Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

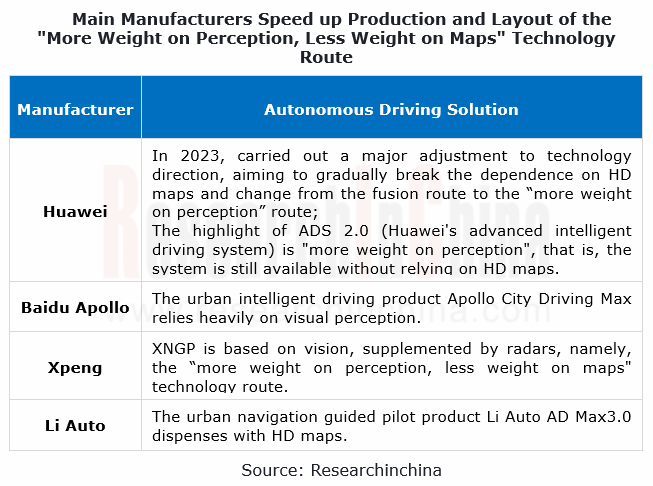

At the Auto Shanghai 2023, "more weight on perception, less weight on maps", "urban NOA", and "BEV+Transformer" abounded of OEMs and Tier 1 suppliers. It can be seen that major manufacturers have turned to the technology route of "more weight on perception, less weight maps", to speed up their layout of urban NOA and break their dependence on HD maps.

Driven by the "more weight on perception" technology route, automotive sensors play a more important role. New products like LiDAR, 4D imaging radar, and 8MP CMOS image sensor (CIS) are quickly applied in vehicles, pushing up the demand for sensor chips. Automotive sensor and chip technologies are entering a new stage of rapid iterative evolution and fast cost reduction.

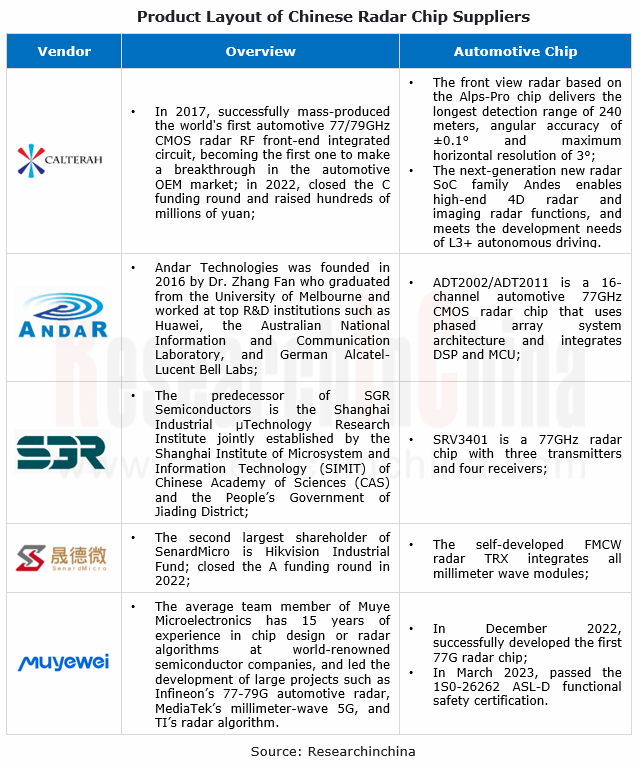

Radar chip: Chinese vendors have made breakthroughs and broken overseas monopoly.

The automotive radar chip market is dominated by such companies as NXP, Infineon, and TI; among Chinese vendors, Calterah Semiconductor as an early starter has forged partnerships with more than 20 automotive OEMs, on designated projects for over 70 passenger car models, and has shipped a total of over 3 million pieces, one third of which were to overseas customers.

