New Energy Vehicle Thermal Management System Market Research Report,2022

Thermal Management Research: Technological Innovation and Iteration Have Spawned Emerging Markets

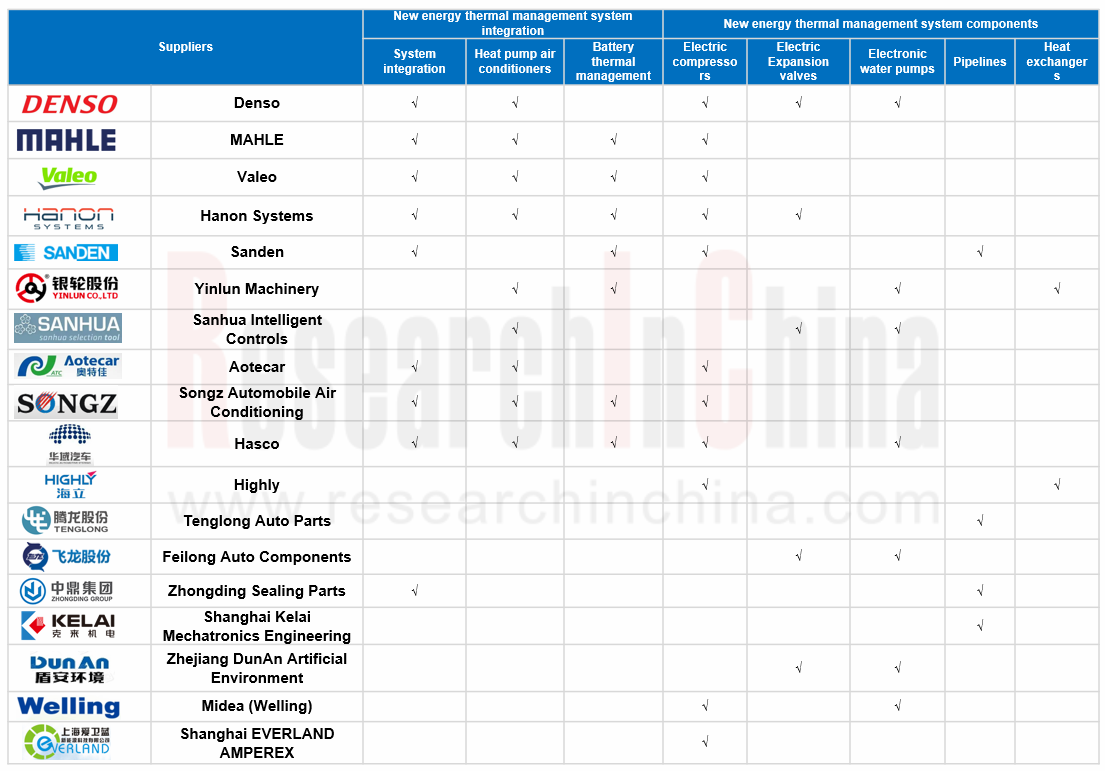

The rapid development of Chinese new energy vehicles has brought more opportunities for parts and components. Chinese enterprises, such as Sanhua Intelligent Controls, Zhejiang Yinlun Machinery, Aotecar, Tuopu Group, etc., have been actively deploying new energy thermal management in recent years. They have obtained orders from emerging automakers, domestic and foreign OEMs and other new energy vehicle companies for thermal management products, and made a breakthrough in the core technology of new energy vehicles.

Business Layout of New Energy Vehicle Thermal Management Suppliers

Market and Technology Trends of System Components

"New Energy Vehicle Thermal Management System Market Research Report, 2022" released by ResearchInChina summarizes and analyzes top 12 providers of new energy vehicle thermal management system integration solutions, top 10 suppliers of heat pump air conditioners, top 10 suppliers of electric compressors, top 10 suppliers of electronic water pumps, top 7 suppliers of battery thermal management systems, top 6 suppliers of thermal management system piping, top 5 suppliers of heat exchangers, and top 4 suppliers of electronic expansion valves.

Development Trend 1: Heat Pump Air Conditioning System

The heat pump system represents a clear development direction for thermal management of new energy vehicles. More and more models adopt heat pumps which can realize comprehensive energy utilization for new energy vehicles. In the future, the heat pump system will develop towards integration and modularization.

