Analysis on 75 Trends at Auto Shanghai 2023: Unprecedented Prosperity of Intelligent Cockpits and Intelligent Driving Ecology

After analyzing the intelligent innovation trends at the Auto Shanghai 2023, ResearchInChina summarized 75 trends, including 14 trends about OEMs, 24 trends about cockpits, 24 trends about intelligent driving, 7 trends about intelligent chassis and 6 trends about electrification. This report illustrates 10 trends with examples.

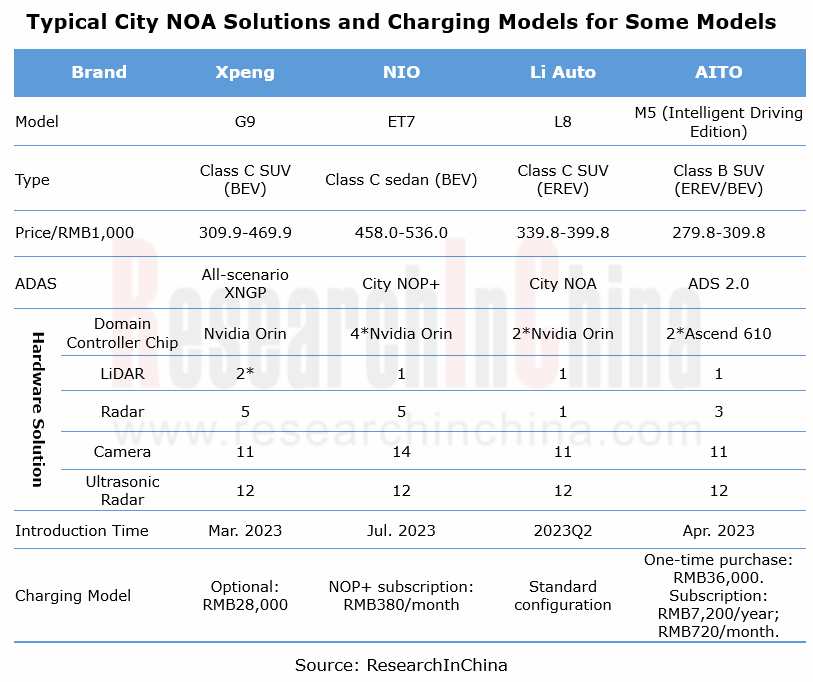

Emerging brands compete with each other fiercely in the arena of city NOA, conventional Chinese independent brands give domestic Tier 1 suppliers scope for growth, while joint venture brands are striving to catch up with them.

The "involution" of emerging brands in vehicle display intensifies. They tend more to create all-scenario interaction experience through integrated display, large display, rear screens and AR-HUD. The multi-screen and large-screen trend becomes clearer. By keeping improving their self-developed IVI systems, emerging carmakers offer intelligent differentiated experience in terms of multi-modal interaction, ecosystem services and scenario engines. Regarding intelligent driving, Xpeng, NIO and AITO will apply the city NOA function on large scale in 2023.

Conventional Chinese independent brands are keen on innovation as well, but they generally achieve intelligent upgrades on car models by way cooperating with domestic Tier 1 suppliers. The foreign decision-makers of joint venture automakers who have learned lessons at the Auto Shanghai are expected to increase investment in intelligence and electrification, thereby bringing more opportunities to domestic Tier 1 suppliers.

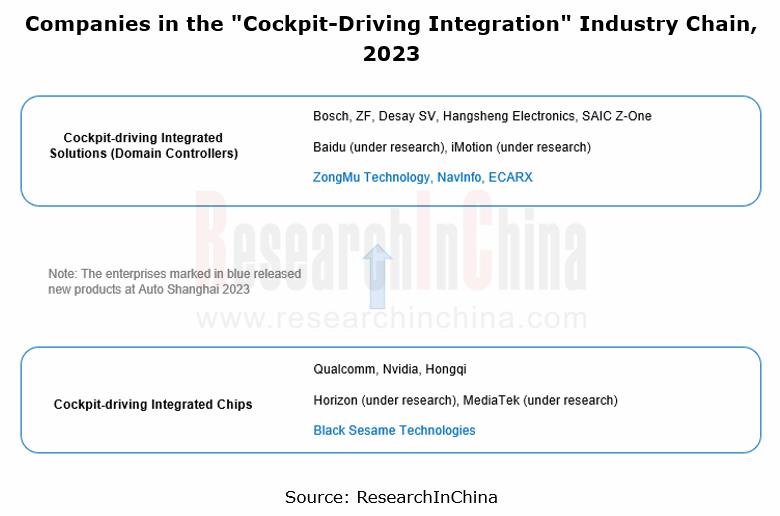

Trend 1: Cockpit-driving integration has become a R&D priority, and is expected to be available to vehicles during 2024-2025.

