Global Passenger Car Vision Industry Chain Report 2021

-

July 2021

- Hard Copy

- USD

$3,900

-

- Pages:210

- Single User License

(PDF Unprintable)

- USD

$3,700

-

- Code:

BHY004

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,600

-

- Hard Copy + Single User License

- USD

$4,100

-

ResearchInChina has released Global Passenger Car Vision Industry Chain Report 2021 to analyze and predict global camera technology and market trends, and conduct research on global mainstream camera vendors.

With policies support of governments worldwide, the rapid development of automotive intelligence has promoted the continuous growth of automotive cameras. The global passenger car camera market was worth USD7.02 billion in 2020, and is expected to hit USD19.26 billion in 2025.

In terms of segmented products, in-car surveillance cameras will be a growth engine in the future. In 2018, Japan's ``Preparation Outline for Autonomous Driving Systems'' required vehicles with autonomous driving functions to record steering wheel operations and the operating conditions of autonomous driving systems. The ADAS directive of "Europe on the Move" issued in 2019 stipulates that all new vehicles must be equipped with "Drowsiness Warning System" and "Distraction Recognition and Prevention System" from May 2022. In 2024, all vehicles in stock must be equipped with the above functions.

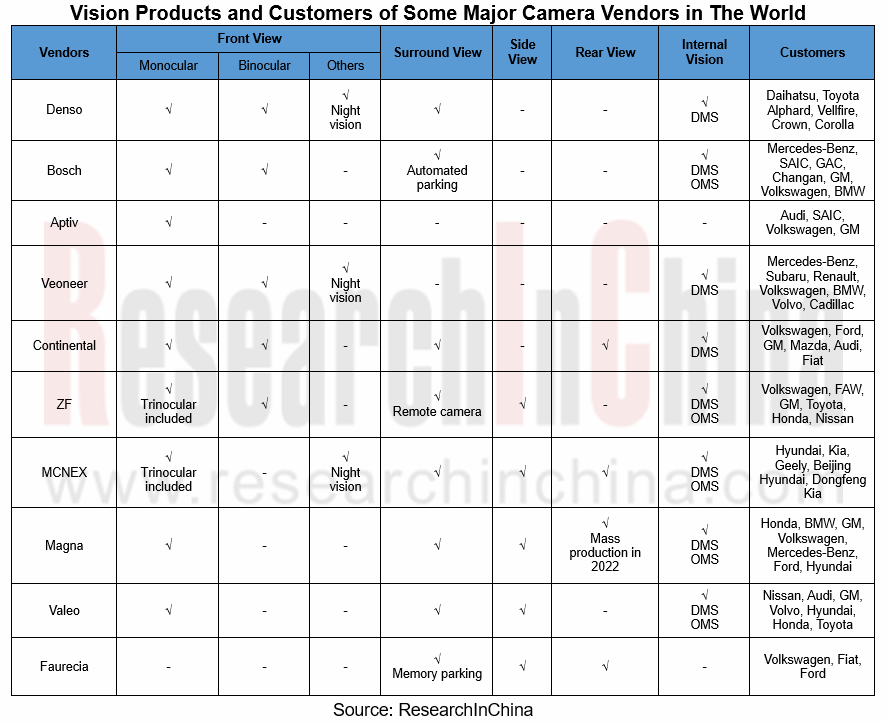

Endeavored by the government and policies, global camera vendors are following market trends and developing new products to meet the demand for advanced autonomous driving. On the one hand, they expand product lines and strive for a complete range of products. Denso develops electronic rear view mirrors based on monocular, binocular, night vision, surround view, internal vision and other products. Magna has already offered a variety of vision products such as Front View monocular cameras, surround view cameras, side view cameras, internal view DMS, internal view OMS, and internal view rear monitors. It plans to mass-produce interior rear view mirrors in 2022. Combined with cameras, mirrors and software products, the rear view mirrors feature a frameless design and can be electronically switched between traditional rear view mirrors and video displays which can customize the field of view.

On the other hand, enhanced visual recognition and algorithms are integrated with other products to offer diverse functions. In June 2021, ZF and CalmCar cooperated to develop an automated valet parking system based on surround view. The system includes ZF's four surround view 192° fisheye cameras, CalmCar's ultrasonic radar and 360° surround view perception software solutions. Bosch and Hyundai Mobis plan to produce the "in-car monitoring system combined with artificial intelligence" and the "high-performance image recognition technology based on deep learning" in 2022 separately.

