Global and China Automotive Millimeter-wave (MMW) Radar Industry Report, 2020-2021

Our Global and China Automotive Millimeter-wave (MMW) Radar Industry Report, 2020-2021 combs through and summarizes the characteristics of the global and China passenger car radar markets, related enterprises’ characteristics, development trends and so forth. In the years to come, ADAS functions upgrade, new cockpit applications (e.g., life signs monitoring), and 4D radar launches will combine to drive up the demand for automotive radars.

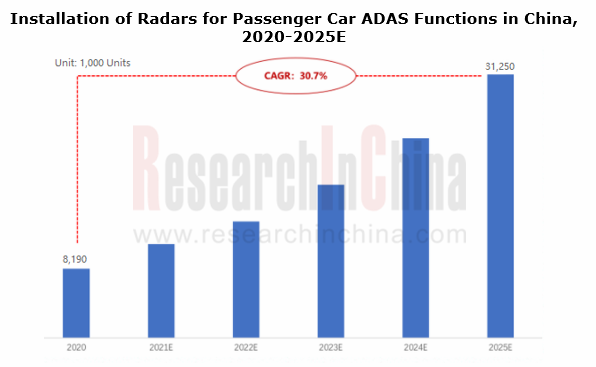

In 2025, China passenger car ADAS functions will carry more than 31 million radars, with demand AAGR of 30.7%.

In 2020, a total of 8.19 million radars were installed in passenger cars in China, including 4.77 million front view radars and 3.31 million rear angle radars. These radars were demanded by front and side road environment detections among L1-L2 ADAS functions.

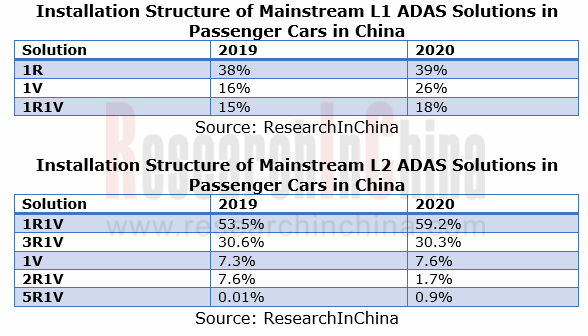

From current mainstream ADAS system solutions, it can be seen that L1 depends on 1R, 1V or 1R1V solution that features simple perception strategy and needs a limited number of radars; L2 needs more radars for requiring a higher level of sensor fusion. Noticeably, the use of 5R1V in vehicles in 2020 provided a further boost to the radar demand.

In a word, the increasing number of sensors per autonomous vehicle is accompanied by ADAS functions upgrade. It is estimated that passenger cars in China will be equipped with over 31 million radars in 2025.

The growth in the demand is expected to follow such trajectory:

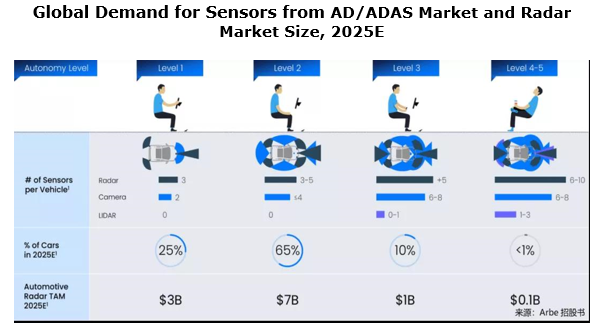

- The upgrade from L1 to L2/L3 will demand 3 or 5 radars;

- For L4/L5, single vehicle may need 7 or even more radars (deployed at both sides of vehicle body);

- ADAS upgrade will fuel the demand for front view radars at first, and then rear angle ones;

- The front view radar + rear angle radar solution is becoming a basic configuration, and the increasing demand for front view radars comes with the launch of L3 functions.

The following picture shows Arbe’s prediction about the demand for various sensors from ADAS in 2025. Arbe argues that in five years, L1 ADAS will be configured with 3 radars, L3 with over 5, and L4-L5 possibly even with as many as 6 to 10. Arbe expresses obvious optimism about the demand for radars.

Cockpit applications like vital signs monitoring and gesture control are expected to be a new engine to the radar growth.

As intelligent cockpit evolves, radars are finding their way into new areas. Currently, they are largely used in cockpits for vital signs monitoring and gesture control.

A. Vital signs monitoring: Wuhu Sensortech Intelligent Technology Co., Ltd. (WHST) was the first one to achieve mass-production

At present, in-vehicle monitoring mainly adopts cameras which invade privacy, while radars can ease the concern. In April 2020, HYCAN 007, a mass-produced model under the brand co-created by GAC and NIO became available on market, which also means the mass production of STA79-4, WHST’s automotive radar used in the car for vital signs monitoring.

In June 2020, at its “Online Launch of Vital Signs Monitoring Technology”, Great Wall Motor also used STA79-4 for vital signs monitoring in vehicle. The solution has been mounted on 2021 WEY VV6.

B. Gesture control: the foreign vendor Acconeer and China’s WHST are exploring.

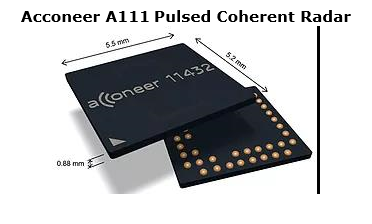

In-vehicle gesture control is currently enabled using cameras, but the technology requires ultrahigh accuracy devices. 60GHz radar that features up to 7GHz bandwidth for sub-micron resolution required by gesture control becomes a new option for cockpit gesture control. More than that, 60GHz radar can penetrate materials to transmit signals, and the integrated design makes it more compact enough to be hidden inside the housing of a device.