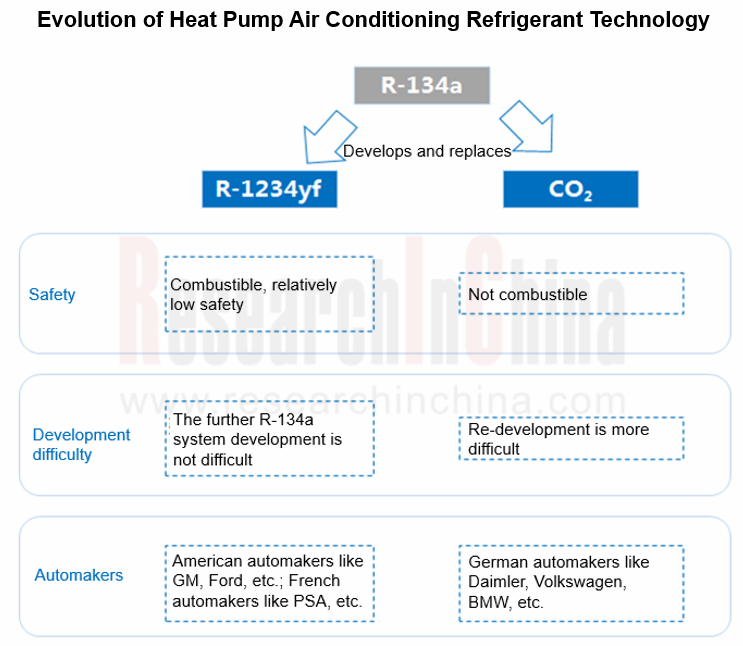

Development Trend 2: Refrigerant Technology Routes

With the steady advancement of environmental protection policies, the replacement of R-134a has become inevitable, but automakers have different opinions on choosing R-1234yf or CO(2) as refrigerant.

DuPont and Honeywell developed R-1234yf jointly and applied for a production process patent for it, which means the use of the technology requires a patent fee. American automakers like GM, Ford, etc., as well as French automakers like PSA, etc. adopt R-1234yf.

In addition to Eco-friendly and heat pump performance, CO(2) is relatively safer because it is not flammable while R-1234yf is moderately flammable. German automakers like Daimler, Volkswagen, BMW, etc. prefer CO(2).

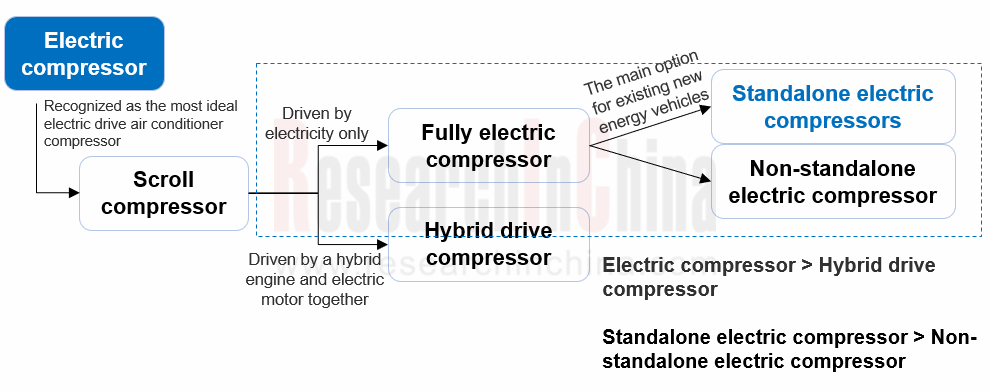

Development Trend 3: Electric Compressors

With the development of new energy vehicles, almost all automotive air-conditioning compressor companies are aggressively transferring to electric compressors. Since electric compressors have a short history as emerging components, most players are standing on the same starting line. With increasing market demand, electric compressor takes relatively tight capacity and is in short supply.

Emerging enterprises: As the sales volume of new energy vehicles escalates, thermal management industry has seen a boarder market space, and a large number of enterprises including conventional white goods enterprises (such as Hisense, Gree, Midea, etc.) and new energy vehicle companies have flocked to electric compressor industry. However, it is not easy for conventional white goods companies to dabble in the field of automotive air conditioning. Nowadays, there is no outstanding Chinese air conditioner brand that excels in automotive air conditioners and air conditioner compressors.

New technology routes: The current novel technology routes for electric compressors include:

R744 (CO2) compressors (R744 ultra-low-temperature heat pump compressors of Shanghai EVERLAND AMPEREX)

R744 (CO2) compressors (R744 ultra-low-temperature heat pump compressors of Shanghai EVERLAND AMPEREX)

Air-enhancing enthalpy compressors (air-enhancing enthalpy compressors of Aotecar and Shanghai EVERLAND AMPEREX)

Air-enhancing enthalpy compressors (air-enhancing enthalpy compressors of Aotecar and Shanghai EVERLAND AMPEREX)

800V electric compressors (Brose’s 800V/55cc electronic air conditioner compressors, MAHLE’s 800V 57cc electric compressors), etc.

800V electric compressors (Brose’s 800V/55cc electronic air conditioner compressors, MAHLE’s 800V 57cc electric compressors), etc.

