China Heavy Truck Industry Report, 2014-2017

-

July 2014

- Hard Copy

- USD

$2,300

-

- Pages:94

- Single User License

(PDF Unprintable)

- USD

$2,150

-

- Code:

LKX001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

In the heavy truck industry, the demand mainly comes from infrastructure construction and transportation, and sales volume is to a large extent influenced by macroeconomy and industrial policies. After the downturn in 2011-2012, China heavy truck industry resumed growth in 2013 thanks to logistics demand and national IV emission standards, with the sales volume increasing by 138,100 or 21.71% year on year to 774,100. From January to May of 2014, the cumulative sales volume of heavy trucks hit 365,200, up 11.48% year on year.

This report mainly involves complete heavy truck, incomplete heavy truck and semi-trailer towing vehicle, which enjoyed the market share of 28.41%, 37.56% and 34.02% respectively in 2013. In 2013, the fastest growing semi-trailer towing vehicle grew up by 38.15% and its market share increased by 4 percentage points. The development of semi-trailer towing vehicle depends on highway freight, cargo turnover, container port throughput and other factors. It is expected that semi-trailer towing vehicle will witness stable growth in the future and become the model holding the largest market share.

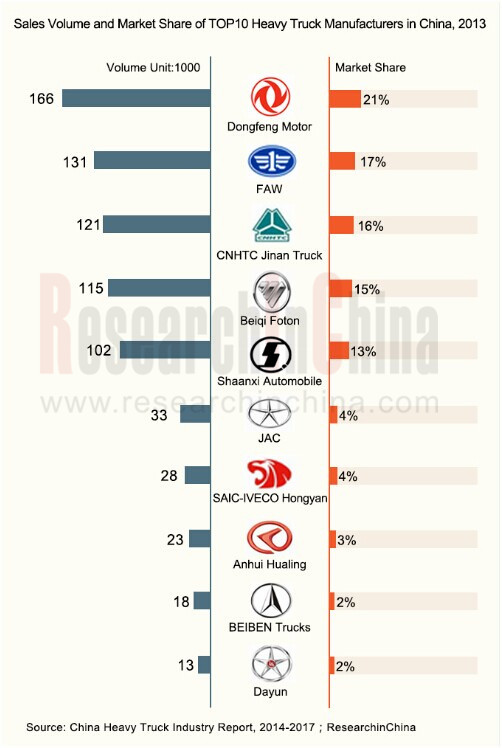

Chinese heavy truck market is featured with high concentration, steady competition pattern and apparent long-term competitive advantages of leading enterprises. From January to May of 2014, China's top 10 heavy truck companies seized 96.89% market shares jointly, up 0.1 percentage point from 2013. In the next few years, the concentration of the heavy truck industry will continue to rise.

As the largest Chinese heavy truck enterprise, Dongfeng Motor Corporation designates its subsidiary Dongfeng Commercial Vehicle to produce and operate heavy trucks, with the production bases in Shiyan (Hubei), Suizhou(Hubei), Liuzhou (Guangxi) and Xinjiang. In 2013, its market share reached 21.41%, nearly one percentage point higher than 2012.

China's second-largest light truck manufacturer JAC has made quick progress in the field of heavy trucks over recent years. In 2010, the company stepped into the heavy truck market through the cooperation with Navistar and Caterpillar, as well as launched Gallop series products. After several years of development, JAC’s heavy truck sales volume grew by 34.98% year on year during the period from January to May of 2014, far higher than the average growth rate of the industry; the market share hit 5.31%, up 1.07 percentage points from 2013. With the deepened cooperation with Navistar, JAC is expected to embrace further development in Chinese heavy truck market.

