Domain Controller Research: Four Types of Players in Autonomous Driving Domain Controllers and Three Types of Players in Cockpit Domain Controllers

In the next 2-3 years, OEMs will focus on upgrading EEA to accelerate the introduction of domain controllers

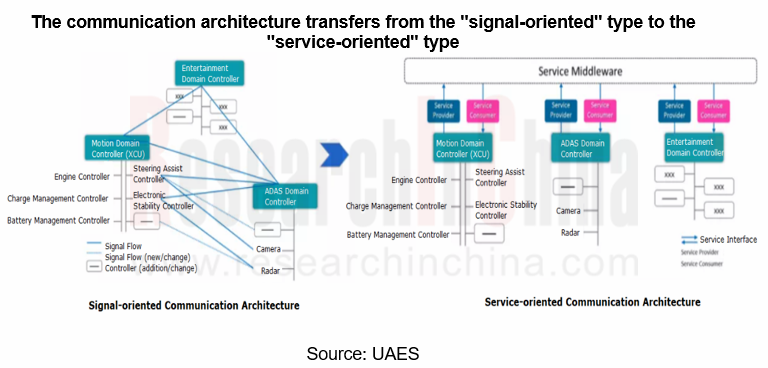

The EEA upgrade will be the focus in the next 2-3 years, which will accelerate the introduction of domain controllers. The automotive EEA upgrade is mainly reflected in three aspects: software architecture, hardware architecture, and communication architecture. Software architecture will gradually realize hierarchical decoupling, hardware will develop from distributed style to Domain controller/centralized style, and automotive network backbone will develop from LIN/CAN bus to Ethernet.

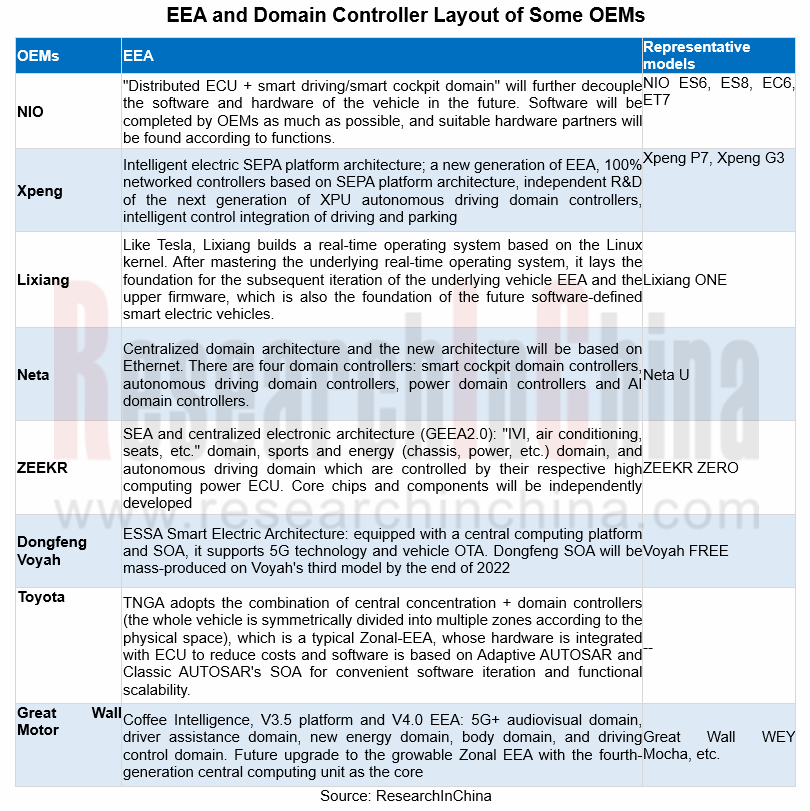

It is expected that most OEMs will still use mixed-domain EEA, that is, part of functional domains will be centralized to form a transition solution of "distributed ECU + domain controllers" and finally forge an architecture of "super controller (central supercomputer) + zonal control Unit (zone controller)". This EEA evolution may take up to 5-10 years.

