China Passenger Car Cockpit Multi and Dual Display Research Report, 2022

Cockpit multi and dual display research: 51.5% year-on-year growth in center console multi and dual display installation from January to July 2022

ResearchInChina released "China Passenger Car Cockpit Multi and Dual Display Research Report, 2022", which compares and summarizes the current domestic cockpit multi and dual display solutions in terms of R&D layout, product implementation, etc.

With the cockpit domain control, software technology maturity and Qualcomm 8155 and other large computing chip is widely used, auto companies and suppliers are no longer stuck in the conventional cockpit display layout, and continue to push the new, landing multi/dual and even integrated display solution, application cases of one-chip, multi-display and single-system also began to increase, supporting the intelligent upgrade of the cockpit.

Further growth in sales of vehicle models with multi and dual display in 2022

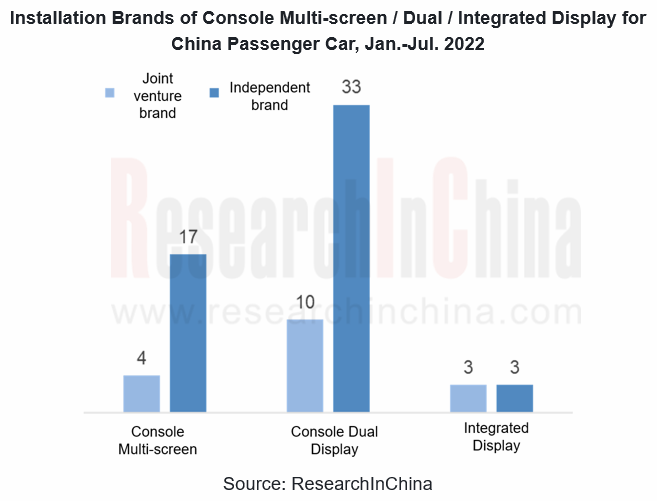

ResearchInChina monitors that the number of auto brands landing multi and dual display solutions in 2022 has further expanded. 21 brands are equipped with multi and dual display solutions, 43 brands are equipped with dual display solutions and 6 brands are equipped with integrated-display solutions in China passenger car market (excluding imported models) on sale from January to July 2022.

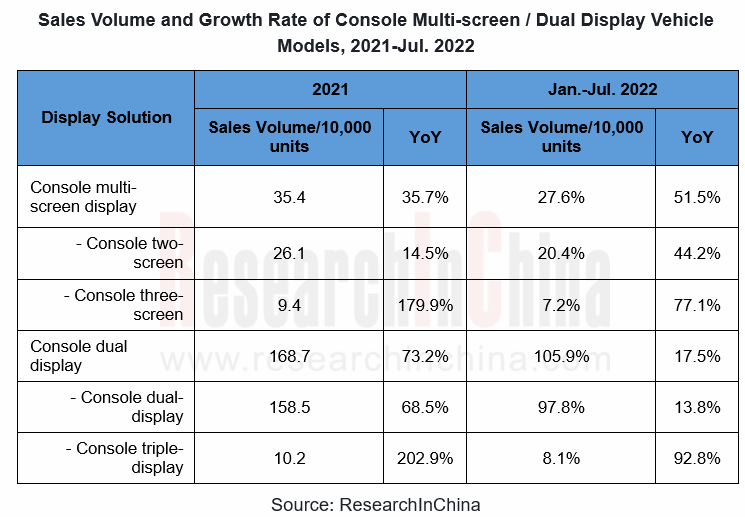

With more vehicle models joining the multi and dual display camp, the installation volume of console multi-screen / dual display still achieved positive growth despite the negative growth of the whole vehicle sales. 276,000 units of console multi-screen models were sold from January to July 2022, up 51.5% year-on-year, and 1,059,000 units of console dual display models were sold, up 17.5% year-on-year. From the composition of the solution, the console two-screen and console dual display currently is still the main force, and the growth rate is obvious.

