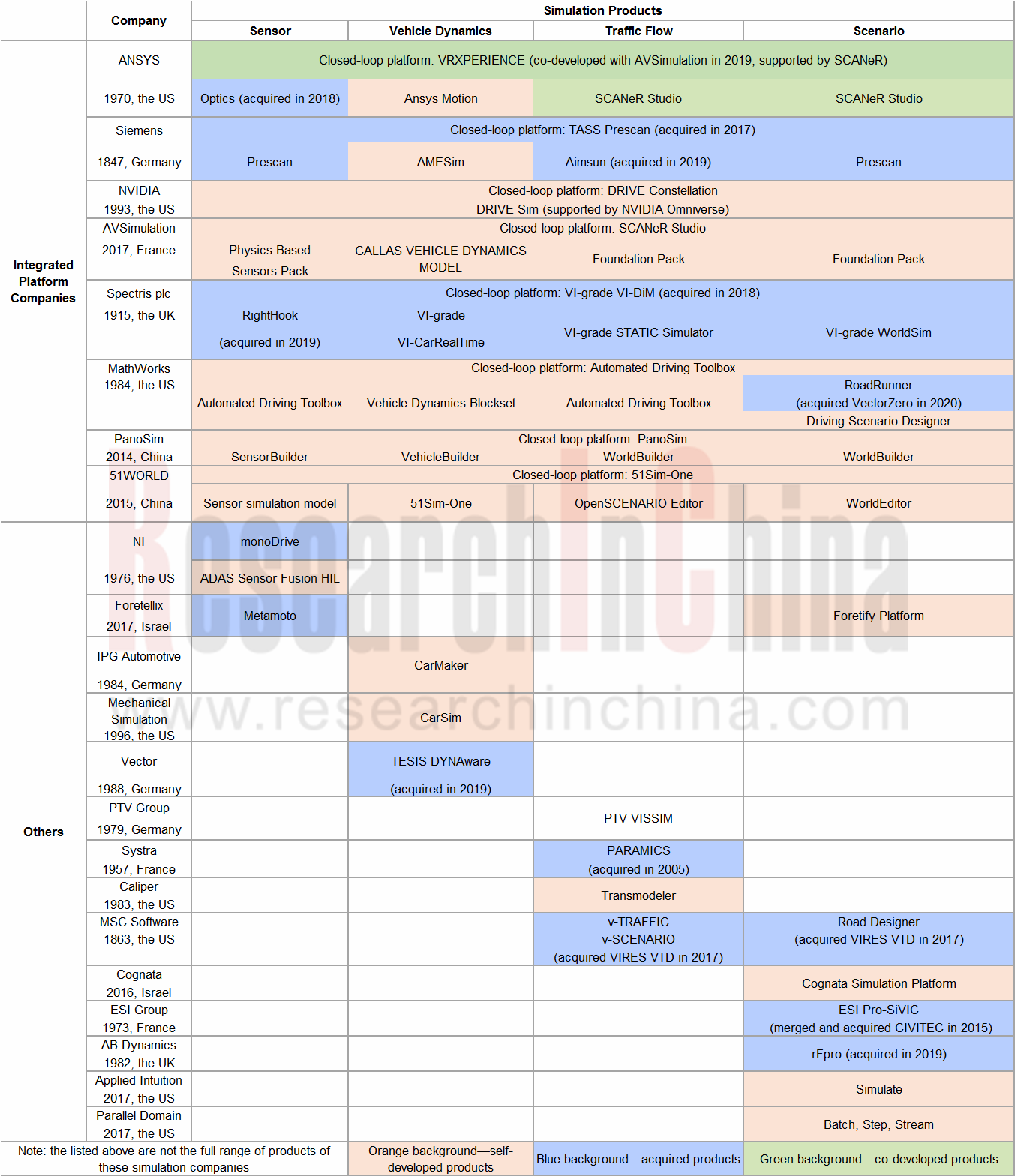

Foreign simulation giants are committed to building closed-loop simulation platforms for setting up industrial barriers

In the transition from industrial simulation to autonomous driving simulation, giants such as Ansys and Siemens have established various modules of autonomous driving simulation through continuous acquisition, cooperation and technological development, strengthened the closed loop of the simulation platform, and built industrial barriers. At present, the layout of foreign leading companies has covered more than 80% of the simulation sector, and which is continuously updated.