Finally, automotive vision should not only integrate autonomous driving functions, but also pay more attention to user experience. 3D surround view will prevail. For example, the new Valeo 360Vue? 3D surround view system gives not only the aerial view of the vehicle, but also a 3D view of the vehicle in the car. The driver can clearly see all obstacles and blind sports near the vehicle. In February 2021, Magna released the 3D surround view system, which can directly see the surrounding environment of the vehicle through the 360° surround view camera to help the driver park and move the vehicle in a narrow space. This system is mainly used in luxury vehicles. In addition, Chinese 3D vision company Smarter Eye is also developing a 3D surround view system.

1. Status Quo and Development Trends of Global Passenger Car Vision Industry

1.1 Overview of Passenger Car Vision Industry

1.1.1 Introduction to ADAS and Functions

1.1.2 Automotive Camera Classification and ADAS Functions Supported

1.1.3 Camera Structure and Imaging Principle

1.2 Status Quo and Development Trends of Global Passenger Car Vision Industry

1.2.1 Status Quo and Development Trends of Global Passenger Car Vision Industry

1.2.2 America’s Policies for Promoting the Development of Autonomous Driving

1.2.3 America Regards the Development of Autonomous Driving as a National Strategy

1.2.4 EU’s Policies for Promoting the Development of Autonomous Driving

1.2.5 EU Autonomous Driving Technology Development Roadmap

1.2.6 Germany's Autonomous Driving Policies are at the Forefront of the World

1.2.7 Policies, Regulations and Planning for Autonomous Driving in the UK

1.2.8 Japan’s Policies for Promoting the Development of Autonomous Driving

1.2.9 Japan’s Autonomous Driving Development Planning

1.2.10 Autonomous Driving Regulations and Policies in South Korea

1.2.11 Development Progress and Planning of Autonomous Driving in South Korea

1.3 Status Quo and Development Trends of Global Passenger Car Vision Product Technology

1.3.1 Multi-sensor Integration Will Be the Trend

1.3.2 Simplified Hardware, Central Integration of Computing Power

1.3.3 Binocular or Multinodular Solutions Will Gradually Replace Monocular Solutions

1.3.4 In-car Driver Monitoring Cameras Will be Included in Standard Configuration

2. Foreign Passenger Car Vision Companies

2.1 Meta-analysis of Foreign Passenger Car Vision Companies - Basic Information

2.2 Meta-analysis of Foreign Passenger Car Vision Companies - Products, Vision Customers, Development Directions

2.3 Denso

2.3.1 Profile

2.3.2 Revenue

2.3.3 Main Customers and Revenue

2.3.4 ADAS Products

2.3.5 Forward View Products

2.3.6 Binocular Stereo Vision Sensors

2.3.7 Driver Monitoring Cameras

2.3.8 DMS Application

2.3.9 Denso Ten 360° Surround View System

2.3.10 Customers and Dynamics of Vision Products

2.4 Bosch

2.4.1 Profile

2.4.2 ADAS Products

2.4.3 The Third-generation Front View Camera

2.4.4 The Third-generation Binocular Camera

2.4.5 The Third-generation Monocular Camera

2.4.6 360° Surround View System

2.4.7 In-car Monitoring System

2.4.8 Customers and Dynamics of Vision Products

2.5 Aptiv

2.5.1 Profile

2.5.2 Operating Data in 2020

2.5.3 Business Goals in 2021

