LiDAR Research: Perception Algorithms Become the Layout Focus of Foreign Vendors

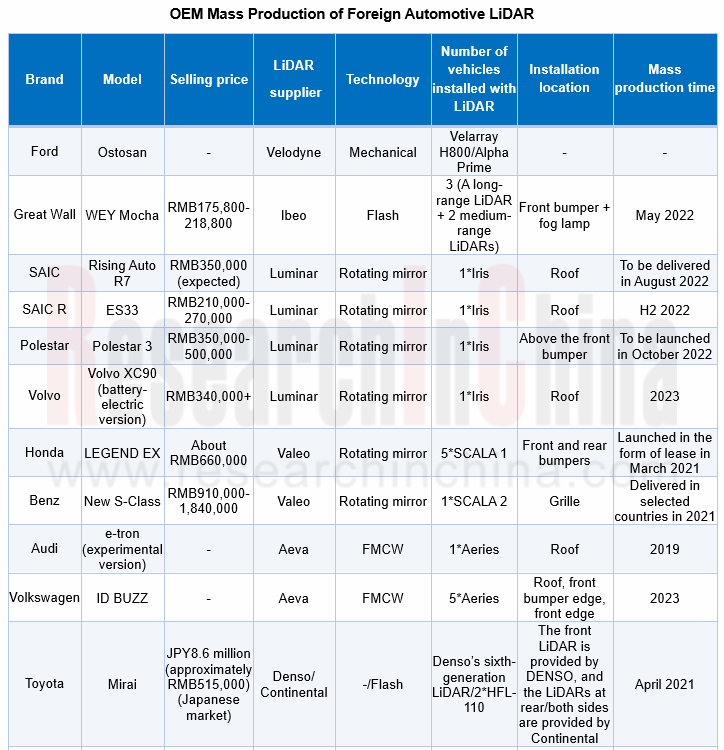

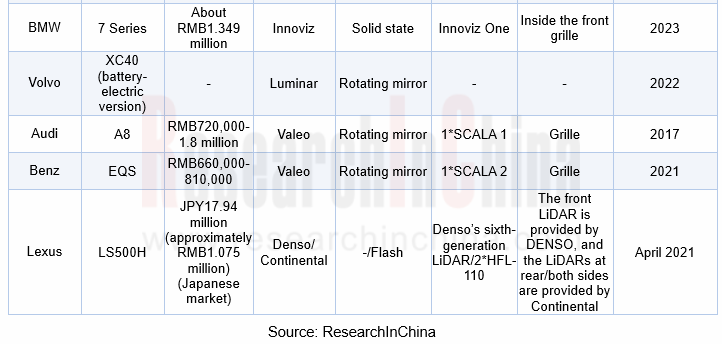

Amid a variety of technology routes in parallel, rotating mirror and flash solutions are adopted most widely during OEM mass production.