Since 2022, NVIDIA and Qualcomm among others have taken the lead in mass-producing cockpit-driving integrated chips. Bosch, ZF, Desay SV, Hangsheng Electronics and SAIC Z-ONE have also released cockpit-driving integrated domain controllers and solutions. At the Auto Shanghai 2023, ZongMu Technology also announced a transformation from driving-parking integration to cockpit-driving integration amid the “involution”. Meanwhile, NavInfo, ECARX, Black Sesame Technologies, HoloMatic Technology and Banma Zhixing also race to work hard on cockpit-driving integration. In addition, Baidu and iMotion are deploying cockpit-driving integration and expected to apply it to vehicles between 2024 and 2025.

Trend 2: Webasto introduced a smart roof that integrates solar energy and dimming technologies, and exhibited a rooftop cinema system with a large display.

As a global roof system leader, Webasto has developed a roof sensor module (RSM) for autonomous vehicles. This module integrates sensors such as LiDAR and camera into the roof line and combines functions like intelligent cleaning and thermal management. So far, Webasto’s smart roof technology has been applied to production cars of Lotus. The LiDAR integrated into the roof can be turn on or off as needed. To cater to consumers better, Webasto continues to develop a range of new roof functions, such as rooftop cinema system, and dimmable and tiltable canopy.

Trend 3: Cockpit chip platforms enter the 3nm era, and the MTK cockpit platform is released.

At the Auto Shanghai 2023, MediaTek launched Dimensity Auto, a brand-new automotive platform which includes Dimensity Auto Cockpit, Dimensity Auto Connect, Dimensity Auto Drive, and Dimensity Auto Components. Utilizing the 3nm process and the AI Processing Units (APU) with flexible AI architecture and high scalability and supporting up to 16 cameras, the cockpit platform can meet the development needs of cabin-parking integration and cabin-driving integration.

Trend 4: UWB has functioned as a technical solution for detecting children left-behind inside the vehicle.

At the Auto Shanghai 2023, Continental introduced the expansion of its digital access system CoSmA by a Child-Presence-Detection function (CPD) using ultra-wideband (UWB) technology. Based on unique respiration rates and micro-body-movements, the CPD with UWB system can classify passengers as infants, children or adults. If children are left behind in the vehicle, the CPD system can send an audible, visual or haptic alert to the driver after ten seconds at the latest. The UWB-based CPD is also able to detect infants and children in any seating position, no matter if they are covered by a blanket or stay hidden in the cabin-footwell.

In March 2023, CEVA announced the Child Presence Detection (CPD) as specified by Euro-NCAP and similar specifications in other regions.

Trend 5: Large games will gradually get on vehicles.

At the Auto Shanghai 2023, ECARX exhibited “Makalu”, its next-generation intelligent cockpit computing platform just released in March 2023. This platform adopts AMD Ryzen Embedded V2000 processors, 7nm process, 6-core and 12-thread APU, GPU consisting of 28 compute units, and 1,792 stream processors.

In March 2023, ECARX announced an ecosystem strategic partnership with Unreal Engine to create an immersive user experience through desktop-level 3D visual effects, which also support large AAA games and the extensive gaming ecosystem of the Epic Games Store, including Tomb Raider.

Desay SV’s Smart Solution 2.0 released at the Auto Shanghai 2023 adds the gaming cockpit concept based on Aurora, an intelligent central computing platform (ICP) with computing power of 4000TOPS. The Smart Solution 2.0 has designed two different gaming systems for rear seat users: one using X86 architecture aims to let users enjoy the desktop-level AAA game experience in vehicles; the other combined with smart surfaces provides children-oriented services such as playing the piano and painting.