2.5.4 ADAS Products

2.5.5 Single-camera Solutions, Sensor Fusion Solutions

2.6 Panasonic

2.6.1 Profile

2.6.2 Automotive Business Revenue in FY2021

2.6.3 Automotive Electronic Products Series

2.6.4 Automotive Vision Products - Rear View Cameras (1)

2.6.5 Automotive Vision Products - Rear View Cameras (2)

2.6.6 Automotive Vision Products - Driving Recorders

2.6.7 Automotive Camera Dynamics

2.7 Veoneer

2.7.1 Profile

2.7.2 Global Layout and Revenue

2.7.3 Products and Customers

2.7.4 Vision System

2.7.5 Night Vision System

2.7.6 DMS

2.7.7 ADAS Technology Released in 2021

2.7.8 ADAS Products Available in Vehicles in 2021

2.8 Continental

2.8.1 Profile

2.8.2 Global Layout and Revenue in 2020

2.8.3 ADAS Products

2.8.4 Vision Products

2.9 ZF

2.9.1 Profile

2.9.2 Revenue in 2020

2.9.3 ADAS Products

2.9.4 Vision Products

2.10 MCNEX

2.10.1 Profile

2.10.2 Operating Data in 2018-2020

2.10.3 Global Business Distribution and Main Customers

2.10.4 Vision Product Layout

2.10.5 Vision Products

2.11 Magna

2.11.1 Profile

2.11.2 Operation in 2020 and Outlook

2.11.3 ADAS Hardware Products, Vision Product Customers

2.11.4 Vision Products

2.12 Valeo

2.12.1 Profile

2.12.2 Revenue in 2020

2.12.3 Vision Sensor Development History

2.12.4 Vision Product Overview

2.12.5 Vision Products

2.12.6 Partners

2.13 Faurecia

2.13.1 Profile

2.13.2 Revenue in 2020

2.13.3 Vision Products

2.14 Gentex

2.14.1 Profile

2.14.2 Revenue in 2020

2.14.3 Automotive Vision Products: Front View Cameras, In-car Cameras

2.14.4 Vision Products: FDM

2.14.5 Next-generation FDM

2.14.6 Automotive Vision Products: CMS

2.14.7 Automotive Vision Products: Hybrid CMS Cases, Vision Product Customers

2.15 First Sensor

2.15.1 Profile

2.15.2 Revenue in 2020

2.15.3 ADAS Product Layout and Application

2.15.4 Vision Products (1)

2.15.5 Vision Products (2)

2.15.6 Vision Products (3)

2.15.7 Vision Products (4)

2.15.8 Vision Product Customers Distribution

2.16 Hyundai Mobis

2.16.1 Profile

2.16.2 Product System and Software R&D Planning

2.16.3 ADAS Product Layout

2.16.4 Vision Products (1)

2.16.5 Vision Products (2)

2.16.6 Vision Products (3)

2.16.7 Customers and Dynamics of Vision Products

2.17 LG

2.17.1 Profile

2.17.2 Operating Data in 2020

2.17.3 Automotive Electronic Product Line

2.17.4 Vision Products: Front View Cameras, Panoramic Surveillance Image System

2.17.5 Customers and Dynamics of Vision Products

2.18 Ricoh

2.18.1 Profile

2.18.2 Operating Data in 2020

2.18.3 Vision Products: Binocular Modules and Application

2.19 Hitachi

2.19.1 Profile

2.19.2 Operating Data in FY2017-FY2021

2.19.3 ADAS Products

2.19.4 Vision Products: Binocular Stereo Cameras, Customers, Dynamics

3. Foreign key Passenger Car Vision Chip Companies and Other Companies

3.1 Mobileye

3.1.1 Profile

3.1.2 Revenue in 2020

3.1.3 Vision Chip Roadmap

3.1.4 Vision Chips: EyeQ5 and Customers

3.1.5 Vision System

3.1.6 Vision Algorithm

3.1.7 Target Recognition Technology

3.2 ON Semiconductor

3.2.1 Profile

3.2.2 Operation in 2020

3.2.3 Automotive Products and Partners

3.2.4 OEM Customers

3.2.5 Vision Chips: CMOS Image Sensors

3.2.6 CMOS Image Sensor: AR0138AT

3.2.7 CMOS Image Sensor: AR0220AT

...............

