Global and China Automotive Wireless Communication Module Industry Report,2023

Vehicle communication module research: 5G R16+C-V2X module, smart SiP module and other new products spring up.

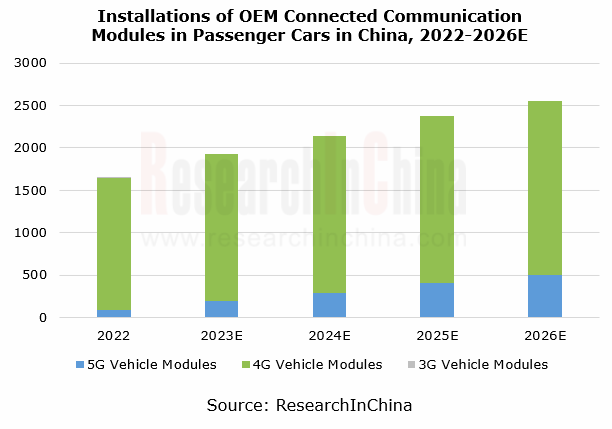

In 2022, 4G modules swept 84.3% of the vehicle communication module market. 5G communication modules enter a boom period from the high-end intelligent electric vehicle target market to the stock market where 4G is being replaced. It is expected that the penetration of 5G modules will rise to over 30% in 2026.

5G C-V2X modules and highly integrated smart modules are key development directions.

The new products launched by automotive communication module manufacturers during 2022-2023 are mainly 5G C-V2X modules and smart modules.

(1) 5G C-V2X modules

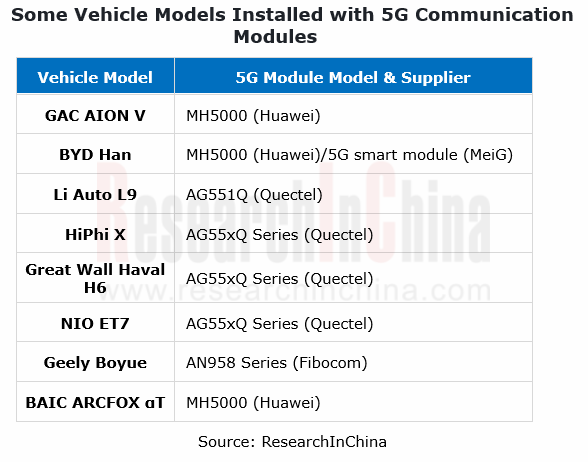

In currant stage, 5G modules have a relatively high entry threshold and pose a much higher technical challenge than 4G modules. Generally, only manufacturers with certain technical expertise in communication modules can produce 5G modules, including Fibocom, MeiG Smart Technology, Quectel, Neoway Technology and Huawei. The new vehicle models in the past two years carried much more 5G modules. For example, the full range of Li Auto L9 was equipped with Quectel 5G vehicle module AG551Q as a standard configuration.

3GPP has frozen 5G Release 16. 5G NR C-V2X offers big improvements in reliability, latency, positioning accuracy, and transmission rate, and can serve second-stage scenarios such as fleet platooning, advanced driving, scalable sensors, and remote driving. C-V2X based on the 5G R16 protocol is expected to play a more important role in advanced driving assistance.

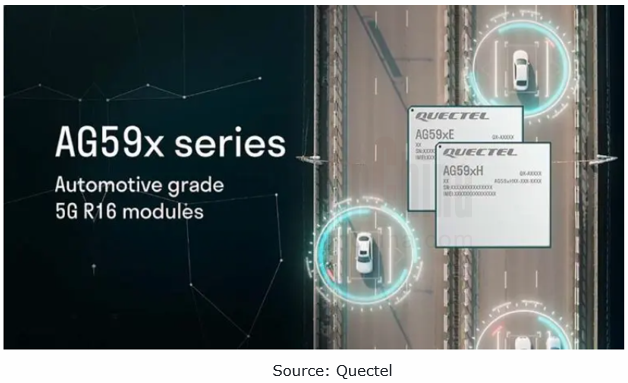

Quectel: in February 2023, Quectel introduced AG59x Series, its new-generation 5G automotive module and also the industry's first 3GPP R16-compliant automotive module. Quectel has designed multiple sub-models for different regional markets around the world, including AG59xH Series and AG59xE Series, and will provide engineering samples in the first half of 2023. Its products provide the following benefits:

In terms of cellular communication capabilities, AG59x supports 4 x 4 MIMO, a technology which can significantly improve the wireless communication performance of the module and increase its data transmission rate;