Technical Architecture and Trends of OEM Thermal Management Systems

The automotive thermal management system controls heat of entire vehicle to ensure that the occupants, batteries, motors, and other components are all within a comfortable temperature environment. New energy vehicles have higher requirements for thermal management, so that the cost herein is about three times that of fuel vehicles. New energy vehicles not only add battery thermal management systems, but also require product replacement and upgrades. Moreover, new energy vehicle components are more sensitive to temperature, so there are higher requirements for components and more detailed requirements for the coordination of all components.

Under such circumstances, new energy vehicle OEMs have launched their own unique thermal management system solutions, dominating the development of thermal management solutions and featuring significant customization.

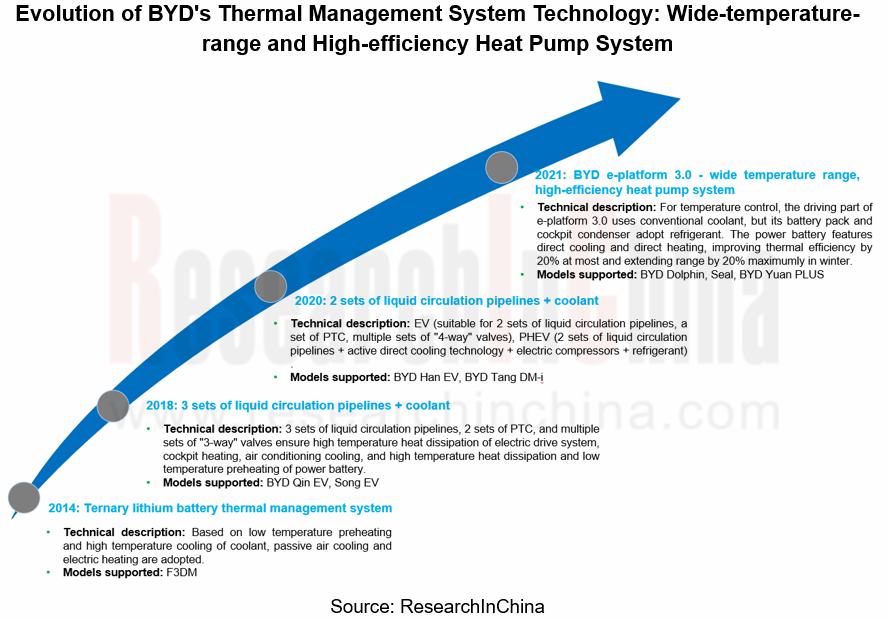

For example, BYD's latest e-platform 3.0 enables heat pump integration. Under the architecture of e-platform 3.0, the integrated thermal management system no longer simply integrates cockpit air conditioning system and blade battery thermal management system.

In terms of design concept, the thermal management system is similar to Tesla's integrated valve island solution, which integrates refrigerant circuit on a large scale. The valve island structure integrates most control components of refrigerant circuit, and divides them into electric compressors, front-end modules, thermal management integrated modules, in-vehicle condensers and evaporators, which are controlled by software through electric drive system.

Under e-platform 3.0 architecture, the integrated thermal management system based on BC series heat pump air conditioning reduces energy loss, conducts the interaction of cooling and heat around cockpit and power battery, makes BYD OS control domains, sends cooling directly to blade battery and cockpit, and allows heat to be transferred between electric drive system, cockpit and blade battery.

1 Introduction and Policy of New Energy Vehicle Thermal Management System

1.1 Introduction of New Energy Vehicle Thermal Management System

1.1.1 Definition

1.1.2 Traditional/New Energy Vehicle Thermal Management System Structure

1.1.3 Traditional/New Energy Vehicle Thermal Management System - Air Conditioning System

1.1.4 Traditional/New Energy Vehicle Thermal Management System - Engine, Transmission and Auxiliary System Thermal Management

1.1.5 Traditional/New Energy Vehicle Thermal Management System - Battery/Electric Motor/ Electric Control System Thermal Management

