Roadside Perception Research: Giants Race to Deploy Radar Video All-in-one and Holographic Perception

Multi-sensor fusion holds a dominant trend for roadside perception

Current roadside perception solutions are led by HD cameras and radars. In addition, the adoption of radar video all-in-one and LiDAR is becoming widespread. Multi-sensor fusion holds a dominant trend for roadside perception.

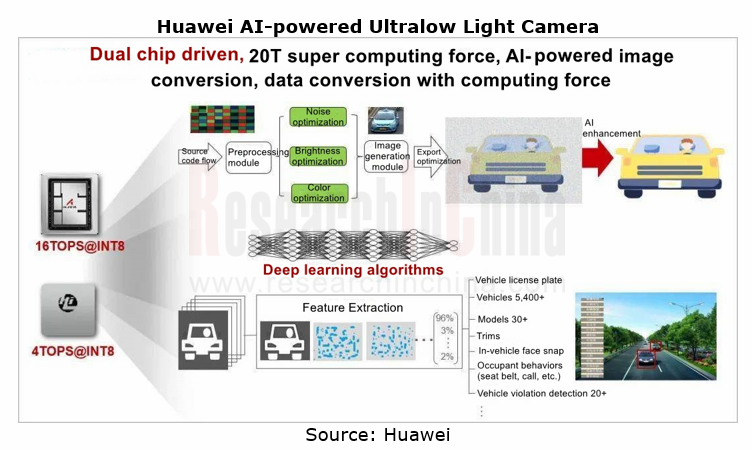

(1) AI-driven visual camera

Roadside cameras with visual AI analysis function enable more intuitive display of current traffic status and details. At present, vendors like Huawei, Dahua Technology and Hikvision have rolled out their AI-driven roadside cameras.

Based on the open architecture SDC OS, Huawei AI ultralow light camera allows for load of third-party algorithms through Huawei HoloSens Store, making “software-defined” cameras a reality. To make more types of targets detected by cameras, Huawei adds algorithms. For example, the perception and detection of non-motor vehicles only needs to load front-end equipment or ITS800 edge computing nodes with powerful non-motor vehicle video detection algorithms.

(2) Radar

Vendors are trying hard to improve the performance of roadside radars. Based on wide area radar front end and advanced data processing technologies, Hurys introduced a new-generation wide-area radar microwave intelligent perception system that offers more abundant, more diverse data; WAYV series ultra-long-range radars Muniu Technology launched in 2020 afford the longest detection range of 1,000 meters.

Moreover, 4D imaging radars are making their way into the roadside perception market. They provide all-round, three-dimensional, multi-dimensional monitoring and tracking of large intersections and highway scenarios, especially the holographic perception of CVIS at large complex intersections and in mixed traffic in cities. Vendors like Continental, Huawei and Oculii, which deploy roadside perception, have launched their 4D LiDARs.

(3) LiDAR

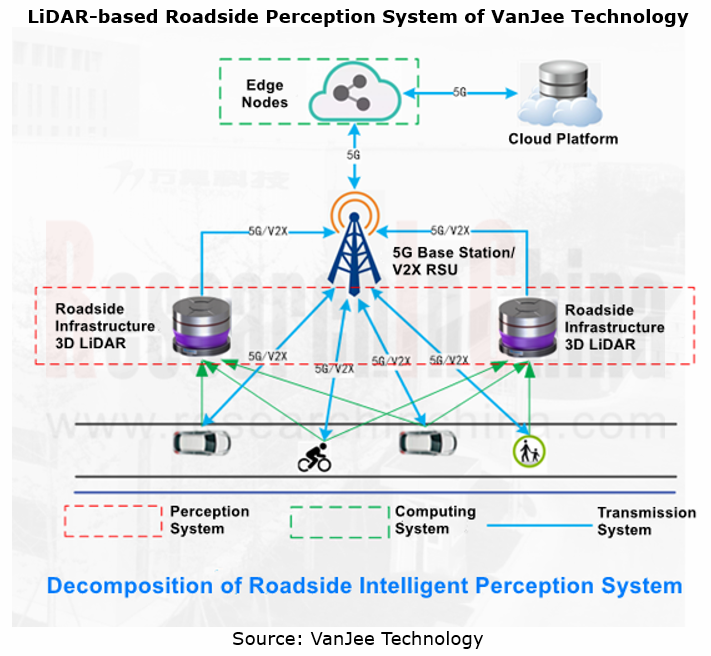

LiDAR that can acquire high-precision three-dimensional information about targets enables e-fence control and some special capabilities (target filtering, customized communication, etc.) in designated areas.

