Global and China Automotive LCD Cluster and Center Console Industry Report, 2021

Cluster and center console display research: how Chinese manufacturers scramble for Mini LED/Micro LE market

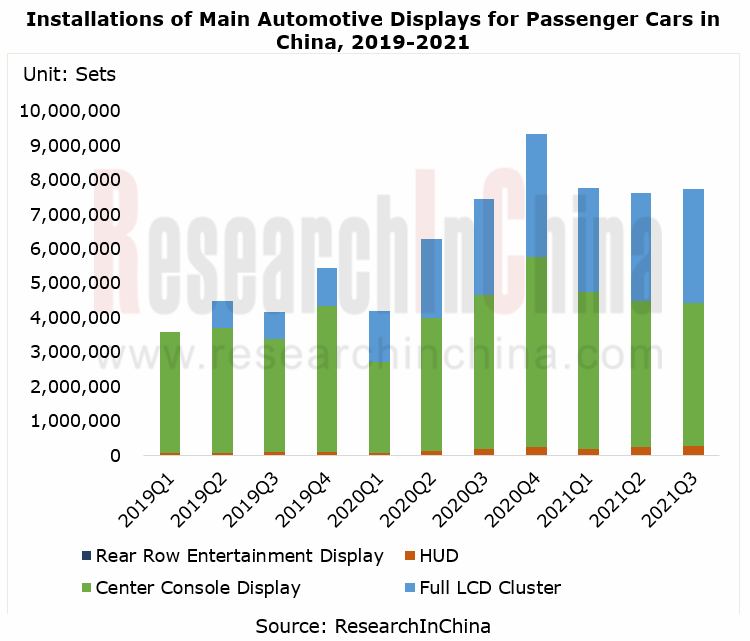

The surging demand for intelligent and connected vehicles, in-vehicle infotainment systems and navigation systems among others gives a big boost to the automotive display market. The statistics from our automotive database show that in 2020 China shipped more than 35 million sets of passenger car displays (cluster, center console, entertainment display, HUD, etc.), up over 4% more than in the previous year.

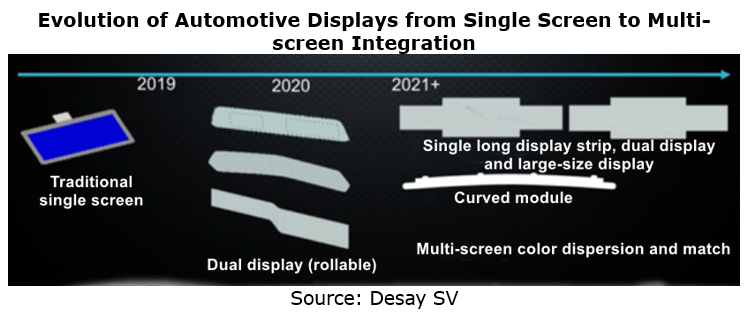

Large-size display and multi-screen display hold the trend for automotive displays.

Automotive display is a key booster to the digital transformation of automotive cockpits. The better performance of on-board computers enables the central computing unit to support LCD cluster, high-resolution infotainment display, HUD, electronic rearview mirror and other display systems, and provides technical support for multi-display systems.

From the new models launched in recent two years, it can be seen that large-size display and multi-screen display have been trends for automotive displays. High-end models have begun to pack at least 4 displays. Products like co-pilot seat entertainment display, control display, rear row entertainment display and streaming media rearview mirror have started finding application, and the demand for large-size displays has been soaring.

Large-size display

The installation of clusters shows that about 60% of new vehicles carry LCD clusters. In the first three quarters of 2021, 6.544 million LCD clusters were installed in passenger cars, a like-on-like spurt of 44.5%, of which 12.0-inch (incl.) to 13.0-inch (excl.) LCD clusters were most installed, up to 2.512 million units, up by 35.0%, and 10.0-inch (incl.) to 12.0-inch (excl.) LCD clusters grew at the fastest pace with the installations rocketing by 173.8% to 1.186 million units.

