TSP research: the coverage of TSPs has spread from IVI, cockpits to vehicles.

With the emergence of Internet of Vehicles, telematics service providers (TSPs) take on the roles of operation platforms, service platforms, cloud platforms and data platforms, and provide services such as call centers, navigation and positioning, audio-visual entertainment, vehicle monitoring, remote upgrade and information security. Influenced by the concept of intelligent cockpits, automotive functions are being redefined. TSP have been constantly enriching their services, and expanding the coverage.

1. From the perspective of service scope, TSPs gradually expand their coverage along the path of "IVI → cockpits → vehicles"

Advances in technologies such as cockpit-driving integration and central computing platforms have made the demand for ecological expansion in the vehicle rigid. TSPs' business scope is spreading from automotive OS to cockpit OS and vehicle OS.

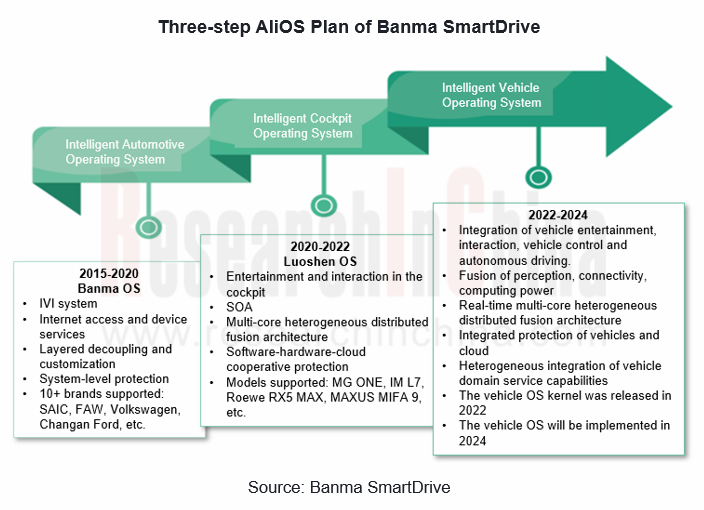

For example, Banma SmartDrive has made a definite three-step plan for its AliOS. From 2015 to 2020, it should realize customization based on layered decoupling and develop intelligent automotive OS. From 2020 to 2022, it should build intelligent cockpit OS based on the heterogeneous distributed fusion architecture. From 2022 to 2024, it should accomplish intelligent vehicle OS based on the time-sharing multi-core heterogeneous distributed fusion architecture.

2. From the perspective of business model, TSPs led by OEMs are seeking business independence.

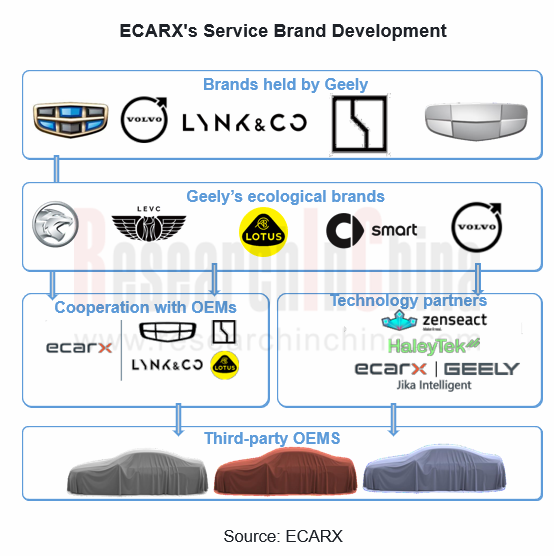

ECARX, a TSP invested by Geely, has contributed significantly to the construction and operation of Geely's IVI system. It has not only helped Geely upgrade G-NetLink to GKUI, but also achieved interoperability with popular ecosystems such as Tencent, Baidu and Alipay by building a unified account system. It has developed Galaxy OS and Galaxy OS Air, the next-generation intelligent cockpit systems, with Visteon and Qualcomm, enabling multi-screen interaction (clusters, center consoles, co-driver screens, AR-HUD), multi-domain integration (power domain, chassis domain and body domain) as well as more natural human-computer interaction.

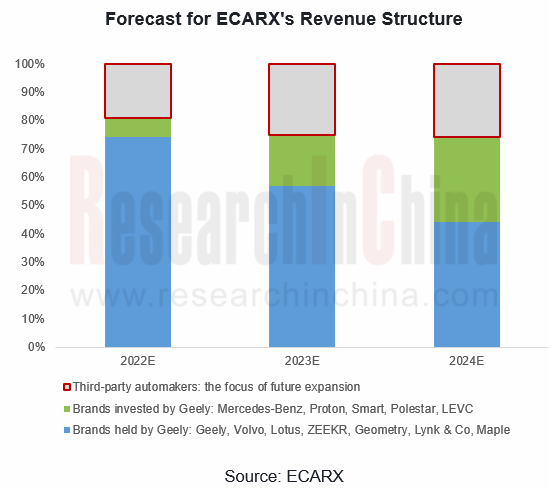

As of the first half of 2022, ECARX’s TSP solution had landed in 3.2 million vehicles, mainly in Geely's 12 brands. In May 2022, ECARX hoped to upgrade the enterprise image and expand the market through the listing on NASDAQ. The focus of market expansion transfers from Geely to third-party suppliers. According to the plan, third-party automakers will contribute about 24% to the revenue of ECARX in 2024.

