Roadside Perception Research: Giants Race to Deploy Radar Video All-in-one and Holographic Perception

Multi-sensor fusion holds a dominant trend for roadside perception

Current roadside perception solutions are led by HD cameras and radars. In addition, the adoption of radar video all-in-one and LiDAR is becoming widespread. Multi-sensor fusion holds a dominant trend for roadside perception.

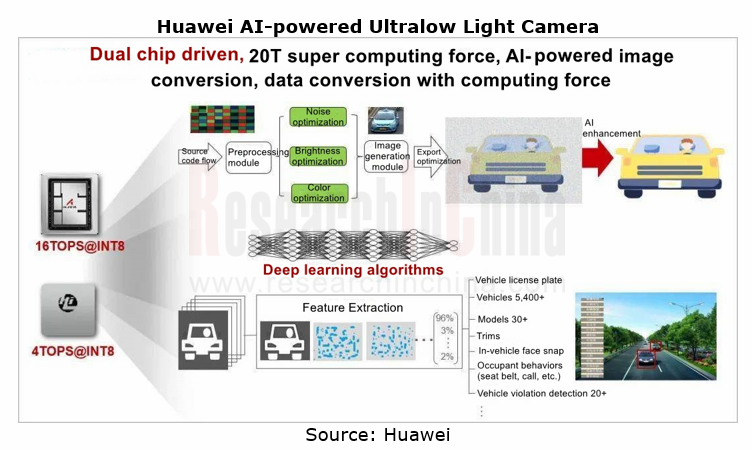

(1) AI-driven visual camera

Roadside cameras with visual AI analysis function enable more intuitive display of current traffic status and details. At present, vendors like Huawei, Dahua Technology and Hikvision have rolled out their AI-driven roadside cameras.

Based on the open architecture SDC OS, Huawei AI ultralow light camera allows for load of third-party algorithms through Huawei HoloSens Store, making “software-defined” cameras a reality. To make more types of targets detected by cameras, Huawei adds algorithms. For example, the perception and detection of non-motor vehicles only needs to load front-end equipment or ITS800 edge computing nodes with powerful non-motor vehicle video detection algorithms.

(2) Radar

Vendors are trying hard to improve the performance of roadside radars. Based on wide area radar front end and advanced data processing technologies, Hurys introduced a new-generation wide-area radar microwave intelligent perception system that offers more abundant, more diverse data; WAYV series ultra-long-range radars Muniu Technology launched in 2020 afford the longest detection range of 1,000 meters.

Moreover, 4D imaging radars are making their way into the roadside perception market. They provide all-round, three-dimensional, multi-dimensional monitoring and tracking of large intersections and highway scenarios, especially the holographic perception of CVIS at large complex intersections and in mixed traffic in cities. Vendors like Continental, Huawei and Oculii, which deploy roadside perception, have launched their 4D LiDARs.

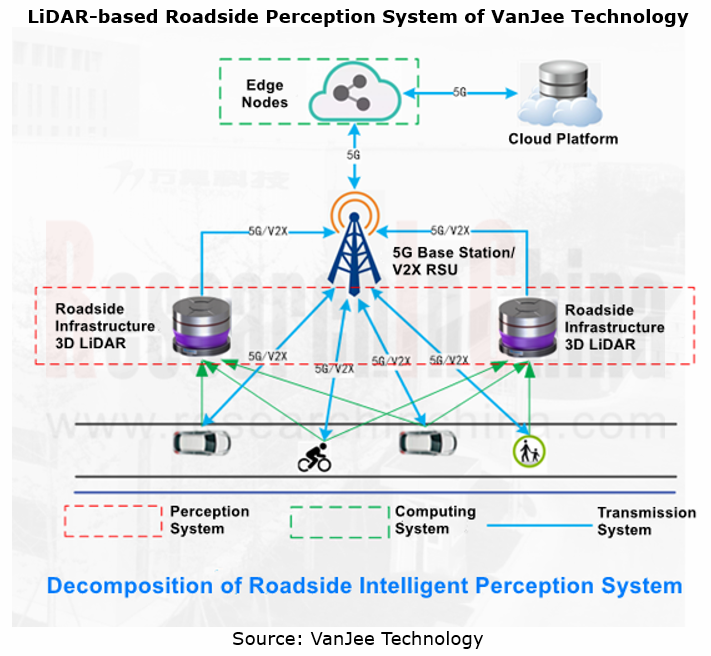

(3) LiDAR

LiDAR that can acquire high-precision three-dimensional information about targets enables e-fence control and some special capabilities (target filtering, customized communication, etc.) in designated areas.

Traditional roadside perception solution providers such as VanJee Technology, Changsha Intelligent Driving Institute Ltd. (CiDi) and China TransInfo Technology already unveil their roadside LiDAR products.