China Heavy Truck Industry Report, 2014-2017 by ResearchInChina mainly covers the following:

Overview of the heavy truck industry, including definition, classification, technology transfer and so on;

Overview of the heavy truck industry, including definition, classification, technology transfer and so on;

Research on Chinese heavy truck market, including ownership, output, sales volume, market competition pattern, etc.;

Research on Chinese heavy truck market, including ownership, output, sales volume, market competition pattern, etc.;

Analysis on Chinese heavy truck market segments, embracing complete heavy trucks, incomplete heavy trucks and semi-trailer towing vehicles;

Analysis on Chinese heavy truck market segments, embracing complete heavy trucks, incomplete heavy trucks and semi-trailer towing vehicles;

Research on the heavy truck industry chain, consisting of key parts market, raw material market and downstream market;

Research on the heavy truck industry chain, consisting of key parts market, raw material market and downstream market;

Analysis on major Chinese heavy truck enterprises, such as operation, output, sales volume, main customers, new products, etc..

Analysis on major Chinese heavy truck enterprises, such as operation, output, sales volume, main customers, new products, etc..

1. Overview of China Heavy Truck Industry

1.1 Definition and Classification

1.2 Technology Introduction

1.3 Emission Standards

1.4 Development Tendency of Products

2. Heavy Truck Market

2.1 Output and Sales Volume

2.1.1 Ownership

2.1.2 Output

2.1.3 Sales Volume

2.2 Competition Pattern

2.2.1 Market Share

2.2.2 Sales Goal

2.3 LNG Heavy Truck

3. Market Segments

3.1 Complete Heavy Truck

3.1.1 Output and Sales Volume

3.1.2 Market Share

3.1.3 Import and Export

3.2 Incomplete Heavy Truck

3.2.1 Output and Sales Volume

3.2.2 Market Share

3.3 Semi-trailer Towing Vehicle

3.3.1 Output and Sales Volume

3.3.2 Market Structure

3.3.3 Market Share

4. Heavy Truck Industry Chain

4.1 Overview

4.2 Key Components

4.2.1 Cost Structure

4.2.2 Supporting

4.3 Raw Materials Market

4.3.1 Iron and Steel Market

4.3.2 Rubber Market

4.4 Downstream Market

4.4.1 Infrastructure Construction

4.4.2 Real Estate Development and Construction

4.4.3 Highway Freight Market

5. Key Companies

5.1 Dongfeng Motor

5.1.1 Profile

5.1.2 Revenue and Gross Margin

5.1.3 Output and Sales Volume of Heavy Trucks

5.1.4 Forecast for Heavy Truck Sales Volume

5.2 CNHTC Jinan Truck Co., Ltd.

5.2.1 Profile

5.2.2 Revenue and Gross Margin

5.2.3 Output and Sales Volume of Heavy Trucks

5.2.4 Industrial Cooperation in Africa

5.3 FAW Group

5.3.1 Profile

5.3.2 Output and Sales Volume of Heavy Trucks

5.3.3 Third-generation Anjie Heavy Truck is Launched

5.4 Shaanxi Automobile Group Co., Ltd.

5.4.1 Profile

5.4.2 Output and Sales Volume of Heavy Trucks

5.5 Beiqi Foton Motor Co., Ltd.

5.5.1 Profile

5.5.2 Revenue and Gross Margin

5.5.3 Major Clients

5.5.4 Output and Sales Volume of Heavy Trucks

5.5.5 High-end Environment-friendly Heavy Trucks Are Launched

5.6 BEIBEN Trucks Group Co.,Ltd

5.6.1 Profile

5.6.2 Output and Sales Volume of Heavy Trucks

5.7 Jianghuai Automobile Co., Ltd.

