HD Map Industry Report: the Curtain on Industrial Integration is Lifted, and Four Survival Models May be Staged.

In current stage, the challenge of HD map lies in follow-up maintenance and updates rather than initial mapping. Industry insiders still disagree over the frequency of HD map update, but it is clear that HD map does not need real-time update of all data, and elements of different attributes vary in update frequency, among which dynamic map layer needs the most frequent updates on traffic conditions including vehicles, non-motor vehicles and pedestrians.

Yet there may be constraints placed by related confidentiality regulations on the update process of HD map, a kind of electronic navigation map, for example, mapping needs qualification, what and how the map presents must be subject to policies and regulations, and requirements on data confidentiality and release should be met.

To solve the compliance issue raised during producing and updating HD map, the Ministry of Industry and Information Technology of China leads the Internet of Vehicles (Intelligent Connected Vehicles) Basic Data Service and Basic Map Service Platform Construction Project, introducing a new role, Tier1.5 (HD dynamic map basic platform) that bridges the gap between OEM, Tier1 (map provider) and government. Tier1.5 with four core capabilities of dynamic data aggregation, data push, service supervision support, and data compliance processing is an effective solution to the compliance issue in the process of crowdsourcing-based update.

In addition, the improving policies and regulations also provide practical solutions for HD map update. For example, the National Regulations on the Administration and Scope of Confidential Surveying and Mapping Geographic Information released in June 2020 defines the levels of confidentiality required for measured data of electronic navigation map, 3D model and point cloud data.

BAT (Baidu, Alibaba and Tencent), Service Providers and Automakers are Vying for HD Map Market, Which is to Raise the Curtain on Indusial Integration.

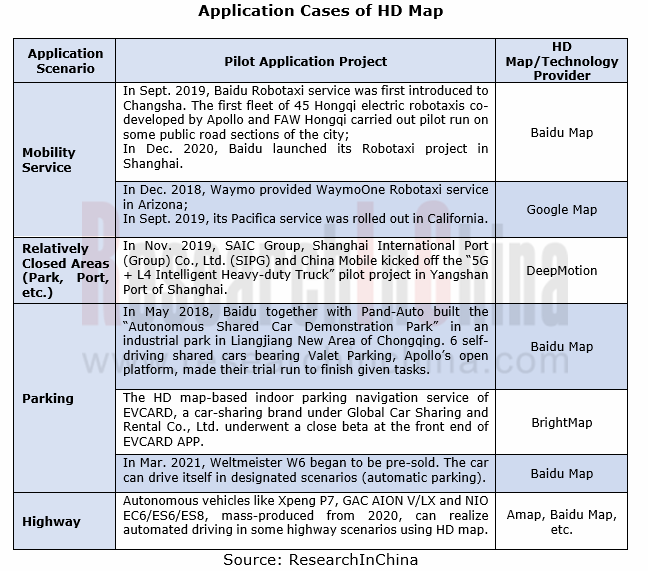

In recent years, L3/L4 automated driving has been in pilot operation in various scenarios like Robotaxi, port logistics and automated parking. Also, L3 autonomous passenger cars went into series production in China in 2020. Our findings show that in 2020, virtually 25,000 sets of HD maps from typical providers like Amap, Baidu, NavInfo and eMapgo were installed in mass-produced passenger cars in China. In future, HD map will be a standard configuration of L3 autonomous vehicles and become optional for some L2+ autonomous vehicles. It is predicted that over 500,000 sets of HD maps will be mounted on passenger cars mass-produced in China in 2025. HD map industry is booming.

The charge mode of HD map involves development, license and update service fees, delivering far higher value per vehicle than conventional navigation maps. Such is the optimism about HD map that players including BAT, Huawei, Didi, JD.com and Meituan in addition to traditional map providers flood into the market.

Baidu: list both autonomous driving and HD map in its strategy, providing HD map solutions for mass-production projects of OEMs as they require;

Alibaba: acquired 100% shares of AutoNavi (now known as Amap), bought in eMapgo (which was wholly acquired by Luokung Technology Corp. in 2021), and lavish on HD map;

Tencent: built its own HD map team (the wholly-owned subsidiary Tencent Tongtu Data acquired the class-A qualification for electronic navigation map early in 2007); bought a stake in NavInfo (trimmed its holdings in 2020);

Huawei: the subsidiary Beijing Huawei Digital Technologies Co., Ltd. was qualified for surveying and mapping in 2019; has forged partnerships with NavInfo and Leador Spatial Information Technology since 2020, hoping to make it easier to collect, produce and update HD map data.