In March 2021, VanJee Technology managed to deploy its smart base stations that integrate with V2X roadside antenna and LiDAR in Xiongan Civic Center V2X Demonstration Project and High-speed Railway Hub Road Intelligence Project.

Also, automotive LiDAR vendors like RoboSense and Ouster have started a foray into the roadside perception field. In 2020, Ouster and LiangDao Intelligence together created a LiDAR-based roadside solution.

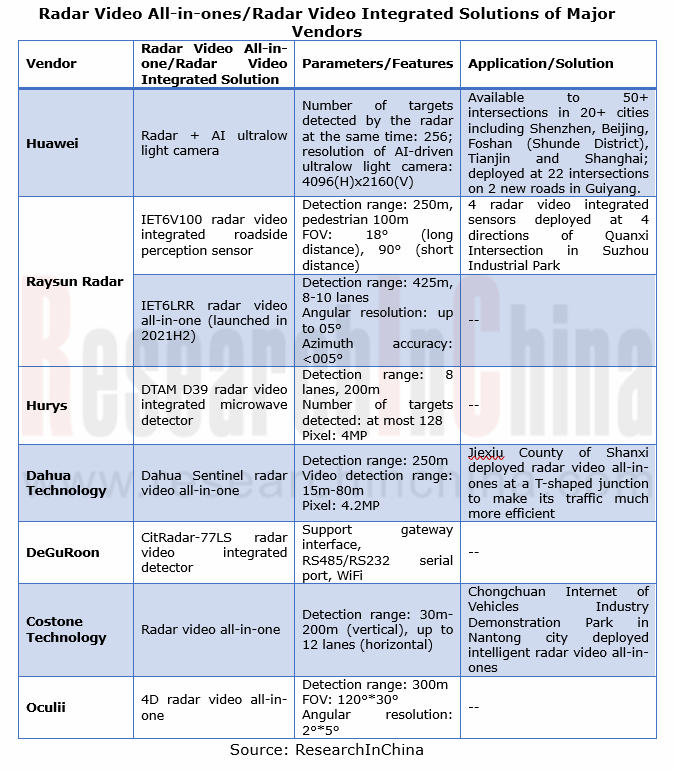

(4) Radar video all-in-one

Radar video all-in-ones that feature integrated design and unified installation and share power supplies, can save a lot of costs of materials and installation. The fronted deployment of perception fusion algorithms at the terminal end leads to a marked reduction in perception latency and computing load at the edge end; and the combination of merits of video and radar offers higher target detection accuracy.

Currently, roadside vision-based HD camera vendors like Dahua Technology and Hikvision and roadside radar vendors such as Raysun Radar, Hurys and DeGuRoon have introduced their radar video all-in-ones. Among them, in 2019 Oculii released 4D radar video all-in-one that uses Falcon, its first-generation point cloud imaging radar; in the second half of 2021, Raysun Radar unveiled IET6LRR, its new-generation radar video all-in-one that provides the maximum detection range of 425 meters.

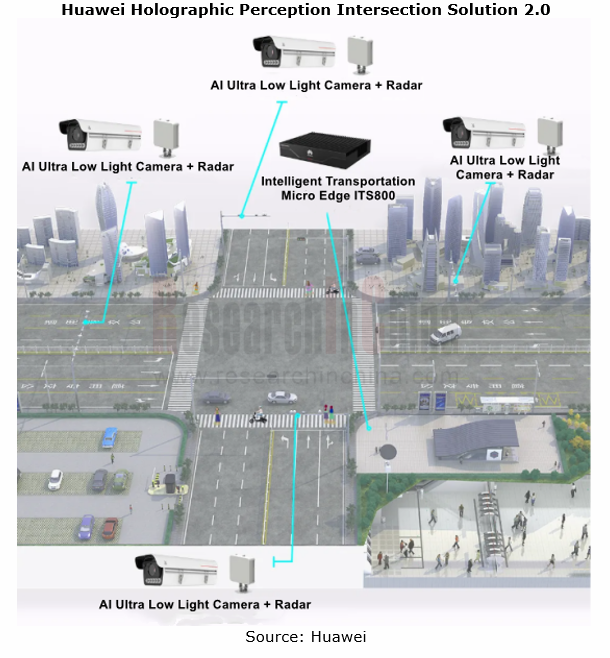

Huawei and Baidu have stepped into the field and launched “holographic perception intersection” solutions

Holographic perception is a foundation for the development of smart roads. It needs roadside perception equipment to provide comprehensive, high-quality, stable traffic data. Since 2000 Huawei, Baidu, OriginalTek and the Institute of Deep Perception Technology (IDPT), among others have rolled out their holographic perception solutions,

Huawei: in 2020 Huawei released the solution Holographic Perception Intersection 1.0; in March 2021, Huawei unveiled Holographic Perception Intersection 2.0, a combination of AI ultra-low light camera, radar, ITS800 edge computing node and intersection HD map, which is applicable to crossroads, T/X/Y-shaped intersections and super large intersections. Based on its holographic perception solutions, Huawei will create holographic road section solutions that enable convergence and access, analysis and communication capabilities at intersections and roadsides via edge computing units, and connect traffic signals and vehicle communication units to lay the foundation for CVIS services such as accurate public transit and driving assistance.

