Intelligent Steering Research: Steer-by-wire is expected to land on independent brand models in 2025

The Passenger Car Intelligent Steering Industry Research Report, 2024 released by ResearchInChina summarizes and studies the status quo, installation, suppliers’ layout, supply chain layout, etc. of intelligent steering in the world and China, and predicts the future development trends of intelligent steering.

1. Policies provide continuous support, and standards concerning steer-by-wire are becoming definite.

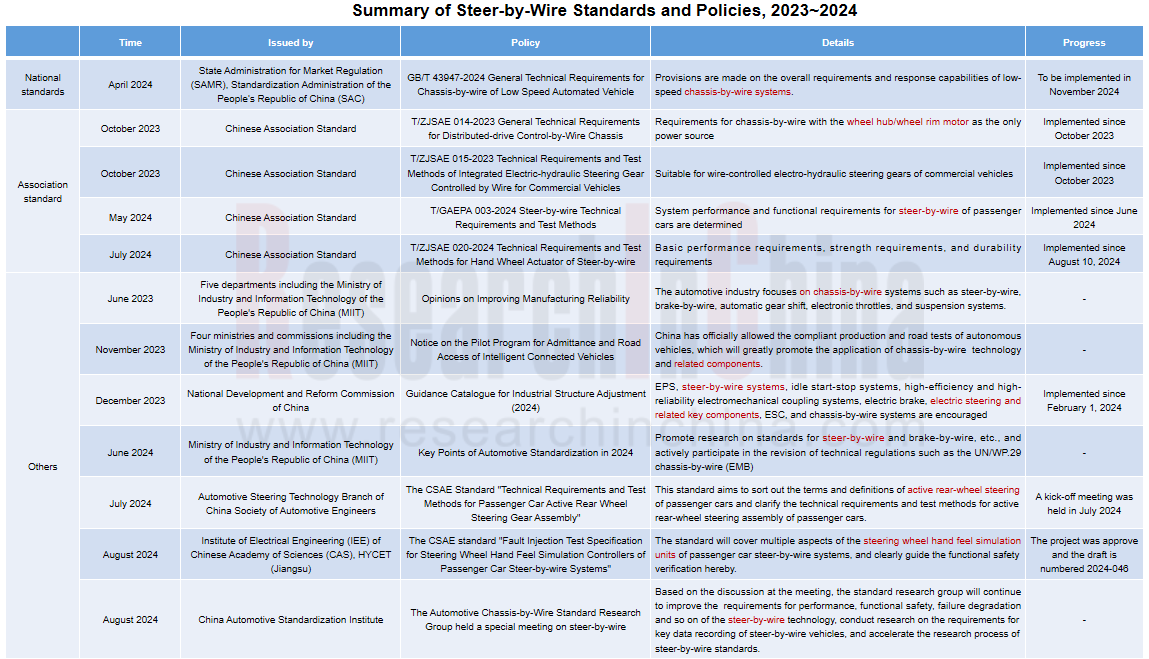

Since 2023, China has formulated a range of national standards, association standards and other policies for steer-by-wire. From system standards such as technical requirements and test methods for steer-by-wire of commercial vehicles and passenger cars, to component standards for wheel hub/wheel rim motors and steer-by-wire road sense simulators, the standards for steer-by-wire are becoming increasingly definite and perfect.

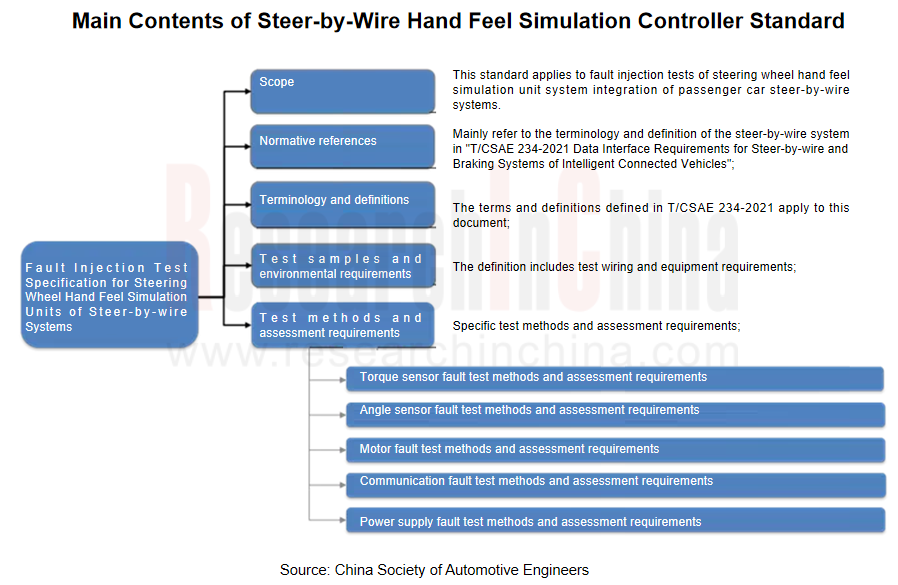

Take the steer-by-wire road sense simulator as an example: when the driver drives a vehicle, the hand feel is very important to the driver. The road sense transmits the force and road conditions of the tires, road surface, and body to the driver through the steering wheel in real time. Without mechanical connection, the road sense can only be produced by the steer-by-wire road sense simulator. The most important function of a road sense simulator is to simulate and restore the driver's feelings as realistically as possible under different road conditions.