Traditional roadside perception solution providers such as VanJee Technology, Changsha Intelligent Driving Institute Ltd. (CiDi) and China TransInfo Technology already unveil their roadside LiDAR products.

In March 2021, VanJee Technology managed to deploy its smart base stations that integrate with V2X roadside antenna and LiDAR in Xiongan Civic Center V2X Demonstration Project and High-speed Railway Hub Road Intelligence Project.

Also, automotive LiDAR vendors like RoboSense and Ouster have started a foray into the roadside perception field. In 2020, Ouster and LiangDao Intelligence together created a LiDAR-based roadside solution.

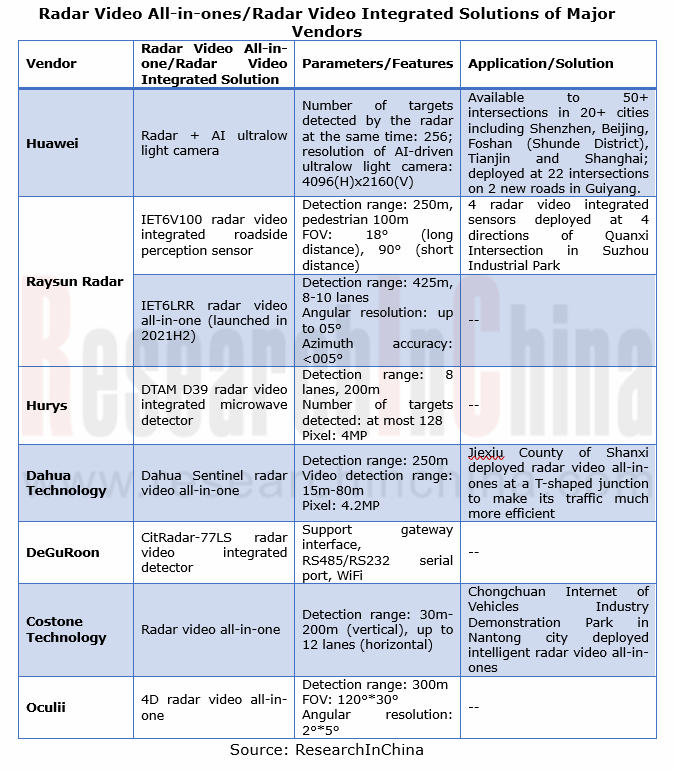

(4) Radar video all-in-one

Radar video all-in-ones that feature integrated design and unified installation and share power supplies, can save a lot of costs of materials and installation. The fronted deployment of perception fusion algorithms at the terminal end leads to a marked reduction in perception latency and computing load at the edge end; and the combination of merits of video and radar offers higher target detection accuracy.

Currently, roadside vision-based HD camera vendors like Dahua Technology and Hikvision and roadside radar vendors such as Raysun Radar, Hurys and DeGuRoon have introduced their radar video all-in-ones. Among them, in 2019 Oculii released 4D radar video all-in-one that uses Falcon, its first-generation point cloud imaging radar; in the second half of 2021, Raysun Radar unveiled IET6LRR, its new-generation radar video all-in-one that provides the maximum detection range of 425 meters.

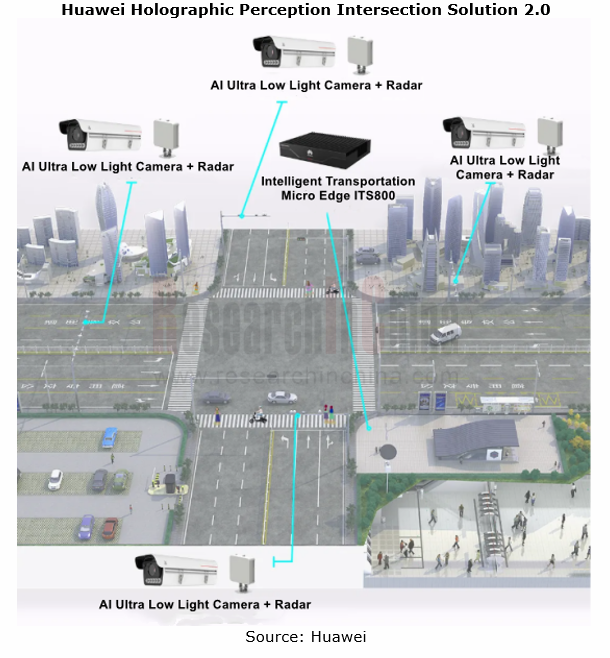

Huawei and Baidu have stepped into the field and launched “holographic perception intersection” solutions

