Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022

Telematics System Research 2: Baidu Family Bucket, Huawei and Tencent Become the Mainstream Ecosystems

ResearchInChina released Chinese Joint Venture OEMs' Telematics System and Entertainment Ecosystem Research Report, 2022 (hereinafter referred to as " this report"), combing through telematics systems of joint venture brands in China.

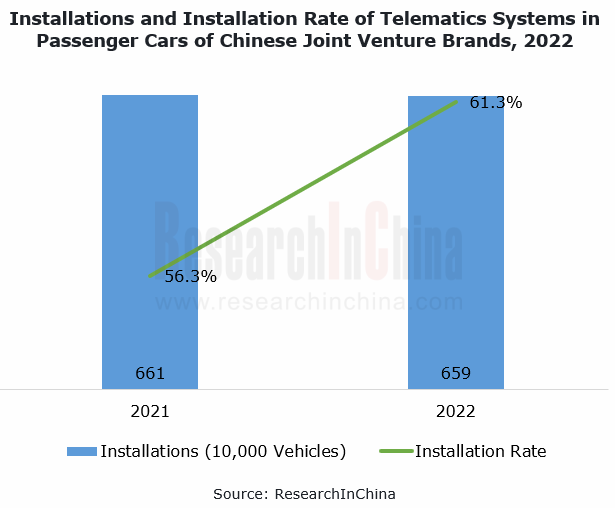

From January to December 2022, joint venture brands in China sold a total of 10.74 million passenger cars, a year-on-year decrease of 8.6%, of which 6.59 million units were equipped with telematics systems, with the installation rate up to 61.3%, 5 percentage points higher than in the previous year.

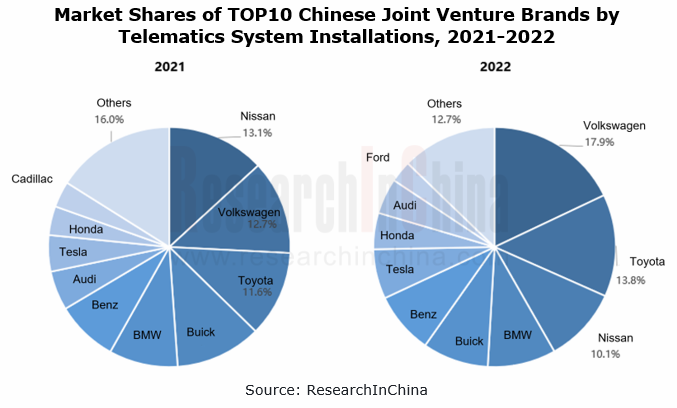

By brands and their telematics system installations in 2022, Volkswagen moved up to first position, with its market share increasing by 5.2 percentage points on an annual basis (Volkswagen sold 2.193 million new vehicles in 2022, down 8.1% year on year); Nissan fell to third, with its market share dropping by 3 percentage points (Nissan sold 802,000 new vehicles in 2022, down 23% year on year).

In 2022, the development of joint venture brands in telematics systems highlighted the following:

1. Cockpit hardware offer big improvements, and high-resolution integrated displays and rear entertainment screens become the norm.

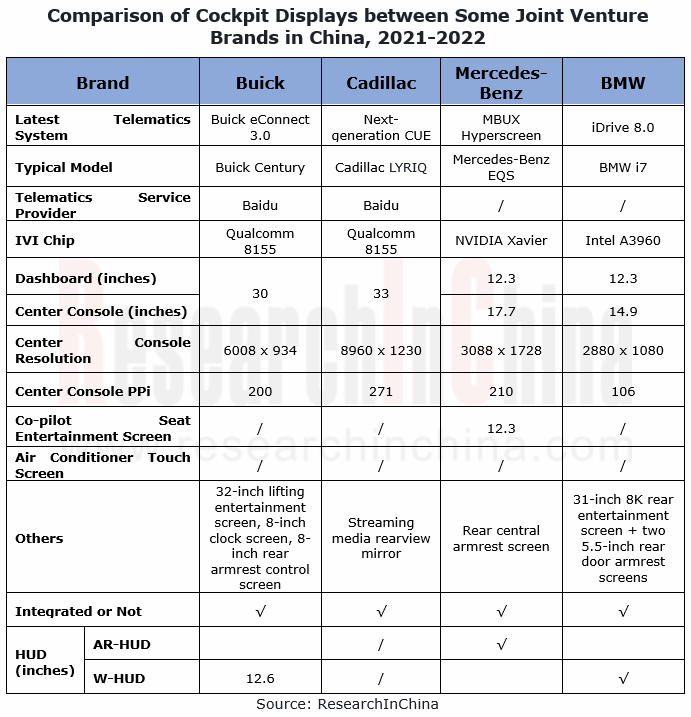

In 2022, the new models of joint venture brands offer big improvements in cockpit displays. Take GM and BMW as examples:

Buick and Cadillac under GM carry virtual cockpit systems (VCS). Buick Century is equipped with a 30-inch 6K curved display in the front row, and a 32-inch entertainment screen and two 8-inch armrest control screens in the rear row (both front and rear rows are equipped with a Qualcomm 8155 chip); Cadillac LYRIQ packs a 33-inch 9K curved display, with the PPI up to 271.