Baidu: Baidu ACE Intelligent Intersection Solution launched in March 2021 enables perception of all elements including road vehicles, roads, pedestrians, environments and traffic incidents, with perception and computing devices (camera, fisheye camera, LiDAR, edge computing unit, etc.) deployed at the roadside. The solution integrating with Baidu Map data delivers a data detection accuracy of over 97%. ACE Smart Intersection is an application of Baidu ACE Smart Traffic Engine (a full-stack intelligent transportation solution that integrates vehicle, infrastructure and pedestrian) in the intersection scenario.

In Baidu ACE Intelligent Intersection Solution, devices like camera, LiDAR, communication equipment and edge computing unit are customized by Baidu with its ecological partners.

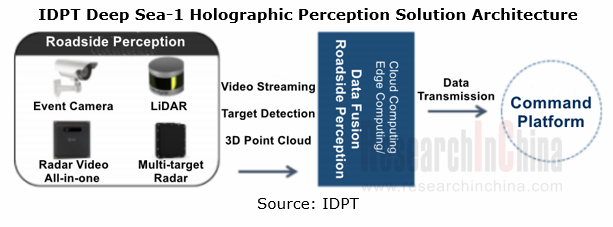

IDPT: the deep fusion of raw data from cameras, LiDARs, radars, and radar video all-in-ones enables 360° image-level holographic perception around the clock in all weather conditions, offering the longest detection range of up to 500m and more reliable data for urban intersections.

In addition, Hikailink Technology achieves holographic intersection perception with radar, camera, and image-level solid-state LiDAR; OriginalTek deployed BotEye? holographic perception devices in the test park where the 2020 C-V2X Cross-industry & Large-scale Pilot Plugfest was held.

The roadside perception market will be worth RMB20 billion in 2025

Intelligent roadside perception will firstly cover highways and urban intersections. The official statistics show that China has 149,600km highways in all, with the overall density of road networks averaging 6.1km/km2 and the total urban construction areas reaching 21,000 km2 in 36 major cities.

On our estimate, China's intelligent roadside perception equipment market (including RSU, camera, radar, LiDAR, and radar video all-in-one) will be valued at RMB20 billion or so in 2025. Camera and radar will be still mainstream devices for roadside perception, while radar video all-in-one and LiDAR will gather pace.

Smart Road-Roadside Perception Industry Report, 2021 highlights the following:

Smart road industry (favorable policies, industry standards, industrial planning);

Smart road industry (favorable policies, industry standards, industrial planning);

Intelligent roadside perception market (size, pattern);

Intelligent roadside perception market (size, pattern);

Status quo and trends of key technologies (HD camera, radar, radar video all-in-one, LiDAR, multi-sensor fusion, etc.);

Status quo and trends of key technologies (HD camera, radar, radar video all-in-one, LiDAR, multi-sensor fusion, etc.);

Deployment cases of roadside perception devices on highways and at urban intersections;

Deployment cases of roadside perception devices on highways and at urban intersections;

Major roadside perception system integrators and equipment suppliers.

Major roadside perception system integrators and equipment suppliers.

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...

Global and China Passenger Car T-Box Market Report, 2022

Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and ana...

Global and China Purpose Built Vehicle (PBV) and Robocar Report, 2022

PBV and Robocar research: new idea of building brick cars, a new car type for future mobility Building brick cars moves the cheese of traditional OEMs.

Purpose built vehicle (PBV) refers to special ...

China Automotive Voice Industry Report, 2021-2022

Automotive voice market: The boom of self-research by OEMs will promote reform in the supply mode

Before the advent of fully automated driving, the user focus on driving, and voice interaction is sti...

Global and China Automotive Emergency Call (eCall) System Market Report, 2022

Automotive eCall system: wait for the release of policies empowering intelligent connected vehicle safetyAt the Two Sessions held in March 2022, more than 10 deputies to the National People's Congress...

Global and China Leading Tier1 Suppliers’ Intelligent Cockpit Business Research Report, 2022 (II)

Tier1 Intelligent Cockpit Research: The mass production of innovative cockpits gathers pace, and penetration of new technologies is on a rapid riseGlobal OEMs and Tier 1 suppliers are racing for the i...