3.2.13 Vision Chips: Image Processors

3.2.14 Automotive Imaging Sensor System

3.3 OmniVision Technologies

3.3.1 Profile

3.3.2 Vision Products

3.3.3 Automotive Vision Products: Driver Monitoring System Parts

3.3.4 Automotive Vision Products: Parts for Autonomous Driving System

3.3.5 Automotive Vision Products: Display-based Image Sensor Parts

3.3.6 Automotive Vision Products: Parts for Surround View Video

3.3.7 Product Development History and Directions

3.4 Sony

3.4.1 Profile

3.4.2 Operating Data in 2020

3.4.3 Automotive CMOS Development History

3.4.4 Product Portfolio and Customers of Automotive CMOS

3.4.5 Automotive CMOS (1)

3.4.6 Automotive CMOS (2)

3.4.7 Automotive CMOS (3)

3.4.8 Image Sensor Development Plan

3.5 Samsung Electronics

3.5.1 Profile

3.5.2 Operating Data in 2020

3.5.3 ADAS Product Layout

3.5.4 Automotive Image Sensor - ISOCELL Auto

3.5.5 R&D of New Automotive Image Sensors

3.6 Texas Instruments

3.6.1 Profile

3.6.2 Operating Data in 2020

3.6.3 Vision Products: Monocular Vision Processing Chips

3.6.4 Vision Products: Surround View System Processing Chips

3.7 Xilinx

3.7.1 Profile

3.7.2 Operating Data

3.7.3 Application of Chips in ADAS

3.7.4 Vision Products

3.8 Cipia

3.8.1 Profile

3.8.2 Vision Technology

3.8.3 Vision System

3.8.4 Vision System: Cabin Sense

3.8.5 Solution: Fleet Sense

3.8.6 Dynamics of Vision Products

3.9 StradVision

3.9.1 Profile

3.9.2 Vision Products (1)

3.9.3 Vision Products (2)

3.9.4 Cooperation with Renesas

3.10 Foresight

3.10.1 Profile

3.10.2 Revenue and Expenditure in 2020

3.10.3 Vision Products

Chinese Joint Venture OEMs’ ADAS and Autonomous Driving Report, 2022

Joint Venture OEM's ADAS Research: Joint venture brands lead in L2/L2.5 installation rate, but have not involved L2.9 for the time being

Following "Chinese Independent OEMs’ ADAS and Autonomous Drivi...

Global and China Hybrid Electric Vehicle Research Report, 2022

Hybrid Research: China Hybrid EV penetration rate will hit 22% within five years

With the development of automobile energy-saving and new energy technologies and the promotion of low-carbon emission ...

China Smart-Road Roadside Perception Industry Report, 2022

Top 10 roadside perception suppliers: quality suppliers come to the front in each market segment.

The growing number of roadside perception players comes with active industrial investment and financ...

China Passenger Car Brake-by-Wire and AEB Market Research Report, 2022

Brake-by-wire research: with an astonishing growth in installation rate, One-Box has commanded much more of the market.

In new energy vehicles, especially intelligent vehicles, the bake-by-wire techn...

Multi-domain Computing and Zone Controller Research Report, 2022

Multi-domain computing and zone controller research: five design ideas advance side-by-side.In the trend for higher levels of autonomous driving, intelligent vehicles pose more stringent requirements ...

Overseas ADAS and Autonomous Driving Tier 1 Suppliers Report, 2022

Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025Countries allow L3/L4 vehicles on the road ...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022

ResearchInChina released "Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2022". This report combs through and summarizes status quo (installations, installation rate), function applicat...

China Passenger Car Electronically Controlled Suspension Industry Report, 2022

Research on electronically controlled suspension: four development trends of electronically controlled suspension and air suspension

Basic concepts of suspension and electronically controlled suspens...

China L2/L2+ Smart Car Audio Market Report, 2022

Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy...

China Commercial Vehicle T-Box Report, 2022

TOP10 commercial vehicle T-Box suppliers: using terminal data to build telematics platforms will become a megatrend.

1. From the perspective of market size, the pace of popularizing T-Box accelerates...

Electric Drive and Power Domain Industry Report, 2022

Electric drive and power domain research: efficient integration becomes a megatrend, and integration with other domains makes power domain stronger.

Electric drive systems have gone through several ...

China Autonomous Retail Vehicle Industry Report, 2022

Research on Autonomous Retail Vehicles: Lower Costs Accelerate Mass Production with Ever-spreading Retail Scenarios Autonomous retail vehicles integrate technologies such as 5G, artificial intelligenc...

China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner. According to ResearchInChina, in the first four months of 2022, China'...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022(II)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

Autonomous Driving and Cockpit Domain Control Unit (DCU) Industry Report, 2022 (I)

Domain Controller Research: Exploration of Five Business Models, Tier1, Tier0.5, Tier1.5 or ODM?

Automakers accelerate the mass production of new E/E architecture platforms, and the penetration rate...

China Minicar Industry Report, 2022

Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minic...

China Automotive Ultrasonic Radar and OEM Parking Roadmap Research Report, 2022

In 2021, ultrasonic radar shipments hit 100 million units, and intelligent parking became a crucial engine.1. In 2025, China’s ultrasonic radar installations will exceed 140 million units.

According...

DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Resea...