Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility

Building brick cars moves the cheese of traditional OEMs.

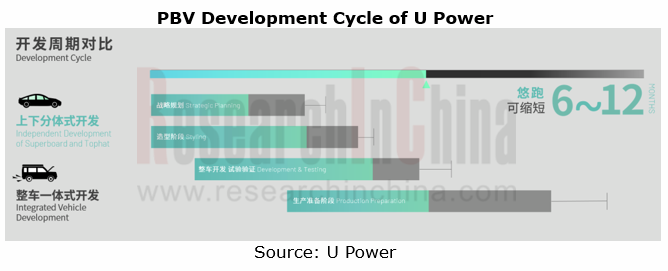

Purpose built vehicle (PBV) refers to special purpose vehicles based on small/medium-sized van or multi-box van. PBV suppliers adopt the approach of independent development of upper and lower vehicle bodies, and derive various vehicle types on the same chassis platform, meeting customization needs. Compared with conventional integrated vehicle development, such a development method has unique features below:

? Short development cycle and low cost

PBVs built on the same chassis don’t need repeated development, which shortens the start-of-production and time-to-market of new models. The standardized chassis components can also be reused, reducing manufacturing costs.

For example, the use of "UP Super Board" developed by Shanghai U Power Technology Co., Ltd. cuts down the orignal 2 or 3 years of vehicle R&D cycle to 12 months, and the R&D costs by up to 60%.

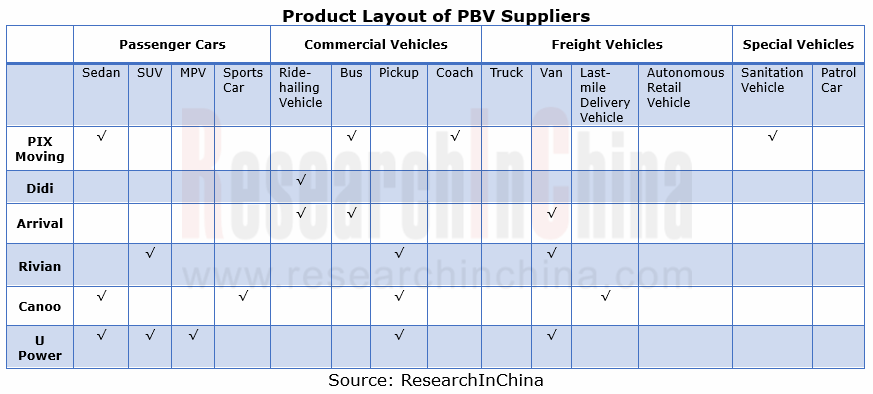

? Diversified PBV product forms

The flexible and changeable upper space of PBV allows a variety of product forms. For example, a PBV can be a logistics vehicle, a retail vehicle, a car, a bus, a sanitation vehicle, and so forth.

From the product layout of PBV suppliers, it can be seen that the product forms of PBV are led by three vehicle types: van, pickup and sedan. Wherein, PIX Moving enjoys the broadest range of product forms, involving four fields: passenger car, commercial vehicle, freight vehicle and special vehicle; U Power boasts the most abundant PBV product lineups and deploys five vehicle types, covering three fields: passenger car, commercial vehicle, and freight vehicle; with single PBV product form, Didi has only one product, D1, a customized car for the online ride-hailing mobility scenario. Didi plans to iterate a version every 18 months, to D3 in 2025 when 1 million units will be launched; and to remove the cockpit and realize autonomous driving in 2030.

? Diversified PBV profit models

Through the lens of business models, PBV suppliers often apply the To B model. Among them, PIX Moving, Arrival and Rivian employ both To B and To C models. For instance, PIX Moving starts with Robobus at the business end in a bid for quick commercialization, and will build a complete marketing system after launching consumer products.

As for manufacturing, all suppliers except for Didi have their own production bases. Didi partners with BYD to produce D1 at BYD’s base in Changsha city. In June 2021, Canoo started building a production line in Oklahoma, the US, and ceased the outsourcing contract with VDL Nedcar, opting to build cars by itself.

There are mainly three profit models: vehicle sales, rental, and software subscription & other value-added services. Didi and Arrival apply the rental model, but their rental schemes are different. Didi offers two rental schemes that target Didi drivers: half-year rental, with a monthly rent of RMB4,399; one-year rental, RMB4,299 per month. Arrival, however, aims at third-party lessors such as LeasePlan (in 2021, Arrival and LeasePlan signed a sales cooperation agreement for 3,000 vans). For profits, the supplier Canoo has begun to take into account both the subscription and vehicle sales models.

Is Robocar the ultimate form of PBV products?

The new idea of building brick cars gives birth to diversified vehicle forms, including Robocar, a robot that looks like a vehicle, can move freely and is capable of L4 autonomous driving. The product forms of Robocars are led by Robotaxi and Robobus. At present, Robotaxies built by Baidu, Pony.ai, QCRAFT and the like have begun to run. In the future, Robocars will also be upgraded to L5 autonomy, competent enough to self-learn, make decisions independently, and adapt to a variety of complex scenarios and inclement weather like rain and fog, and they will completely replace humans by then.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...