Smart glass research: the automotive smart dimming canopy market valued at RMB127 million in 2022 has a promising future.

Smart dimming glass is a new type of special optoelectronic glass formed by compounding a liquid crystal film into the middle of two layers of glass and bonding them under high temperature and high pressure. By implementation mode, it falls into electrically controlled, temperature-controlled, optically-controlled and pressure-controlled types.

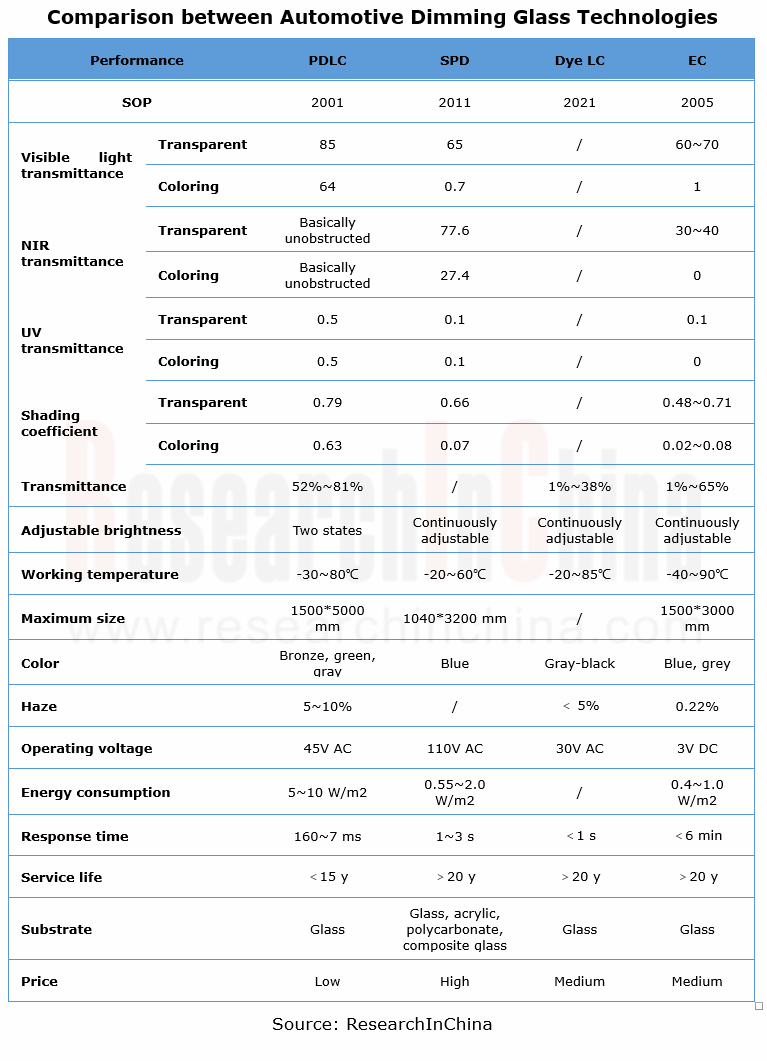

In the automotive field, there are four major types of dimming glass: polymer dispersed liquid crystal (PDLC), suspended particle devices (SPD), electrochromic (EC) and dye liquid crystal (Dye LC). Wherein, PDLC, SPD and Dye LC feature physical dimming, and EC chemical dimming.

PDLC appeared first. As the most mature and lowest cost technology, the majority of Chinese dimming glass manufacturers are using the solution;

PDLC appeared first. As the most mature and lowest cost technology, the majority of Chinese dimming glass manufacturers are using the solution;

SPD is mainly used in high-end models such as Mercedes S/SL and yachts due to high power consumption and high cost;

SPD is mainly used in high-end models such as Mercedes S/SL and yachts due to high power consumption and high cost;

Dye LC spends a relatively short time on dimming using dichroic dye molecules;

Dye LC spends a relatively short time on dimming using dichroic dye molecules;

EC features low haze, low energy consumption, good thermal insulation effect, continuous dimming, relatively long dimming time (2min on average) and medium cost.

EC features low haze, low energy consumption, good thermal insulation effect, continuous dimming, relatively long dimming time (2min on average) and medium cost.

At present, smart dimming glass is often applied to panoramic canopies, not only giving a deeper spatial impression but also automatically reducing the transmittance of ultraviolet and infrared rays in the blazing sun for the purpose of lowering the temperature inside. According to the data from ResearchInChina, 1,636,900 units of new passenger cars in China were installed with panoramic canopies in 2022, 0.5% of which were smart dimming canopies. It is expected that panoramic canopies will be installed in 3,684,100 units of new passenger cars in 2025, 6.1% of which will be smart dimming canopies.

In this report, the panoramic canopy refers to: non-opening large-size sunroof without segmental structure; the dimming canopy means: enabling the smart dimming control function on the basis of panoramic canopy.

