Research on intelligent steering of passenger cars: The development of intelligent steering is accelerating, and it will be put on vehicles in batches in 2023

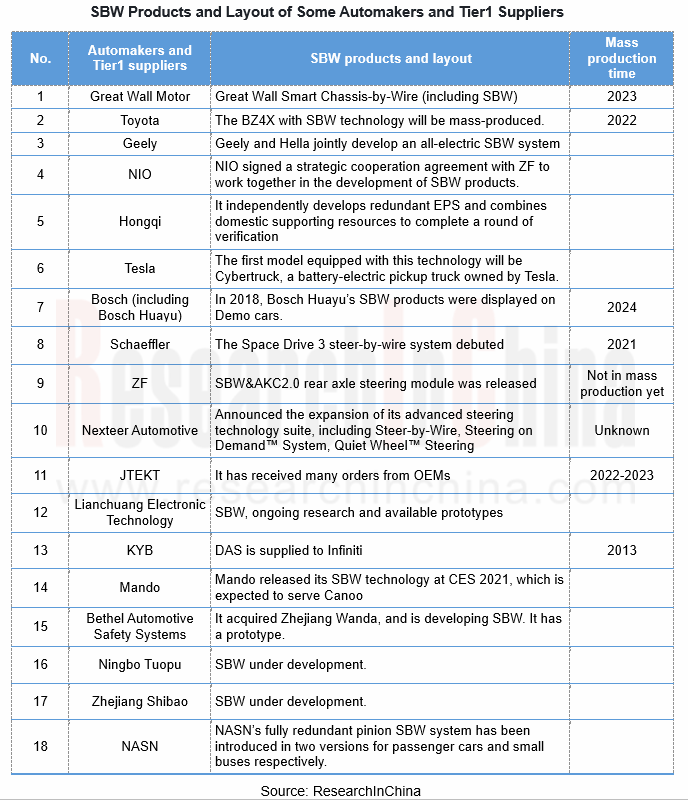

- In September 2022, Geely and Hella jointly developed a series production-ready steer-by-wire (SBW) system which will be spawned from 2026.

- In October 2022, NIO signed a strategic cooperation agreement with ZF. They will work together in the development of SBW products.

- Toyota bZ4X featuring JTEKT 's SBW technology was put into mass production and launched in October 2022.

- Schaeffler Technologies AG & Co. KG and Arnold Verwaltungs GmbH signed a basic agreement under which Schaeffler Technologies AG & Co. KG will acquire the remaining 10% stake in the joint venture company Schaeffler Paravan Technologie GmbH & Co. KG (Schaeffler Paravan) from Arnold Verwaltungs GmbH. Schaeffler’s objective is to accelerate the development of integrated SBW systems for large-series automotive production, and also to use the market access gained through Space Drive applications to market fully developed volume production solutions.

……

From the perspective of supply and demand, the above-mentioned phenomena indicate that intelligent steering systems (including SBW systems) will gradually enter the consumer market. In 2023, the era of traditional mechanical connection will come to an end, while the SBW age may begin.

SBW systems will gradually replace electronic power steering systems.

With the development of intelligence, automotive chassis is evolving from traditional chassis to chassis-by-wire. For the sake of more accurate actuation, faster response and higher safety, high-level intelligent driving or autonomous vehicles require chassis systems to cancel the mechanical connection between actuators as much as possible, and use electrical signals to transmit instructions instead. At the same time, the system reliability and security should be ensured by additional redundant electronic components.

At present, electronic power steering (EPS) systems are the most advanced steering system solution for mass production. The fundamental difference between SBW and EPS is that the former removes mechanical connection between steering wheel and steering rod, and completely decouples steering wheel and steering mechanism. After being widely used in high-level intelligent driving in the future, SBW can avoid interference with the driver's steering action and possible collision when the vehicle automatically turns in an emergency under control of ECU. Without a physical structure, SBW helps improve vehicle performance in terms of lightweight, responsiveness, and cockpit layout.

In chassis-by-wire, a SBW system is the core component that controls the lateral movement, and also one of important actuators of high-level intelligent driving. At present, SBW systems are still in the technical verification stage, let alone mass production. However, the absence of mechanical redundancy puts forward higher requirements for the reliability of electronic equipment and systems. Before high-level autonomous driving is popular, there are still many challenges for the development of SBW. At present, EPS is still the mainstream of market, but SBW with smaller size and higher security will embody the future trend.

