Automotive MCU Research: Chinese vendors pursue replacement of foreign peers in the context of “shortage of chips”.

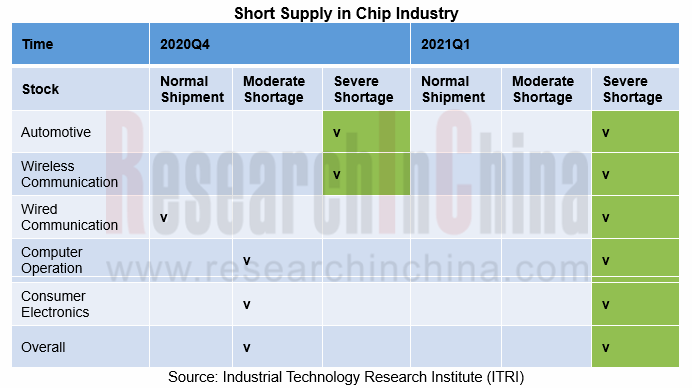

Concentrated capacity and repeated outbreaks of the COVID-19 make it hard to relieve the shortage of MCUs at once.

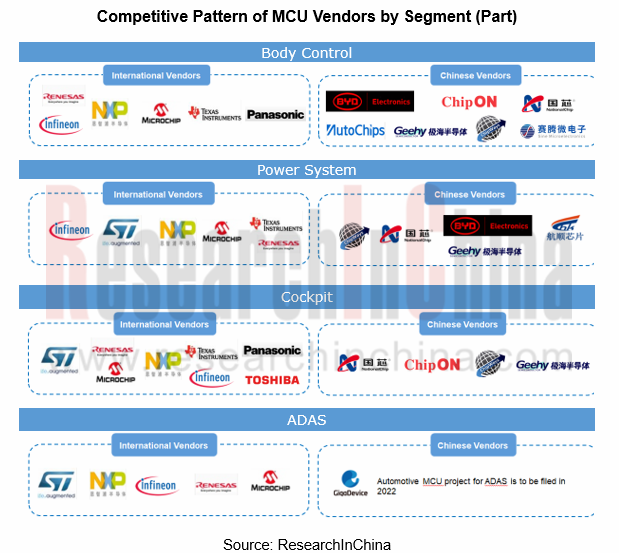

MCU, a core chip for vehicle control, finds application in body control, driving control, infotainment and driving assistance. MCU is a mature market featuring a stable pattern. NXP, Infineon, Renesas, STMicroelectronics and Texas Instruments have long been the top five players in the global automotive MCU market where CR7 (hold by international giants) reached over 95% in 2020.

Automotive MCUs with multiple specifications are often produced with 40/45/65nm process, and the operating cost of production lines remains high. So most integrated device manufacturers (IDM) like NXP, Renesas, Infineon, Texas Instruments and Microchip Technology adopt the foundry strategy. Automotive MCU foundry is a highly concentrated industry. Globally, 70% of automotive MCUs are produced by TSMC. Yet MCU capacity makes up a mere 3% of TSMC’s total capacity.

As the pandemic in 2020 led to a slump in the demand from automotive industry, MCU vendors reduced their orders and digested their inventory. In 2021, the recovery of global automotive industry has caused a short-term short supply of automotive chips that need a long time to supply.

Since 2021Q2, Malaysia and Taiwan have underwent a much severer COVID-19 outbreak. Taiwan-based TSMC is a major MCU fab; Malaysia is home to OSAT companies of vendors such as NXP, Renesas and Infineon. As a result, automotive MCU industry may be hit hard again, taking a bigger toll on chip supply.

At present, most vehicle and component production suspensions are a result of the shortage of MCUs which are largely demanded by automakers. It is predicted that the lack of chips will last across 2021 but may be eased from 2022 for the following reasons.

(1) Suppliers and fabs race to expand their capacity. For example, Infineon will construct and put into use a new 12-inch fab in late 2021; in 2021, TSMC will produce MCUs 60% more than in 2020, and concentrate on the expansion of its Nanjing plant (28nm) for larger MCU capacity.

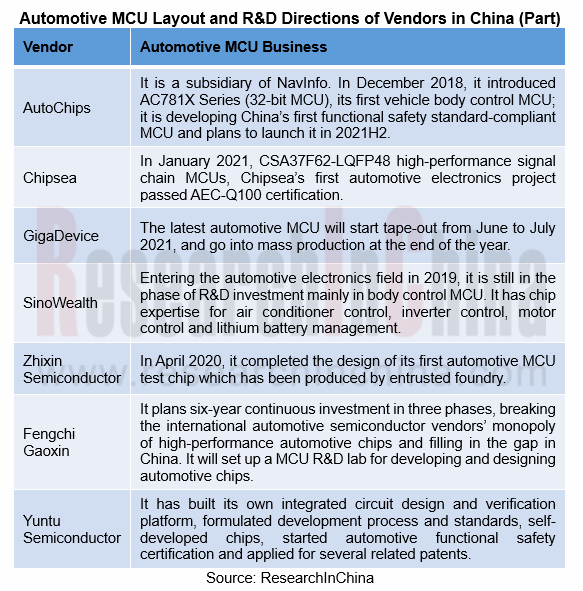

(2) Chinese companies are working to make deployments in MCU. They are expected to start mass production in 2022 to replace foreign products and mitigate the short supply of chips. An example is GigaDevice which plans to spawn its latest automotive MCU products in 2021.