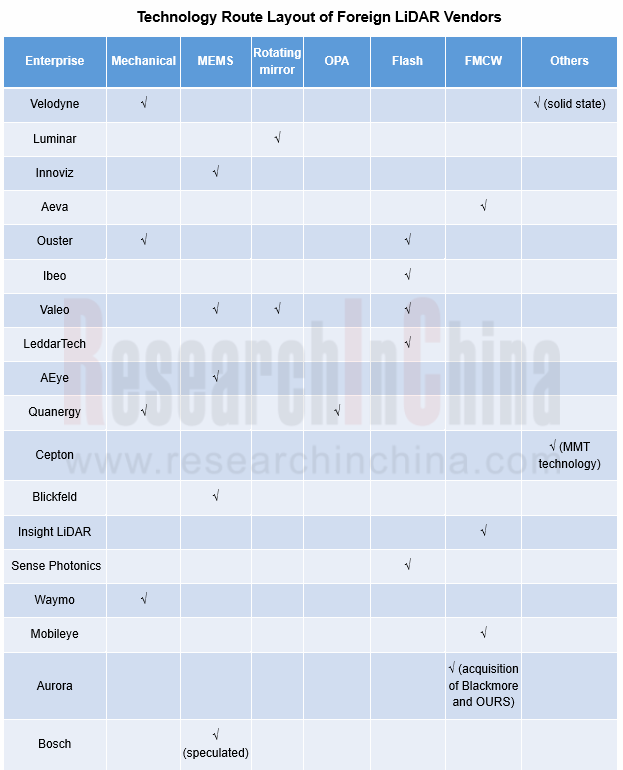

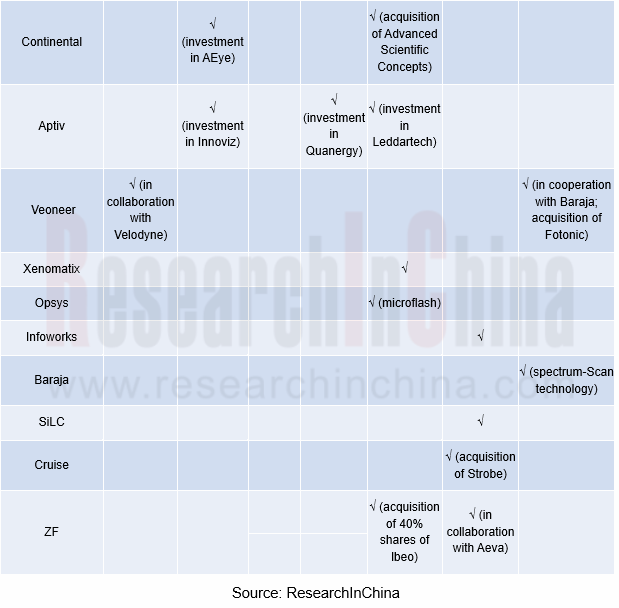

LiDAR technology routes include mechanical, MEMS, rotating mirror/prism, OPA, flash, etc. On the whole, LiDAR evolves from mechanical type to solid-state type, with multiple technology routes existing in parallel (for example, Velodyne has developed mechanical and solid-state solutions simultaneously since Velarray debuted at the 2017 Frankfurt Auto Show). Flash is the most popular solution in the layout of foreign vendors, followed by FMCW and MEMS.

As per OEM mass production, rotating mirror and flash solutions are adopted most widely. Valeo is a typical vendor leveraging the rotating mirror solution, and it produces LiDAR at the Wemding factory in Bavaria, Germany. As of 2021, its Scala LiDAR shipments had exceeded 160,000 units, with a single unit costing less than $1,000. Ibeo is known for its flash LiDAR. The ibeoNEXT LiDAR system produced by ZF features the detection range of more than 250 meters, the horizontal angular resolution of 0.04°, and the vertical angular resolution of 0.07°. It can recognize guardrails, road signs, cars, bicycles and pedestrians, along with their respective positions and movement directions. It has been installed on Great Wall WEY Mocha.

Perception algorithms become the layout focus of foreign vendors

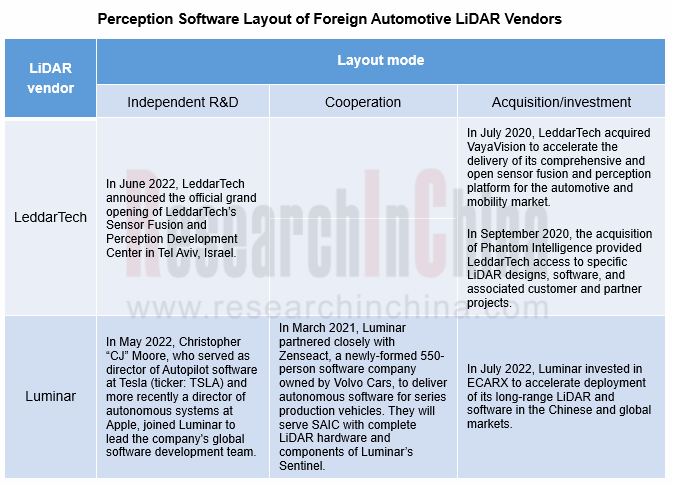

The quality of perception algorithm determines perception accuracy and distance. Therefore, LiDAR vendors not only upgrade their own hardware, but also develop perception software, so as to form the closed loop of perception fusion and system-level supply. Foreign LiDAR vendors mainly leverage self-research, acquisition and cooperation with software companies to deploy perception algorithms.

