ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function application, market layout, development trends, etc. of leading conventional OEMs in China in the current ADAS and autonomous driving market.

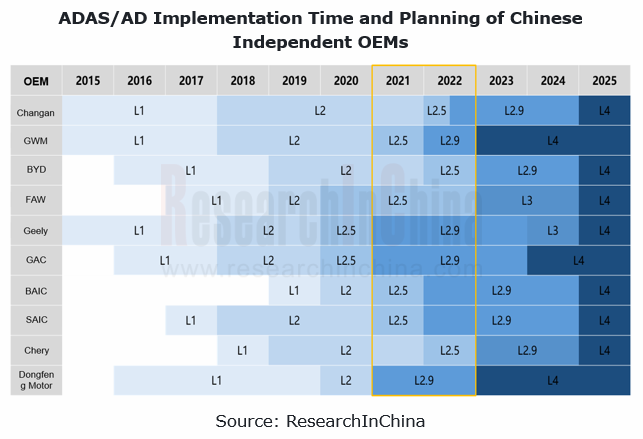

Chinese independent brands plan implementation of L4 autonomous driving in 2024/2025

This report sorts out the autonomous driving development plans and product implementation of each company. In terms of L4 autonomous driving, they set almost the same goal: implementation in 2024/2025.

In its strategy "Smart Geely 2025", Geely proposes commercialization of L4 autonomous driving, complete mastery of L5 autonomous driving, and realization of full-stack self-development in 2025.

In its strategy "Smart Geely 2025", Geely proposes commercialization of L4 autonomous driving, complete mastery of L5 autonomous driving, and realization of full-stack self-development in 2025.

GAC will release a strategic model (AH8) in 2024, which will be based on Huawei's MDC810 platform and support L4 autonomous driving.

GAC will release a strategic model (AH8) in 2024, which will be based on Huawei's MDC810 platform and support L4 autonomous driving.

In April 2022, HAOMO.AI, an autonomous driving subsidiary of Great Wall Motor, announced its roadmap for HPilot, an intelligent driving product for passenger cars, and the plan of launching HPilot 4.0 in 2023, a product that supports L4 autonomous driving.

In April 2022, HAOMO.AI, an autonomous driving subsidiary of Great Wall Motor, announced its roadmap for HPilot, an intelligent driving product for passenger cars, and the plan of launching HPilot 4.0 in 2023, a product that supports L4 autonomous driving.

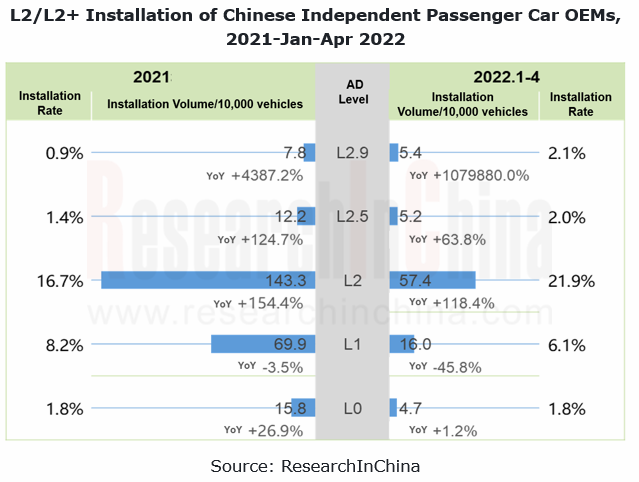

Following their progressive development strategy, Chinese independent brands have kept rolling out vehicle models with L0-L2.9 functions. In sales’ term, their performance also shines.

Chinese independent brands have been in the battle position of L2 ADAS and launch an offensive in L2.5/2.9.

ResearchInChina’s data show that Chinese independent brands had 2.489 million vehicles equipped with ADAS functions in 2021 (installation rate: 29.1%), an upsurge of 69.6% year on year; from January to April 2022, the ADAS installations sustained growth, up from 636,000 vehicles in the same period of the previous year to 887,000 units (installation rate: 33.9%). It is clear that the ADAS installation has not been hampered by negative factors such as the epidemic or chip shortage, but instead taken a big step forward.

From sub-functions, it can be seen that with the battle position in L2 ADAS, Chinese independent brands go on the offensive in L2.5/L2.9. In 2021, Chinese auto brands gradually doubled down on L2, and thus enjoyed growth in both installations and installation rate. Between January and April 2022, L2 installations soared by 118.4% on the previous year to 574,000 units, and the installation rate also reached 21.9%; the installations of L2.5 and L2.9 surged to 106,000 units, and the combined installation rate rose to 4.1%.