42 auto companies have equipped with dual display solutions

From the implementation, the earliest application of dual display solution is Mercedes-Benz E-Class, which was launched in August 2016, and since then Mercedes-Benz has gradually introduced the dual display solution into A-Class/GLA/GLB/EQA/EQB/EQC and other models. In the past 6 years, a total of 42 auto companies have joined the console dual display camp, such as Haval, MG, Roewe, BMW, Volkswagen, Kia, etc.

Typical model of dual display: Haval Shenshou

In December 2021, Haval Shenshou, the brand's first dual display model, was launched with Continental's V-shaped dual display solution (12.3-inch instrument cluster, 14.6-inch center console, 1920×720 resolution), covered by a shaped glass. In the solution, the console screen is slightly tilted to the driver's side, which can precisely match the driver's line of sight. In terms of chip-display-OS, Haval Shenshou is equipped with a Qualcomm 8155 chip running QNX and Android dual system, which provides computing power for LCD dashboard and console screen.

Typical model of dual-display: BMW 3 Series

A few months after BMW officially unveiled its world's first dual screen display solution model, BMW iX, BMW Brilliance followed suit, and 2022 BMW Brilliance i3 and 3 Series were launched with dual screen display solutions. BMW Brilliance i3 and 3 Series are equipped with the same integrated floating curved screen of BMW iX (12.3-inch instrument cluster, 14.9-inch center console, 200 PPI), which is suspended through bracket and tilted towards driver at a 6 ° inclination angle. As a long-term partner of Intel, BMW Brilliance 3 Series is equipped with an Intel Atom X7-3960 chip based on Apollo Lake platform, which runs a Linux system in LCD meter and console display. In the future, BMW Brilliance plans to introduce dual display solution to more models, including X1 and X3.

Typical model of triple-display: Rising Auto R7

Rising Auto, as a high-end new energy brand of SAIC Group, applies the triple-screen display solution for the first time in Rising Auto R7. The solution adopts integrated packaging technology, by using AGC Dragontrail glass integrated coverage, the full lamination design completely eliminates the gap between glass and OLED screen. The size of the triple-screen display is 10.25-inch instrument cluster, 15.05-inch console screen and 12.3-inch co-pilot entertainment screen, with a total size of 43 inches. In terms of chip-display-OS, RISING OS and UI are developed and designed by SAIC Z-one Tech, equipped with Qualcomm Snapdragon SA8155 chip, based on the mainstream virtualization technology and RTOS + Android AOSP operating system in automotive field, and equipped with many platform modules required for cloud-pipe-end integrated SOA software architecture.

Integrated display landing on a small scale

Screen as the most important human-machine interaction information display window in the intelligent cockpit, its size also represents a certain degree of intelligence. In addition to increasing the number of screens, the ultra-wide integrated screen has become the choice of some OEMs, including conventional OEMs and emerging automakers. Integrated display can integrate multiple screens such as instrument, center console and co-pilot entertainment, and completely eliminate the physical interval of the ultra-wide screen to further enhance the cockpit technology.

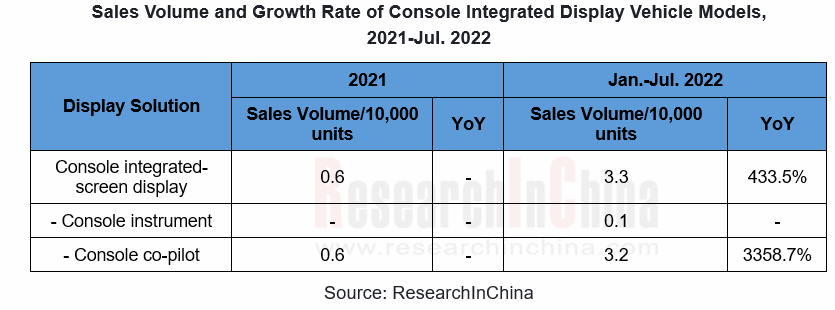

Currently, China passenger car market has a total of six brands (Ford, Lincoln, Cadillac, ARCFOX, IM, Roewe) to launch integrated-display models, but the sales are still in the small-scale. From 2021 to July 2022, integrated-display model sales were only 39,000 vehicles.

