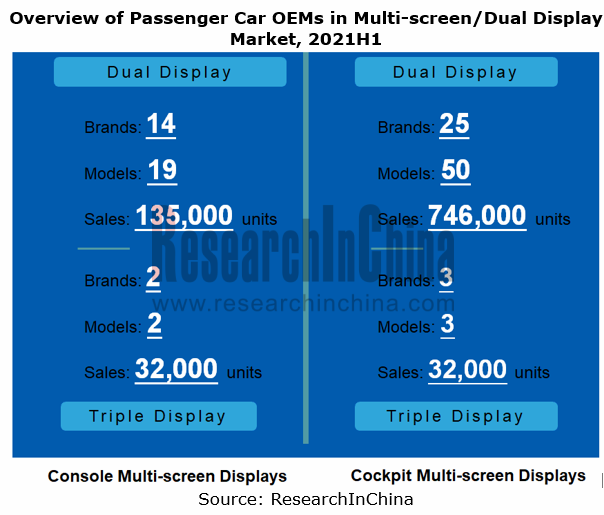

In 2021H1, the sales of vehicle models with console multi and dual display surged by 61% and 155% on a like-on-like basis, respectively

Our Automotive Cockpit Multi and Dual Display Trend Report, 2021 combs through the passenger car models with console multi and dual displays during 2020-2021H1, and discusses the relationship between chip, display and system.

“Console multi-screen display”, a functional description of center console, refers to center console display with two or more screens, for example, center console screen + co-pilot entertainment screen, function control screen, etc.

“Cockpit dual display”, a functional description of cockpit, refers to the abreast layout of in-vehicle displays, that is, integrated design or approximate design, for example, integrated display solutions like “LCD dashboard screen + console screen dual display” and “LCD dashboard screen + console screen display + co-pilot entertainment screen triple display”.

1. The pace of launching models with multi and dual displays quickens.

In 2021H1, a total of 136 auto brands were scrambling for the Chinese passenger car market. In the fairly fierce competition, Chinese and foreign brands kept updating their products from within.

On the face of it, users can directly see how in-vehicle screens are deployed and how many they are. In a connotative view, cockpit software systems implement new hardware and software architectures via high-performance computing chips, thus providing better user experience in actual use. Quite a few automakers make in-depth improvements based on intelligent cockpits, and accelerate the roll-out of models that pack integrated displays, multi-screen displays, and one-chip, multi-screen, dual-system solutions.

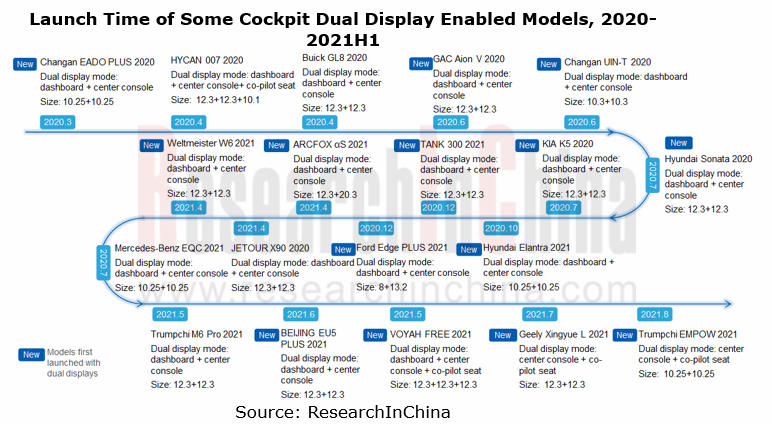

In the case of cockpit dual display, several auto brands including Chinese, German, American and Korean ones have launched their mass-produced models that carry dual/triple displays on market during 2020-2021H1.

In 2021H1, the sales of models with console multi and dual displays surged by 61% and 155% on a like-on-like basis, respectively.

In spite of the downturn in overall passenger car sales in China, models with multi and dual displays bucked the trend and showed an aggressive growth in 2021H1. The sales of models with console multi-screen displays and cockpit dual displays shot up by 61% and 155% from the prior-year period, separately.

The booming sales of such models indicate how determined automakers are in cockpit disruption, and are also an evidence of their high acceptance in market. The positive effects given by automakers and the market have created an active and effective closed loop, which will make the sales of models with multi-screen and dual displays sustain rapid growth.