4D radars rapidly penetrate into mid- and high-end models and autonomous models. OEMs such as BMW and GM, and Tier 1 suppliers like Continental and ZF have completed the layout in this field. Quite a few Chinese brands including Li Auto, Changan, BYD, Tesla and Geely have designated or spawned and applied 4D radars. HW4.0, Tesla’s next-generation autonomous driving platform equipped with a "Phoenix" 4D imaging radar, has become a tipping point in market.

In the field of conventional radar chips, Infineon and NXP are almost in a monopoly position. As the main development direction of radars, 4G imaging radars can better serve advanced autonomous driving functions such as urban NOA. Chinese manufacturers are also expediting layout of 4D radar chips.

Calterah: in December 2022, announced Andes, its next-generation new radar SoC family that enables 4D imaging radar functions and promotes the development of L3+ autonomous driving, with the following key features:

- 4T4R SoC using 22nm process

Multi-core CPU, including DSP (digital signal processor) and RSP (radar signal processor)

Gigabit Ethernet with RGMII/SGMII

Support for flexible cascading

Subject to ASIL-B & AEC-Q100 Grade 1 requirements

Muye Microelectronics: a 4D radar start-up specializes in 4D high-precision imaging radars. In December 2022, it successfully developed the first 77G radar chip; in March 2023, passed the "1S0-26262 ASL-D functional safety certification"; in April 2023, closed the Pre-A funding round and raised RMB100 million, which is spent for chip productization, and production and delivery to Alpha customers.

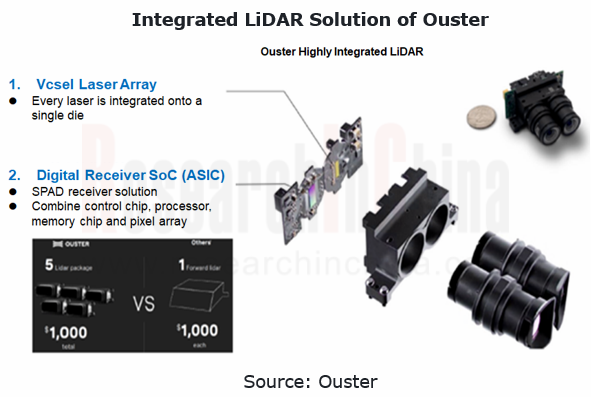

LiDAR chip: develop towards SoC integration.

Since 2022, much more LiDARs have been used in vehicles, and about 164,000 passenger cars have been installed with LiDARs in China. LiDARs are often used in L2+++ passenger cars (with the highway + urban NOA function), most of which are high-end new energy vehicles valued at over RMB250,000. It is estimated that in 2026, 3.666 million LiDARs will be installed in passenger cars in China. If LiDARs are mounted on RMB150,000 passenger cars, a bigger cost reduction will be required. This may be hard to achieve in the short run.

In 2023, the LiDAR price war has begun, and the shipping price has slumped to around USD500, but still relatively high compared to the price (USD200-300) of 4D radars. Based on SoCs, LiDARs will be further integrated and become cheaper.

(1) Integration with transceiver chips

The wide adoption of LiDARs in vehicles first needs cost control. Different LiDAR routes of manufacturers lead to differential costs. Yet transceiver chips are the main cost component. The integration with transceiver chips is an effective way to cut down the cost of LiDARs.

Transmitter chip: replacing discrete modules with integrated modules can slash the cost of materials and debugging by more than 70%;

Receiver chip: the small size of the SPAD solution favors the integration with the readout circuit, which can further reduce the cost.

LiDAR chip technique is mastered by foreign manufacturers, but Chinese vendors have also worked to develop related technologies in recent years. In the case of transmitter chips, Chinese manufacturers have begun to step into upstream VCSEL chip design; as concerns receiver chips, Chinese start-ups march into SPAD and SiPM chips, among which QuantaEye and FortSense concentrate their efforts on SPAD/SiPM R&D.