From the perspective of OEM planning, autonomous driving domain, smart cockpit domain, and central control domain may become three main incremental domains.

The competitive landscape among four types of players in autonomous driving domain controllers

With the evolution of automotive EEA from distributed domain to centralized domain, the relationship between automakers and automotive electronics suppliers is undergoing profound changes. The number of automotive electronics suppliers will gradually decrease, while the status of domain controller suppliers will become more important and attract more entrants.

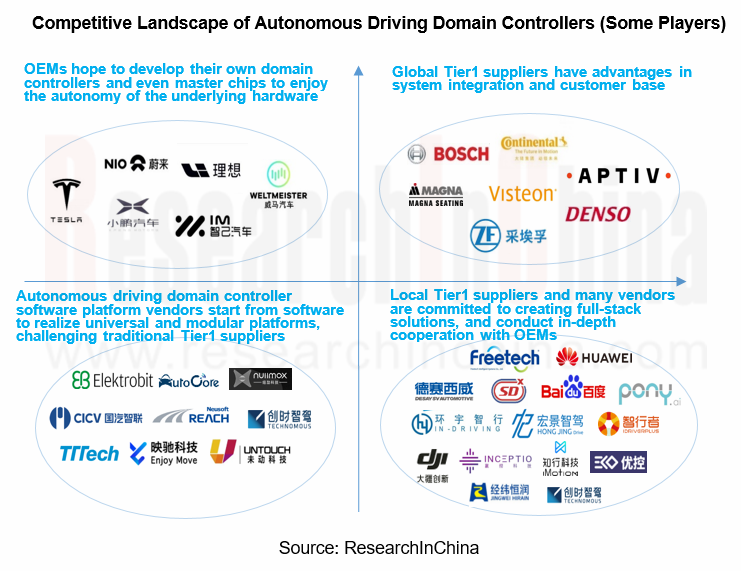

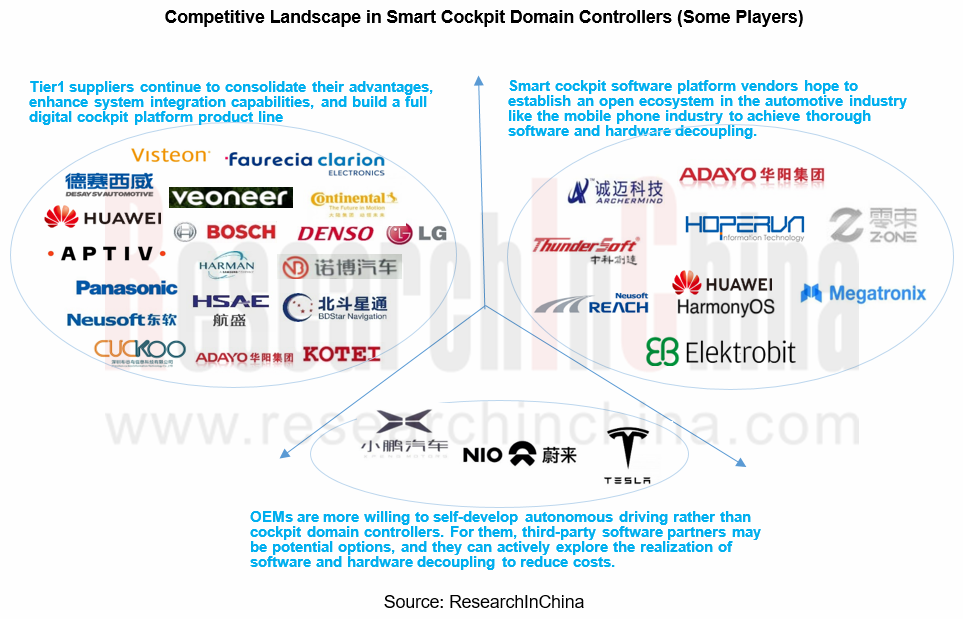

We divide autonomous driving domain controller players into four categories: Global Tier1 suppliers (system integrators), Local Tier1 suppliers (system integrators), autonomous driving domain controller software platform vendors, and OEMs.