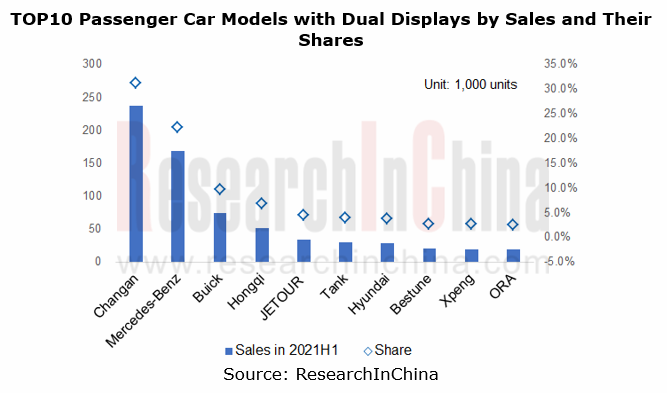

Chinese brands hold a more positive, more open attitude towards cockpit dual displays.

Still take cockpit dual display as an example. Homegrown brands in China have become the main drivers of cockpit dual display solutions in the first half of 2021, with a market share of 62.3%, among which Changan Auto is the most typical player followed by Hongqi and Jetour. In the joint venture brands, Hyundai, Ford and SOL have introduced several dual display-enabled models during 2020-2021H1.

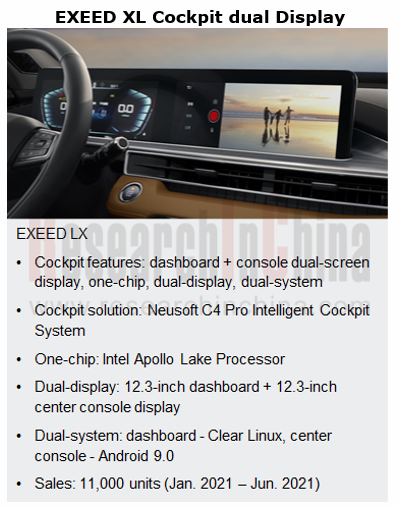

Chery is one of the earliest homegrown brands deploying dual displays and using one-chip, dual-display, dual-system solutions.

In October 2019, EXEED, a high-end brand under Chery introduced EXEED LX, its second model equipped with i-Connect@Lion 3.0 and 12.3-inch dashboard + 12.3-inch console dual-screen display. Differing from the previous versions, i-Connect@Lion 3.0 co-developed by Neusoft, Baidu and Intel enables a one-chip, dual-display, dual-system solution via ACRN hypervisor that runs on the Intel Apollo Lake processor.

This solution has become available to the full range of EXEED models, making the auto brand one of the few thorough implementers of dual displays and one-chip, dual-display, dual-system solutions in the auto industry.