In 2018, Sweden-based Acconeer rolled out A111, a 60GHz pulsed coherent radar applicable to vehicles for smoothly controlling the vehicle functions to be actuated. Furthermore, it can be applied widely in areas from robots and drones, and mobile and wearable devices to Internet of Things, power tools and industry, healthcare and fitness. In automobiles, it is often used for gesture recognition and safety alert.

4D radars being installed in vehicles enjoys a rosy prospect.

4D radar outperforms a 3D one in the following three aspects:

(1) Detect “height”, for example, distinguishing an overpass from vehicles on the road;

(2) Offer higher resolution: 1-degree angular resolution (even lower in the case of super resolution algorithm) in both azimuth and elevation;

(3) Classify static obstacles, able to detect roadside obstacles and small targets, e.g., water bottles and tire fragments.

The unique edge ensures 4D radars to work better in detection of static obstacles and support L3-L5 highly automated driving. As for its application scenarios, 4D radars will be massively seen in ADAS front view function in future to replace some few-channel LiDARs, expectedly becoming a “new star” in radar market.

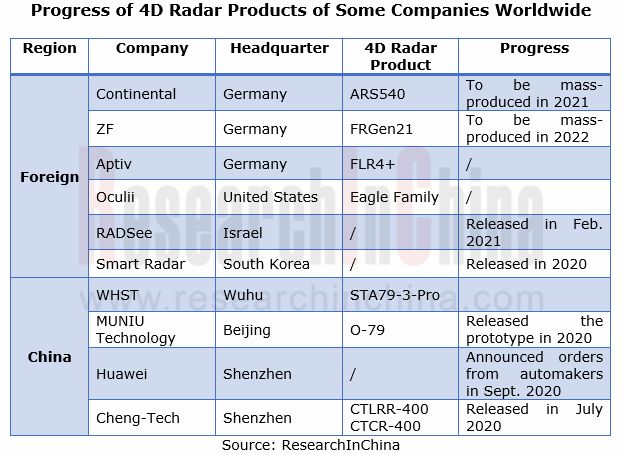

Current foreign 4D radar vendors are divided into two types: conventional Tier1 suppliers like Continental, Aptiv and ZF; start-ups, typically Arbe, Oculii and Vayyar.

Chinese players such as WHST, MUNIU Technology and Huawei, started late but gather pace.

The curtain on the mass-production of 4D radars has been lifted. Continental ARS540 ordered by BMW is to be spawned in 2021; ZF 4D radar mounted on SAIC R ES33 will be produced in quantity in 2022.

In March 2021, SAIC R Brand showcased ES33, its new model of strategic importance. 2 ZF 4D radars are installed at the front bumper of the car, affording an over 300m detection range. Besides, ES33 also bears 31 other perception hardware devices including 1 LiDAR and 12 cameras, hoping to enable L3-L4 automated driving.

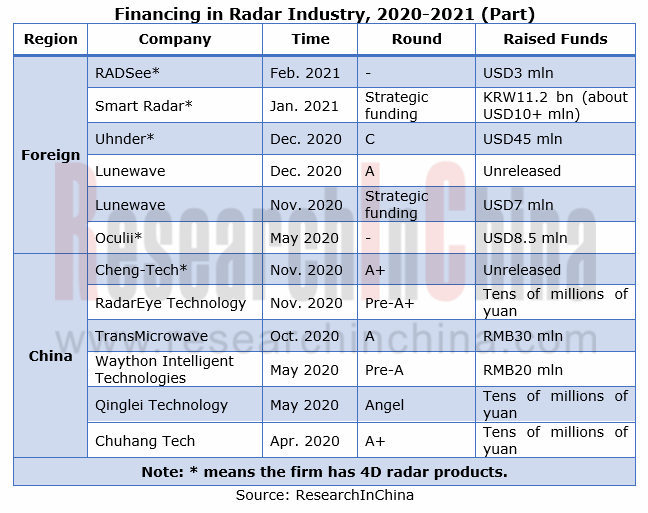

As well as OEMs welcoming 4D radar, capital favors it, too. Since 2020, the financing for nearly 50% start-ups in radar industry has gone to 4D radar.

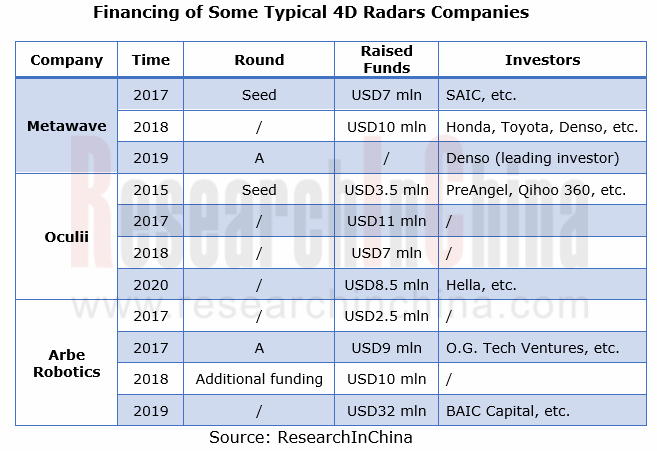

Also, some traditional OEMs and Tier1 suppliers bet on 4D radars in recent years. For example, SAIC, Honda, Toyota and Denso invested in Metawave between 2017 and 2019; BAIC participated in the USD32 million funding round Arbe closed in 2019; in 2020, Hella was an investor in Oculii’s USD8.5 million strategic funding round.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...