From 2020 to 2021, top foreign simulation companies updated and optimized the following sectors:

01 More sensor models such as camera, radar, LiDAR, etc. are supported

Ansys: unified simulation with the addition of camera, LiDAR and radar

On January 7, 2020, FLIR Systems, Inc. and ANSYS were partnering to deliver superior hazard detection capabilities for assisted driving and autonomous vehicles (AVs) — empowering automakers to deliver unprecedented vehicle safety. Through this partnership, FLIR will integrate a fully physics-based thermal sensor into ANSYS’ leading-edge driving simulator to model, test, and validate thermal camera designs within an ultra-realistic virtual world. The new solution will reduce OEM development time by optimizing thermal camera placement for use with tools such as automatic emergency braking (AEB), pedestrian detection, and within future AVs.

In January 2021, ANSYS 2021 R1 expanded sensor simulation capabilities with scanning and rotating lidar models to improve AV simulation reliability. At the same time, it used a new GPU to accelerate the radar simulation.

Siemens: addition of LiDAR simulation

In September 2020, Siemens partnered with XenomatiX to add a generic, physics-based LiDAR simulation model to its Simcenter Prescan software. The knowledge and expertise of XenomatiX’ optical team together with its advanced, true solid-state, LiDAR technology, can enable Siemens to fine-tune its simulation model and validate it with real-life measurements from XenomatiX.

At present, the LiDAR model of Prescan can accurately describe all the optical properties (including surface shape, reflection characteristics, texture, and structure) of materials.

CARLA: upgrade of LiDAR sensor

In September 2020, CARLA 0.9.10 came with the trunk packed of improvements, with notable dedication to sensors. The LIDAR sensor was upgraded, and a brand-new semantic LiDAR sensor provides with much more information of the surroundings.

02 Expansion of Cloud Simulation

Cloud computing capabilities can support large-scale simulation, cover massive driving scenarios, achieve high-concurrency running tests, and accelerate simulation running speed. Therefore, massively parallel acceleration in the cloud is one of the necessary core capabilities of autonomous driving simulation test platforms. Currently, the autonomous driving industry generally chooses Microsoft Azure as the cloud simulation partner.

For instance:

In October 2020, Ansys collaborated with Microsoft to offer cloud-enabled autonomous vehicle (AV) simulation capabilities to joint customers. Ansys VRXPERIENCE, an AV virtual test platform, can unlock massive scalability when run on Azure, empowering users to test drive millions of virtual miles across countless scenarios in an expedient manner — greatly optimizing safety and development costs.

In December 2020, AirSim added development environment deployment documents on Azure to support cloud simulation.

Siemens PreScan is compatible with Microsoft Azure, Amazon AWS, as well as some Chinese cloud service providers and cloud platforms.

03 Joint simulation has become a key development direction

Different simulation platforms have different emphasis on simulation modules. For example, Carsim, CarMaker, VI-Grade, VeDYNA, etc. focus on simulation of vehicle dynamics, while Vissim, SUMO, etc. keep an eye on simulation of traffic flow. From 2020 to 2021, more and more solution providers opened software interfaces and conduct joint simulations with other solutions.

The new version of Prescan released in January 2020 supports the generation of large-scale traffic flows. This feature is supported by the Aimsun plug-in and the PTV Vissim plug-in. The Aimsun plug-in enables the synchronization of Aimsun's micro traffic original scenarios; the Vissim plug-in can perform collaborative simulation and data transmission between TASS PreScan and PTV Vissim.

CARLA 0.9.9 released in April 2020 can realize the collaborative simulation with SUMO. In this mode, the actions or events that occur in one simulator will be automatically propagated to another simulator.

CARLA 0.9.11 released in December 2020 enables co-simulation between CarSim and CARLA, allowing users to create CarSim vehicles, taking control over dozens of parameters, including suspension system and tires.

In January 2021, Mechanical Simulation Corporation announced the release of 2021.0 versions of the vehicle simulation tools CarSim?, TruckSim?, BikeSim?, and SuspensionSim?. This release focuses on scenes and scenarios to improve ease of setup and testing. The user interface and math models have improved third-party software support. In the future, the company will continue to develop tight interfaces to third-party software from technology partners like Epic Games, NVIDIA, atlatec, Foretellix, monoDrive, Siemens, and CARLA.