In August 2024, the Institute of Electrical Engineering (IEE) of Chinese Academy of Sciences (CAS) and HYCET EPS System (Jiangsu) jointly took the lead in drafting the CSAE standard "Fault Injection Test Specifications for Steering Wheel Hand Feel Simulation Controllers of Passenger Car Steer-by-Wire Systems", a standard which filled the gap in this field.

The following table shows the statistics of steer-by-wire standards and policies from 2023 to 2024:

2. Many OEMs are vying to deploy steer-by-wire technology which is expected to be available in domestic independent brand models in 2025.

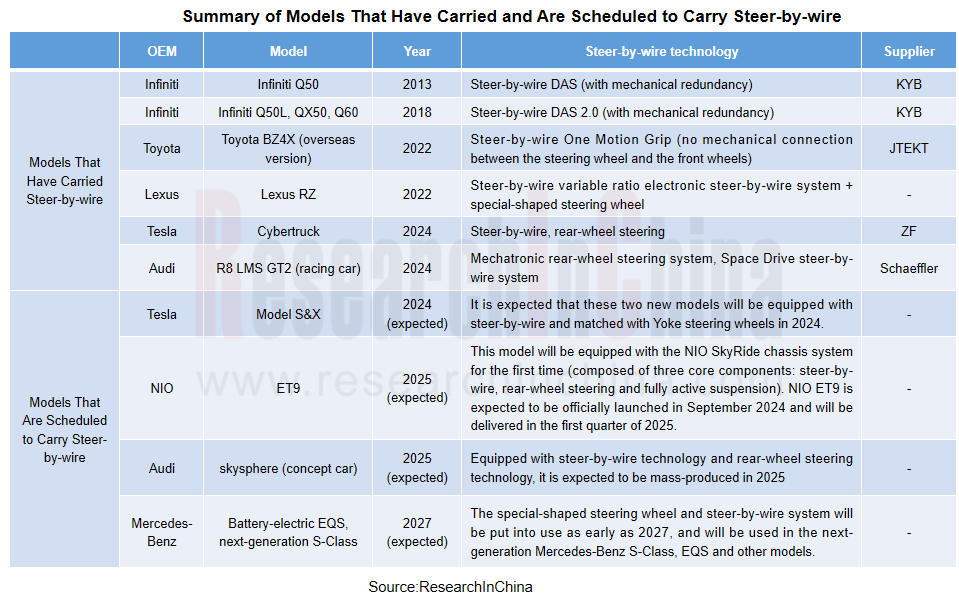

There are fewer than 10 passenger car models equipped with steer-by-wire in the world, including Infiniti Q50, Q50L, QX50, Q60, Toyota bZ4X, Lexus RZ, and Tesla Cybertruck. The following table lists the models that have carried and are scheduled to carry steer-by-wire:

Seen from the plans of OEMs, steer-by-wire is expected to be available in domestic independent brand models in 2025.

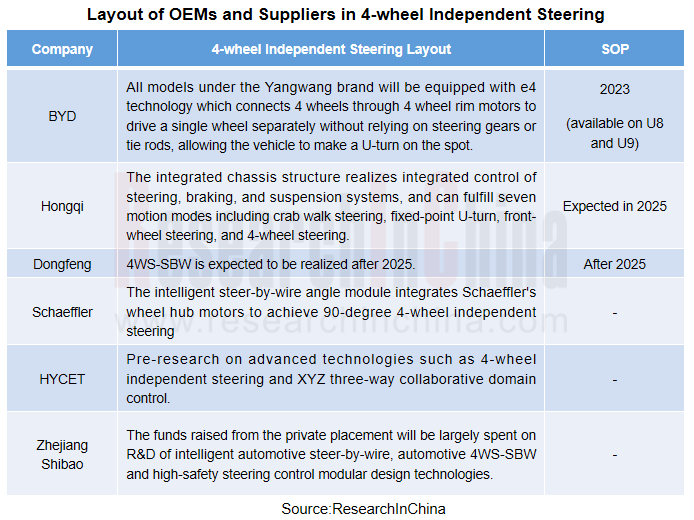

3. Four-wheel independent steering will be the future development direction of steer-by-wire

The 4-wheel steering with steer-by-wire system (4WS-SBW) is composed of an independent mechanical transmission mechanism and a steering actuator motor. Each wheel can independently control the steering angle, enabling the vehicle to turn in place while increasing the freedom of driving attitude. The greatest significance of 4-wheel independent drive lies in safety. It can improve the stability and anti-skid control of the vehicle. It also provides power and steering dual redundancy for the autonomous driving system. Even if the steering wheel fails, steering can be achieved through the speed difference between the four wheels.

