Automotive Vision Research: With the division of labor, Mobileye's share in China is expected to exceed 55%

With the development of smart cars, the industry has gradually reached a consensus on "software-defined cars" whose core lies in the separation of software and hardware as well as embedded hardware. From January to May of 2021, many new cars released in China, such as NIO ET7, SAIC R ES33, IM L7, Xpeng P5, ARCFOX αS Huawei HI, ZEEKR 001 and so on, were embedded with a large number of sensor hardware, especially cameras, to achieve ADAS functions above L2/L2+.

In the future, as new cars equipped with high-speed autonomous driving, urban autonomous driving, and memory parking increase in volume, the demand for perception around and inside cars will further rise. It is estimated that more than 11 cameras are generally required for L2+ and above, and over 15 vision-based cameras for L4\L5.

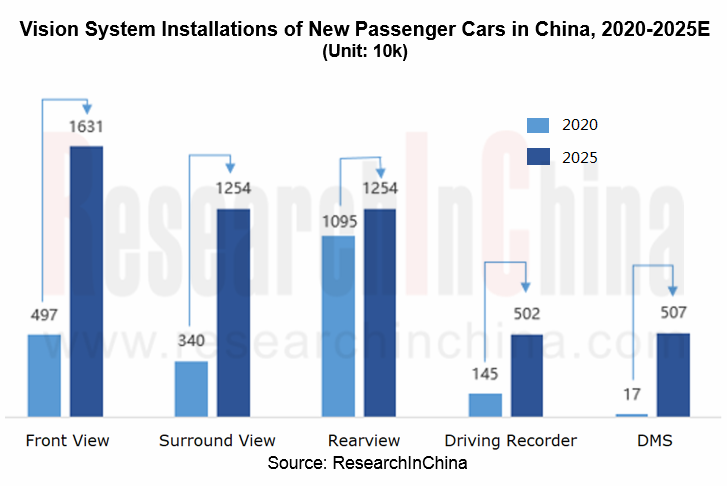

It is estimated that more than 16 million passenger cars in China will be installed with front view system in 2025

Front View: In 2020, 4.968 million new passenger cars in China were equipped with front view, up 62.1% year-on-year; the installation rate was 26.4%, a year-on-year increase of 10.9 percentage points. With the improvement in the computing power and increase of functions of front view system and the relative cost advantage, it is estimated that more than 16 million passenger cars in China will be installed with front view system in 2025 with the installation rate of 65%.

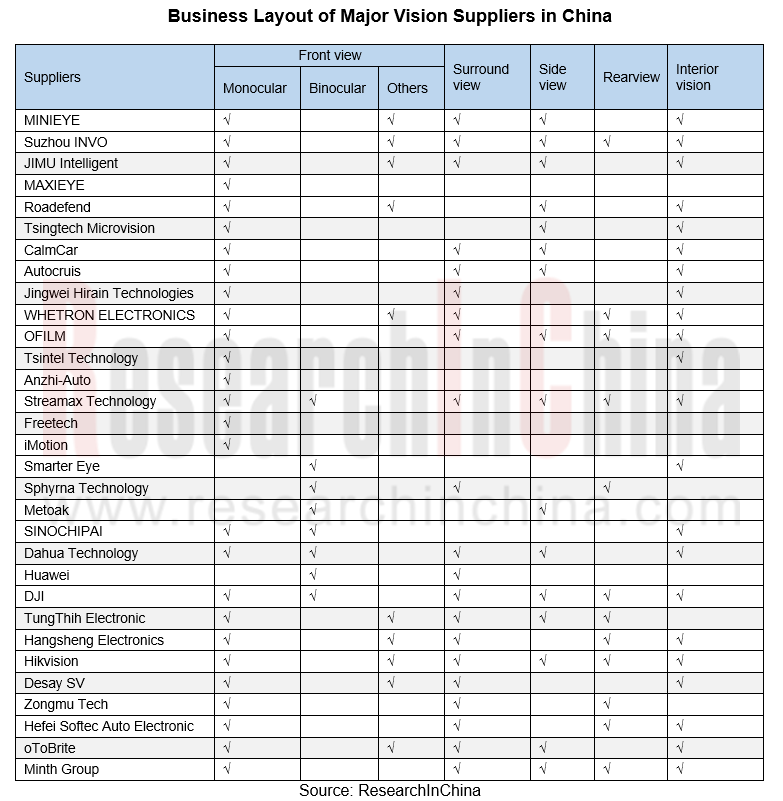

Currently, the front view monocular solution is the mainstream solution for Chinese passenger cars, and some companies are also exploring the application of front view cameras such as binocular cameras. In 2021, Huawei and DJI successively launched self-developed binocular cameras and solutions. Huawei's binocular cameras have been applied on ARCFOX Alpha S. DJI also plans to apply the binocular camera autonomous driving solution to Chinese models in 2021.

