Global and China Automotive Intelligent Cockpit Platform Research Report, 2021

Next-Generation Intelligent Cockpit Platform: Deep Domain Integration, Pluggable Hardware, Reusable Software

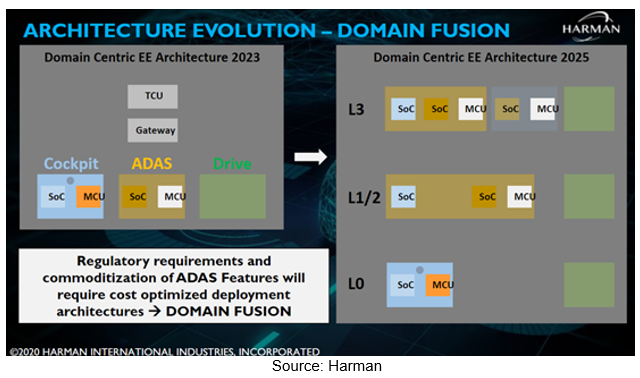

As new-generation E/E architectures evolve, deep integration of cockpit domain may become a trend.

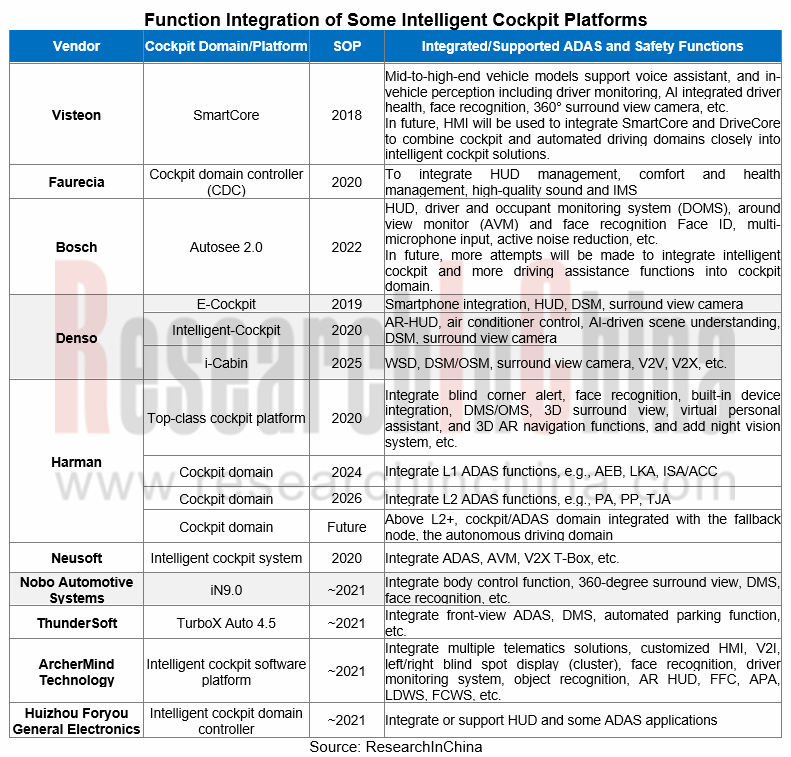

The development of automotive E/E architectures comes with the integration of ADAS functions and V2X systems into the cockpit domain that already combines conventional cockpit electronics.

Through the lens of function integration, the cockpit domain tends to be integrated. As well as basic capabilities including dashboard and center console, rear seat entertainment, HUD and voice, quite a few suppliers currently integrate also surround view camera, DMS, IMS and some ADAS functions into their intelligent cockpit platforms.

In Harman’s case, its cockpit platform already integrates L0 ADAS functions from AR navigation and 360° surround view to DMS/OMS and E-mirror. In future, Harman will combine intelligent cockpit domain controller and ADAS domain controller to support L1~L2+/L3 capabilities, giving OEMs scope for lowering their costs and simplifying systems.

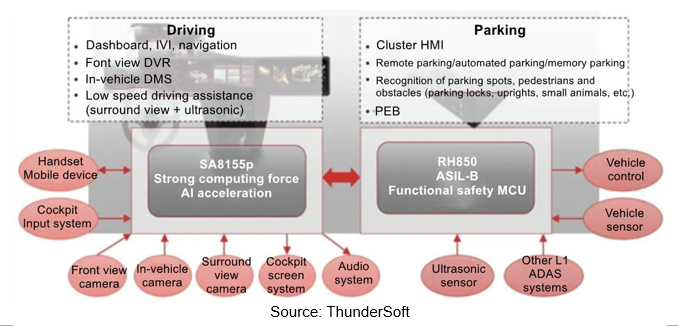

In 2021, ThunderSoft also introduced TurboX Auto 4.5, its new-generation intelligent cockpit platform that allows the cockpit to integrate DMS and automated parking solution and interact with ADAS scenarios. Its intelligent cockpit that can start the built-in computing platform in the parking process optimizes low speed driving with stronger computing force or assists the driver in parking, providing better driving experience.