Integrated-display typical model: Ford EVOS

The current USA brands in cockpit display solution is more radical, Ford, Lincoln, Cadillac all have launched integrated display, Ford as a representative brand, its EVOS, Mondeo, Explorer are equipped with 27-inch "center console + co-pilot entertainment" integrated display on sale. Take Ford EVOS as an example, it is equipped with a 27-inch center console + co-pilot integrated screen with a resolution of 4032×756, forming a dual-screen solution with LCD dashboard. The total length of the dual-screen display is 1.1m, running through the entire center console. As for the IVI, it is equipped with a Desay SV domain controller with a built-in NXP i.MX8M and a Qualcomm 820A chip, which provide computing power for LCD dashboard (QNX) and the center console co-pilot (Android) respectively.

Integrated- display typical model: IM L7

As the high-end brand of SAIC, IM pursues unconventional cockpit display solutions. The front row of the IM L7 cockpit is equipped with 3 screens, of which the 26.3-inch "instrument center console" integrated display and the 12.3-inch co-pilot entertainment screen support independent lifting. Among them, the resolution of the instrument center console integrated screen reaches 4320 × 720, and the maximum brightness is 1000nit. The entire cockpit system provides information display for the three screens of instrument/center console, co-pilot entertainment and function control through a Qualcomm 8155 chip and a set of Banma AliOS.

Future dynamic privacy display is expected to be applied to the co-pilot screen to help driving safety

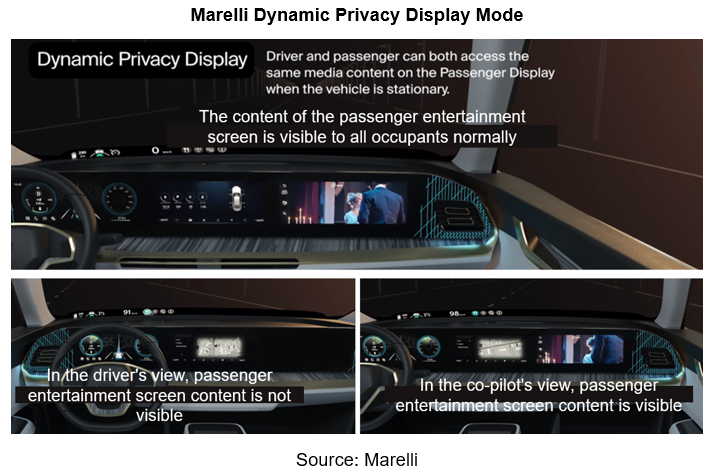

The increase in the number of screens in the front of cockpit will undoubtedly bring hidden problems such as light interference and distraction for the driver. To ensure driving safety, Continental, Visteon and Marelli have been planning and laying out the co-pilot entertainment display with privacy technology. The main principle is through the backlight technology, in different perspectives of the screen can provide different information display.

For example, Marelli's switchable dynamic privacy technology solution is based on intelligent backlight architecture to dynamically control the viewing angle of the co-pilot display, and switch between the two viewing angles at will. In privacy mode, by reducing the brightness and contrast of the screen in the driver's view, the driver cannot see the content of the passenger display, while the passenger can use the passenger entertainment screen normally. In the sunlight reflection and night environment, the driver can achieve safe driving without interference and share the content with the front passenger while ensuring safety.

Note: Explanation of terms

Console multi-screen display: split or expand functions in conventional center console screen, and set co-pilot entertainment screen and function control screen to the right and below the center console screen. Combination form: center console + co-pilot; center console + function control; center control + co-pilot + function control and other multi-screen display.

Console dual display: in conventional layout solution, there is a certain physical distance between LCD dashboard and center console screen, and a strong sense of visual division. By rearranging the LCD dashboard, center console screen, co-pilot entertainment screen and other screens covered by a glass, visually create a screen integration, one black technology, greatly weaken the sense of physical division between display. Combination form: instrument + center console; center console + co-pilot; instrument + center console + co-pilot entertainment and other dual display.

Integrated display: further upgraded in the form of console dual screen, the instrument, center console, co-pilot entertainment and other information is concentrated in an ultra-wide display screen, completely eliminating the physical interval. Combination form: instrument + center console; center console + co-pilot and other integrated display.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...