With the development of high-level autonomous driving and the synchronization of "electrification, intelligence, software and sharing", the intelligent steering of passenger cars presents the following development trends:

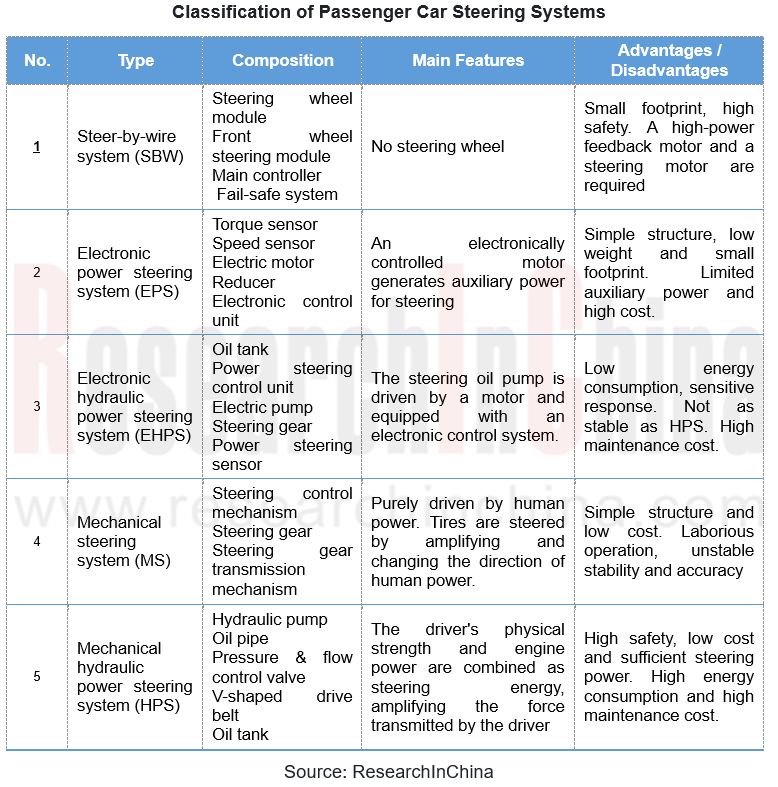

Trend 1: Steering systems gradually evolve

As the core part of chassis, steering systems have gone through many mutations, such as mechanical steering systems, hydraulic power steering (HPS) systems, electric power steering (EPS) systems, redundant steering systems (RSS), steer-by-wire (SBW) systems, etc., gradually transforming from mechanization to electrification, then to intelligence. The operating performance of steering systems has been improved, with higher levels of integration, electrification and intelligence. As the penetration rate of autonomous driving increases, the evolution to SBW systems will accelerate, and the upgrade of steering systems will match the level of autonomous driving.