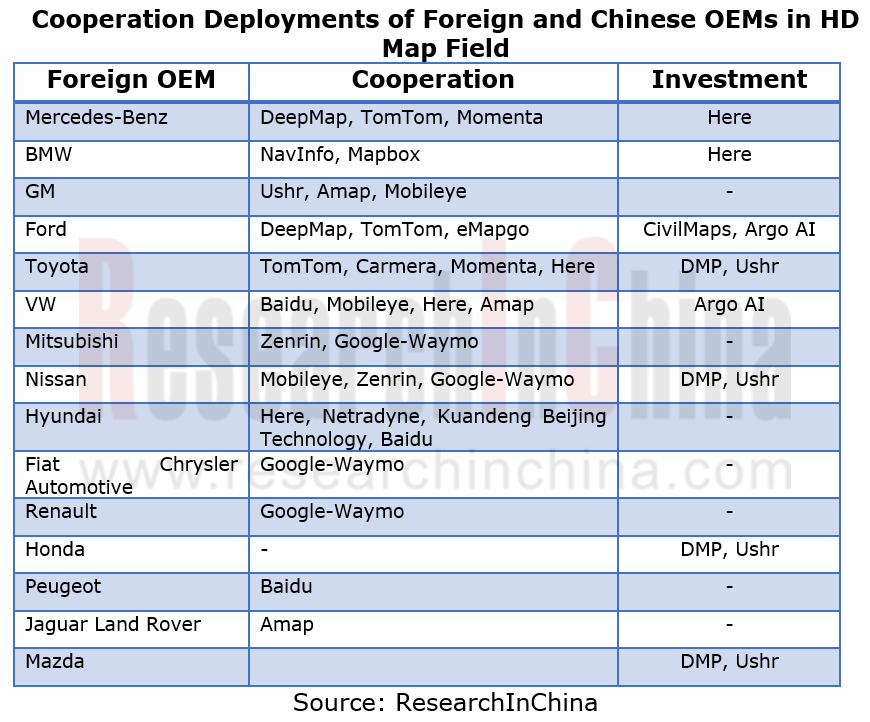

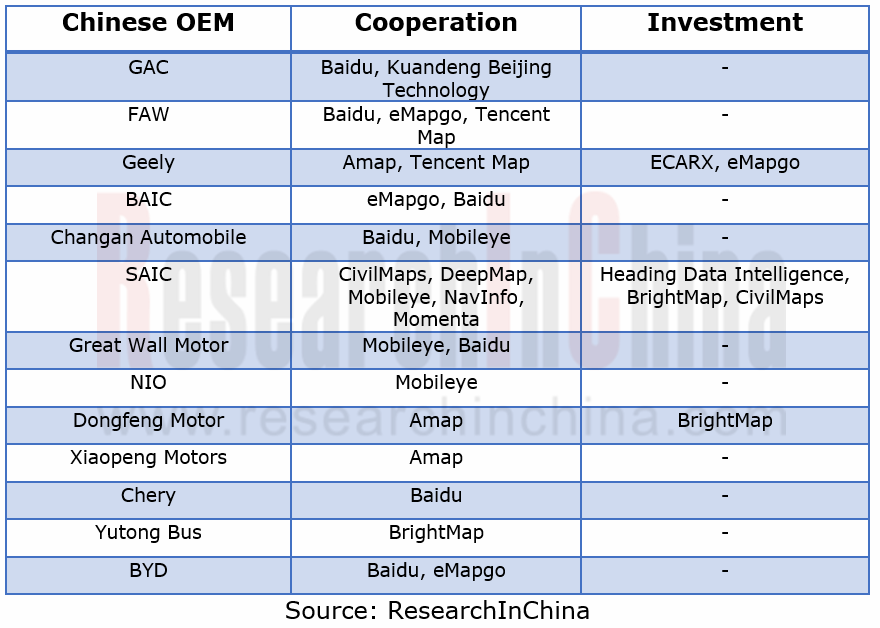

Moreover, OEMs have made a gradual foray into the HD map field. Foreign OEMs have made early deployments by way of acquisition and investment. In recent two years, Chinese OEMs like SAIC and Geely took up the activity as well.

SAIC: the wholly-owned subsidiary Heading Data Intelligence Co., Ltd. was qualified for surveying and mapping in 2018; BrightMap co-funded by SAIC, Dongfeng Motor and Jiangling Motors acquired the qualification in 2019; SAIC also invested in foreign HD map start-ups such as Civil Maps and DeepMap, and cooperated with Mobileye on REM map.

Geely: in 2019, Geely Technology Group invested in Luokung Technology Corp. and helped the big data tech firm buy 51% equities of eMapgo. In March 2021, Luokung Technology bought eMapgo out. In October 2020, Geely’s arm, ECARX Co., Ltd., obtained the qualification for surveying and mapping. Geely deployments in HD map are a preparation for CoPilot solution to be released by Lynk & Co. for planned high automation on structural roads in 2021 and on public roads before 2023.