Surround View: In 2020, surround view system was available in 3.398 million cars in China, an increase of 44% over 2019; the installation rate was 18%, up 6 percentage points year-on-year. With surround view system's replacement of rearview and the addition of parking functions, surround view system installations will further jump. As surround view system is an alternative to rearview and the 360° surround view + ultrasonic solution becomes the mainstream solution for integrated parking, 360° surround view has entered a new development stage. It is estimated that the installation rate will rise to 50% in 2025.

Visual DMS: According to ResearchInChina, more than 10 new passenger car models, such as Changan Automobile, NIO, Xpeng, WEY, EXEED, Neta, Leapmotor, Geely, WM Motor, GAC Aion, etc., in China was equipped with DMS in 2020. In 2020, DMS was seen in 173,000 cars, with the installation rate of 0.9%. By 2025, the installation rate is expected to leap to be about 20%.

In April 2021, the Ministry of Industry and Information Technology issued Access Management Guide for Intelligent Connected Vehicle Manufacturers and Products (Trial), requiring intelligent connected vehicles to have HMI and driver monitoring functions, which released strong signals of mandatory DMS installation.

Driving Recorder: In 2020, 1.453 million cars in China had driving recorders, an increase of 7.6% compared to 2019. Meanwhile, the installation rate of driving recorders was 7.7%, up 0.9 percentage points from 2019.

Access Management Guide for Intelligent Connected Vehicle Manufacturers and Products (Trial), which requires intelligent connected vehicles to feature event data recording and autonomous driving data storage, will accelerate the assembly of driving recorders on new vehicles. The installation rate is expected to be 20% by 2025.

Mobileye enjoyed about 30+% share of China’s passenger car front view chip market in 2020, and it expects to seize over 55% in 2025

According to ResearchInChina, the main suppliers of passenger car front view system in China include Denso, Bosch, Aptiv, Kostal, Panasonic, Veoneer, Continental, Jingwei Hirain Technologies, etc. The top 10 suppliers in 2020 occupied more than 90% of the market share. In China, only Jingwei Hirain Technologies was shortlisted, with a market share of 3.6%.

The chip (algorithm) supply of front view system generally has two modes: the self-developed mode (from the core chip to system integration) and the division of labor mode (the core chip is supplied by a company (such as Mobileye) while the system is integrated by Tier1 suppliers.

For example, Jingwei Hirain Technologies mainly uses Mobileye's chips for its front view system to realize the functions of identifying vehicles in front, lane lines, and pedestrians. Major customers include SAIC MAXUS, FAW Hongqi, FAW Jiefang, FAW Besturn, Roewe, MG, Geely, JMC, JAC, Sinotruk, Shaanxi Heavy Duty Truck and other automakers.

In addition to Jingwei Hirain Technologies, Aptiv, ZF, Kostal, Wistron, Yihang AI, iMotion, etc. have also established long-term cooperative relationship with Mobileye. According to ResearchInChina, Mobileye enjoyed about more than 30% share of China’s passenger car front view chip market in 2020. At the same time, Mobileye continued to contact new OEMs and Tier 1 suppliers, such as Great Wall Motors, Dongfeng Motors, and Toyota. It launched a full-scale deployment plan with Volkswagen and Ford. It is expected that its market share will reach more than 55% by 2025.

Great Wall Motors: In 2019, Great Wall Motors said that L0-L2+ADAS based on Mobileye‘s technology will be integrated into a series of models in the next 3-5 years. In 2020, Big Dog, the third-generation H6, and Tank 300 were all equipped with the “monocular camera + Mobileye EyeQ4 chip vision” solution, which has realized the autonomous driving function of L2 and above.