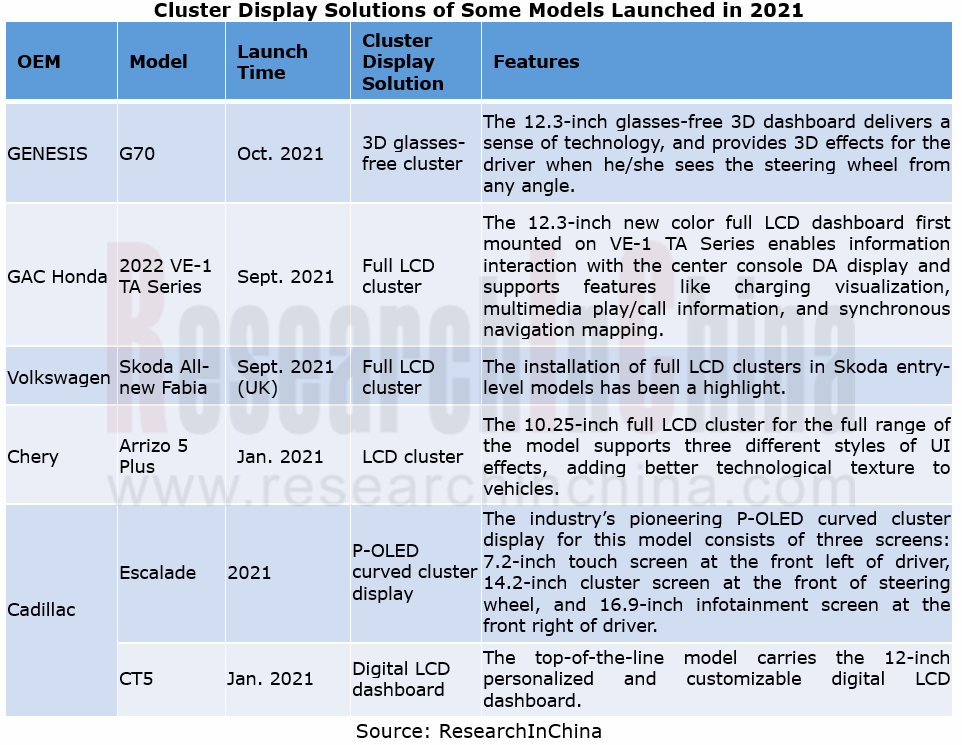

Through the lens of installation in mass-produced models, most new models launched in 2021 are equipped with larger than 10-inch LCD clusters.

From center console displays, it can be seen that the installations of large-size ones have surged. In the first three quarters of 2021, 8.0-inch to 9.0-inch center console displays were most installed, up to 4.016 million units, up by 4.3% from the prior-year period, but with the proportion of the total center console display installations down 4.2 percentage points; the installations of 13.0-inch to 15.0-inch center console displays proliferated by 250.6%; that of 15.0-inch and above center console displays multiplied by 204.0%.

Multi-screen display

Cockpit electronics are heading in the direction of multi-display integration. Early in 2019, emerging carmakers have rolled out mass-produced models like LiXiang One and ENOVATE ME7 with 4 and even 5-screen displays. Traditional OEMs also step up efforts to deploy, having introduced multi-screen display products since 2020.

FAW Hongqi H9 unveiled in August 2020 bears dashboard, center console, and co-pilot seat entertainment displays, 2 rear row entertainment displays, and HUD. In addition, it also packs an electronic image acquisition and display system (i.e., streaming media rearview mirror) which consists of digital camera, image processing and high-definition digital display. The system uses the rear camera to project images onto the display, and displays them on the rearview mirror in digital format.

Great Wall Mecha Dragon introduced in November 2021 is equipped with 10.25-inch dashboard, 27-inch 4K center console display, 25-inch head-up display, two 1.6-inch touch bars, and two rear row capacitive touch screens, as well as external display technology at the rear.