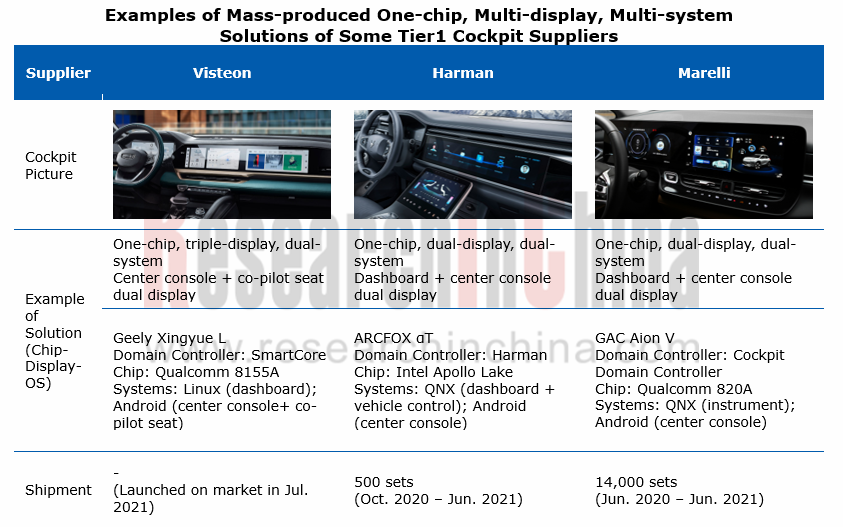

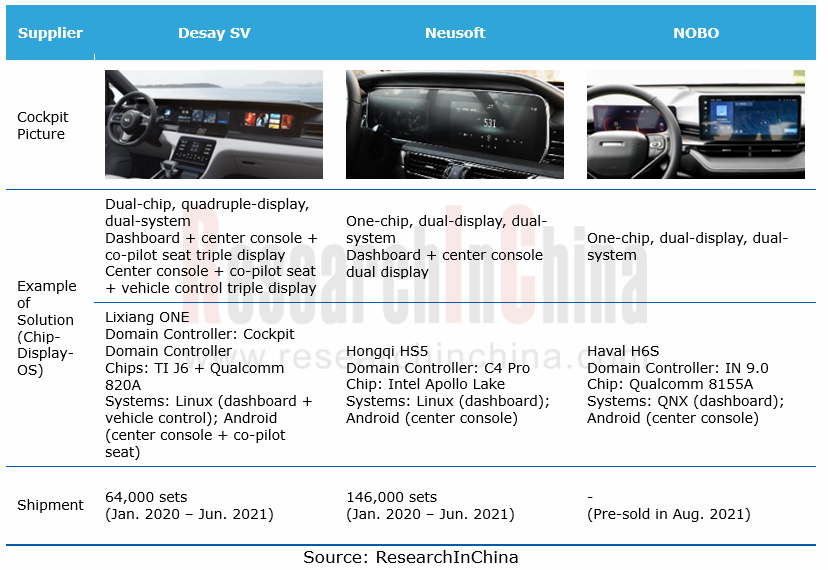

2. Chip vendors and Tier1 cockpit solution suppliers are strong advocates of one-chip, multi-display, multi-system solutions.

Simple technology upgrade is not enough to make cockpits intelligent in a substantial way. High performance chips such as Qualcomm, Renesas and Intel bring in a possibility for multiple operating systems to run on one chip, and also support several screens including LCD dashboard screen, center console screen and co-pilot entertainment screen.

Take Qualcomm SA8155 as an example: as the world’s first mass-produced 7nm automotive digital cockpit chip, the octa-core chip supports 4 2K screens or 3 4K screens, with the computing forces of CPU and GPU up to 80K DMIPS and 1142G FLOPS, respectively. Qualcomm SA8155 has provided one-chip, multi-display solution enablers for mass-produced models like AION LX, WEY Mocha and Xingyue L.

Automotive E/E architecture is shifting to a domain centralized one, which allows Tier1 cockpit suppliers to integrate different operating systems into the cockpit domain controller through hardware isolation or hypervisor technology, so as to realize the one-chip multi-system function on a single hardware platform for higher computational efficiency and lower cost.

One example is SmartCore, Visteon's latest cockpit domain controller which enables HMI seamless connection in multiple display domains such as digital cluster, infotainment and rear seat infotainment. On the strength of its powerful computing force, the Hypervisor-based SmartCore architecture running on two systems allows SmartCore solution to simultaneously drive digital cluster system, infotainment system, and body control system. SmartCore domain controller has provided one-chip, dual-system solution support for mass-produced models like Mercedes-Benz A-Class, AION LX and Xingyue L.

Globally, Tier1 cockpit suppliers both inside and outside China are racing to launch one-chip, multi-display, multi-system cockpit solutions based on high performance chip and cockpit domain controller.

3. Challenges and Trends

Multi-screen and dual displays provide substantially better occupant experience in multiple aspects: in usability, both displays improve the interaction efficiency between people and vehicles to some extent and make it cheaper for users to obtain vehicle information and functions; in scalability, both of them expand the information load capacity of a cockpit and add more driving information and entertainment content.

Meanwhile, the upgrade of current cockpit industry chain technologies including chip, operating system, cockpit domain controller and display will leave more scope for OEMs to conceive and implement multi-screen and dual displays, helping to reshape cockpits technologically.

As concerns whether it is necessary to introduce multi-screen/dual display or one-chip, multi-display, multi-system solution into a car or not, automakers need to take into account a combination of factors such as product orientation, user needs, R&D costs and competitive pattern. As for cockpit interior structure, it is not the use or re-layout of displays that poses technical and cost challenges to OEMs, but how to improve user experience with multi-screen/dual displays of limited number and size, that are introduced into a cockpit based on redesigned software and hardware architecture, in an age of intelligent cockpits. This is really worth OEMs thinking about.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...