1.1.6 Industrial Chain Structure of Thermal Management System

1.2 Related Policies

1.2.1 Global New Energy Vehicle Incentive Policy

1.2.2 China's National Policy Promotes Long-term Benefits of New Energy Vehicle Market

1.2.3 National New Energy Vehicle Thermal Management Safety Supervision Policy

1.2.4 New Energy Vehicle Thermal Management System Industry Standard - Air Conditioning System

1.2.5 New Energy Vehicle Thermal Management System Industry Standard - Power Battery Thermal Management

1.3 Development Trend

1.3.1 Technology Development Trend (1)

1.3.2 Technology Development Trend (2)

1.3.3 Market Trends

2 Current Situation and Trend of New Energy Vehicle Thermal Management Market

2.1 Global New Energy Vehicle Sales Forecast

2.1.1 Global New Energy Vehicle Policies and Incentives

2.1.2 Ten-year Sales forecast of Global New Energy Vehicle

2.1.3 Global New Energy Vehicle Sales

2.1.4 Global New Energy (EV + PHEV) Passenger Car Sales

2.1.5 Global New Energy (EV + PHEV) Passenger Car Sales by Brand

2.1.6 Global New Energy (EV + PHEV) Passenger Car Sales by Model

2.2 Sales/Ownership of New Energy Vehicles in China

2.2.1 Automobile Sales in China

2.2.2 Number of Motor vehicles/Automobiles in China

2.2.3 Car Ownership in China - Urban Distribution

2.2.4 Overall Production and Sales of New Energy Vehicles in China

2.2.5 Overall Production and Sales of New Energy Vehicles in China - by Fuel Type

2.2.6 Sales of New Energy Passenger Car in China

2.2.7 Sales of new energy commercial vehicles in China

2.3 Global and China Automotive Thermal Management System Market Size

2.3.1 Global and China New Energy Vehicle Thermal Management System Market Size

2.3.2 Global and China New Energy Vehicle Thermal Management Segment Product Market Size

2.4 Cost of New Energy Vehicle Thermal Management System

2.4.1 Cost Composition of New Energy Vehicle Thermal Management System

2.4.2 Value of Single Vehicle with New Energy Thermal Management System is about 2-3 times Higher than that of Traditional Vehicle

2.4.3 Comparison of Single Vehicle Value of Traditional/New Energy Vehicle Thermal Management System

2.5 New Energy Vehicle Thermal Management System Competition Landscape

2.5.1 New Energy Vehicle Thermal Management System is Domestically Produced in large quantities, and Technical Level Grows rapidly