FortSense: it has started deploying SPAD LiDAR chip R&D from 2019. It taped out in 2021, and passed automotive certification in September 2022. It has been favored by designated LiDAR suppliers of over 5 automakers. In December 2022, it closed the C funding round, with the raised funds to be used to develop LiDAR chips.

Hesai Technology: in recent years, it has been committed to developing LiDAR chips. Hesai Technology has started developing LiDAR SoCs since 2018, and has made the strategy for developing multiple generations of chip-based transceivers (V1.0, V1.5, V2.0, V3.0, etc.). Wherein, for V2.0, the receiving end is upgraded from SiPM to SPAD array for integration of detectors and circuit function modules under the CMOS technology; as for the V3.0 architecture, it is expected to complete the development of the VCSEL area array driver chip and the area array SoC based on SPAD detector.

Hesai’s long-range semi-solid-state LiDAR AT128: it is equipped with a self-developed automotive chip. A single circuit board integrates 128 scanning channels for chip-based solid-state electronic scanning.

Hesai’s new-generation all-solid-state gap filler radar FT120: a single chip integrates an area array composed of tens of thousands of laser receiving channels for laser emission and reception completely through the chip. With much fewer components than conventional LiDARs, it is more cost-effective than the AT family.

(2) Single-chip LiDAR solution

LiDAR cost reduction needs to use the photonic integration process to integrate various optoelectronic devices, which is evolving from heterogeneous materials integration to single-chip integration, a process to slot the prepared silicon wafer to the monocrystalline silicon substrate, and then grow the group III-V materials on the monocrystalline silicon substrate in an epitaxial way. Despite high difficulty, the process offers benefits of low loss, easy to package, high reliability, and high integration.

In early 2023, Mobileye demonstrated its next-generation FMCW LiDAR for the first time. To be precise, it is a LiDAR SoC with a wavelength of 1320nm. Based on Intel's chip-level silicon photonics process, this product can measure distance and speed at the same time.

The chip-based silicon photonics FMCW solid-state LiDAR technology route may become a preferred direction in future LiDAR development, involving such key technologies as FMCW, solid-state dispersion scanning and silicon photonics. As a new technology route, FMCW LiDAR still poses a lot of technical challenges. In addition to foreign manufacturers like Mobileye, Aeva and Aurora, Chinese vendors such as Inxuntech and LuminWave have also made deployments.

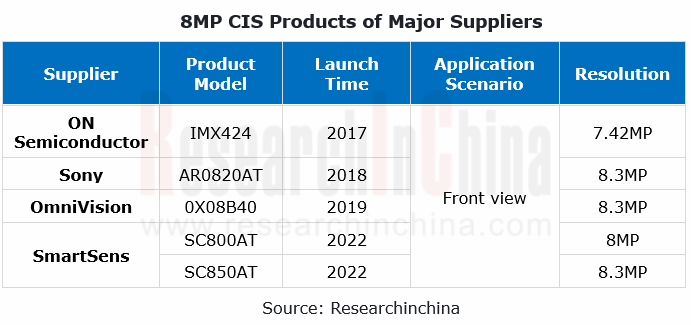

Vision sensor chips: giants race to lay out 8MP products.

Automotive camera hardware includes lens, CIS and image signal processor (ISP). Thereof, automotive CIS with a high entry threshold is an oligopolistic market in which dominant competitors include ON Semiconductor, OmniVision and Sony. In the future the products will tend to have high pixel and high dynamic range (HDR). As well as conventional ISPs, the current ISP integrated solutions also integrate ISP into CIS or SOC.

CIS develops towards high pixel.

The development of high-level autonomous driving requires increasingly high imaging quality of automotive cameras. Generally speaking, the higher the pixel of cameras, the better the imaging quality and the more useful information automakers/autonomous driving providers can get. The pace of using 8MP cameras in vehicles quickens. Xpeng P7i launched in early 2023 packs an 8MP camera for intelligent driving assistance solutions.