Holographic perception is a foundation for the development of smart roads. It needs roadside perception equipment to provide comprehensive, high-quality, stable traffic data. Since 2000 Huawei, Baidu, OriginalTek and the Institute of Deep Perception Technology (IDPT), among others have rolled out their holographic perception solutions,

Huawei: in 2020 Huawei released the solution Holographic Perception Intersection 1.0; in March 2021, Huawei unveiled Holographic Perception Intersection 2.0, a combination of AI ultra-low light camera, radar, ITS800 edge computing node and intersection HD map, which is applicable to crossroads, T/X/Y-shaped intersections and super large intersections. Based on its holographic perception solutions, Huawei will create holographic road section solutions that enable convergence and access, analysis and communication capabilities at intersections and roadsides via edge computing units, and connect traffic signals and vehicle communication units to lay the foundation for CVIS services such as accurate public transit and driving assistance.

Baidu: Baidu ACE Intelligent Intersection Solution launched in March 2021 enables perception of all elements including road vehicles, roads, pedestrians, environments and traffic incidents, with perception and computing devices (camera, fisheye camera, LiDAR, edge computing unit, etc.) deployed at the roadside. The solution integrating with Baidu Map data delivers a data detection accuracy of over 97%. ACE Smart Intersection is an application of Baidu ACE Smart Traffic Engine (a full-stack intelligent transportation solution that integrates vehicle, infrastructure and pedestrian) in the intersection scenario.

In Baidu ACE Intelligent Intersection Solution, devices like camera, LiDAR, communication equipment and edge computing unit are customized by Baidu with its ecological partners.

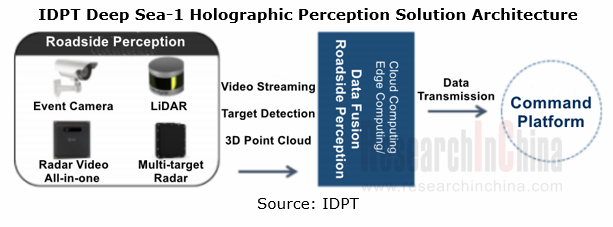

IDPT: the deep fusion of raw data from cameras, LiDARs, radars, and radar video all-in-ones enables 360° image-level holographic perception around the clock in all weather conditions, offering the longest detection range of up to 500m and more reliable data for urban intersections.

In addition, Hikailink Technology achieves holographic intersection perception with radar, camera, and image-level solid-state LiDAR; OriginalTek deployed BotEye? holographic perception devices in the test park where the 2020 C-V2X Cross-industry & Large-scale Pilot Plugfest was held.

The roadside perception market will be worth RMB20 billion in 2025

Intelligent roadside perception will firstly cover highways and urban intersections. The official statistics show that China has 149,600km highways in all, with the overall density of road networks averaging 6.1km/km2 and the total urban construction areas reaching 21,000 km2 in 36 major cities.

On our estimate, China's intelligent roadside perception equipment market (including RSU, camera, radar, LiDAR, and radar video all-in-one) will be valued at RMB20 billion or so in 2025. Camera and radar will be still mainstream devices for roadside perception, while radar video all-in-one and LiDAR will gather pace.

Smart Road-Roadside Perception Industry Report, 2021 highlights the following:

Smart road industry (favorable policies, industry standards, industrial planning);

Smart road industry (favorable policies, industry standards, industrial planning);

Intelligent roadside perception market (size, pattern);

Intelligent roadside perception market (size, pattern);

Status quo and trends of key technologies (HD camera, radar, radar video all-in-one, LiDAR, multi-sensor fusion, etc.);

Status quo and trends of key technologies (HD camera, radar, radar video all-in-one, LiDAR, multi-sensor fusion, etc.);

Deployment cases of roadside perception devices on highways and at urban intersections;

Deployment cases of roadside perception devices on highways and at urban intersections;

Major roadside perception system integrators and equipment suppliers.

Major roadside perception system integrators and equipment suppliers.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...