LeddarTech mainly makes its layout through acquisitions. LeddarTech acquired sensor fusion and perception software companies VayaVision and Phantom Intelligence in 2020. LeddarTech’s open platform based on its full-waveform digital signal processing technology combined with VayaVision’s raw data sensor fusion and perception software stack will deliver the most accurate environmental model, enabling the volume deployment of ADAS and AD applications. In September 2020, the acquisition of Phantom Intelligence provided LeddarTech access to specific LiDAR designs, software, and associated customer and partner projects.

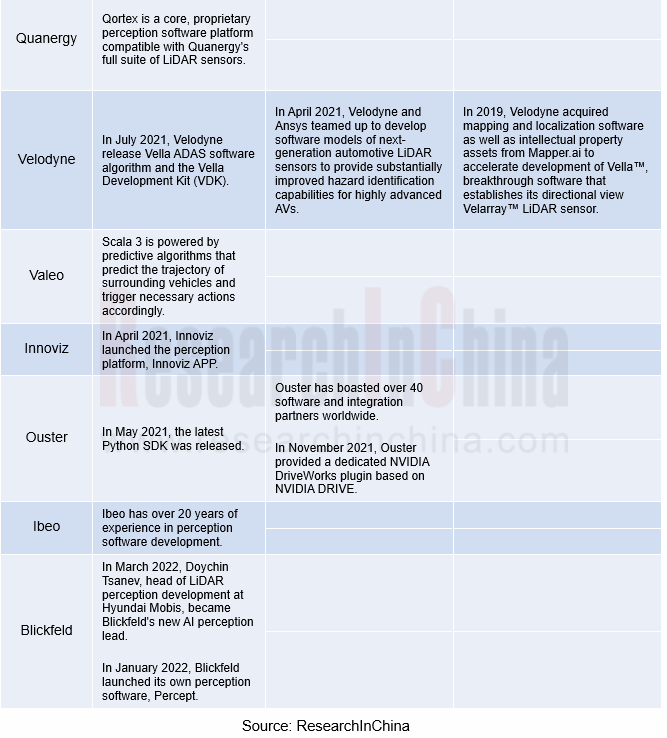

Innoviz mainly develops its own perception algorithm. In April 2021, Innoviz launched embedded automotive perception platform "Innoviz APP". Innoviz APP can accurately detect and classify objects in any 3D driving scenario up to 250 meters away, including cars, trucks, motorcycles, pedestrians, and more. It also executes perception algorithms in real time, detecting and classifying pixels as collision relevant or non-collision relevant. At the same time, it can also be integrated on chips as an embedded software IP. Innoviz's software leverages the massive data from LiDAR and proprietary AI algorithms to provide excellent scenario awareness as well as an automatically upgradable ASIL B(D) solution.

