Research on automotive modularization: the creation of electric modular platforms, the reduction of the number of platforms, and the development of core platforms

The demand for low-cost and short development cycles of new models promotes the development of automotive modular platforms.

An automotive modular platform includes the design and assembly of all sub-systems of a car in a modular manner, and the standardized design and production of auto parts in the form of modules, and the final "assembly" according to the positioning of models.

Unlike the traditional automotive platform which is only for models at the same single level, the modular platform reduces R&D and production costs and shortens the development cycle of new models. At the same time, it facilitates to unify quality standards and improve the overall strength of products.

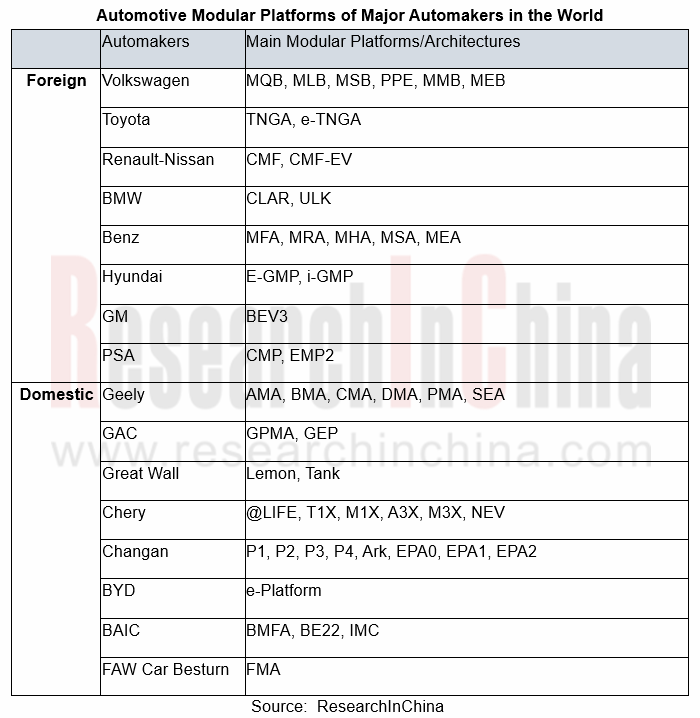

Since Volkswagen launched the MQB platform in 2012, international automakers (including Toyota, Renault-Nissan, Mercedes-Benz, BMW, etc.) and Chinese counterparts (like Changan, Geely, and GAC) have all released their own modular platforms, covering multiple levels and models.

It is an inevitable trend to build a dedicated modular platform for electric vehicles

At present, new energy vehicles have represented the main direction of the transformation and development of the global automotive industry. In 2020, 3.125 million new energy vehicles were sold worldwide with a year-on-year increase of 41.4%. The figure is expected to reach 15 million by 2026.

In this context, it is a mainstream trend to build a dedicated modular platform for electric vehicles. Compared with the oil-to-electricity platform, the modular platform features advantages like longer mileage and better safety. At present, most companies have launched or planned to launch their exclusive platforms for electric vehicles. In addition, companies including Volkswagen, Mercedes-Benz, and PSA that use the oil-to-electricity mode to produce new energy vehicles have also begun to study and unveil their own dedicated platforms for electric vehicles that are being developed.

Electric vehicle modular platforms are mainly proposed by traditional automakers that follow the product layout of the fuel vehicle model when manufacturing electric vehicles, but they are more inclined to build a wide range of electric vehicle product lines to meet the demand of different consumers in different market segments. Therefore, modular platforms extend to electric vehicles.

The emerging automakers represented by Tesla adhere to the principle of short product lines, and pay more attention to the design advantages of a single model and the software upgrade of the entire vehicle. Modular platforms are of little significance to them.

Fewer platforms and core platforms embody the development direction

Under normal circumstances, automakers offer multiple modular platforms for different models, and each modular platform covers a limited range of models. In the future, they will focus on reducing the number of platforms, emphasizing core platforms, and raising the output of core platforms. The move will help further reduce costs and improve efficiency of R&D and production.