In the future, as standards and regulations are improved, more vehicle displays will be used. For example, in June 2021, Zhejiang Society of Automotive Engineers was approved for release of group standard, the Performance Requirements and Test Methods of Passenger Car Digital Perspective A-pillar System. Neta Auto under Hozon Auto introduced its “transparent A-pillar”-enabled mass-production models with OLED flexible screens as display interfaces. The issuance of this standard will accelerate the application of “transparent A-pillar”.

New display technologies tend to be production-ready.

The soaring demand for vehicle displays give impetus to development of new vehicle display technologies. In current stage, a-Si TFT LCD still prevail in vehicle display market, but advanced display technologies such as LTPS TFT LCD, OLED, mini LED backlight and micro LED are making their way into the market.

OLED has achieved mass production.

The year of 2020 saw the start of production of automotive OLED. Due to high cost, OLED, often larger than 7.2 inches, is largely used in high-end models, with applications including cluster, center console and copilot seat entertainment displays. Suppliers are led by LGD, Samsung Display and BOE.

2021 Mercedes-Benz S-Class sedans differ greatly from the previous generations in application of displays, changing the original siamesed center console display into a large waterfall display, a 12.8-inch vertical waterfall OLED screen with resolution of 1888×1728. They also pack a glasses-free 3D full LCD dashboard, HUD and rear row entertainment display, which connect with each other.

Mercedes-Benz EQS rolled out overseas in September 2021 features an OLED flexible integrated touch screen that sweeps almost from A-pillar to A-pillar, and adopts innovative technologies like optically clear adhesives (OCA) and On-cell touch control.

2021 Cadillac Escalade is equipped with an OLED AR perspective curved display with three screens total – a 7.2-inch driver information display, a 14.2-inch digital dashboard, and a 16.9-inch infotainment screen. Wherein, the cluster option features a large speedometer displaying temperature and time at the left and dynamics at the right. In addition, the display is in night mode where infrared technology is used to observe farther than human eyes.

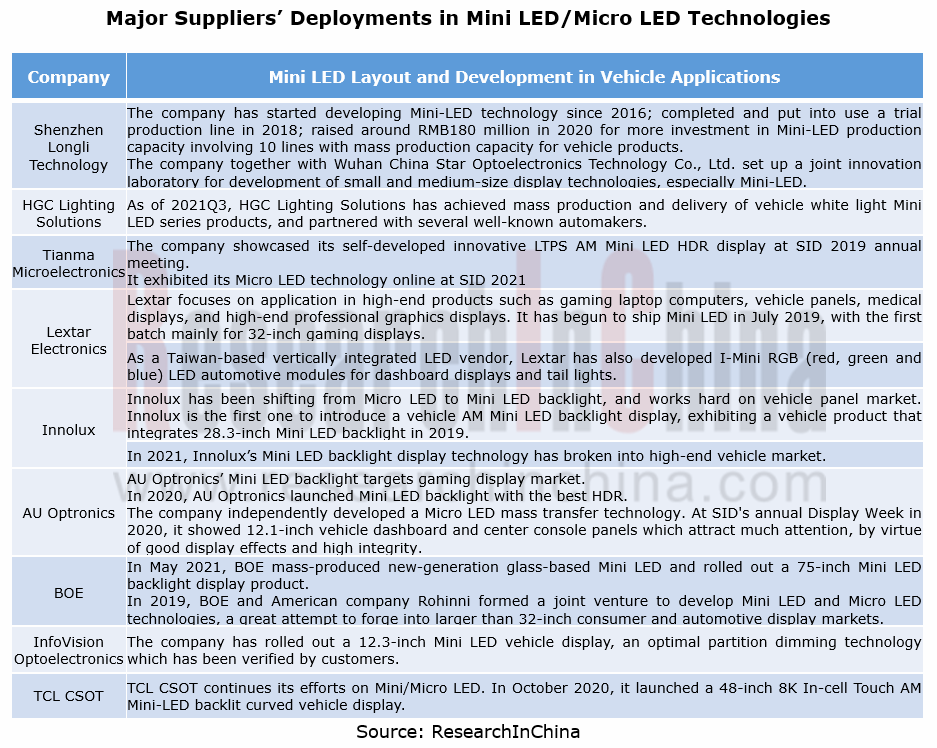

Mini LED comes into mass production.

