Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

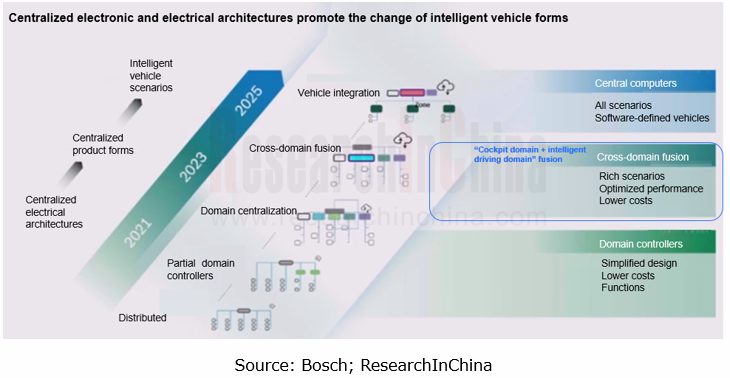

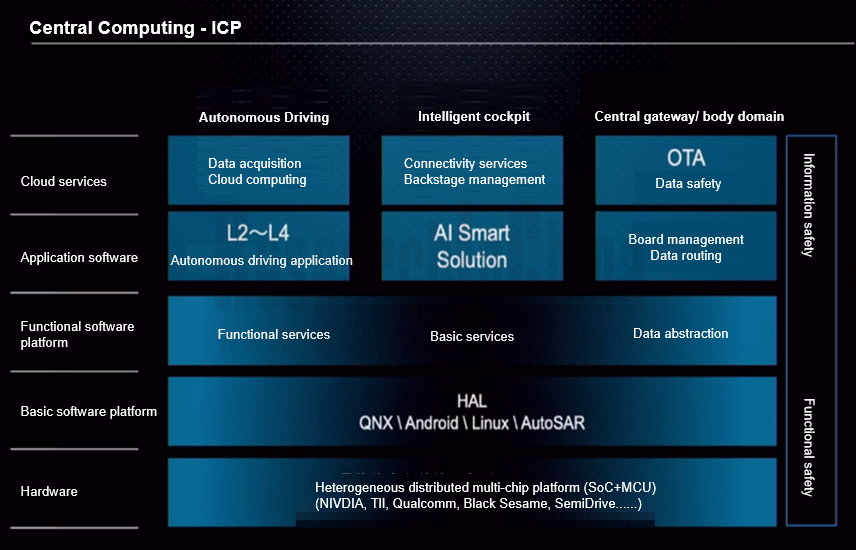

At present, automotive electronic and electrical architectures are evolving towards domain integration and central computing. Some functional domains (intelligent driving domain, cockpit domain, chassis domain, body domain, power domain, etc.) are being integrated, for example, body and chassis domain integration, and cockpit and intelligent driving domain integration.

Cockpit-driving integration refers to the integration of cockpit and intelligent driving domains into a high-performance computing unit that supports both intelligent driving and intelligent cockpit functions. It is an effective solution to reducing development cycle and vehicle cost.

Cockpit-driving integration falls into two types: multi-SoC integration, that is, cockpit and intelligent driving functions are deployed on different boards; single SoC integration, that is, the software and algorithms of cockpit and intelligent driving are all deployed on one board.

Based on a single SoC and with a hypervisor running on the chip, the real cockpit-driving integration divides different functional modules through the hypervisor to enable different security levels of secure cockpit and driving functions. Yet limited by architecture solutions, software and hardware technologies, supply chain and other factors, the cockpit-driving integration based on a single SoC is hard to come true in a short time.

2. How to facilitate cockpit-driving integration?

Given varying maturity and requirements of cockpit and intelligent driving technologies, cockpit-driving integration is iterating and being promoted in a gradual manner.

Zhao Jianhong, the vice president of product at EnjoyMove Technology, said that the company will prioritize cockpit-driving integrated solutions because of the demand from OEMs. At present, for parking solutions are relatively mature, and cockpit domain controllers offer sufficient computing power, integrating parking into cockpit domain controllers brings a cost advantage. Cockpit-parking integration signifies the first step of cockpit-driving integration, that is, cockpit-driving integration will be considered after the cockpit-parking integration technology matures.

