Automotive wiring harness is often split into two types: main wiring harness and small wiring harness. As new energy vehicles emerge, automotive wiring harness is also divided into low-voltage and high-voltage types. Conventional fuel-powered vehicles use low-voltage harness while new energy vehicles employ the high-voltage harness.

The boom of new energy vehicles will fuel the demand for high-voltage wiring harness. On our estimate, the global new energy vehicle high-voltage wiring harness market was valued at RMB4.69 billion in 2020, 41.4% more than in the previous year, sharing roughly 3% of the entire automotive wiring harness market. In future, the new energy vehicles promoted by governments and automakers will see a rising sales share, which in turn will give a big boost to the high-voltage wiring harness market in the years to come.

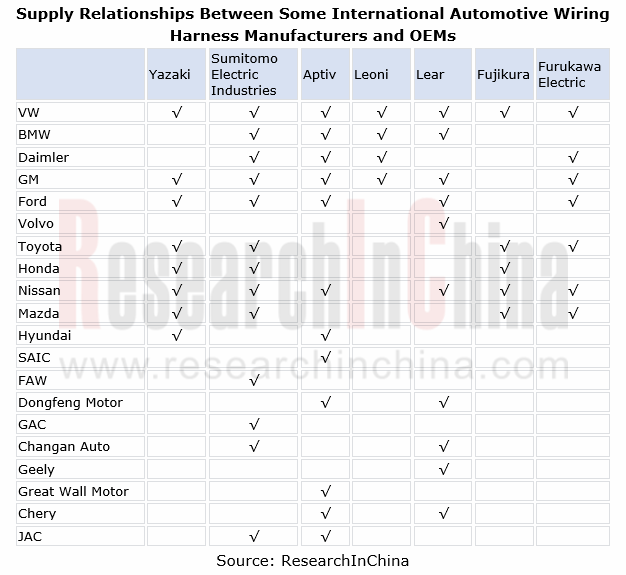

Globally, there are four echelons of automotive wiring harness companies: the first-echelon players are Yazaki and Sumitomo Electric Industries; Aptiv, Leoni and Lear are typical second-echelon players; the third-echelon players are led by Draexlmaier, Kromberg & Schubert, Furukawa Electric, Yuratech, Kyungshin and Fujikura; players in the fourth echelon are a number of other small wiring harness firms.

In current stage, the global automotive wiring harness market is almost carved up by the first three echelons which have built stable supply relationships with automakers. Furthermore, international wiring harness manufacturers deploy the promising Chinese market by way of acquiring or establishing wholly-owned companies or joint ventures with local companies, hoping to support co-funded auto plants and homegrown automakers.

Local companies edge into the supply chains of international automakers.

In China, typical automotive wiring harness companies include Kunshan Huguang Auto Harness Co., Ltd., THB Group, Shenzhen Deren Electronics Co., Ltd., Shanghai Jinting Automobile Harness Co., Ltd. (Jiangsu Etern Co., Ltd.), Mind Electronic Appliances Co., Ltd., Luxshare Precision Industry Co., Ltd., Shenzhen Qiaoyun Electronics Co., Ltd., Jiangsu Huakai Wire Harness Co., Ltd. and Keboda Technology Co., Ltd.

As more homemade auto parts tend to be purchased, some domestic harness companies with years of technical expertise and synchronous development experience have gained far more strength and edged into the supply chains of world-renowned automakers by virtue of timely and effective services and reliable products. Examples include THB Group, Kunshan Huguang Auto Harness Co., Ltd., Shanghai Jinting Automobile Harness Co., Ltd., Shenzhen Deren Electronics Co., Ltd. and Keboda Technology Co., Ltd.