In terms of cellular communication capabilities, AG59x supports 4 x 4 MIMO, a technology which can significantly improve the wireless communication performance of the module and increase its data transmission rate;

The compatibility with Quectel’s first-generation 5G automotive modules AG55xQ Series and AG57xQ Series allows existing automotive customers to realize seamless migration and upgrade just by directly replacing, slashing design cost and development time;

The compatibility with Quectel’s first-generation 5G automotive modules AG55xQ Series and AG57xQ Series allows existing automotive customers to realize seamless migration and upgrade just by directly replacing, slashing design cost and development time;

Support optional C-V2X PC5 Mode 4 direct communication function (subject to 3GPP R15);

Support optional C-V2X PC5 Mode 4 direct communication function (subject to 3GPP R15);

For AG59x Series modules, the company can provide a range of matched high-performance antenna products.

For AG59x Series modules, the company can provide a range of matched high-performance antenna products.

MeiG Smart Technology: in March 2023, MeiG Smart Technology launched MA925 Series, its new-generation automotive 5G module designed, developed and produced on Qualcomm’s second-generation Snapdragon? automotive 5G modem and RF platform. It supports the 3GPP Release 16 standard, and integrates application processors (AP) with maximum compute of 22K DMIPS. The full range of the series supports the optional C-V2X function. In terms of software architecture, the introduction of hypervisor mechanism has greatly improved the safety, usability and maintainability of the product.

(2) Smart modules

Compared with conventional communication modules, smart modules have certain benefits: higher integration and effective cost reduction.

Smart modules that integrate high-compute chip and storage offer powerful processing capabilities and abundant interfaces, and enable such functions as driving record, 360-degree surround view, and head-up display. They may become the mainstream solutions for intelligent cockpits and body domain controllers in the future.

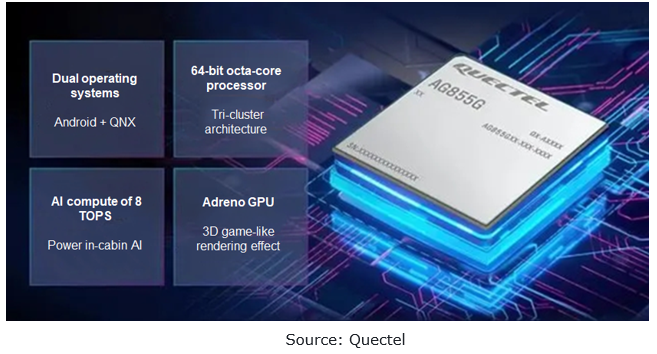

Quectel: in September 2022, Quectel introduced AG855G, China’s first smart SiP module that integrates Qualcomm's third-generation automotive intelligent cockpit chip SA8155P. Kryo 485, a 64-bit octa-core processor integrated in AG855G, delivers CPU compute of 100K DMIPS and AI compute of 8 TOPS, and supports up to 3 channels of 4K multiple screens that allow for independent touch control to display different contents, and 12 channels of cameras, enabling high integration of the all-digital dashboard and center console.

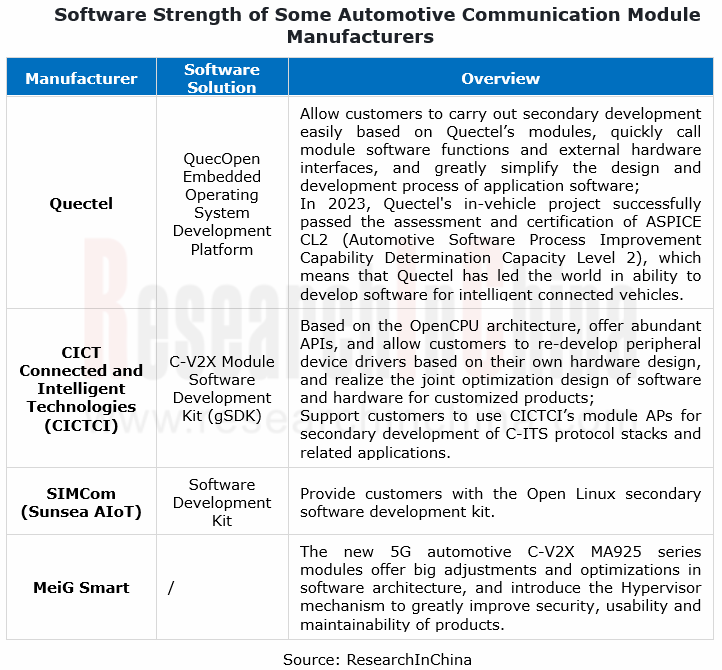

In the trend for software-defined vehicles, module manufacturers are required to have great software strength.