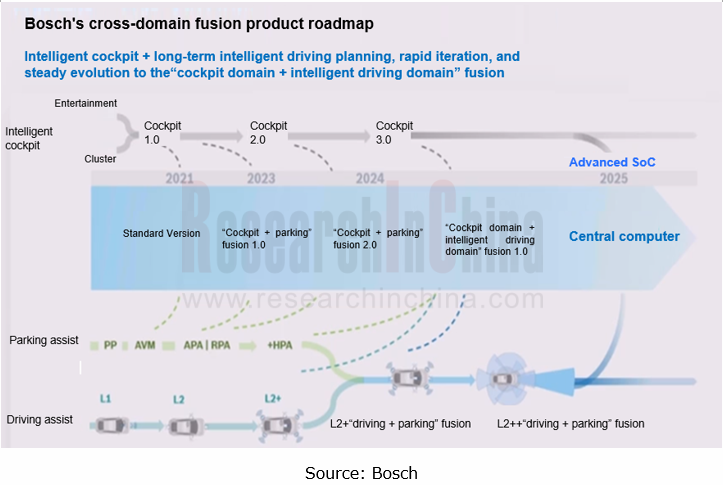

Bosch Group also plans to achieve cockpit-driving integration around 2024 after the implementation of the Cockpit-Parking Integration 1.0 (based on Qualcomm 8155) and Cockpit-Parking Integration 2.0 (based on Qualcomm 8295).

In the future, both the driving-parking integration (launched in 2022 on large scale) around intelligent driving, and the cockpit-parking integration (expected to be mass-produced in 2023) centering on the cockpit will eventually head towards the cockpit-driving integration expected to be spawned around 2025.

3. How companies deploy cockpit-driving integration?

Since 2022, cockpit-driving integration has become the focus of the industry, attracting entrants like Z-ONE, Neta Auto, Tesla, Desay SV, ThunderSoft and Continental.

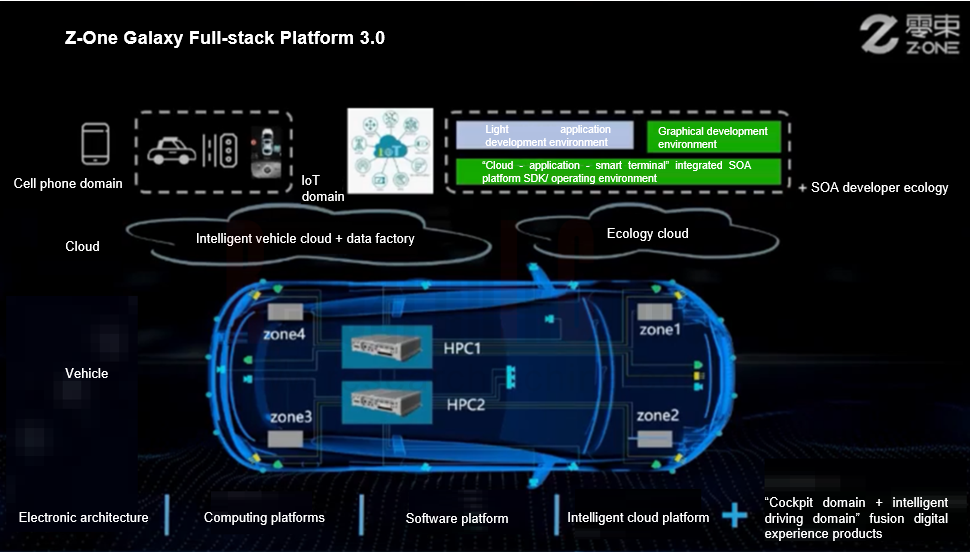

Z-ONE: the Galaxy Full-stack Solution 3.0 for smart cars was released in November 2022. It adopts central computing and zonal control, and is equipped with ZXD, a cockpit-driving integrated computing platform. It is scheduled to be mass-produced in 2025.

Features of ZXD:

The conventional domain framework is broke up for the layered design of "cloud platform + central brain + zone + intelligent sensing and execution" so as to realize software and hardware decoupling, and cross-domain integration.

The conventional domain framework is broke up for the layered design of "cloud platform + central brain + zone + intelligent sensing and execution" so as to realize software and hardware decoupling, and cross-domain integration.

Based on Chinese homemade chips, the AI compute up to 1,000 TOPS supports continuously simultaneous operation of multi-domain functions (e.g., autonomous driving and in-vehicle infotainment), independent calculation of cockpit and intelligent driving domains, and hard-core information encryption, as well as L4 and above autonomous driving, and high-resolution multi-screen display of intelligent cockpit.