1.OEMs

In the long run, the number of ECUs in the centralized EEA will decrease and the functions will be weakened. The dominance may be transferred from suppliers to OEMs. For example, the EEA of Tesla's self-developed central computer CCM + zonal body controller is at least 5 years ahead of traditional OEMs. Domestic start-ups, such as NIO, Xpeng, WM Motor, Lixiang, SAIC IM, etc., have developed or will develop autonomous driving domain controllers in order to master the autonomy of the underlying hardware of software-defined cars and achieve more powerful OTA upgrades.

Xpeng plans to self-develop XPU autonomous driving intelligent control unit to break the interaction barriers between the previous four domains, achieve deeper domain integration, and integrate the intelligent control of driving and parking.

Although more and more leading automakers have their own software R&D teams to independently develop domain controller hardware and corresponding software, it is almost impossible for them to research all by themselves. They will still rely on suppliers in terms of hardware design and manufacturing, and more standardized "middleware"; especially from a single domain to cross-domain (body domain, cockpit domain, autonomous driving domain), the complexity has increased exponentially, and the importance of cross-domain (multi-domain integration) high-performance computing software platforms will become more prominent, and the value of domain controller software platforms of Enjoy Move Technology, Neusoft Reach and TTTech will gradually appear.

2.Global Tier1 suppliers (systems integrators)

In the future automotive EEA, especially in the “central computing unit + zone controller” stage, the software and hardware are completely decoupled, and the hardware is peripheral. The real challenge for automakers lies in the software architecture. The traditional automotive supplier system will be greatly impacted, while the value of software suppliers will be further highlighted, and there will be some giants in domain controller software.

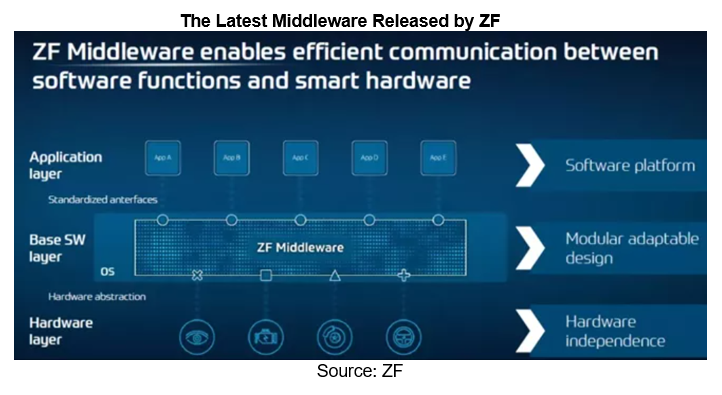

In response to this trend change, global Tier1 giants are also actively building independent software platform products to cope with the competition. Both Bosch and ZF launched middleware designed for autonomous driving in 2020.

In July 2020, Bosch launched Iceoryx, a middleware for advanced autonomous driving, compatible with ROS2 and Adaptive AutoSAR interfaces to meet the requirements of different development periods (pre-ROS, mass production of Autosar).

In December 2020, ZF released ZF Middleware, providing a modular solution that can be integrated into automakers’ software platforms. At the same time, the middleware will be installed on mass-produced vehicles in 2024.

It is worth noting that foreign Tier 1 suppliers dabble in underlying system R&D and build a bridge between system and software applications while accomplishing functions. Bosch and ZF have successively released middleware products, hoping to centrally configure autonomous driving solutions for OEMs through a comprehensive sensor layout so as to simplify system integration, lower development costs and accelerate product launch.

In addition, ZF will establish a global software center in 2021 in order to meet the challenges of future automobile software requirements.

3.Autonomous driving domain controller software providers

New vendors focusing on the development of autonomous driving software platforms are particularly worthy of attention. The domain controller platform vendors starting from software may challenge traditional Tier1 suppliers.