3. From the perspective of ecological content, cross-terminal information flow will infinitely broaden the service boundary.

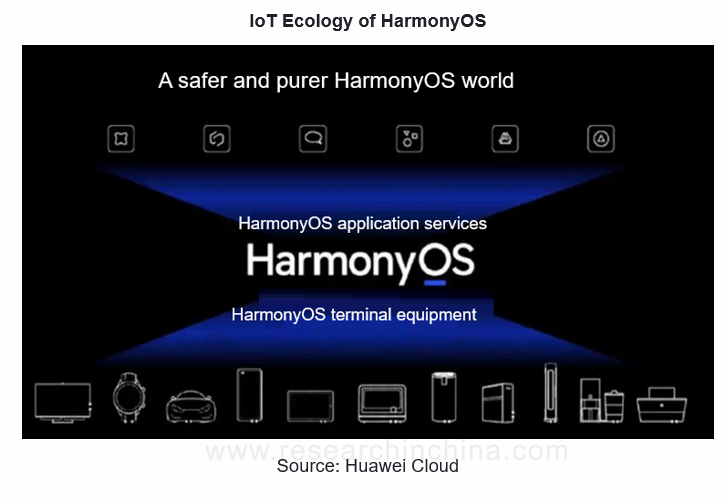

ICT suppliers represented by Huawei are committed to transplanting the mobile phone ecology into vehicles in the field of TSP, with the "flow" of information as the highlight.

Huawei HarmonyOS is a future-oriented distributed intelligent operating system for all scenarios. In the form of building the underlying operating system, it organically links people, equipment and scenarios through a super virtual terminal, connects with applications via communication, and extends the advantages of mobile phones to IVI and other peripheral devices.

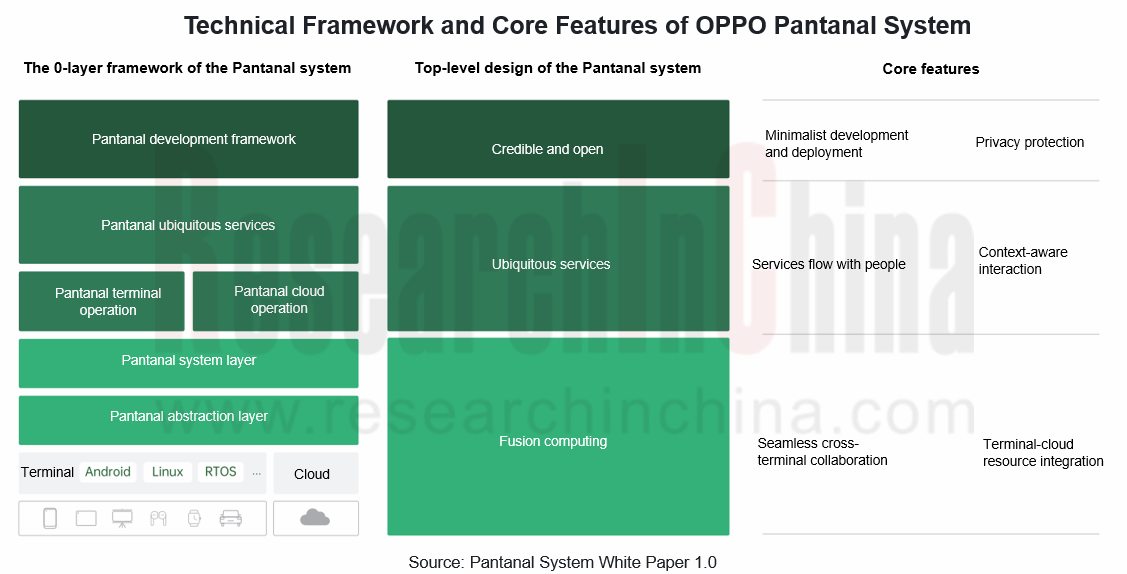

The Pantanal system released by OPPO is grafted to different operating systems in the form of middleware to enable seamless service flow across brands, systems and devices.

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...

Automotive Intelligent Cockpit SoC Research Report, 2025

Cockpit SoC research: The localization rate exceeds 10%, and AI-oriented cockpit SoC will become the mainstream in the next 2-3 years

In the Chinese automotive intelligent cockpit SoC market, althoug...

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...