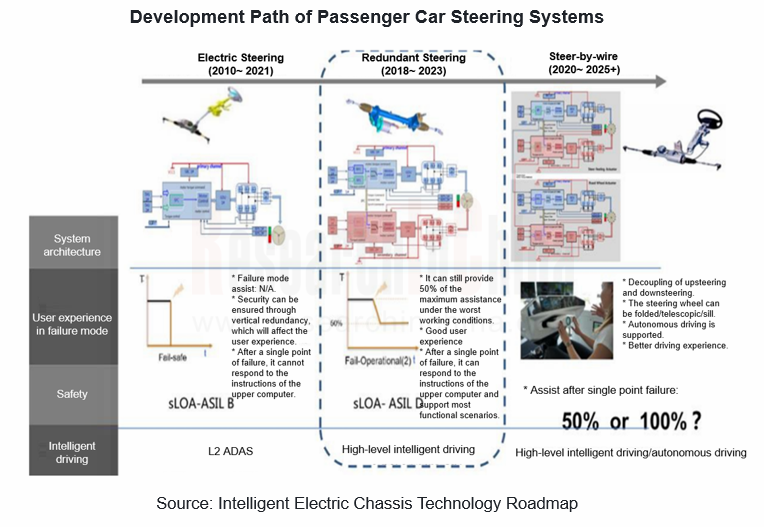

Trend 2: From electric control steering, redundant steering to SBW

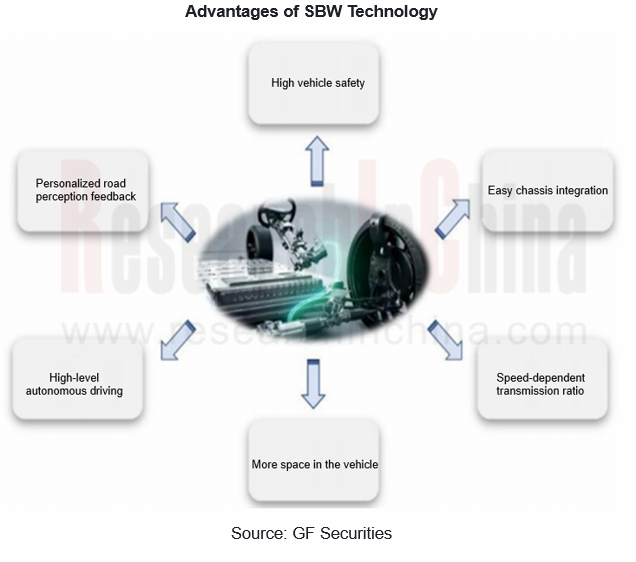

Amid the electrification of vehicles, intelligence has become a new driving force for the development of steering technology. In response to the requirements of autonomous driving, steering systems should feature higher safety and reliability to ensure that vehicles can enter a safe state or even continue to run safely when electrical systems fail. Therefore, the industry is studying new technologies such as redundant EPS and SBW to guarantee system safety. Compared with redundant EPS, the most notable feature of SBW lies in zero mechanical connection between the steering wheel and the actuator, which brings about obvious advantages in cost control, design flexibility, functional richness and space layout.

As the core role of intelligent chassis, steering systems have high technical barriers. At present, German, American, Japanese and Korean steering giants still dominate the steering system market, especially redundant EPS and SBW segments. China is catching up with them. With the gradual maturity of China's intelligent automotive industry chain, some enterprises have mastered the core technology of steering systems and even SBW. They are expected to break the technical barriers and quickly seize the market share in the future.

Trend 3: SBW has not seen mass production, but domestic and foreign automakers and suppliers are deploying SBW vigorously

Toyota bZ4X has once again introduced the SBW technology to automotive market, providing the first experience for the mass production and application of SBW. It may make a major breakthrough in the development of SBW technology. Tesla aims to start mass production of its eagerly anticipated all-electric pickup truck “Cybertruck” in late 2023. Great Wall Motor's next-generation smart chassis also adopts SBW technology and it plans to start mass production in 2023. SBW will be verified by the market extensively.

At present, neither international nor local vendors have realized mass production of SBW technology. Amid high R&D investment by local enterprises, the vendors with leading positions in EPS and technology accumulation will perform better in SBW technology, and may surpass international counterparts soon.

Trend 4: 2023 may become the first year of mass production of SBW

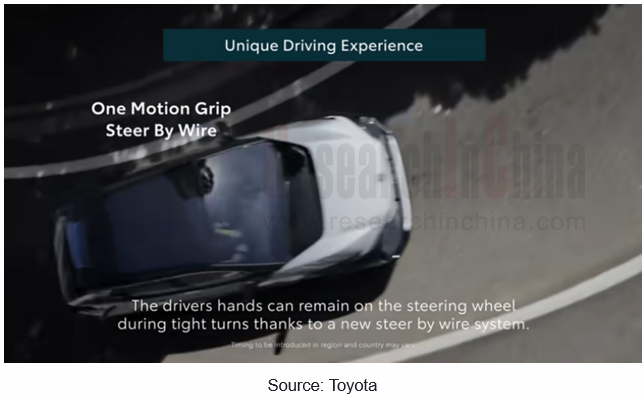

Toyota will launch bZ4X equipped with a SBW system in European market. This system has an additional standby power supply module, which improves the stability and diversity of system power supply with lithium batteries and capacitors based on a traditional generator and 12V power supply. In order to ensure reliability and safety of steering system, bZ4X has added electronic redundancy to power supply, communication bus, torque sensor, motor angle sensor, microprocessor, power drive and motor coil. Toyota bZ4X has once again introduced SBW technology to automotive market, providing the first experience for the mass production and application of SBW. It may make a major breakthrough in the development of SBW technology. The technical achievements of SBW have taken shape, and mass production may start in 2023.