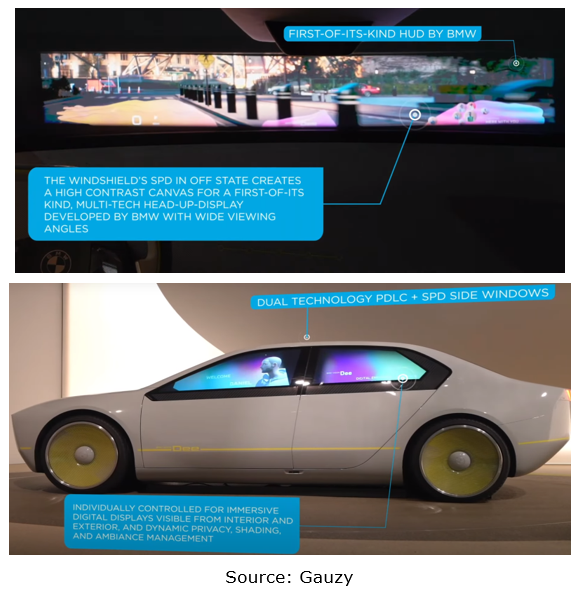

In the future, smart dimming glass may be applied to side windows and front windshield among others. For example, the side windows can display advertisements (displaying when the vehicle is stopped and becoming transparent when the vehicle is started and power on), and offers backseat graffiti function for children, human-computer interaction, entertainment and other capabilities; the front windshield incorporates AR HUD for anti-glare: combined with the front view camera, recognize the high beam of the oncoming vehicle, and automatically adjust the transmittance of the front windshield to eliminate glare and ensure safe driving.

At the CES 2023, BMW iVISION Dee Concept car that features Gauzy’s PDLC and SPD smart glass technologies was showcased. The front windshield enables the HUD to provide wide viewing angles for a virtual image for all passengers; the side windows support dynamic privacy, shading, and ambiance management.

The segmented SPD-LCG? smart glass windshield for BMW iVISION Dee enables the HUD to provide wide viewing angles for a virtual image.

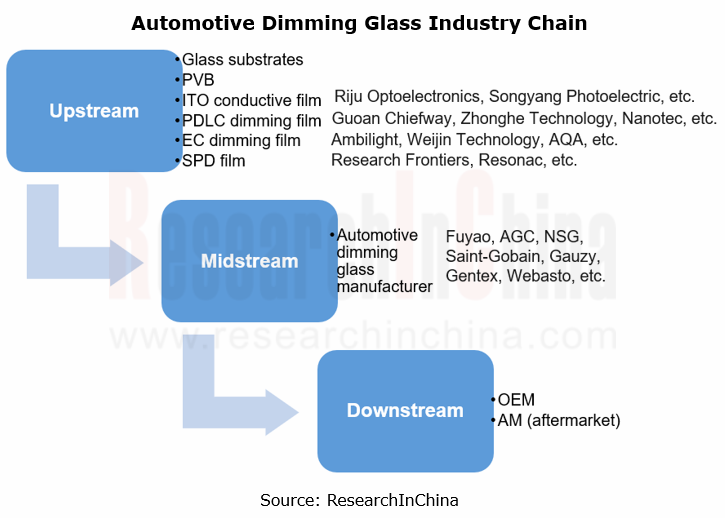

From the smart dimming glass industry chain, it can be seen that the upstream is mainly engaged in production of relevant dimming materials, films, glass substrates and PVBs; the midstream is responsible for integrating dimming glass that is applied to OEM markets and aftermarkets. The upstream and midstream manufacturers first started from deploying patents. Among the global top 1,000 companies by patent filings, the first five companies are BOE, Nitto Denko, Ricoh, Sony and Fuyao, of which most patents of BOE and Fuyao are filed during 2019-2022.

For example, in May 2019 BOE filed the CN 210514886 U Dimming Glass Patent, a display window technology patent in which the dimming glass layer is set up with basic dimming structure and functional dimming structure: the former is used to adjust the transmittance of light shining onto it, and the latter is used to reflect the light of a specific waveband shining onto it.

From the prospective of smart dimming glass supply, the key suppliers are Fuyao, AGC, NSG, Gauzy, Saint-Gobain, Ambilight, and Research Frontiers. Among them, Fuyao remains absolutely dominant, thanks to its stable supply relationships in the automotive glass market, as well as factors such as dimming glass technology R&D, cost balancing and occupant experience.

In the OEM market, the installed models include Toyota Venza, BYD Seal, Neta S, Lotus Eletre, NIO EC7, Porsche Taycan, Lexus RZ, and Cadillac CELESTIQ (not mass-produced). Among them, the dimming canopy glass surface of Porsche Taycan is split into nine individually controlled areas, and offers five dimming effects: transparent, matte, translucent, vivid, and user-defined. In the future, as consumers demand more beautiful, more comfortable and more intelligent vehicles, smart dimming glass will usher in a boom period in other fields in addition to panoramic canopy.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...