In a fiercely contested market, most HD map start-ups gain competitive edges by developing differentiated products. Examples include Wayz.ai, Kuandeng Beijing Technology and Momenta which use AI-based visual solutions to slash the cost of collection and update.

As for HD map update, Mobileye leads the world with its REM technology.

The General Manager of Mobileye Greater China, Tong Lifeng says that by 2025, the global MaaS market will be worth more than USD160 billion, including the over USD70 billion potential data-related segment. And without a doubt, HD map data is one of the biggest data gold mines. Yet in China regulations will pose a barrier to the adoption of Mobileye REM technology.

OEMs place a high premium on the map data collected in real time. OEMs in possession of enormous amounts of HD map data, become data and technology companies, not traditional enterprises any more.

We argue that the curtain on industrial integration is to be lifted and four survival models may be staged:

(1) The first is conventional map providers, like Baidu, Amap and NavInfo. Baidu and NavInfo are trying to create complete autonomous driving solutions including HD map. Although typical map providers and OEMs have struck cooperation agreements of series production, it is hard for their HD maps to find broad application due to high cost.

(2) The second is map providers with close partnerships with OEMs, such as Heading Data Intelligence, BrightMap and eMapgo. The in-depth cooperation with OEMs helps these map providers remove some difficulties of improving the efficiency of automated driving projects. Their big gap with top three conventional HD map providers in strength calls forth their close ties with OEMs.

(3) The third is vendors with full stack solutions for autonomous driving, such as Momenta, Huawei and Mobileye. Momenta has enabled fully data-driven environmental perception, HD map, prediction and other links, and also has achieved continuous iteration and upgrade by closed loop automation. In March 2021, Momenta raised USD500 million in a Series C funding round led by SAIC, Toyota and Bosch. Momenta’s HD map mode, very similar to REM mode and with class-A qualification for surveying and mapping, is favored by capital.

(4) The fourth is players which depend on some specific ecosystem, such as Didi, JD.com, Meituan and SF Express. They work hard on their own segments, and produce HD maps applicable to their own operations (e.g., autonomous delivery). Differing from OEMs, they need such road elements as bikeways, sidewalks, blind sidewalks and isolation piles.

Application of HD Map in the Favorable Wind Blowing from New Infrastructure

As well as perceptual redundancy for autonomous vehicles, the boom of new infrastructure, vehicle-infrastructure cooperation (CVIS) and smart highway gives HD map greater scope for growth.

In the case of application in vehicle-infrastructure cooperation in highway scenarios, HD map enables highways to be capable of warning. HD map, geo-fence technology and multi-sensor fusion constitute the solution.

Furthermore, the collaboration between HD map providers and highway operators allows for the backhaul of a mass of data from roadside infrastructure to enable rapid update of HD map.

The combination of HD map and CVIS not only favors real-time update of HD map data through V2X roadside equipment but helps to distribute data from the cloud to vehicles for lane-level warning and decision for autonomous driving and driving assistance.

Also, the HD and CVIS integration serves as a foundation for future layout of intelligent transportation. Nationwide HD map data as well as abundant data elements, lane-level positioning and quickly updated features provide basic data support for traffic control and real-time monitoring.

Map providers backed by ICT companies, such as Amap, Baidu, Huawei and NavInfo stand more chances of partaking in new infrastructure. An example is NavInfo’s V2X-DMP (Dynamic Map Platform) that applies HD map and CVIS.

Global and China HD Map Industry Report, 2021 highlights the following:

1. HD map (basic technologies, industrial policies, regulations and standards);

2. HD map market (size, competitive landscape, and business and charge models);

3. HD map industry (main technical challenges and development trends, e.g., crowdsourcing update scheme and compliance, data fusion/correction, and HD map and V2X integrated application);

4. OEMs’ demand for HD map, cooperative models and outlook of OEMs and HD map providers;

5. Main Chinese and foreign HD map providers, start-ups and technology providers.

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...

Global and China Skateboard Chassis Industry Report, 2021-2022

Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the aut...

Emerging Automakers Strategy Research Report, 2022--NIO

Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade...

Automotive and 5G Industry Integration Development Report, 2022

Research on integration of vehicle and 5G: OEMs rush into mass production of 5G models whose sales may reach 3.68 million units in 2025

By the end of 2021, China had built and opened in excess of 1.3...

China Automotive Finance Industry Report, 2022-2030

Auto finance is lucrative with the highest profit margin in the international automobile industry chain, contributing to roughly 23% of the global automobile industry profits. Yet, auto finance only h...

Global and China Power Battery Management System (BMS) Industry Report, 2022-2026

1. Robust demand from new energy vehicle spurs BMS market to boom

New energy vehicle sales have been growing rapidly worldwide over the recent years, reaching 6.5 million units with a year-on-year up...