2.5.2 Main Products and Customers of New Energy Vehicle Thermal Management suppliers

2.5.3 Foreign Automotive Thermal Management Companies have Settled in China

2.5.4 Parts and Integrated Product Layout of Domestic New Energy Vehicle Thermal Management Enterprises

2.6 Development Trend of New Energy Vehicle Thermal Management System

2.6.1 New Energy Vehicle Thermal Management System Should Meet Product Characteristics

2.6.2 Development of Core technologies

2.6.3 Systematic and Modular Development

3 Analysis of New Energy Vehicle Thermal Management Industry Chain

3.1 New Energy Vehicle Thermal Management System Integration

3.1.1 System Integration Structure

3.1.2 System Integration: Core Supplier Business and Product Progress (1)

3.1.3 System Integration: Core Supplier Business and Product Progress (2)

3.1.4 System Integration: Core Supplier Business and Product Progress (3)

3.1.5 System Integration: Core Supplier Business and Product Progress (4)

3.1.6 System Integration: Business and Product Progress of Automakers (1)

3.1.7 System Integration: Business and Product Progress of Automakers (2)

3.1.8 System Integration: Business and Product Progress of Automakers (3)

3.2 New Energy Vehicle PTC/Heat Pump Air Conditioner

3.2.1 Development Trend

3.2.2 Air conditioning system of PTC Air Heater

3.2.3 PTC Electric Heater

3.2.4 Heat Pump Air Conditioning System - Vehicle Assembly

3.2.5 Heat pump air conditioning system - Equipped Models

3.2.6 Heat Pump Air Conditioning: Core Suppliers and Business Progress (1)

3.2.7 Heat Pump Air Conditioning: Core Suppliers and Business Progress (2)

3.2.8 Heat Pump Air Conditioning: Core Suppliers and Business Progress (3)

3.2.9 Heat Pump Air Conditioning System Case - Volkswagen MEB Platform Architecture (1)

3.2.10 Heat Pump Air Conditioning System Case - Volkswagen MEB Platform Architecture (2)

3.3 New Energy Vehicle Heat Pump Air Conditioner Refrigerant

3.3.1 Heat Pump Air Conditioning Refrigerant - Development Stage

3.3.2 Heat Pump Air Conditioning Refrigerants - Cost Comparison

3.3.3 Heat Pump Air Conditioning Refrigerants - Development Route

3.3.4 Development of CO(2) Technical Route

3.3.5 Competition Landscape OF CO(2) Air Conditioning Pipeline Products

3.3.6 Technical Prospects of Carbon Dioxide Refrigeration (R744) (1)

3.3.7 Technical Prospects of Carbon Dioxide Refrigeration (R744) (2)

3.3.8 Technical Prospects of Carbon Dioxide Refrigeration (R744) (3)

3.3.9 Heat Pump Air Conditioning Refrigerants - Development Opportunities

3.3.10 Heat Pump Air Conditioning Refrigerants - Development Challenges

3.4 New Energy Vehicle Power Battery Thermal Management System

3.4.1 Power Battery Thermal Management System is the core of New Energy Vehicle Thermal Management System

3.4.2 Power Battery Thermal Management System - Air-cooled

3.4.3 Power Battery Thermal Management System- Air-cooled Models

3.4.4 Power Battery Thermal Management System - Liquid-cooled

3.4.5 Power Battery Thermal Management System - liquid-cooled Models

3.4.6 Power Battery Thermal Management System - Direct Cooling

3.4.7 Power Battery Thermal Management System - Direct Cooling Models

3.4.8 Battery Thermal Management System - PACK Cooling Method Summary

3.4.9 Battery Thermal Management: Core Supplier Business and Product Progress (1)

3.4.10 Battery Thermal Management: Core Supplier Business and Product Progress (2)

3.4.11 Cooling Architecture of Battery Thermal Management System

3.4.12 Low temperature Battery Thermal Management Solution

3.5 New Energy Vehicle Electric Compressor

3.5.1 Development Status

3.5.2 Thermal Management System - Electric Scroll Compressors: Structural Analysis

3.5.3 Electric Compressors for New Energy Vehicles - Market Size

3.5.4 Electric Scroll Compressors: Market Competitive Analysis

3.5.5 Electric Scroll Compressors: Core Suppliers and Business Progress (1)

3.5.6 Electric Scroll Compressors: Core Suppliers and Business Progress (2)

3.5.7 Electric Scroll Compressors: Core Suppliers and Business Progress (3)

3.5.8 New Energy Electric Compressor Emerging Players

3.5.9 New Product Solution of Electric Compressor: Shanghai Aiweilan R744 ultra-low temperature Heat Pump Compressor

3.5.10 MAHLE Thermal Management Solutions: High Pressure PTC Heaters, 800V 57cc Electric Compressors

3.6 New Energy Vehicle Electronic Expansion Valve

3.6.1 Electronic Expansion Valve Structure

3.6.2 Electronic Expansion Valves: Core Supplier Business and Product Progress (1)

3.6.3 Electronic Expansion Valves: Core Supplier Business and Product Progress (2)

3.6.4 Development Trend of Electronic Expansion Valve

3.7 New Energy Vehicle Electronic Water Pump

3.7.1 Development Advantages

3.7.2 Market Size

3.7.3 Electronic Water Pumps: Core Supplier Business and Product Progress (1)

3.7.4 Electronic Water Pumps: Core Supplier Business and Product Progress (2)

3.7.5 Electronic Water Pumps: Core Supplier Business and Product Progress (3)

3.8 New Energy Vehicle Heat Exchanger

3.8.1 Core Supplier Business and Product Progress

3.9 New Energy Vehicle Thermal Management System - Pipeline

3.9.1 Development Status

3.9.2 Core Supplier Business and Product Progress (1)

3.9.3 Core Supplier Business and Product Progress (2)

3.9.4 New Product Technology Route

4 New Energy Vehicle Thermal Management System Suppliers

4.1 Denso

4.1.1 Profile

4.1.2 Automotive Thermal Management System Products (1)

4.1.3 Automotive Thermal Management System Products (2)

4.1.4 Automotive Thermal Management System Products (3)

4.1.5 Automotive Thermal Management System Products (4)

4.1.6 Automotive Thermal Management Solutions

4.1.7 Heat Pump System

4.1.8 Heat Pump System Assembly Case

4.1.9 Heat Pump System Development Stage

4.2 MAHLE

4.2.1 Profile

4.2.2 Main Business

4.2.3 Automotive Thermal Management System

4.2.4 MAHLE Integrated Thermal Management System

4.2.5Passenger Car Thermal Management System: Refrigerant Circuit with Expansion Valve