Around 2021, quite a few OEMs such as Changan, GWM and BYD added the lane change turn signal capability, plus TJA+ICA+LKA, enabling highway assist (HWA), which meant they stepped into L2.5 autonomous driving. Furthermore, the upgrade of HD maps and sensors empowers vehicles with the function of navigation guided pilot (NGP) or navigate on pilot (NOP), realizing the L2.9 autonomous driving function. Examples include WEY Mocha, Lynk & Co 01EM-F and new ARCFOXαS HI version.

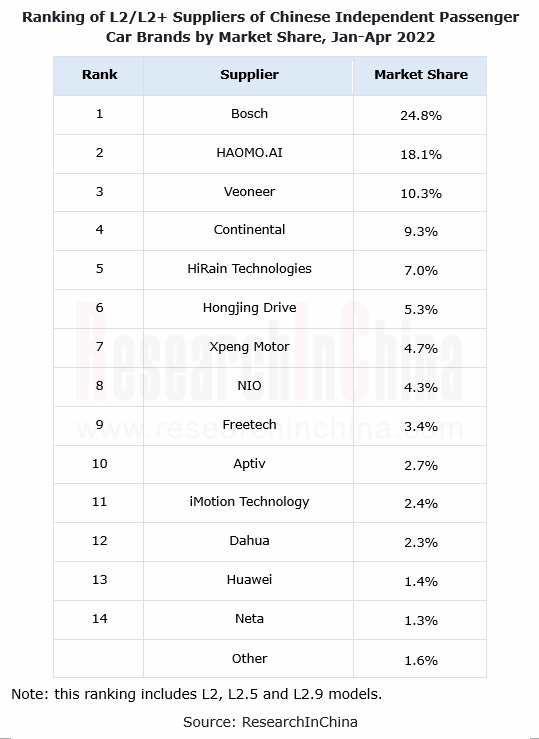

BYD is way ahead in L2 ADAS market, and local suppliers follow local OEMs to rise.

As of April 2022, among all the Chinese independent competitors (including emerging carmakers), 47 and 14 brands have delivered L2 and L2.5 models to users, respectively, of which BYD, Haval and Geely were at the forefront.

Entering 2022, BYD still gains popularity in market, becoming a sought-after brand among multiple consumers. The average monthly installations of L2 in Song PLUS and Han models outnumber 10,000, helping BYD to claim the top spot on the OEMs’ ranking list by L2 installations.

The boom of Chinese independent OEMs in the L2 passenger car market has also boosted local L2 suppliers, among which HAOMO.AI, Jingwei HiRain Technologies, Hongjing Drive and Freetech among others lead the way.

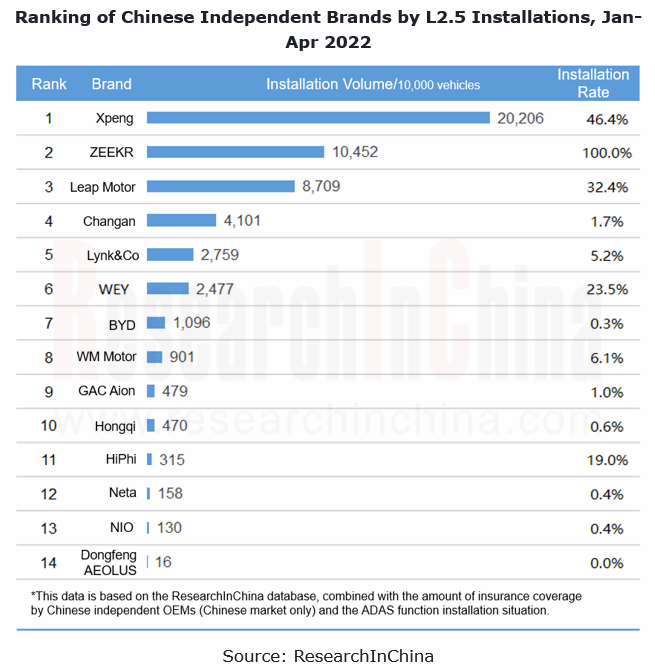

In the L2.5 camp, there are few companies, 14 in total, having actually delivered cars to users, of which 5 are conventional brands. From both installations and installation rate, it can be said that GWM WEY is an outstanding typical conventional automaker in L2.5.

Thanks to the full-stack self-development of autonomous driving algorithms of Great Wall Motor's autonomous driving subsidiary HAOMO.AI, the full range of WEY Mocha models rolled out in May 2021 carry standard L2.5 functions, gaining the lead in the industry. In addition, in April 2022 BYD introduced 2022 Han, a model equipped with highway assist (HWA) and interactive lane change assist (ILCA) systems. This model is expected to be a trump card for BYD to forge into the L2.5 market.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...