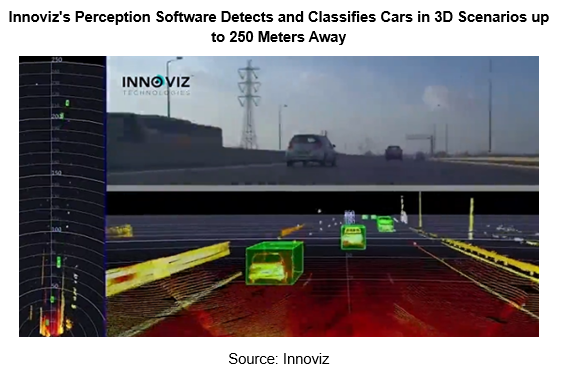

Luminar makes its layout through cooperation, investment and independent R&D. In March 2021, Luminar cooperated with Volvo’s self-driving software subsidiary Zenseact to create a “holistic autonomous vehicle stack” made for production vehicles. The stack is called Sentinel, which will integrate Zenseact’s OnePilot autonomous driving software solution alongside Luminar’s Iris LiDAR, perception software, and other components as a foundation. The system is designed to handle highway autonomy and a number of safety measures to proactively avoid collisions with evasive maneuvers, reducing accident rates by up to seven times. Luminar completed development of the alpha version of Sentinel in 2021 and plans to accomplish the beta version in 2022. In addition, Luminar will serve SAIC’s production vehicles with complete LiDAR hardware and components of Luminar’s Sentinel.

Chip-based LiDAR development is vital for mass production and cost reduction

Inside LiDAR, there are hundreds of discrete devices with high costs in materials and optical assembly, which pose a major obstacle to mass production. Chip-based LiDAR can integrate hundreds of discrete devices into one chip, effectively reducing the product size and costs while facilitating mass production.

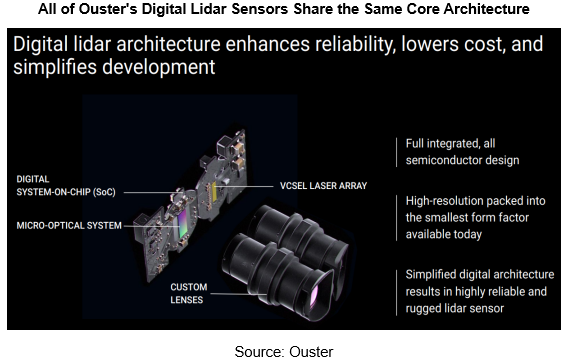

For example, all of Ouster's digital LiDAR sensors share the same core architecture. The architecture consists of two chips and a patented micro-optical system, replacing hundreds of discrete components inside traditional analog LiDAR, improving reliability and reducing price (the ES2 debuts with an expected price of $600 for series production -- and Ouster’s digital LiDAR technology provides a clear roadmap that will allow future models to break the $100 price barrier).

As shown above, in Ouster's LiDAR core architecture, a vertical cavity surface emitting laser (“VCSEL”) array integrates all lasers on a single chip. The custom SoC integrates single photon avalanche diode (“SPAD”) detectors and a proprietary digital signal processing system to handle all commands and control logic of LiDAR. The patented micro-optical system guides light through LiDAR to improve the detector efficiency exponentially.

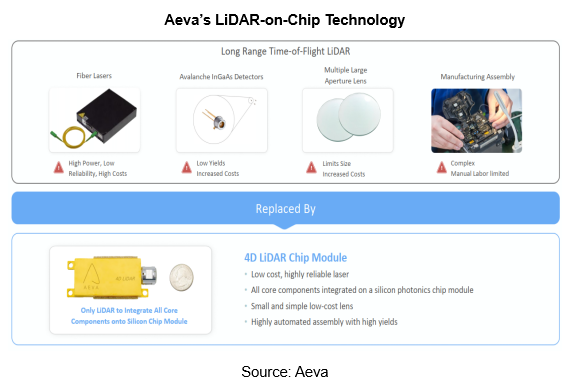

Aeva is also working on a chip-based layout. In February 2022, Aeva unveiled Aeries? II, a 4D LiDAR? sensor leveraging Aeva’s unique Frequency Modulated Continuous Wave (FMCW) technology and the world’s first LiDAR-on-chip module design which places all key components including transmitters, receivers and optics onto a silicon photonics chip in a compact module. The compact design is 75% smaller than the previous generation. Mass production is expected in 2023.

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...