Domestic companies have embarked on autonomous driving simulation from the perspective of scenarios

The wider the coverage of scenarios that autonomous driving systems can handle, the wider the area that autonomous vehicles can drive. With the upgrade of autonomous driving functions, the number of scenarios that need be tested and verified has increased exponentially during the upgrade and iteration from L1 to L4/L5, and the construction of scenario libraries has become a vital part of the simulation industry chain.

At present, Chinese companies such as Tencent, CATARC, CAERI, Baidu, 51World have established their own autonomous driving simulation scenario libraries.

Tencent: More than 99% of autonomous vehicle simulation scenarios can be covered

Based on powerful game engine capabilities, Tencent's autonomous driving simulation platform TAD Sim performs excellently in the reality and accuracy of scenarios. Its scenario generation system can derive 20 million virtual scenarios based on 2,000 types of logic scenarios, covering more than 99% of automated vehicle simulation scenarios.

In June 2020, Tencent released TAD Sim 2.0, the new generation of its autonomous driving simulation platform, to improve the development and testing efficiency of autonomous driving. Compared with the previous generation, TAD Sim 2.0 fills the gap between road test data and virtual scenarios. With higher resolution in 3D scenario reconstruction and sensor simulation, the platform can make the simulation closer to reality. A huge variety of environments, weather conditions and even extreme traffic conditions can be generated by combining road test data and virtual scenarios to fulfill the needs of autonomous driving testing in TAD Sim 2.0.

However, Tencent will not stop at autonomous driving. Its further layout is to further explore its own capabilities, build virtual twin cities, and facilitate smart cities and smart transportation. Specifically, it will integrate its game technology, cloud technology, and simulation technology to create a virtual twin platform so as to realize the mapping between the real world and the virtual world, and self-learn and update in the virtual world. In the future, it will achieve iteration, prediction, decision-making and other capabilities.

CATARC: AD Scenario Generator debuts, and the built-in scenario library covers 4,000 Scenarios

CATARC’s self-developed simulation platform AD Chauffeur has a built-in scenario library covering natural driving scenarios, standard and regulatory scenarios, CIDAS dangerous accident scenarios and experience restructuring scenarios, etc.

The AD Chauffeur 2.0 released by CATARC in September 2020 adds the AD Scenario Generator, which enables scenario construction, the conversion of multi-source data formats OpenSCENARIO, logical scenario splicing and reorganization to support scenario generation. At the same time, it expands the built-in scenario library to cover 4,000 scenarios, which is convenient for clients.

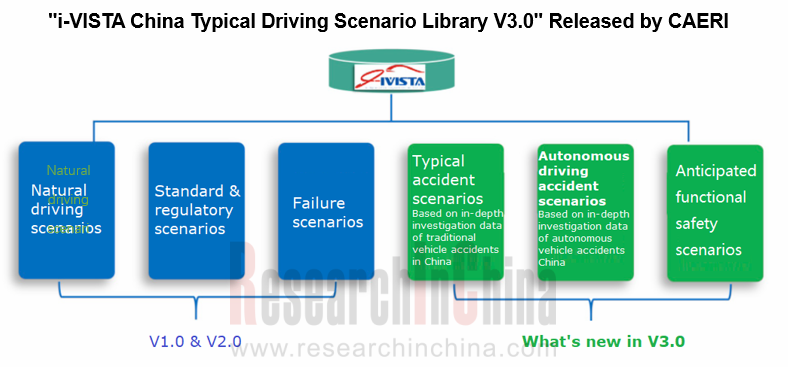

CAERI: typical accident scenarios, autonomous driving accident scenarios, and expected functional safety scenarios are added

In December 2020, CAERI released the "i-VISTA China Typical Driving Scenario Library V3.0". Based on the natural driving scenarios, standard and regulatory scenarios, experience scenarios and a small number of accident scenarios in the previous version, CAERI added typical accident scenarios, autonomous driving accident scenarios, and expected functional safety scenarios. It supports autonomous driving simulation test and evaluation, and application to simulation systems such as MIL, SIL, and HIL.

In addition to the above-mentioned companies, Baidu exploits Apollo technology to establish a simulation scenario library. 51World’s "Urban All-Element Scenario Automation Platform (AES2021)" has improved the coverage and accuracy of scenarios.

Generally speaking, Chinese companies are still fighting their own way in the construction of scenario libraries, facing problems such as inconsistent data on scenarios, difficulty in establishing an evaluation and certification system of autonomous driving simulation & test. Therefore, the establishment of scenario library standards has become one of the current concerns in the field of simulation.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...