The surging global freight shipping rates will rev up the deployment of automated driving in ports.

The global freight shipping rates have enjoyed a marked increase since June 2020, for example, from USD1,358 per FEU on March 5, 2021 to USD4,115 per FEU on March 6, 2021. The frequent shipping crises in 2021 have forced many exporters to sign freight contracts for the next 12 months at high prices.

A combination of factors including soaring demand for goods boosted by global fiscal and monetary stimulus, saturated ports, and shortage of ship and dock workers and truck drivers trigger the increase in shipping costs. Port operators are keen on higher operation efficiency and solutions to labor shortage.

Globally, foreign countries made an early start on straddle carrier and AGV, having won a place in the market. Yet it is hard for them to accelerate port container turnover and lower operating cost in a short time, due to rising international shipping costs, too long time taken to deploy AGVs, and larger space needed for autonomous straddle carriers. While, autonomous container trucks cost less than other solutions, its rapid deployment only requires introduction of intelligent roadside facilities to existing smart terminals. It is predicted that large container ports worldwide will work to deploy autonomous container trucks from 2021 onwards.

As a key importer and exporter in the world, China is trying hard to promote autonomous driving that enables port logistics and enhance the construction of new-generation automated terminals and the mass adoption of autonomous container trucks. By 2025, some coastal container hub ports should preliminarily build intelligent systems that enable comprehensive perception, internet of everything, and port-truck cooperation; by 2035, container hub ports should complete the construction of intelligent systems, according to the Guideline to Accelerate the Building of World-class Ports issued by the Ministry of Transport of China. Faster progress in construction of “new infrastructure” in ports comes with the boom of 5G, CVIS and autonomous driving technologies.

Autonomous logistics covers the whole process from port shipping hubs to trunk highways.

Port automated driving is a typical closed scenario of low speed operation and a representative scenario that is the first one to allow for commercial use of autonomous driving. In current stage, China boasts the ownership of more than 25,000 container trailers, but most port terminals still depend on manned container trucks, with the penetration of autonomous ones lower than 2%.

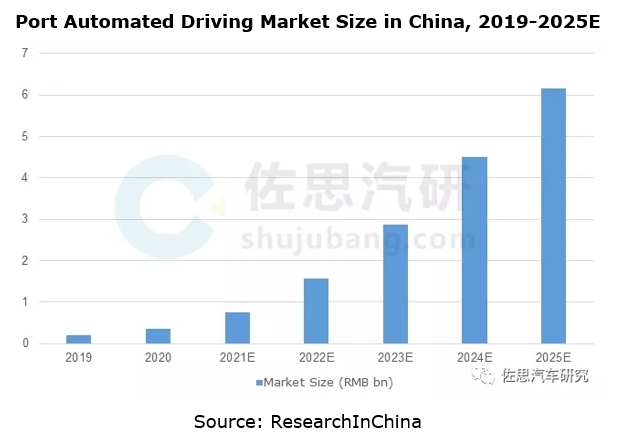

It is expected that in 2025, 6,000 to 7,000 L4 autonomous container trucks will come into service in Chinese ports, with their penetration over 20%; China’s port automated driving market will be worth more than RMB6 billion in 2025, holding roughly 30% of the global market.

Despite not a big market, port automated driving creates a demonstration effect and many derivatives, such as autonomous logistics scenario covering the whole process from shipping to port and then to trunk highway and logistics hub.

At first, port autonomous container trucks take priority to acquire the rights of transporting containers from ships to container yards to distributing centers. On one estimate, China’s trunk logistics market valued at RMB5 trillion or so (approximately USD700 billion) attracts autonomous driving investors. In 2020, half the autonomous driving funding cases in China targeted start-ups making deployments in commercial vehicles. Among the 19 investees, 8 that deploy trunk logistics scenarios averagely raised more funds than those focusing on other segments.

