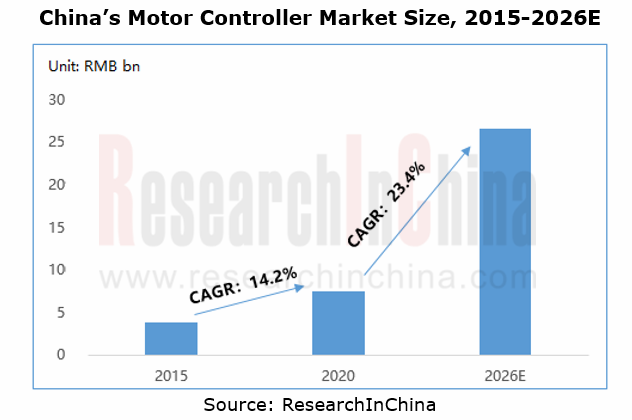

Automotive motor controller industry is expected to grow at CAGR of 23.4%, and local manufacturers are rising.

1) The growing new energy vehicle market gives a boost to the motor controller market.

The supply and demand in the electric vehicle motor controller market is dependent on the expansion of new energy vehicle market.

At present, countries and automakers worldwide have formulated their plans and requirements for the development of new energy vehicles. In future, new energy vehicle sales will be bound to surge. As the new energy vehicle market booms, the motor controller market will make steady growth. It is predicted that China’s motor controller market will sustain a CAGR of up to 23.4% between 2020 and 2026.

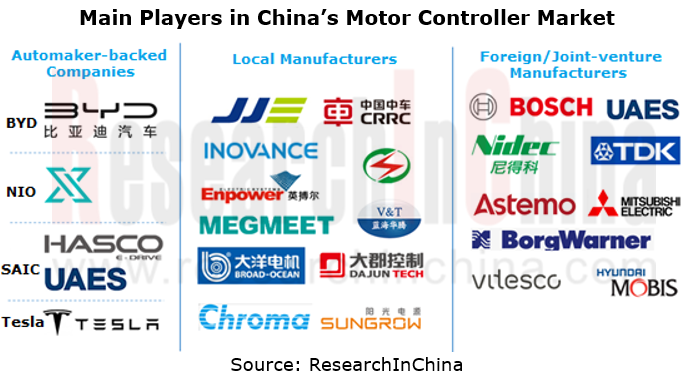

2) In the fiercely competitive motor controller market, local manufacturers lead the way.

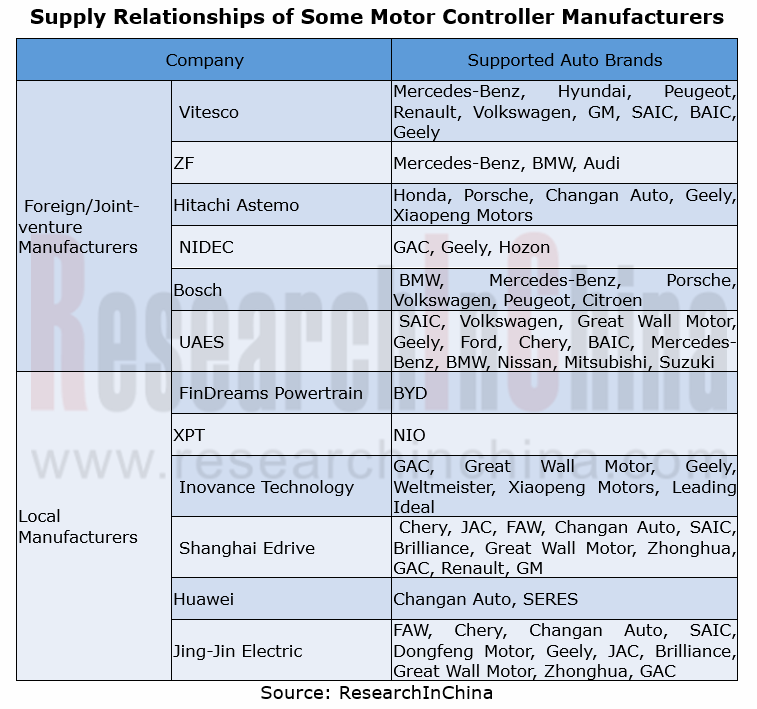

Currently, China’s electric vehicle motor controller market is intensely competitive. There are mainly three types of players: automaker-backed companies, local manufacturers, and foreign/joint-venture manufacturers. Among them, automaker-backed players support their own vehicles; local manufacturers are suppliers of Chinese independent auto brands; foreign/joint-venture companies build supply relationships with foreign/joint-venture auto brands.