Based on Chinese homemade chips, the AI compute up to 1,000 TOPS supports continuously simultaneous operation of multi-domain functions (e.g., autonomous driving and in-vehicle infotainment), independent calculation of cockpit and intelligent driving domains, and hard-core information encryption, as well as L4 and above autonomous driving, and high-resolution multi-screen display of intelligent cockpit.

The pre-installed intelligent vehicle operating system ZOS can realize "software and hardware synergy" with China’s local chips, offer standard uniform interfaces for software and hardware decoupling, and provide a unified development platform for cross-domain integration.

The pre-installed intelligent vehicle operating system ZOS can realize "software and hardware synergy" with China’s local chips, offer standard uniform interfaces for software and hardware decoupling, and provide a unified development platform for cross-domain integration.

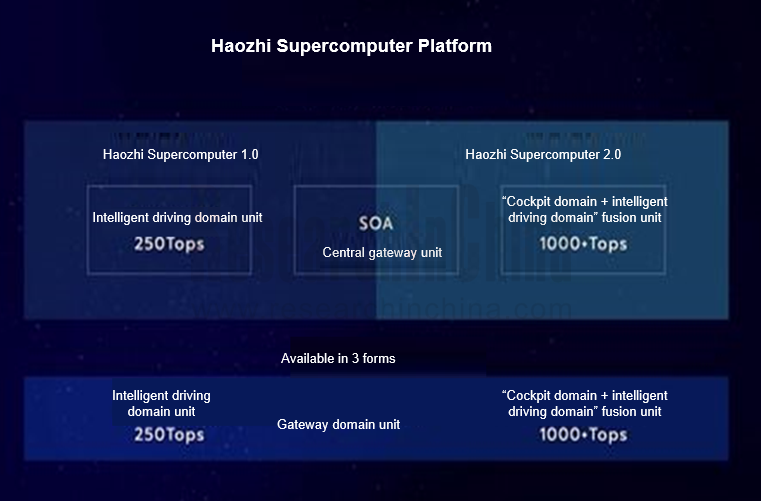

Neta Auto: the latest electronic and electrical architecture is a central computing architecture whose core is a supercomputing platform (including Haozhi Supercomputer 1.0 and Haozhi Supercomputer 2.0). With computing power up to 1,000 TOPS, it supports L4 autonomous driving integrated with intelligent driving and cockpit functions.

Haozhi Supercomputer 2.0 uses a "central + zonal" architecture composed of two boards: a cockpit-driving integration domain unit and an intelligent control unit. It will be applied to Neta S+/Shanhai Platform.

Desay SV: in April 2022, Desay SV unveiled "Aurora", an automotive intelligent computing platform. As a multi-SoC based cockpit-driving integrated solution, it realizes a leap from domain controllers to central computing platform, with the following features:

Hardware: supports mainstream heterogeneous SoCs with high computing power, such as NVIDIA Orin, Qualcomm SA8295, and Black Sesame Huashan A1000, and deliver total computing power of over 2,000 TOPS.

Hardware: supports mainstream heterogeneous SoCs with high computing power, such as NVIDIA Orin, Qualcomm SA8295, and Black Sesame Huashan A1000, and deliver total computing power of over 2,000 TOPS.

Function: integrate core functional domains such as intelligent cockpit domain, intelligent driving domain and connectivity services, to achieve cross-domain integration.

Function: integrate core functional domains such as intelligent cockpit domain, intelligent driving domain and connectivity services, to achieve cross-domain integration.

Structure: adopt a plug-in structure, and offer flexibly configured computing power to meet the requirements of models at varying prices.

Structure: adopt a plug-in structure, and offer flexibly configured computing power to meet the requirements of models at varying prices.

Most of the cockpit-driving integrated solutions of OEMs and Tier1 suppliers in China are based on multiple SoCs from Qualcomm, Nvidia and SemiDrive. The single SoC based solutions are still under development.

It is worth noting that NVIDIA and Qualcomm have successively released high-compute cockpit-driving integrated chips since 2022, providing strong support for application of single SoC solutions.