4.2.6 Engine cooling system

4.2.7 Cooling System: Direct Booster Air Cooling Circuit

4.2.8 Cooling System: Indirect Intercooler Circuit

4.2.9 Cooling System: Indirect Booster Air Cooling Circuit - Exhaust Gas Recirculation Cooling

4.2.10 Battery cooling system

4.2.11 Battery cooling systems: Coolant and Refrigerant based Circuits

4.2.12 Automotive Thermal Management Products: Air Conditioning Systems and Components

4.2.13 Automotive Thermal Management Products: Engine Cooling Components, Modules (1)

4.2.14 Automotive Thermal Management Development

4.2.15 Aftermarket Expansion of Thermal Management Product Line

4.2.16 Global Layout

4.2.17 China Layout

4.3 Valeo

4.3.1 Profile

4.3.2 Main Business

4.3.3 Automotive Thermal Management System Business Revenue

4.3.4 Automotive Thermal Management System Business

4.3.5Heat Pump Technology

4.3.6 FlexHeaters

4.3.7 Battery Thermal Management System

4.3.8 Main Customers of Automotive Thermal Management Systems

4.3.9 Global Layout

4.4 Hanon

4.4.1 Profile

4.4.2 Automotive Thermal Management Products: HVAC

4.4.3 Automotive Thermal Management Products: Compressors

4.4.4 Automotive Thermal Management Products: Others

4.4.5 New Energy Vehicle Thermal Management System: Electric Vehicles/Hybrid Vehicles

4.4.6 New Energy Vehicle Thermal Management System: Fuel Cell Vehicles

4.4.7 Major Customers of Automotive Thermal Management Systems

4.4.8 Global Layout of New Energy Vehicle Thermal Management System

4.5 Sanden Corporation

4.5.1 Profile

4.5.2 Main Business

4.5.3 Integrated Thermal Management System

4.5.4 Battery Thermal Management System

4.5.5 Heat Pump System

4.5.6 Electric Compressor Product Iteration: Gen2-Gen4

4.5.7 CO2 Compressor

4.5.8 Other Parts of Automotive Thermal Management System

4.5.9 Business Distribution

4.6 Continental

4.6.1 Classification of Thermal Management System

4.6.2 System-level Optimization Strategy for Thermal Management System

4.6.3 Thermal Management Technology

4.6.4 New Energy Vehicle Thermal Management System Production Base

4.7 Aotecar

4.7.1 Profile

4.7.2 Electric Vehicle Air Conditioning Compressor Products

4.7.3 Automotive Air Conditioning System

4.7.4 Low-temperature Heat Pump System

4.7.5 Thermal Management System Production and Sales Volume

4.7.6 Major Customers of New Energy Vehicle Thermal Management System

4.8 Yinlun Machinery

4.8.1 Profile

4.8.2 Automotive Thermal Management Business

4.8.3 Automotive Thermal Management Products

4.8.4 Thermal Management Products for New Energy Passenger Vehicles (1)

4.8.5 Thermal Management Products for New Energy Passenger Vehicles (2)

4.8.6 Capacity of Thermal Management Products for New Energy Vehicles

4.8.7 Major Customers

4.8.8 R & D Investment

4.8.9 New Energy Thermal Management R & D Project

4.8.10 Global Layout

4.9 Sanhua Intelligent Controls

4.9.1 Profile

4.9.2 Automotive Thermal Management Business Revenue

4.9.3New Energy Vehicle Thermal Management System Products

4.9.4 Automotive Electronic Expansion Valve

4.9.5 Automotive Electronic Water Pump

4.9.6 Automotive Thermal Management Other Products

4.9.7 New items of Auto Parts

4.9.8 Major Customers of New Energy Vehicle Thermal Management System

4.9.9 Business Scope

4.10 Songz Automobile Air Conditioning

4.10.1 Profile

4.10.2 Vehicle Thermal Management System Business

4.10.3 Production and Sales of Thermal Management Products for New Energy Vehicles

4.10.4 Automotive Thermal Management System Business Model

4.10.5 Battery Thermal Management Products

4.10.6 Battery Thermal Management System

4.10.7 Heat Pump System

4.10.8 Electric Compressor

4.10.9 Auto Parts Project Planning