Front view is the application scenario with the most urgent need for 8MP high-resolution cameras. Currently, mainstream automotive CIS suppliers have successfully deployed 8MP CIS products.

SmartSens: it announced SC850AT in November 2022. This sensor product supports 8.3MP resolution, and adopts SmartSens SmartClarity?-2 innovative imaging technology architecture and the upgraded self-developed Raw domain algorithms that can effectively protect image details and improve overall image effects. In addition to Staggered HDR, it also supports SmartSens’ unique PixGain HDR? technology to achieve 140dB HDR, and can capture more accurate image information, ensuring its ability to accurately capture details in brightness and darkness in complex lighting conditions.

The volume production of the chip is scheduled in the second quarter of 2023.

ISP: evolve towards integration.

There are two types of ISP solutions: independent and integrated. Wherein, independent ISPs are powerful but with high cost, while integrated ISPs have the benefits of low cost, small area and low power consumption but with relatively weak processing capabilities. In recent years major vendors have vigorously deployed ISP-integrated SOC in addition to ISP-integrated CIS.

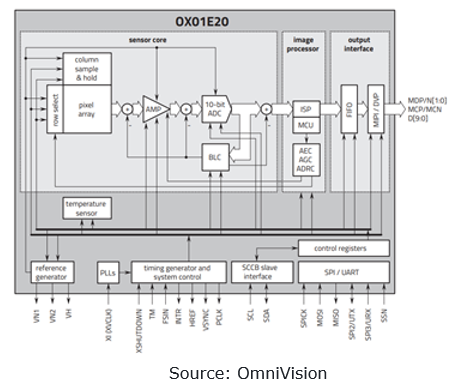

ISP-integrated CIS: the integration of ISP into CIS can achieve the aim of saving space and reducing power consumption. It is mainly some CIS leaders that introduce relevant solutions. In January 2023, OmniVision announced its new 1.3-megapixel (MP) OX01E20 system-on-chip (SoC) for automotive 360?degree surround view systems (SVS) and rear-view cameras (RVC). The OX01E20 brings top-of-the-line LED flicker mitigation (LFM) and 140db high dynamic range (HDR) capabilities. It features a 3?micron image sensor, an advanced image signal processor (ISP), and full-featured distortion correction/perspective correction (DC/PC) and on-screen display (OSD).

ISP-integrated SOC: the way of removing the ISP from the CIS and directly integrating it into the main control SoC for autonomous driving enable a big reduction in the cost of perception hardware, and the removal of the ISP from the camera can not only solve the serious problem of heat dissipation caused by high-pixel cameras, but also help to further reduce circuit board size and power consumption for automotive cameras. Almost all autonomous driving domain control SoCs integrate the ISP module.

Automotive Sensor Chip Industry Report, 2023 highlights the following:

Automotive sensor chip industry (overview, formulation of industrial policies and standards, market size, etc.);

Automotive sensor chip industry (overview, formulation of industrial policies and standards, market size, etc.);

Main automotive sensor chip industry segments (automotive camera chip, radar chip, LiDAR chip, etc.) (product structure, technology trends, market size, market pattern, etc.)

Main automotive sensor chip industry segments (automotive camera chip, radar chip, LiDAR chip, etc.) (product structure, technology trends, market size, market pattern, etc.)

Main automotive radar chip suppliers (product line layout, performance of main products, development of new products, product application, etc.);

Main automotive radar chip suppliers (product line layout, performance of main products, development of new products, product application, etc.);

Main automotive LiDAR chip suppliers (product line layout, performance of main products, development of new products, product application, etc.);

Main automotive LiDAR chip suppliers (product line layout, performance of main products, development of new products, product application, etc.);

Main automotive vision sensor chip suppliers (product line layout, performance of main products, development of new products, product application, etc.).

Main automotive vision sensor chip suppliers (product line layout, performance of main products, development of new products, product application, etc.).

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...