The automotive communication module industry features first-mover advantages. Once OEMs select a communication module supplier, they will not change it readily due to high cost. This also made it hard for Chinese suppliers to enter the supply chains of overseas automakers in early years, so they made an expansion at abroad by acquiring automotive module businesses of foreign manufacturers. For example, in 2018, Titan Invo Technology Limited acquired Telit’s vehicle communication business; in 2020, Fibocom bought Sierra Wireless’ automotive communication module business through its subsidiary Rolling Wireless.

As 5G and C-V2X markets develop, module suppliers are required to have higher technical reserves, especially software strength. In addition, in the megatrend for software-defined vehicles, OEMs’ needs for complex application development will further test the software support capabilities of suppliers. The automotive communication module industry has entered a new round of reshuffle.

CICTCI: the self-developed C-V2X module software development kit (gSDK) based on the OpenCPU architecture provides abundant APIs, and allows customers to redevelop peripheral device drivers based on their own hardware design and realize the joint optimization design of software and hardware for customized products.

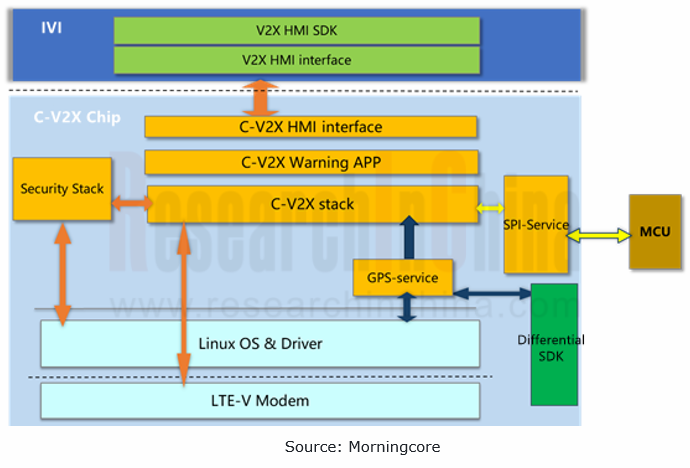

Morningcore: partnered with several application software providers such as Nebula Link, Neusoft, nFore Technology and Hikailink to jointly launch a turnkey solution that integrate a C-V2X protocol stack and security application software: a full-stack software and hardware integrated solution for mass production.

The solution has a built-in complete protocol stack and various V2X application algorithms, meeting the function and performance requirements of all current V2X security application scenarios and algorithms for low latency, high reliability, high-speed mobility and security. Widely used in telematics, it provides reliable solutions for smart cars, autonomous driving and intelligent transportation systems, and accelerates the development and production of V2X products.

Global and China Automotive Wireless Communication Module Industry Report,2023 highlights the following:

Automotive communication module industry (overview, industry chain, industry standards, market size, market pattern, etc.);

Automotive communication module industry (overview, industry chain, industry standards, market size, market pattern, etc.);

Technical highlights of automotive communication modules (manufacturing capabilities of manufacturers, cost composition, and software strength of suppliers, etc.);

Technical highlights of automotive communication modules (manufacturing capabilities of manufacturers, cost composition, and software strength of suppliers, etc.);

Development directions of automotive communication modules (including 5G modules, smart modules, etc.);

Development directions of automotive communication modules (including 5G modules, smart modules, etc.);

Integration of communication modules in vehicles (integration modes, OEMs’ plans for communication module production and application in vehicles, etc.);

Integration of communication modules in vehicles (integration modes, OEMs’ plans for communication module production and application in vehicles, etc.);

Major automotive communication module suppliers (product lines, product plans, latest products, application fields, etc.).

Major automotive communication module suppliers (product lines, product plans, latest products, application fields, etc.).

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024 released by ResearchInChina systematically analyzes the iteration process of IVI systems of mainstream automakers in Chin...

Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. I...

Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-compu...

Global and China Passenger Car T-Box Market Report, 2024

Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-B...

AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024

AI foundation models are booming. The launch of ChapGPT and SORA is shocking. Scientists and entrepreneurs at AI frontier point out that AI foundation models will rebuild all walks of life, especially...

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...

Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumpin...

Automotive AI Foundation Model Technology and Application Trends Report, 2023-2024

Since 2023 ever more vehicle models have begun to be connected with foundation models, and an increasing number of Tier1s have launched automotive foundation model solutions. Especially Tesla’s big pr...

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...