4.10.10 R & D Direction and Development Stage of Automotive Thermal Management System

4.10.11 Partners

4.11 HASCO

4.11.1 Profile

4.11.2 Thermal Management System

4.11.3 New Energy Vehicle Thermal Management System

4.11.4 Air Conditioning Compressor Products

4.11.5 Heat Pump Air Conditioning

4.11.6 Electric Compressor Supporting Customers

4.11.7 Electric Air Conditioning and Thermal Management System

4.11.8 Electric Air Conditioning and Thermal Management System Products

4.11.9 Main Customers of Electric Air Conditioning and Thermal Management Systems

4.11.10 Electric Air Conditioning and Thermal Management System Company Layout

4.11.11 Other Thermal Management System Parts

4.12 Tenglong Auto Parts

4.12.1 Profile

4.12.2 Business Development of Automotive Thermal Management System

4.12.3 Production and Sales of Automotive Thermal Management System Products

4.12.4 Automotive Thermal Management System Products

4.12.5 Automotive Thermal Management System Project

4.12.6 Major Customers

4.12.7 R & D Center and Production Base

4.13 Feilong Auto Components

4.13.1 Profile

4.13.2 Production, Sales and Revenue of New Energy Thermal Management System

4.13.3 Electronic Water Pump Products

4.13.4 Thermal Management Control Valve Products

4.13.5 New Energy Thermal Management System Order

4.13.6 Automotive Thermal Management Project Planning

4.13.7 Major Customers

4.14 Kelai

4.14.1 Profile

4.14.2 New Energy Auto Parts Business

4.14.3 Production, Sales and Capacity

4.14.4 New Energy Vehicle Thermal Management System Products

4.14.5 CO2 Heat Pump Air Conditioning Pipeline

4.14.6 Major Customers and Technologies

4.15 Dun'an Artificial Environment

4.15.1 Profile

4.15.2 New Energy Vehicle Thermal Management Business

4.15.3 New Energy Vehicle Thermal Management Products (1)

4.15.4 Thermal Management Products for New Energy Vehicles (2)

4.15.5 New Energy Vehicle Thermal Management Unit

4.15.6 Large Diameter Electronic Expansion Valve

4.16 Midea Welling Car

4.16.1 Business Development Route

4.16.2 Business Solutions (1)

4.16.3 Business Solutions (2)

4.16.4 Thermal Management Solutions (1)

4.16.5 Thermal Management Solutions (2)

4.17 Baling Technology

4.17.1 Profile

4.17.2 New Energy Vehicle Thermal Management System Products

4.17.3 New Energy Vehicle Thermal Management System Capacity

4.17.4 R & D Project of New Energy Vehicle Thermal Management System

4.17.5 Major Customers of New Energy Vehicle Thermal Management System

4.18 Huawei

4.18.1 Smart Vehicle Thermal Management Solution TMS: Appearance Structure

4.18.2 Smart Vehicle Thermal Management Solution TMS: Integrated Design (1)

4.18.3 Smart Vehicle Thermal Management Solution TMS: Integrated Design (2)

4.19 Zhongding

4.19.1 Profile

4.19.2 Pipeline Products of New Energy Thermal Management System

4.19.3 Core Technology of Pipeline of New Energy Thermal Management System

4.19.4 Customer of New Energy Thermal Management System

5 OEM Thermal Management System Solution

5.1 Tesla

5.1.1 Development Stage of Automotive Thermal Management System

5.1.2 Thermal Management System Technical Route

5.1.3 Thermal Management System are Becoming more and more Integrated

5.1.4 Thermal Management System Structure

5.1.5 Operating Mode of Thermal Management Heat Pump System

5.1.6 4th Generation Thermal Management System Working Mode (1)

5.1.7 4th Generation Thermal Management System Operating Mode (2)

5.1.8 4th Generation Thermal Management System Working Mode (3)

5.1.9 4th Generation Thermal Management System Working Mode (4)

5.1.10 4th Generation Thermal Management System Operating Mode (5)

5.1.11 4th Generation Thermal Management System Operating Mode (6)