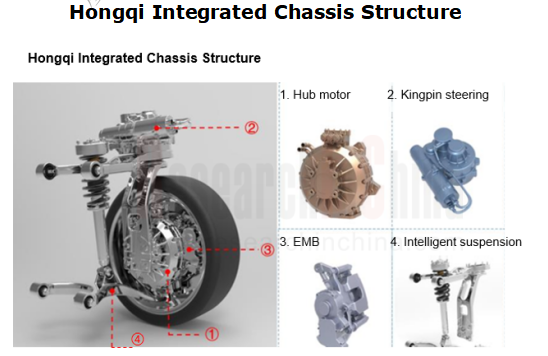

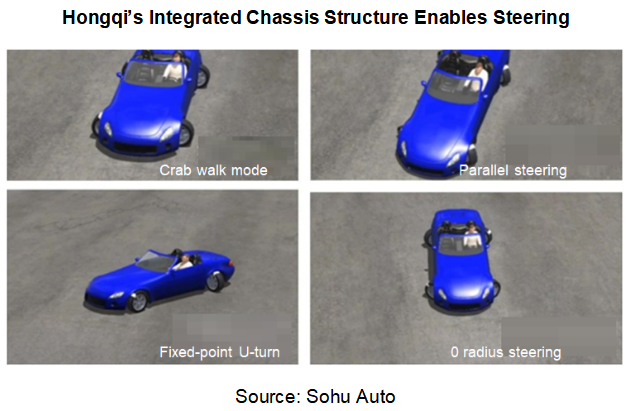

For example, the Hongqi integrated chassis structure comes from the "Hongqi drive-steering integrated power chassis" technology of the intelligent driving safety chassis system of the e.RFlag electric platform (HME). This chassis technology platform pioneered a chassis domain control algorithm to achieve integrated control of steering, braking and suspension systems. It removes the motors that drives the wheel from the body, integrates them directly into the wheel, and installs them on the inside of the wheel hub instead. All four wheels adopt the same design. This is equivalent to directly canceling the transmission devices on traditional vehicles, allowing the wheels to drive "themselves", and realizing seven motion modes including crab walk steering, fixed-point U-turn, front-wheel steering, and four-wheel steering.

BYD, Hongqi, Dongfeng and Schaeffler among others have laid out 4-wheel independent steering, a technology which is a major future development direction of steer-by-wire.

4. Steer-by-wire technology will disrupt cockpit design

Change 1: Steer-by-wire can enable foldable steering wheels to increase the available space in the cockpit. Nexteer's steer-by-wire can realize a foldable steering wheel, which automatically retracts during autonomous driving to increase the available space in the cockpit. ZF's steer-by-wire will allow the steering wheel to automatically retract in the future.

Change 2: Steer-by-wire technology can eliminate the steering wheel and replace it with other devices:

In November 2023, Schaeffler announced its force feedback operating joystick technology, which cancels the traditional steering wheel and replaces it with a joystick placed next to the armrest. Schaeffler's force feedback operating joystick has no mechanical connection with the front steering mechanism. This joystick can clearly feed the road sense back to the driver. The full steering stroke is about 100 degrees from the left to the right. The entire system development meets the relevant functional safety requirements and standards.

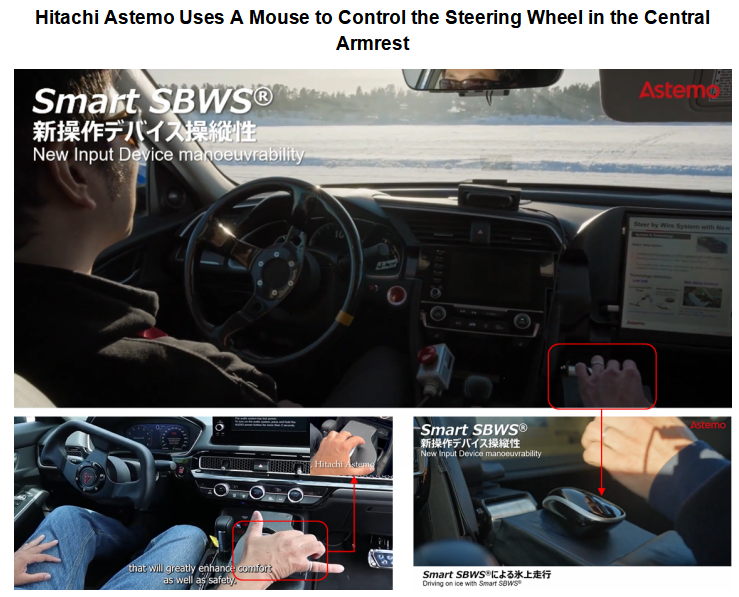

In May 2024, Hitachi Astemo's Smart SBWS used multiple control solutions to replace the traditional steering wheel, for example, using a mouse to control the steering wheel in the central armrest box, or using a new device on the left side of the front passenger to control the steering wheel. The system is expected to be mass-produced in 203X.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...