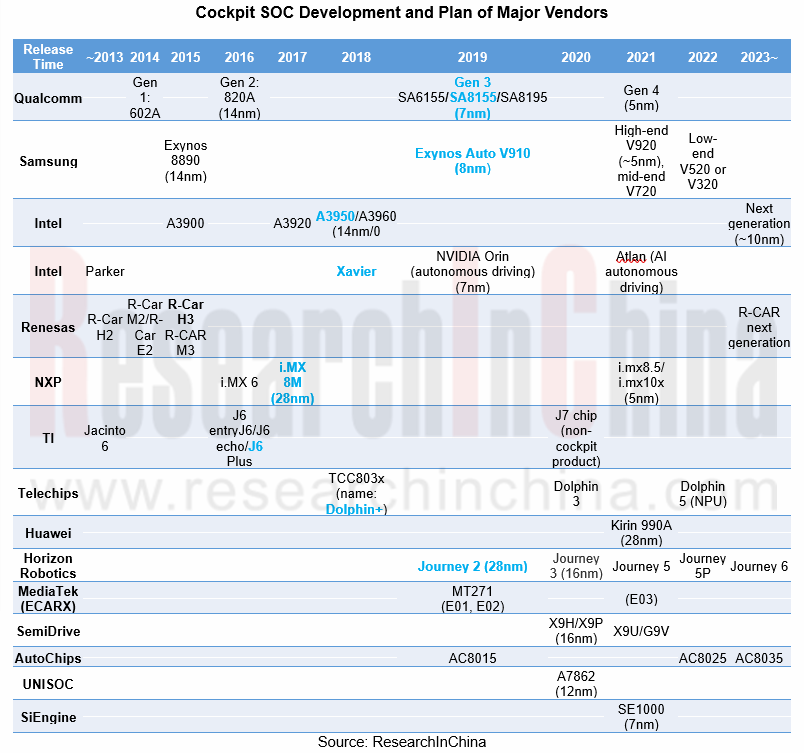

Cockpit SoC trends: stronger CPU and AI computing force, more displays and sensor interfaces, modular and renewable

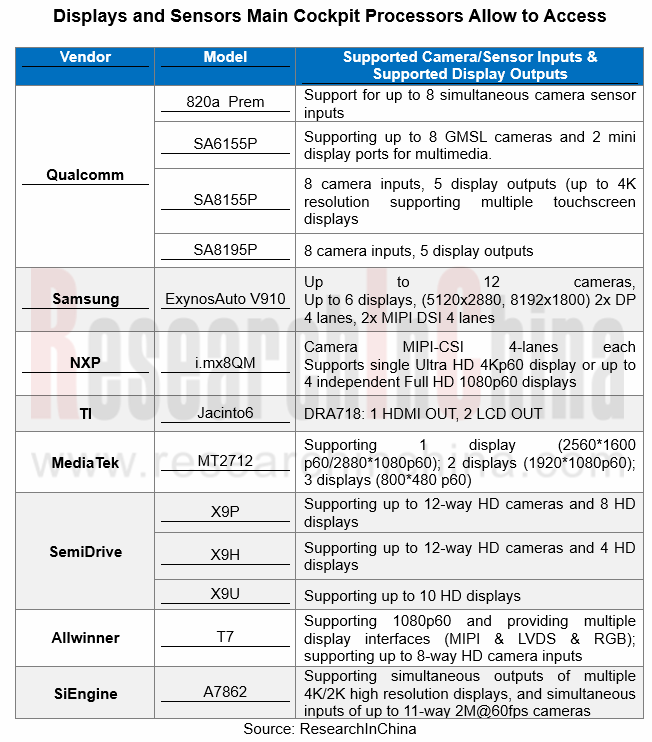

With a tendency towards intelligent cockpit multi-sensor fusion, multi-mode interaction and multi-scene mode, cockpit SoC as the processing center needs breakthrough upgrades. The next-generation cockpit SoC will head in the following directions:

1. Increasingly strong CPU computing force: for example, Qualcomm Snapdragon SA8155P chip and SA8195P CPU boast computing force of 85KDMIPS and 150KDMIPS, respectively; SemiDrive’s latest X9U cockpit chip features CPU computing force of up to 100KDMIPS.