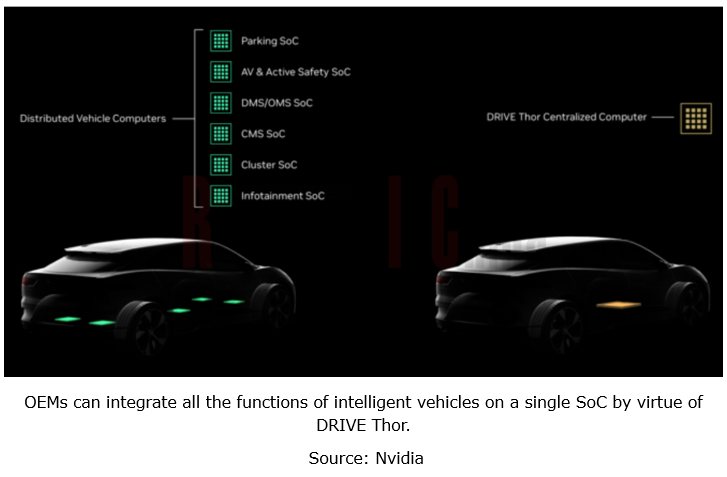

Nvidia: Nvidia announced DRIVE Thor, a superchip of epic proportions, in September 2022. With computing power of 2,000 TOPS, it is compatible with Linux, QNX and Android-based IVI systems, and supports cockpit-driving integration. Nvidia plans to put DRIVE Thor into production in 2024.

Nvidia DRIVE Thor will be installed in ZEEKR’s next-generation smart cars to be produced in early 2025. The latest news in March showed that Lenovo will also adopt Nvidia DRIVE Thor. According to Lenovo's plan, its cockpit-driving integrated controller will be launched during 2024-2025, with computing power of 1,000/2,000 TOPS.

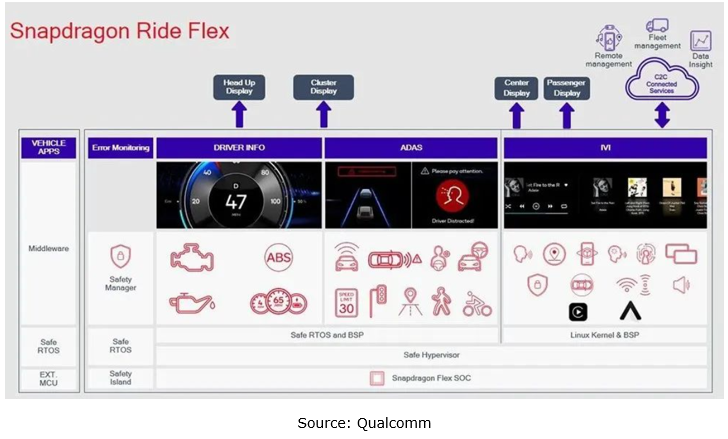

Qualcomm: in January 2023, Qualcomm launched the Snapdragon Ride Flex, the automotive industry’s first scalable family of SoCs to simultaneously support digital cockpits and ADAS. The expected start of production will begin in 2024.

The Snapdragon Ride Flex has three levels: Mid, High, and Premium. The AI compute of the single Premium SoC is above 600 TOPS. Combined with AI accelerators (probably NPUs or MAC arrays), it can support performance of up to 2,000 TOPS.

It is known that Volkswagen will adopt the Snapdragon Ride Flex to support single-chip multi-domain computing (covering driving assistance and intelligent cockpit). The Snapdragon Ride Flex will first land on the new-generation PPE-based Porsche Macan that will be launched in 2024.

Generally speaking, cockpit-driving integration is still in the exploration stage, facing quite a few problems and challenges in organizational structure, technology development and industrial chain coordination, for example: integration of high-compute chips; SOA-based software layered design, and cross-domain integration of operating systems and middleware; application of high-bandwidth, low-latency automotive Ethernet communication technology.

Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. I...

Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-compu...

Global and China Passenger Car T-Box Market Report, 2024

Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-B...

AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024

AI foundation models are booming. The launch of ChapGPT and SORA is shocking. Scientists and entrepreneurs at AI frontier point out that AI foundation models will rebuild all walks of life, especially...

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...

Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumpin...

Automotive AI Foundation Model Technology and Application Trends Report, 2023-2024

Since 2023 ever more vehicle models have begun to be connected with foundation models, and an increasing number of Tier1s have launched automotive foundation model solutions. Especially Tesla’s big pr...

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...