Dongfeng Motor: ZF has launched its coASSIST L2+ semi-automated driving system on the 2020 Dongfeng Aeolus Yixuan which was launched late in 2020. ZF coASSIST is the cost-effective (the price is less than $1,000) L2+ solution that helps meet Euro NCAP performance requirements while delivering the most popular Level 2+ ADAS functions utilizing Mobileye, an Intel Company, EyeQ ? technology. In the next few years, it will be applied to Dongfeng Aerolus Yixuan MAX.

Toyota Motor: In May 2021, ZF and Mobileye were chosen by Toyota Motor to develop ADAS for use in multiple vehicle platforms starting in the next few years. Prior to this, Toyota mainly adopted Denso's solutions.

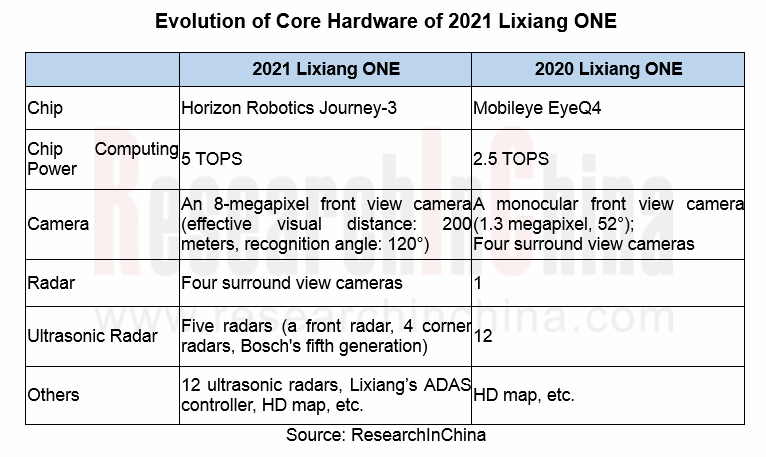

It can be seen that the division of labor mode is more recognized by OEMs. In addition to Mobileye, Horizon Robotics is also making efforts in the field of vision chips.

The 2021 Lixiang ONE, released in May 2021, is equipped with two Journey-3 processors developed by Horizon Robotics, an 8-megapixel front view camera (effective visual distance: 200 meters, recognition angle: 120°), four surround view cameras, five radars, 12 ultrasonic radars, Lixiang’s ADAS controller, and NOA navigation assistance driving capabilities.

Domestic suppliers consolidate the commercial vehicle market while working hard on the passenger car OEM market

Since 2017, the commercial vehicle ADAS market has been booming thanks to the mandatory installation of early warning functions such as LDWS and AEBS. Leading companies such as Continental and ZF have launched ADAS and integrated solutions for commercial vehicles. China-based MAXIEYE, Jingwei Hirain Technologies, JIMU Intelligent MINIEYE, etc. have received orders from commercial vehicle OEMs, and realized the large-scale mass production of L1 assisted driving.

While consolidating the advantages in the commercial vehicle ADAS market, local suppliers represented by Suzhou INVO, MINIEYE, MAXIEYE, Freetech, iMotion, etc. have begun to make efforts in the L2 (or above) passenger vehicle ADAS market.

MINIEYE: MINIEYE has secured passenger vehicle projects of BYD and JAC. In March 2021, it was designated by a new energy OEM to conduct a L2+ mass production project. On the basis of Huawei’s MDC 210 platform, it adopts a multi-sensor fusion solution with AEB, ACC, LKA, HWP, TJP and other functions. In addition, it is co-developing L0-L3 autonomous driving perception solutions with Xilinx; it is cooperating with SMART on L3 (or above) ADAS.

MAXIEYE: In October 2020, MAXIEYE won the domestic L2+ production passenger car model project, providing products based on IFVS - intelligent forward visual perception system, which can realize LKA, LCK, AEB, ACC, TJA, ILC, ELK and other functions. In April 2021, in cooperation with HYCAN (formerly GAC NIO New Energy), MAXIEYE will gradually implement the L3 autonomous driving in high-speed scenarios and the L2+ driving assistance system in open urban roads.

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...

Global and China Flying Car Industry Research Report, 2022

ResearchInChina has released “Global and China Flying Car Industry Research Report, 2022".

A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous t...