On April 15, 2021, TuSimple listed its shares on Nasdaq, with the first-day closing price at USD40 a share sending its market capitalization to USD8.48 billion. TuSimple concentrates on L4 automated driving for such logistics scenarios as highways, ports and sites. In March 2021, TuSimple became qualified for intelligent connected vehicle demonstration application in Shanghai, which allows it to carry out load tests on designated test roads in the downtown, Lingang Logistics Park, East Sea Bridge and Yangshan Port within the Lin-gang Special Area of China (Shanghai) Pilot Free Trade Zone.

Port logistics has been a critical application scenario of autonomous vehicles. That is mainly because:

First, port automated driving can be deployed in the shortest time, pays off and offers a clear business model. It is expected the commercial use of port automated driving will be widespread in the next two or three years. Actual operation of automated driving that needs heavy investment and has a long payback period, allows for testing technologies in ports and also brings benefits, making the commercial operation a reality in a short term.

Second, it takes just one or two years to extend the commercial use of automated driving from ports to trunk logistics, because the two scenarios share hardware devices of commercial vehicles like chassis and use the common engineering approaches, and the large-scale commercial operations in ports will accumulate and iterate capabilities of algorithm, engineering, operation and commercialization rapidly, preparing for future extension to external container trucks and trunk logistics.

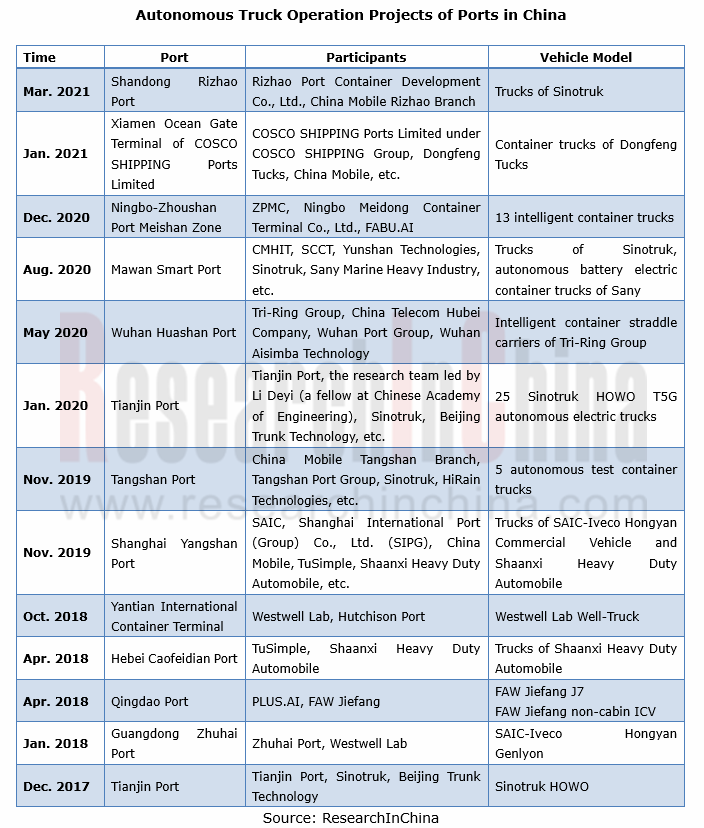

China already has 13 ports introducing autonomous container trucks.

Since 2018, China has speeded up construction of autonomous ports. Quite a few autonomous driving solution providers have phased in application to autonomous trucks for commercial trial use. At present, there are 13 ports applying autonomous container trucks, including Shanghai Yangshan Port, Tianjin Port, Mawan Port, Ningbo Zhoushan Port, Zhuhai Port and Xiamen Port, which forms a “north-central-south” coastal deployment pattern.

China: port automated driving is often found in the southeast coastal ports, especially in new or expanded coastal port projects like Shenzhen Mawan Smart Port, Shanghai Yangshan Port, Ningbo Zhoushan Port and Tianjin Port, while hardly seen in inland ports and river terminals due to more bulk cargos and less containers there.

Overseas: Chinese companies are making an aggressive expansion in overseas markets. In 2020, Shanghai Zhenhua Heavy Industries (ZPMC) and Westwell Lab began to operate Westwell Lab Q-Truck at Khalifa Port Container Terminal Phase II in Abu Dhabi, UAE; in April 2020, Westwell Lab’s 6 Q-Truck trucks went into operation in Laem Chabang, Thailand and completed 12-hour continuous loading and unloading operation.