Local manufacturers now have the upper hand on the strength of the development of homegrown new energy vehicle brands, especially emerging automakers. In 2020, seven out of the top ten manufacturers by market share were local companies, among which BYD still dominated the list with a 13.5% share; Inovance Technology, Sungrow and Huayu E-drive first edged into the top-ten list.

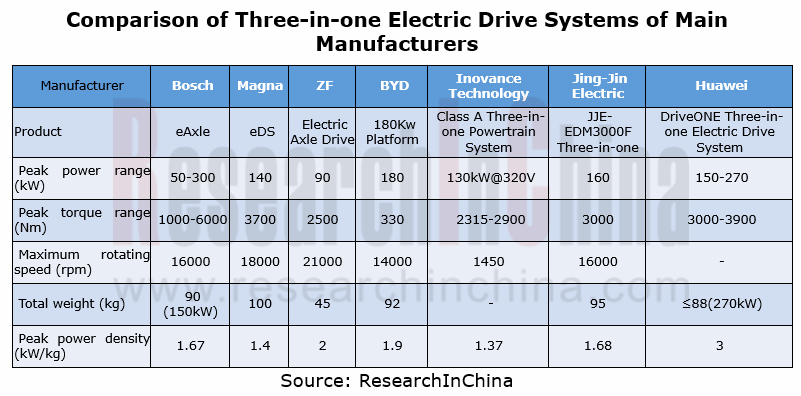

3) N-in-one products hold the trend, and three-in-one drive system will become the mainstream

Motor and ECU integration is a way to not only reduce weight and size of products but cut costs of production and procurement and improve efficiency. In current stage, most companies still stay at the two-in-one phase, while the three-in-one drive system will become the mainstream.

In 2020, China shipped more than 500,000 sets of three-in-one electric drive systems for passenger cars, or around 37% of the total motor controller shipments. Companies including Bosch, BYD, Inovance Technology and Jing-Jin Electric have rolled out their three-in-one electric drive systems. One example is Huawei DriveONE three-in-one electric drive system which boasts peak power density of 3kW/kg, the highest in the industry.

Through the lens of market share, the three-in-one system is still an oligopolistic market. In 2020, Tesla, BYD, XPT and NIDEC took a combined 82.1% of the total sales. Yet as Dongfeng SERES SF5 equipped with Huawei three-in-one system goes into mass production in 2021, the competition in the three-in-one electric drive system market will be more intense.

4) Power modules head in high voltage, and silicon carbide becomes a mainstream material.

New energy vehicles now use 400V electrical voltage systems. 80% SOC for a battery takes about 30 minutes, but the use of an 800V voltage system will cut the time down to 10 minutes. The need for fast charge makes high voltage power modules an inevitable trend.

Manufacturers like Hitachi Astemo, BorgWarner, Vitesco, Inovance Technology and ZF currently have introduced their 800V inverter/electric drive system products to meet fast charge needs, and all use silicon carbide (SiC) material except for Hitachi Astemo.

In BorgWarner’s case, its SiC inverter mass-produced in 2019 is the first 800V inverter using SiC power switch. The double-sided cooling structure makes the inverter 40% lighter and 30% smaller, improves its power density by 25%, and allows the inverter to perform better in thermal conductivity, high temperature stability and efficiency for shortening the charging time and extending the range.

Electric Controller Upstream Market

1) Automotive IGBT market—local companies gear up to scramble

IGBT module which plays a crucial role in new energy vehicles makes up roughly 45% of the cost of electric vehicle motor controller.