Trend 5: SBW highlights convenience

Without a steering column, SBW can prevent driver from being injured by steering column in an accident. When the driver is driving, SBW ECU can judge whether the driver's operation is reasonable according to the driving state, and make certain adjustments to improve driving stability and safety. At present, different models are equipped with different steering systems, which cannot fit all.

Due to mechanical decoupling and flexible space layout, SBW can be applied to different models, assisting the development of chassis integration and reducing the OEM production cost. The SBW system abolishes the intermediate mechanical shaft for connection in the traditional steering system, allows the ECU to handle steering actively, and keeps the steering wheel still during the steering process, which facilitates high-level intelligent driving and facilitates the driver to take over. The traditional steering system adopts mechanical connection with a fixed steering ratio, so that steering is determined by mechanical structures such as gears.

SBW has no mechanical connection, so the steering ratio can be adjusted at any time by software and the transmission ratio varies with the speed. After the steering column is removed, the space under the steering wheel becomes bigger, which makes the driver's legs have more room for movement with more freedom and convenience.

Trend 6: The development goals and technology route of SBW systems

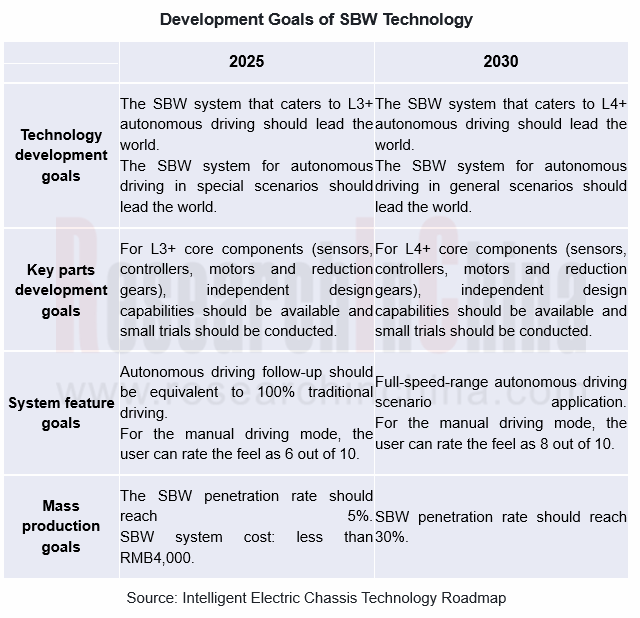

According to Intelligent Electric Chassis Technology Roadmap released by Wire Control Working Group of China Industry Technology Innovation Strategic Alliance for Electric Vehicle (CAEV) in 2022, the development goals of passenger car SBW are shown in the following figure:

Goals in 2025: The SBW system that caters to L3+ autonomous driving should lead the world. For L3+ core components, independent design capabilities should be available and small trials should be conducted. The SBW penetration rate should reach 5%.

Goals in 2030: The SBW system that caters to L4+ autonomous driving should lead the world. For L4+ core components, independent design capabilities should be available and small trials should be conducted. The SBW penetration rate should reach 30%.

The intelligent steering technology for passenger cars mainly follows the route:

In 2022, SBW should vary with the speed with a variable transmission ratio.

In 2022, SBW should vary with the speed with a variable transmission ratio.

In 2023, functional safety should realize security network and safe development.

In 2023, functional safety should realize security network and safe development.

In 2024, advanced functions should support highway assistance and traffic congestion assistance, and the mass production of rear wheel SBW should begin.

In 2024, advanced functions should support highway assistance and traffic congestion assistance, and the mass production of rear wheel SBW should begin.

In 2025, front wheel SBW should be mass-produced with dual redundant controllers (10fit) and the coordinated control of steering and braking.

In 2025, front wheel SBW should be mass-produced with dual redundant controllers (10fit) and the coordinated control of steering and braking.

In 2028, autonomous driving should bolster self-learning, personalized software and FOTA updates.

In 2028, autonomous driving should bolster self-learning, personalized software and FOTA updates.

In 2030, intelligent chassis should feature SBW, brake-by-wire and suspension-by-wire to realize three-way coordinated control.

In 2030, intelligent chassis should feature SBW, brake-by-wire and suspension-by-wire to realize three-way coordinated control.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...