In the scenario of horizontal transportation at port container terminals, autonomous driving solutions that enable single vehicles are not enough to meet the current actual needs of smart terminals. Fleet-level scheduling systems are thus needed to bridge the gap between the original production operation system and single vehicles to let the two systems work together smoothly for higher overall efficiency.

Development Trends of Port Automated Driving

5G-based network communication (5G Port Private Network+MEC+V2X): “port automated driving” requires low latency, large bandwidth, high reliability communication connections; communication systems for large special operation equipment for automated terminals need to afford efficient and reliable transmission of control, multi-channel video and other information. 5G V2X is a new engine for the construction of “smart ports”.

In September 2020, Beijing Trunk Technology Co., Ltd.’s autonomous container trucks packed 5G V2X technology, a solution to ultra-long truck queues in port logistics hubs. 5G V2X enables autonomous container trucks to perceive more widely for better interconnection with other production equipment and systems in port areas. Moreover, based on low-latency, high-bandwidth 5G networks, the cloud computing and remote monitoring services enable real-time system optimization, intelligent scheduling control and remote driving.

Electrified/hydrogen fuel-powered: transport vehicles in autonomous ports feature electric drive, quicker response, direct power supply to the autonomous driving system, and higher efficiency than fuel-powered vehicles. Electric vehicles for autonomous ports hold the trend. Among current autonomous container trucks operated in ports, 8 models, or 61.5% of the total are electric drive.

SAIC-Iveco Hongyan Commercial Vehicle Co., Ltd. has introduced intelligent hydrogen fuel cell heavy trucks, giving full support to construction of green ports and green transportation systems. In April 2020, Shenzhen Center Power Tech. Co., Ltd. made a strategic investment in Westwell Lab, aiming at co-developing port hydrogen-powered autonomous vehicles and building a port AI + hydrogen energy ecosystem in an age of 5G+AIoT.

Top-level design: through the lens of digitalization in the whole industry, port scenario lags behind others in such as digital concept and new technology application. Greater effort should be made on new digital technology development and top-level design, and data flow + business flow development plan on the basis of other technologies. Top-level design brings a shake-up to existing port information and intelligent construction resources.

In January, 2021, Beijing Trunk Technology Co., Ltd. and Huawei signed a cooperative agreement in Tianjin Port. With its 5G technology, Huawei provides “Car Cloud”-“Roadside”-“Car End” port intelligent driving solutions. In August 2020, Alibaba Cloud won the bidding of Shandong Port Group (China’s first smart port owning 4 port companies: Qingdao Port, Rizhao Port, Yantai Port and Bohai Bay Port) for top-level design schemes.

Platooning/CVIS: in the closed port environment with multiple scenarios, autonomous container trucks need to communicate with other container trucks, other types of vehicles, port equipment and containers. Fleet operation and CVIS is a trend for port automated driving.

In November 2020, the platooning of 13 autonomous container trucks independently developed and delivered by Beijing Trunk Technology Co., Ltd. was carried out in Ningbo Zhoushan Port. This is another delivered mass-production project of the company following the commercial order for 25 autonomous container trucks from Tianjin Port.

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (I)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...

China Commercial Vehicle Intelligent Cockpit Industry Report 2021

Research on Intelligent Cockpits of Commercial Vehicles: Heading for Large Screens, Voice Interaction, Entertainment and Life

Following AD/ADAS functions, the intelligent configuration of the cockpit...

Automotive Ultra Wide Band (UWB) Industry Report, 2022

UWB got initially utilized in the military field, and began to be commercially applied after the release of criteria for UWB commercialization in 2002. In 2019, Car Connectivity Consortium (CCC) liste...

China Automotive Distribution and Aftermarket Industry Report, 2022-2027

Since the introduction of 4S store model into China at the end of 20th century, China's authorized dealer system has gradually developed from a single-store-based mode to a group-based mode, and from ...