Taking TTTech (the domain controller software supplier of Audi zFAS) as an example, more than 25 models equipped with "MotionWise" (TTTech’s domain controller software platform) have been mass-produced globally. In China, TTTech and SAIC have established a joint venture named Technomous, which has already produced iECU autonomous driving domain controllers for SAIC’s member companies.

Domestic companies such as Enjoy Move Technology, Neusoft Reach, Untouch, and Nullmax have also launched domain controller software platforms to seize market opportunities. Domain controller software platforms (middleware) (between automotive operating systems and software applications) mainly abstract computer hardware from software applications, and also serve as a communication bridge between applications. As the communication architecture transfers from the "signal-oriented" type to the "service-oriented" type, the value of domain controller middleware will become more prominent.

Domain controller middleware builds a bridge between automakers and Tier 2, namely the so-called Tier 1.5 that connects the software of automakers and Tier 1 to the hardware of Tier 2. The new development model will promote software suppliers to become important players in the automotive industry. Domain controller middleware requires high-level software, and more and more start-up software vendors have begun to dabble in this market, which will challenge Tier1 suppliers who are good at hardware.

4.Local Tier1 suppliers (systems integrators)

More and more local Tier1 suppliers have self-developed domain controllers to build an autonomous driving full-stack solution that integrates software and hardware. The innovatively developed intelligent driving operating systems AOS, VOS and MDC Core run on Huawei’s MDC computing platform hardware, with a complete development tool chain. Partners can develop algorithms and applications on the basis of MDC to form an industrial ecosystem. The Huawei MDC810 computing platform has been mass-produced on the BAIC ARCFOX αS (Huawei HI).

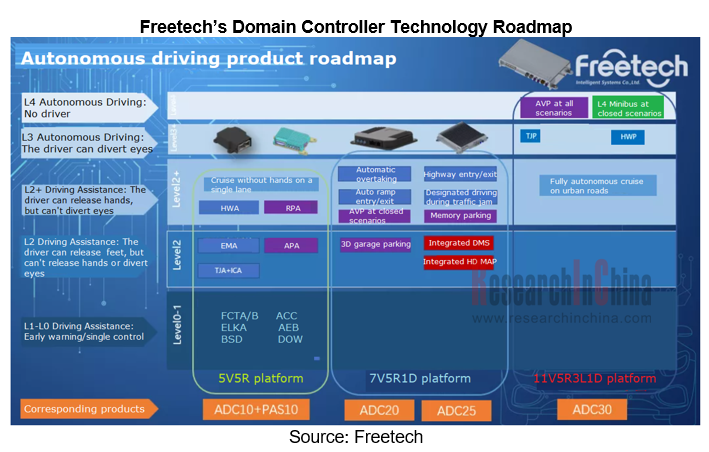

Freetech, a Chinese ADAS supplier supporting Geely, Changan, Chery and Baoneng, has begun the research and development of domain controllers. It is committed to providing full-stack solutions for cost-sensitive mass-produced passenger cars. Based on the mature L2 system, Freetech has designed a modular, tailorable, and expandable software and hardware integration technology architecture, developed and launched an autonomous driving domain controller solution for mass production, including ADC20, ADC25, and ADC30 domain controllers, as well as provided OEMs with autonomous driving systems with flexible configuration.

Desay SV provides the autonomous driving domain controller IPU03 for Xpeng P7, with the shipments exceeding 10,000 units in 2020 and mass production, IPU04 based on NVIDIA’s ORIN computing platform is also under development and is planned to be launched in Lixiang in large scale in 2022. As one of Nvidia's six global partners, Desay SV has occupied the core position.

In addition, Hong Jing Drive, Pony AI, IDRIVERPLUS, Jingwei Hirain Technologies, and Yingbo Supercomputing have also deployed autonomous driving domain controllers. On the one hand, they provide support for their own system integration solutions. On the other hand, they are actively developing OEMs as customers and offer them with software and hardware solutions. For example, Hong Jing Drive has reached deep cooperation with JAC and formed a joint venture named "Yuchi Smart", and Yingbo Supercomputing has provided Chery New Energy with L2.99 autonomous driving domain controllers.