Buick and Cadillac under GM carry virtual cockpit systems (VCS). Buick Century is equipped with a 30-inch 6K curved display in the front row, and a 32-inch entertainment screen and two 8-inch armrest control screens in the rear row (both front and rear rows are equipped with a Qualcomm 8155 chip); Cadillac LYRIQ packs a 33-inch 9K curved display, with the PPI up to 271.

The front row of BMW i7 adopts a curved display that integrates the 12.3-inch dashboard and 14.9-inch center console screens, with the resolution of 2880*1080 and the PPI of 201. A 31-inch 8K entertainment screen is first introduced in the rear row, and can be controlled via the two 5.5-inch rear door screens on the left and right.

The front row of BMW i7 adopts a curved display that integrates the 12.3-inch dashboard and 14.9-inch center console screens, with the resolution of 2880*1080 and the PPI of 201. A 31-inch 8K entertainment screen is first introduced in the rear row, and can be controlled via the two 5.5-inch rear door screens on the left and right.

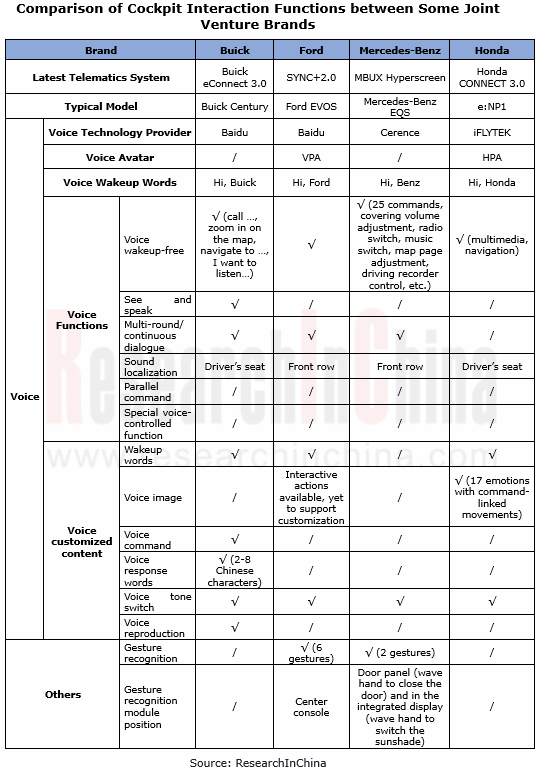

2. In cockpit interaction, voice interaction becomes a standard configuration, but few advanced functions are installed in vehicles.

In 2022, typical models of joint-venture brands came with voice interaction, but few of them bore advanced voice functions, such as “see and speak”, four-zone sound recognition, and sound reproduction. Among the 12 models in this report, only Buick Century is equipped with “see and speak” and voice reproduction features, and Nissan ARIYA supports four-zone sound recognition.

Toyota bZ3, to be launched in March 2023, is planned to be equipped with voice interaction functions from dual-zone sound recognition, wakeup-free, sound reproduction and scenario DIY to 20/30/60/120-second continuous dialogue and semantic interruption, which will be gradually upgraded and opened up later.

Compared to Chinese independent brands which have developed such functions as user-defined voice command, voice-controlled ADAS and external voice interaction, joint venture brands still have a long way to go in interaction modes. (see details in Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022)

3. In terms of ecosystem, Baidu Family Bucket (Baidu’s applications) has found massive application in vehicles, and Huawei and Tencent cooperate with more brands.

Among the 13 joint venture brands researched in this report, 8 brands cooperate with Baidu, of which Buick, Cadillac and Chevrolet under GM, Toyota and Hyundai choose to install Baidu Family Bucket. In addition, Tencent Aiquting, Tencent MINI Scenario and Huawei APP Store are gradually available to vehicles. For example, BMW i7 integrates Tencent Aiquting and Tencent MINI Scenario applications on its front row center console screen, and Huawei APP Store on its rear row entertainment screen.

In contrast, the cooperation of Alibaba Ecosystem with joint venture brands is being scaled down. Except for Amap, Tmall Genie falls short of expectations, losing its partner BMW in 2022 (in October 2022, BMW announced that starting from November 14, 2022, it will phase out Tmall Genie and related functions in its IVI system and My BMW APP).

Global and China Passenger Car T-Box Market Report, 2024

Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-B...

AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024

AI foundation models are booming. The launch of ChapGPT and SORA is shocking. Scientists and entrepreneurs at AI frontier point out that AI foundation models will rebuild all walks of life, especially...

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...

Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumpin...

Automotive AI Foundation Model Technology and Application Trends Report, 2023-2024

Since 2023 ever more vehicle models have begun to be connected with foundation models, and an increasing number of Tier1s have launched automotive foundation model solutions. Especially Tesla’s big pr...

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...