5.7.1 Profile

5.7.2 Revenue and Gross Margin

5.7.3 Output and Sales Volume of Heavy Trucks

5.8 SAIC-IVECO Hongyan Commercial Vehicle Co., Ltd

5.8.1 Profile

5.8.2 Output and Sales Volume of Heavy Trucks

5.8.3 The First High-end Heavy Truck Model -- StralisHi-Way is Launched

5.9 Anhui Hualing Automobile Co., Ltd.

5.9.1 Profile

5.9.2 Output and Sales Volume of Heavy Trucks

5.10 Chengdu Dayun Automotive Group Company Limited

5.10.1 Profile

5.10.2 Output and Sales Volume of Heavy Trucks

5.11 Hubei Tri-Ring Special Vehicle Co., Ltd.

5.11.1 Profile

5.11.2 Output and Sales Volume of Heavy Trucks

5.12 GAC Hino Motors Co., Ltd.

5.12.1 Profile

5.12.2 Output and Sales Volume of Heavy Trucks

5.12.3 New 700 Series Products Complying with National Ⅳ Emission Standards Are Launched

5.13 Zhejiang Feidie Automobile Manufacturing Co., Ltd.

5.13.1 Profile

5.13.2 Output and Sales Volume of Heavy Trucks

5.14 Nanjing Xugong Automobile Manufacturing Co., Ltd.

5.14.1 Profile

5.14.2 Output and Sales Volume of Heavy Trucks

5.15 Qingling Motors (Group) Co., Ltd.

5.15.1 Profile

5.15.2 Output and Sales Volume of Heavy Trucks

6 Summary and Forecast

6.1 Market Size

6.2 Market Structure

Classification of Heavy Truck Industry

Technology Introduction of Key Heavy Truck Manufacturers in China

China Vehicle Emission Standards

China's Heavy Truck Ownership, 2002-2013

China's Heavy Truck Output, 2007-2013

Output and Market Share of Heavy Truck Breakdown Products, 2012-2013

Heavy Truck Output and Growth Rate by Model, Jan-May 2014

China's Heavy Truck Sales Volume, 2007-2013

Sales Volume and Market Share of Heavy Truck Breakdown Products, 2012-2013

Heavy Truck Sales Volume and Growth Rate by Model, Jan-May 2014

Sales Volume and Market Share of Major Heavy Truck Enterprises in China, 2013

Sales Volume and Market Share of Major Heavy Truck Enterprises in China, Jan-May 2014

China's Complete Heavy Truck Output and Sales Volume, 2007-2014

China's Complete Heavy Truck Sales Volume, Growth Rate and Market Share, 2013

China's Complete Heavy Truck Sales Volume, Growth Rate and Market Share, Jan-May 2014

China's Complete Heavy Truck Import and Export Volume, 2009-2014

China's Complete Heavy Truck Export Structure, 2009-2014

China's Heavy Truck (14t

China's Heavy Truck (Gross Weight> 20t) Export Volume and Growth Rate,, 2009-2014

Proportion of Complete Heavy Truck Export Volume in Total Sales Volume in China, 2009-2014

China's Incomplete Heavy Truck Output and Sales Volume, 2007-2014

China's Incomplete Heavy Truck Sales Volume, Growth Rate and Market Share, 2013

China's Incomplete Heavy Truck Market Share, Jan-May 2014

China's Semi-trailer Towing Vehicle Output and Sales Volume, 2007-2014

China's Semi-trailer Towing Vehicle Sales Volume by Tonnage, 2007-2013

Semi-trailer Towing Vehicle Sales Volume, Growth Rate and Market Share by Model, 2013-2014

Sales Volume and Market Share of Semi-trailer Towing Vehicle Enterprises in China, 2013

China's Semi-trailer Towing Vehicle Sales Volume, Growth Rate and Market Share by Model, 2013

China's Semi-trailer Towing Vehicle Sales Volume, Growth Rate and Market Share by Model, Jan-May 2014