At present, Volkswagen, BMW, and GM have announced their platform integration plans. In the future, they will prioritize the development of core platforms instead of the existing multiple platforms.

Brand new E/E architecture pushes transformation of the profit model of automotive industry

While launching modular platforms, some automakers have begun to upgrade their E/E architectures to "domain integration" or even "centralized" style. For example, the Geely SEA architecture adopts a brand-new E/E architecture which integrates three domains, and it will introduce a centralized architecture in the future. In the future, with the development of modular platforms, it is expected that the E/E architecture of automobiles will be upgraded.

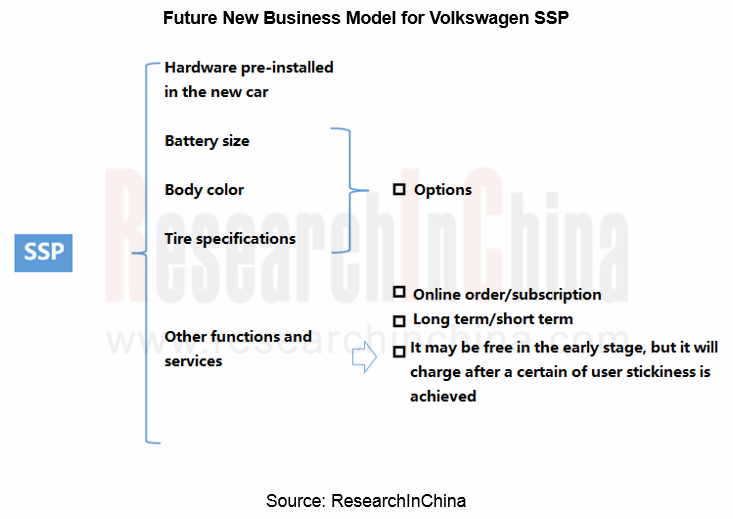

However, due to the adoption of the automotive E/E architecture, the on-board software system has to be re-integrated, which will gradually shift the profit model of the automotive industry from the hardware-oriented mode to the software and services-oriented mode. Currently, Volkswagen has stated that it will launch a new business model for the Scalable Systems Platform (SSP) in 2024.

Modular body is expected to be mass-produced

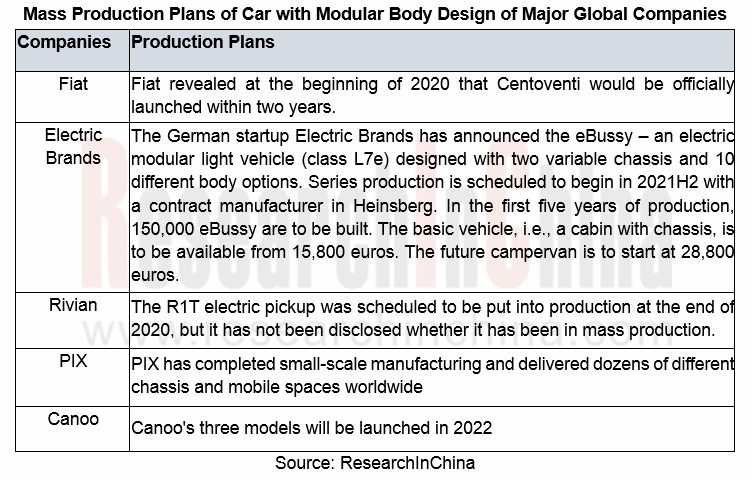

Modular body means that the combination of the same chassis and different modular compartments can be used in different scenarios to improve vehicle utilization. At present, traditional automakers and emerging technology companies including Fiat, Mercedes-Benz, Rinspeed, Rivian, Schaeffler, etc. have launched concept cars with interchangeable bodies.

Although most of the current modular cars are concept cars, some companies have put mass production on the agenda.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...