In the long run, as vehicles tend to be intelligent, connected and electrified, the shortage of chips will become normal. The basic solution to the supply safety in China’s intelligent connected vehicle industry chain is to build an independent chip industry chain.

The short supply of chips will bring the window of opportunity to Chinese MCU industry

Through the lens of supply chain, MCU ecosystem covers a lot including a variety of software, hardware, development tools, and open source platforms used by end customers. China currently still depends heavily on foreign software and tools.

International manufacturers are in dire need of MCUs amid the short supply of chips. Automakers have begun to add purchase channels and candidate suppliers, which brings the window of opportunity to Chinese MCU vendors.

In China, few companies such as AutoChips, ChipON, Sine Microelectronics, Chipways, BYD and NationalChip can produce MCUs in quantities, among which BYD, Sine Microelectronics, ChipON and AutoChips can support OEMs, but their products are still used for controlling simple functions like windows, lighting and cooling system and rarely seen in power control, intelligent cockpit and ADAS, among other complex applications.

MCU is a platform-based product. With abundant product lines, overseas vendors provide full range of products for customers. At present, Chinese vendors are working to deploying MCU product lines of all series.

Chinese MCU vendors may make breakthroughs in the following two aspects:

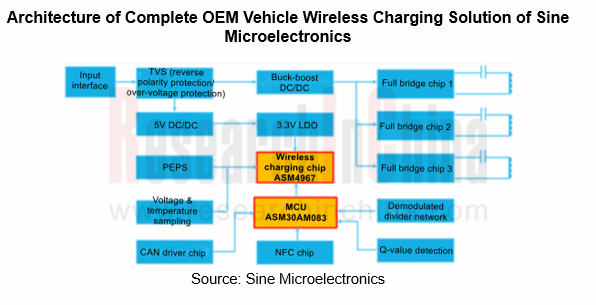

Body control: MCU solutions for vehicle wireless charging, ambient light control and flowing water blinker rear light control, which were once available to high-class models, have now been largely used in low- and mid-class vehicles, and the demand will surge.

For example, Sine Microelectronics has rolled out MCUs for vehicle wireless charging and flowing water blinker rear light control, of which ASM87F0812T16CIT, a MCU master chip designed for vehicle LED flowing water blinker rear light has been shipped more than 1.5 million pieces as of January 2021.

Power control: Chinese vendors have begun to introduce related products, but there are still no heavyweight products. Players that have products landed have more potential to replace foreign counterparts.

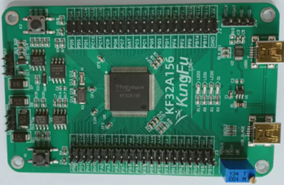

In May 2021, ChipON launched KF32A156, a new automotive MCU subject to AEC-Q100 standard and using kernel processor. KF32A156 is applicable to power supply, motor control and so on. With wider power domains than the previous products, the mass-produced MCU will be available to 70% body and power control unit modules compared with the previous 30%.

Building an independent industry chain is of vital importance in addition to improving layout of product lines. Coordinating the upstream and downstream resources of the industry chain from IP and chip design to foundry and OSAT helps to make homemade automotive MCUs safer, more stable and more reliable.

ResearchInChina’s Automotive Microcontroller Unit (MCU) Industry Report, 2021 highlights the following:

Automotive MCU industry (favorable policies, market size, competitive pattern, industry chain, foundry, technology trends, etc.);

Automotive MCU industry (favorable policies, market size, competitive pattern, industry chain, foundry, technology trends, etc.);

China Automotive MCU industry (localization, industrial layout by domestic companies, and suggestions on how to accelerate replacement of foreign products);

China Automotive MCU industry (localization, industrial layout by domestic companies, and suggestions on how to accelerate replacement of foreign products);

MCU vendors’ supply relationships with automakers (body control MCU, power system MCU, intelligent cockpit MCU, ADAS MCU, etc.);

MCU vendors’ supply relationships with automakers (body control MCU, power system MCU, intelligent cockpit MCU, ADAS MCU, etc.);

Automotive-grade products of foreign and Chinese MCU vendors.

Automotive-grade products of foreign and Chinese MCU vendors.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...