Automobile Industry Chain

Cost Structure of Heavy Truck Industry

China's Galvanized Sheet (Strip) Output and Sales Volume, 2005-2014

China's Galvanized Coil Price, 2012-2014

China's Cold-rolled Thin Sheet Output and Sales Volume, 2005-2014

China's Cold-rolled Coil Price, 2012-2014

China's Natural Rubber Spot Price, 2012-2014

China's Investment in Fixed Assets, 2004-2014

Prosperity Index of China Real Estate Industry, 2010-2013

China's New Housing Construction Area, 2004-2014

China's Commercial Housing Sales Area, 2004-2014

China's Highway Freight Volume, 2004-2014

China's Highway Freight Turnover, 2004-2014

Number of Employees of Dongfeng Motor, 2009-2013

Dongfeng Motor's Revenue, Net Income and Gross Margin, 2009-2013

Dongfeng Motor's Revenue Breakdown by Region, 2009-2013

Dongfeng Motor's Heavy Truck Output and Sales Volume, 2007-2014

Dongfeng Motor's Heavy Truck Sales Volume, 2007-2014

Dongfeng Motor's Heavy Truck Output and Sales Volume, 2014-2017E

Number of Employees of CNHTC, 2009-2013

CNHTC's Revenue, Net Income and Gross Margin, 2008-2013

CNHTC's Main Heavy Truck Products

CNHTC's Heavy Truck Output and Sales Volume, 2007-2014

CNHTC's Heavy Truck Sales Volume, 2007-2014

CNHTC's Heavy Truck Output and Sales Volume, 2014-2017E

FAW's Heavy Truck Output and Sales Volume, 2007-2014

FAW's Heavy Truck Sales Volume, 2007-2014

FAW's Heavy Truck Output and Sales Volume, 2014-2017E

Heavy Truck Output and Sales Volume of Shaanxi Automobile Group, 2007-2014

Heavy Truck Sales Volume of Shaanxi Automobile Group, 2007-2014

Heavy Truck Output and Sales Volume of Shaanxi Automobile Group, 2014-2017E

Number of Employees in Beiqi Foton, 2009-2013

Beiqi Foton's Revenue, Net Income and Gross Margin, 2009-2013

Name List and Revenue Contribution of Top 5 Clients of Beiqi Foton, 2012-2013

Beiqi Foton's Heavy Truck Output and Sales Volume, 2007-2014

Beiqi Foton's Heavy Truck Sales Volume, 2007-2014

Beiqi Foton's Heavy Truck Output and Sales Volume, 2014-2017E

BEIBEN's Heavy Truck Output and Sales Volume, 2007-2014

BEIBEN's Heavy Truck Sales Volume, 2007-2014

Number of Employees of JAC, 2009-2013

JAC's Revenue, Net Income and Gross Margin, 2009-2013

JAC's Overseas Revenue and % in Total, 2009-2013

JAC's Heavy Truck Output and Sales Volume, 2007-2014

Heavy Truck Output and Sales Volume of SAIC-IVECO Hongyan, 2007-2014

Heavy Truck Sales Volume of SAIC-IVECO Hongyan, 2007-2014

Heavy Truck Output and Sales Volume of SAIC-IVECO, 2014-2017E

Hualing Automobile's Heavy Truck Output and Sales Volume, 2007-2014

Hualing Automobile's Heavy Truck Sales Volume, 2007-2014

Dayun Automotive's Heavy Truck Output and Sales Volume, 2009-2014

Dayun Automotive's Heavy Truck Sales Volume

Heavy Truck Output and Sales Volume of Tri-Ring Special Vehicle, 2007-2014

Heavy Truck Sales Volume of Tri-Ring Special Vehicle, 2007-2014

GAC Hino's Heavy Truck Output and Sales Volume, 2009-2014

GAC Hino's Heavy Truck Sales Volume, 2009-2014

Zhejiang Feidie's Heavy Truck Output and Sales Volume, 2009-2014

Xugong Automobile's Heavy Truck Output and Sales Volume, 2009-2014

Xugong Automobile's Heavy Truck Sales Volume, 2009-2014

Heavy Truck Output and Sales Volume of Qingling Motors, 2012-2014

Heavy Truck Sales Volume of Qingling Motors, 2012-2014

Cumulative YoY Growth Rate of China's Heavy Truck Monthly Sales Volume, 2014

Forecast for China's Heavy Truck Sales Volume, 2014-2017E

China's Heavy Truck Market Structure, 2017E

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...