Smart cockpit domains incorporating more and more ADAS functions will prevail

In the end, a smart car will become a mobile supercomputer and data center, and a new Wintel will be born. In the future, the core technologies of the advanced autonomous vehicle era will include computing platforms, operating systems and application software. After 2030, autonomous driving high-performance chips and cockpit control chips will be further integrated into central computing chips as the autonomous driving technology roadmap matures, hereby improving computing efficiency and reducing costs through integration.

Under this trend, cockpit electronics companies, including Tier1 suppliers and software vendors, are seeking to integrate more and more ADAS functions (typically autonomous parking, DMS, and more advanced L1/L2 ADAS functions) into the cockpit domain and enhance the functional safety level of the smart cockpit domain.

Similar to intelligent driving domain controllers, a large number of domain controller software vendors have emerged in the field of smart cockpits. Megatronix, a software infrastructure provider that only has a history of two years, recently announced that it has raised over USD100 million in financing, and has accepted cockpit platform orders from OEMs such as HYCAN 007 and Lixiang. Investors have begun to attach importance to the broad prospects of this market.

From the perspective of OEMs, the urgency of self-developed cockpit domain controllers may not be as obvious as that of autonomous driving, mainly because: in the short to medium term, it is difficult for consumers to pay for cockpit function customization. For OEMs, they may potentially choose third-party software partners, and can actively explore the realization of software and hardware decoupling to achieve a better customer experience at low costs. In this context, ThunderSoft, Megatronix and other companies have emerged.

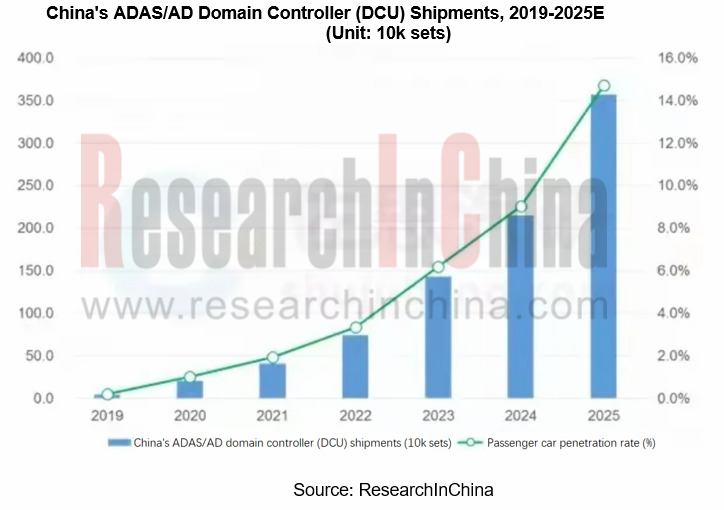

The penetration rate of the domain controller market will swell in the next 5 years

In China, the industry is currently promoting mass production of L2+ autonomous cars on a large scale, and even L2++ or L2.9 autonomous driving, which is infinitely close to L3, is also rapidly being realized, mainly thanks to the impetus of Tesla Model series, NIO ES, Xpeng P7 and other models. ResearchInChina estimates that by 2025, the annual shipments of ADAS/AD domain controllers for passenger cars in China will reach 3.565 million sets, and the penetration rate of passenger car OEM autonomous driving domain controllers will reach 14.7%.

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...

Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

In 2022Q1, the installation rate of L2 and a...

Global and China Electronic Rearview Mirror Industry Report, 2021-2022

Electronic rearview mirror research: the streaming rearview mirror installations soared by 73% in 2021.

This report combs through and summarizes the global and Chinese electronic rearview mirror mark...

Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century....

Automotive Intelligent Cockpit Platform Research Report, 2022

Research on Intelligent Cockpit Platforms: Intelligent cockpits rush into a new era of "cross-domain integration and layered software design"

Cockpit hardware platform field: Faster cross-domain inte...