5.1.12 Model Y Eight-Way Valve Heat Pump Solution (1)

5.1.13 Tesla-Model Y Eight-Way Valve Heat Pump Solution (2)

5.1.14 T4th Generation Thermal Management System Model Summary

5.2 BYD

5.2.1 New Energy Vehicle Thermal Management

5.2.2 Development Stage of Automotive Thermal Management System

5.2.3 BYD E3.0 Wide Temperature Domain High Efficiency Heat Pump System (1)

5.2.4 BYD E3.0 Wide Temperature Domain High Efficiency Heat Pump System (2)

5.2.5 New Energy Vehicle Thermal Management System: Low-temperature Heat Pump Technology

5.2.6 New Energy Vehicle Thermal Management System: BMS Technology

5.2.7 Battery Thermal Management System (1)

5.2.8 Battery Thermal Management System (2)

5.2.9 Han EV Thermal Management System (1)

5.2.10 Han EV Thermal Management System (2)

5.2.11 Tang DM-i Thermal Management System

5.2.12 Dolphin Thermal Management System (1)

5.2.13 Dolphin Thermal Management System (2)

5.2.14 Dolphin Thermal Management System (3)

5.3 Volkswagen

5.3.1 Development Stage of Automotive Thermal Management System

5.3.2 Heat Pump System

5.3.3 Heat Pump System Composition: AC Compressor

5.3.4 Heat Pump System Composition: Valve Unit Assembly (1)

5.3.5 Heat Pump System Composition: Valve Unit Assembly (2)

5.3.6 Heat Pump System Composition: Control Mode

5.3.7 Heat Pump System Composition: Working Mode (1)

5.3.8 Heat Pump System Composition: Operating Mode (2)

5.3.9 Heat Pump System Composition: Working Mode (3)

5.3.10 Heat Pump System Composition: Operating Mode (4)

5.3.11 Volkswagen ID.4 X Heat Pump Air Conditioning

5.3.12 Volkswagen ID.4 X Heat Pump Air Conditioning: Operating Mode

5.3.13 Volkswagen Golf GTE Golf Plug-in Hybrid Thermal Management System (1)

5.3.14 Volkswagen Golf GTE Golf Plug-in Hybrid Thermal Management System (2)

5.4 NIO

5.4.1 Development Stage of Automotive Thermal Management System

5.4.2 NIO ET7 Thermal Management System

5.4.3 NIO ES6 Thermal Management System

5.4.4 NIO ES8 Thermal Management System

5.4.5 Thermal Management System Patent

5.5 SAIC Group

5.5.1 Development Stage of Automotive Thermal Management System

5.5.2 MARVEL R Thermal Management System

5.5.3 Roewe RX5 eMAX Thermal Management System

5.5.4 SAIC Roewe Thermal Management System (1)

5.5.5 SAIC Roewe Thermal Management System (2)

5.6 Geely

5.6.1 Development Stage of Automotive Thermal Management System

5.6.2 Lynk & Co ZERO Direct Heat Pump System (1)

5.6.3 Lynk & Co ZERO Direct Heat Pump System (2)

5.6.4 Geometry C Thermal Management System (1)

5.6.5 Geometry C Thermal Management System (2)

5.6.6 Emgrand EV450 Thermal Management System (1)

5.6.7 Emgrand EV450 Thermal Management System (2)

5.6.8 Emgrand EV450 Thermal Management System (3)

5.7 Li Auto

5.7.1 Development Stage of Automotive Thermal Management System

5.7.2 Li Auto L9 Thermal Management System Supplier

5.7.3 Li ONE Thermal Management System Structure (1)

5.7.4 Li ONE Thermal Management System Structure (2)

5.8 Xpeng

5.8.1 Development Stage of Automotive Thermal Management System

5.8.2 X-HP Intelligent Thermal Management System

5.8.3 P7 Vehicle Thermal Management Solution (PTC Electric Heating Solution)

5.8.4 P7 Vehicle Thermal Management Solution (Main Component Supplier)

5.9 WM

5.9.1 Development Stage of Automotive Thermal Management System

5.9.2 Comparison of Thermal Management Systems

5.9.3 Thermal Management System 1.0

5.9.4 Thermal Management System 2.0

5.9.5 Battery Thermal Management

5.10 Audi

5.10.1 Development Stage of Automotive Thermal Management System

5.10.2 Winter Electric Vehicle Thermal Management System (1)

5.10.3 Winter Electric Vehicle Thermal Management System (2)

5.10.4 Winter Electric Vehicle Thermal Management System (3)

5.10.5 Audi Q4 e-tron Thermal Management System Structure

5.10.6 Main Components of Audi-Q4 e-tron Thermal Management System

5.10.7 Audi Q4 e-tron Thermal Management: Non-Heat Pump Systems (1)

5.10.8 Audi Q4 e-tron Thermal Management: Non-Heat Pump Systems (2)

5.10.9 Audi Q4 e-tron Thermal Management: Non-Heat Pump Systems (3)

5.10.10 Audi Q4 e-tron Thermal Management: Heat Pump Systems

5.10.11 Audi e-tron Heat Pump Management System

5.10.12 Audi e-tron Thermal Management Motor Cooling System

5.10.13 Audi e-tron Thermal Management Battery Cooling System (1)

5.10.14 Audi e-tron Thermal Management Battery Cooling System (2)

5.10.15 Audi e-tron Thermal Management System Working Mode

5.10.16 Audi R8 e-tron Pure Electric Thermal Management System

5.11 BMW

5.11.1 Development Stage of Automotive Thermal Management System

5.11.2 BMW i4 EV Thermal Management System

5.11.3 BMW iX3 EV Thermal Management System

5.11.4 BMW i3 EV Thermal Management System

5.11.5 BMW i3 EV Heat Pump Air Conditioning Main Components (1)

5.11.6 BMW i3 EV Heat Pump Air Conditioning Main Components (2)

5.11.7 Working Mode of BMW-i3 EV heat pump air conditioner

5.11.8 BMW 5 Series PHEV/3 Series PHEV Battery Pack Thermal Management System - Refrigerant Direct Cooling (1)

5.11.9 BMW 5 Series PHEV/3 Series PHEV Battery Pack Thermal Management System - Refrigerant Direct Cooling (2)

5.11.10 BMW X5/BMW i8 Battery Pack Thermal Management System-R134a Direct Cooling

5.12 SAIC-GM

5.12.1 Development Stage of Automotive Thermal Management System

5.12.2 SAIC-GM-Ultium New Energy Vehicle Thermal Management System

5.13 Hyundai Motor

5.13.1 Development Stages of Hyundai Kia-Automotive Thermal Management System

5.13.2 Hyundai Kia - Thermal Management Integrated Module (1)

5.13.3 Hyundai Kia - Thermal Management Integrated Module (2)

5.13.4 Hyundai Kia - Thermal Management Integrated Module (3)

5.13.5 Hyundai Kia-Hyundai Kona (ENQINO) EV Thermal Management System (1)

5.13.6 Hyundai Kia-Hyundai Kona (ENQINO) EV Thermal Management System (2)

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...