Trend 6: AI foundation models are available to cockpits, and multiple brands unveil AI assistants.

Banma Co-Pilot, the third-generation automotive AI capability system of Banma Zhixing, was officially unveiled at the Auto Shanghai 2023. The related technologies will be first seen in SAIC IM cars. Based on the Tongyi Qianwen, a foundation model independently developed by Alibaba based on natural language understanding and generation, Banma Co-Pilot designed for automotive scenarios builds full-stack cloud-terminal integrated AI capabilities and boasts such core capabilities as scenario customization, multi-source data, expertise, service access and behavior prediction.

Trend 7: Dual-chip driving-parking integrated solutions get upgraded to single-SoC ones, and the competition in the industry intensifies

Driving-parking integration is a key solution to intelligent driving at present. Dual-chip driving-parking integrated solutions are being upgraded to single-SoC ones. For example, Baidun has upgraded Apollo Highway Driving Pro, a driving-parking integrated product where the computing platform gets upgraded to a single TDA4-VH. Yihang.AI has also upgraded its previous dual-chip solution to the Lite, a single-SoC driving-parking integrated solution with optimized algorithms and fewer chip, helping to cut down the domain controller cost to around RMB1,000.

Hong Jing Drive’s driving-parking integrated domain controller packs a single Journey 3 SoC that supports both driving and parking scenarios and time-division multiplexing algorithms. In driving scenarios, this domain controller with the 5R5V sensor configuration enables highway Navigate on Autopilot (NOA).

Trend 8: Horizon Journey 5 is selected by international Tier 1 giants as the main control chip of intelligent driving platforms.

At the Auto Shanghai 2023, Continental announced a consensus with Horizon Robotics to build the Driving-parking Integrated Domain Controller Solution 3.0 that supports L2+ NOA and integrates higher-level parking functions to enable end-to-end ADAS. Continental Xinzhijia, a joint venture between Continental and Horizon Robotics, will create Driving-parking Integrated Domain Controller 3.0 based on Horizon's next-generation high-performance chips.

On April 20, 2023, ZF announced a close strategic partership with Horizon Robotics to develop high-performance platform solutions based on Horizon’s Journey series chips so as to empower ZF coPILOT. The first Journey 5-based computing platform will be delivered in Q3 2024.

Trend 9: Many domain controller vendors choose chips from Black Sesame Technologies.

Black Sesame Technologies has main offerings of A1000, A1000L and A1000 Pro. JICA Intelligent Robot, Fusionride, Baolong Automotive, Lan-You Technology, Yixing Zhilian, and Anhui Domain Compute have developed driving-parking integrated domain controllers based on A1000/A1000L chips.

Trend 10: 4D imaging radar vendors realize a more accurate target classification by using innovative imaging technology and perception algorithms.

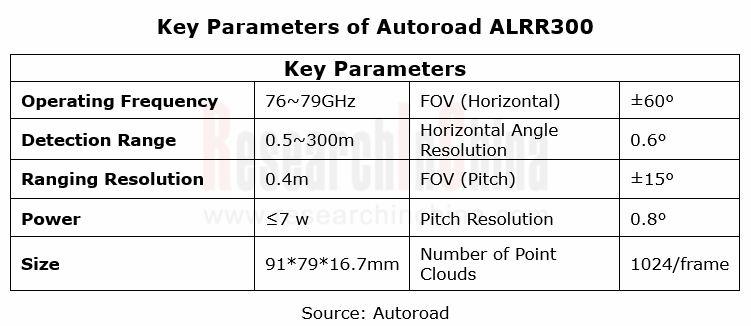

Beijing Autoroad Technology Co., Ltd. released ALRR 300, a brand-new 77Ghz automotive 4D radar. Based on dual-chip cascaded hardware and sparse signal imaging technology, the product delivers horizontal and pitch resolution of less than 1°, which facilitates more accurate target classification, and provides better performance through compressed perception algorithms. ALRR300 can precisely recognize six kinds of targets: motor vehicles, non-motor vehicles, people, high places, grounds and ground targets (not limited to lamp poles, road signs and bridges). It not only ensures the reliability of the AEB function, but also supports dense point cloud output, about 1024 points per frame. In addition, ALRR300 can penetrate the rain, snow and fog to detect targets.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...