The more functions are added in vehicles, the more wiring harnesses are demanded, which directly causes a surge in length and weight of wiring harnesses and further much heavier automobiles, and makes it too much harder to deploy wires. Optimizing wiring harnesses from quality to wiring is a must for meeting the soaring demand. We argue that automotive wiring harness will head in the following directions:

Trend 1: lightweight

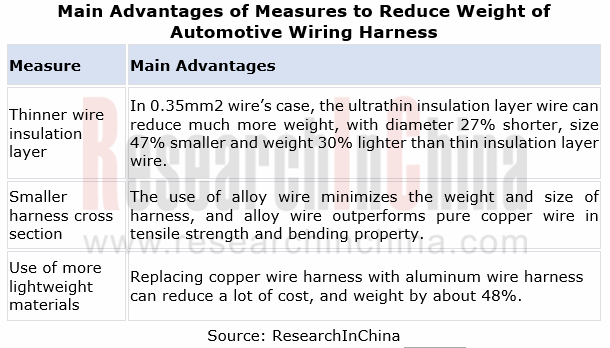

Automotive wiring harness is a key component that makes up around 5% of vehicle curb weight. As vehicles become lighter, lightweight automotive wiring harness already holds the trend. Currently, there are mainly three ways to reduce the weight of automotive wiring harness: thinner wire insulation layer; improved process for smaller harness cross section; use of more lightweight materials.

Trend 2: E/E architecture design optimization

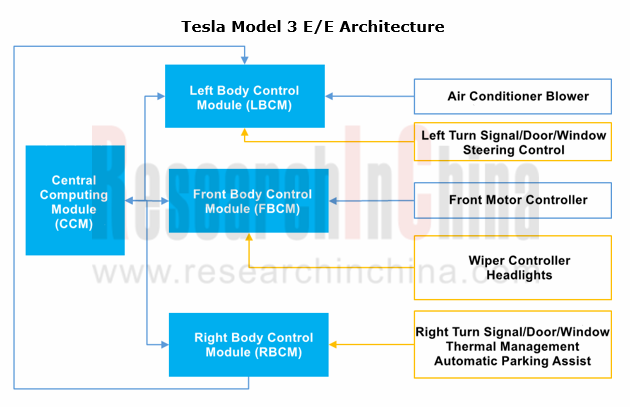

Lightweight automotive wiring harness can reduce weight, but fundamentally less use of harness will pay off more in optimizing harness. The adoption of new E/E architecture is a key to improving automotive wiring harness. A new architecture can lessen wires used for various vehicle functions through simplifying wiring design, also reduce weight to favor automated production and lower cost.

Take Tesla as an example. Its application of new E/E architecture leads to a sharp cut in harness length from 3km of Model S to 1.9km of Model 3. In addition, its patented technology released in 2019 upgrades the wiring layout where harness can be as short as 100m. Yet current Model Y falls short of the goal. In future, the mass adoption of flexible circuit boards to replace current wires may achieve the length cut goal.

Also, Aptiv announced its smart vehicle architecture (SVA) that allows for the integration of multiple ECUs into a small domain control unit. The architecture can thus save multiple microcontrollers, multiple power supply devices, and multiple housings and copper wiring harnesses but still maintain or even improve the vehicle computing power, which contributes to a 20% reduction in both harness weight, and the weight and size of computing-related hardware.

Trend 3: production process automation

Wiring harness is a typical labor-intensive industry where 95% harnesses are handmade products and productivity is low, because automotive wiring layout is complex. Labor cost therefore has been a critical constraint on capacity expansion and scale effect. At present, most automotive wiring harness manufacturers still rest on advanced equipment to automate just some production links. Intelligent manufacturing has not yet become widespread.

As automotive wiring harness tends to be integrated and production technology advances, intelligent manufacturing will have the potential to penetrate the whole process of automotive wiring harness from design, production, warehousing and logistics to management and service. Automotive wiring harness players such as Aptiv, Lear and Kunshan Huguang Auto Harness all are promoting the automated production process.

Trend 4: apply wireless communication to reduce the use of wiring harnesses

The application of wireless communication will reduce the use of wiring harnesses.

A patent Yazaki obtained in 2018 involves an extended system’s electronic device and ECU that are configured to send and receive signals with each other via wireless communication. This avoids the necessary addition of communication circuits to the extended system, simplifying wiring layout and lessening harnesses.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...