Mini LED is a necessary transition phase from fine pitch LED to Micro LED. At present, most vehicle display technology companies have deployed Mini LED and Micro LED, and ever more vehicle projects use mini LED backlight technology. One example is Cadillac Lyriq EV in which GM plans to use a 33-inch mini LED backlit display in 2022.

In November 2021, Mecha Dragon, the first model of SL, a high-end brand of Great Wall Motor made a debut at Auto Guangzhou. The Mini-LED external display technology at the rear of this model enables display of user-defined content, the first attempt to apply Mini-LED in cars.

Mini LED and Micro LED will be deployed rapidly.

Automotive displays head in the direction of large size and multi-screen integration, and the surging demand creates huge room to grow. Various suppliers are therefore trying hard to deploy innovative technologies such as Mini LED and Micro LED.

Tianma Microelectronics: in 2020 it first outran JDI and became the world’s largest vehicle display company in terms of shipments. The company supplies through Tier1s, covering 92% of global customers (top 24 Tier1s) and 100% of Chinese brands (top 10).

Tianma Microelectronics works to deploy Mini LED and Micro LED technologies. Following the on-site exhibition of its self-developed LTPS AM Mini LED HDR display at annual meeting of Society for Information Display (SID) early in 2019, the company showcased its Micro LED technologies online at SID 2021, including 5.04" Splitting ultra-narrow bezel Micro LED, the world’s first 7.56" transparent Micro LED, and innovative technology applications combined with electronic paper.

Moreover, its self-developed Hybrid TFT Display (HTD) technology is in the phase of verification for mass production. The company has deployed HTD on its flexible AMOLED production lines, and will achieve mass production based on the advanced drive and backplane technologies with lower power consumption.

HGC Lighting Solutions: the new-generation white light Mini LED vehicle backlight display module features automotive-grade reliability, ultra-thin display body, multi-zone dynamic control, and million-level ultra-high contrast.

This white light Mini LED display module uses automotive chip and self-developed superior ACSP chip-scale packaging technology. By removing the cost of QD and DBEF and upgrading the production process, it not only delivers automotive-grade reliability but cuts 15-25% production cost. The company have spawned and delivered white light Mini LED vehicle display series products and partnered with several well-known automakers.

TCL CSOT: in November 2021, TCL CSOT joined hands with Yanfeng to roll out the industry's first under-screen camera-based automotive intelligent display. Combining TCL CSOT’s blind-hole optical design with the smoked black processing method and Yanfeng’s HMI design, the product embeds a camera into backlight hole to enable an integrated under-screen camera solution, that is, the DMS camera is hidden in the display.

The Automotive LCD Cluster and Center Console Display Industry Report, 2021 highlights the following:

Automotive cluster and center console display (overview, industry chain, industrial policies and standards, market size and competitive pattern, etc.);

Automotive cluster and center console display (overview, industry chain, industrial policies and standards, market size and competitive pattern, etc.);

China automotive display market (installation of LCD/HUD/center console/rear seat entertainment displays, display technologies of major suppliers, vehicle display installation schemes of major OEMs, etc.);

China automotive display market (installation of LCD/HUD/center console/rear seat entertainment displays, display technologies of major suppliers, vehicle display installation schemes of major OEMs, etc.);

Vehicle display (installation rate, technology trends, business models, development trends, etc.);

Vehicle display (installation rate, technology trends, business models, development trends, etc.);

Foreign and Chinese vehicle display system solution providers (vehicle display business, vehicle display technology, etc.);

Foreign and Chinese vehicle display system solution providers (vehicle display business, vehicle display technology, etc.);

Foreign and Chinese vehicle display suppliers (display business, display technology, etc.).

Foreign and Chinese vehicle display suppliers (display business, display technology, etc.).

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...