2. Needs for ever stronger AI computing force that allows the driver to interact with voice, graphics and even vehicle functions. In current stage, some mass-produced cockpit SoCs are embedded into AI accelerated computing platforms, affording computing force of 1~5TOPS. Examples include Nvidia Parker for Mercedes-Benz's first-generation MBUX, with AI computing force of 1TOPS, and Samsung’s mass-produced Exynos Auto V910 with AI computing force of approximately 1.9TOPS and its Exynos Auto V920 cockpit chip to be spawned around 2025 with NPU computing force of 30TOPs.

3. Access to more vehicle displays and sensors. For example, Qualcomm 8155/8195 supports up to 8 sensor outputs and 5-way displays; Samsung V910 supports 6-way displays; X9U, SemiDrive’s latest intelligent cockpit chip unveiled at Auto Shanghai 2021 supports 10 HD displays.

4. More advanced chip process. At present, 7nm and 8nm cockpit chips such as Qualcomm 8155/8195 and Samsung V910 have been mass-produced. Qualcomm’s new fourth-generation Snapdragon automotive cockpit chip adopts 5nm process and is projected to be produced in quantities in 2022.

5. Faster chip iteration, shorter release cycle. New cockpit chips are released every 1 or 2 years compared with previous 3 or 5 years, showing faster iteration.

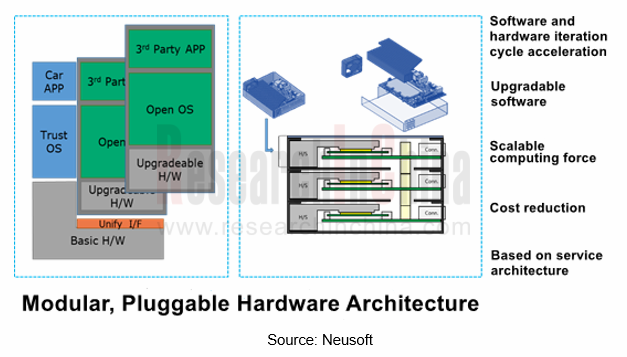

6. Cockpit SoC also tends to be modular, replaceable and scalable. In April 2021, Huawei released 9610, an IVI module with built-in Kirin 990A automotive chip. The chip module featuring pluggable design can be upgraded by way of replacing central processing unit every three years, and each generation with the same interfaces allows direct replacement, covering the full life cycle of vehicles.

Neusoft Vehicle Computing Platform (VCP) also allows flexible, free configurations with hardware plug and unplug. The separation of the computing unit from the functional unit successfully decouples the software and hardware development process, making it a reality features and advantages like upgradable hardware, sharable computing force and scalable software, to build more flexible business models for automakers.

Cockpit software platform: a standard, scalable, open integrated basic software platform

Quite a few technology firms including Continental EB, ThunderSoft, Neusoft Reach, Huawei, ArcherMind Technology and Banma Information Technology have made deployments in intelligent cockpit software platform.

At present, decoupling and separating the intelligent vehicle cockpit software and hardware has been a common belief. Based on service oriented architecture (SOA), the decoupling and reuse of vehicle software and hardware at the underling layer enable rapid iteration of software functions, and the interaction with users over the air (OTA) helps to deliver personalized and differentiated cockpit product experience.

TurboX Auto 4.5, ThunderSoft’s SOA-based intelligent cockpit platform, enables decoupling of scenarios and services, and rapid development and iteration of scenario services.

Besides needed rapid iteration of cockpit software, reusability, scalability and enough flexibility should also be taken into account in SOA design so that the needs for a mass of inputs can be satisfied with minimal software change.

Neusoft already builds its general standard software architecture and software platform that can fast adapt to different mainstream SoC hardware platforms, and help to realize mass production of high-, mid- and low-end multi-platform intelligent cockpits shortly to meet the needs of different OEMs.

In Jul. 2020, Foryou introduced ADAYO Automotive Open Platform (AAOP) which decouples the telematics software ecosystem at the upper layer and the hardware ecosystem at the underlying layer. AAOP focuses on the intelligent cockpit platform. Based on the standard, modular, layered and categorized software framework of AAOP, Huizhou Foryou General Electronics’ software development model can be transformed from project-based embedded software delivery to layered, categorized software development, which accelerates research and development, reduce R&D preparations and improve R&D efficiency.

Automotive market business models are undergoing disruption. Under the new cooperation model, components suppliers and OEMs partner more closely, and their joint development of cockpit software platforms will become a trend. Tier1s have even been a part of automakers’ engineering design, even partaking in their product design. Platform-based open cooperation on both hardware and software holds a trend. Tier1s are becoming so-called Tier0.5s, while Tier2s work towards Tier1s.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...