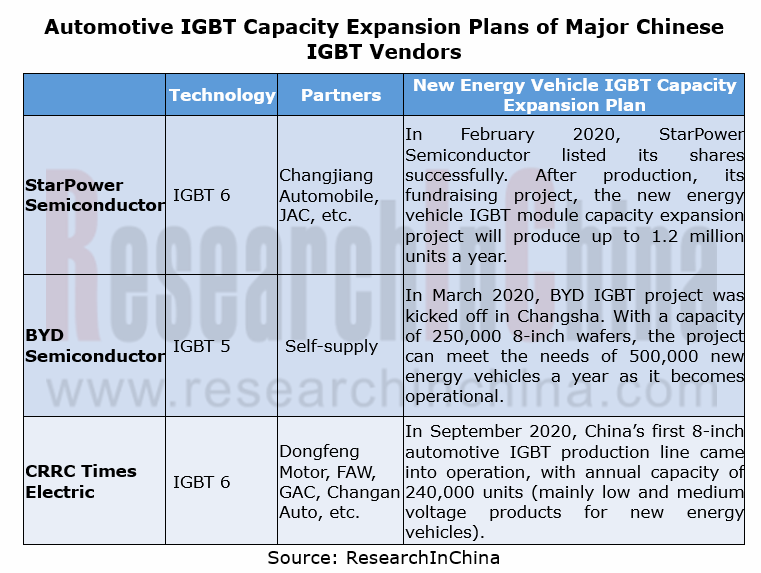

Current local companies such as BYD Semiconductor, StarPower Semiconductor and CRRC Times Electric already work hard on new energy vehicle IGBT development, and race to expand their capacity to rival their foreign peers.

China’s automotive IGBT market is dominated by international vendors like Infineon, Mitsubishi Electric, Semikron and Denso, among which Infineon shares over half the market, up to 58.2% in 2019. BYD Semiconductor, StarPower Semiconductor and CRRC Times Electric were however on the list of the top ten automotive IGBT vendors in 2019, especially BYD Semiconductor which became the runner-up with market share of 18%, far higher than the third-ranking Mitsubishi Electric which occupied just 5.2%.

2) Silicon carbide power devices are expected to be an alternative to IGBT, a key component of motor controller.

Globally, there is a belief that silicon carbide is the next-generation semiconductor material.

Compared with Si-based IGBT power devices, silicon carbide (SiC) power devices feature lighter weight, smaller size, higher power density, longer range, lower controller loss, better thermal conductivity, and stronger high temperature resistance. Motor controllers using SiC power devices are an effective way for new energy vehicles to improve range, power mass density, and electric energy conversion efficiency. So SiC power devices are expected to replace IGBT as a key component of motor controller.

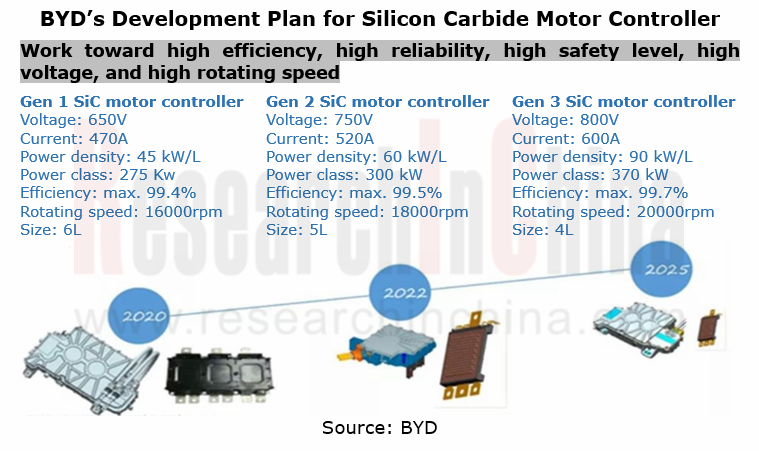

Manufacturers such as Delphi and BYD have set about making deployments in SiC motor controller. BYD indicated that from 2020 to 2025, its SiC motor controllers will have three iterations, with applicable voltage platforms up to 800V, power density up to 90kW/L, efficiency up to 99.7%, and rotating speed up to 20,000 rpm.

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...

China Roadside Edge Computing Industry Report, 2022

Roadside Edge Computing Research: how edge computing enables intelligent connected vehicles?

Policies and standards for roadside edge computing are implementing one after another, favoring the boom o...