Intelligent cockpit platform research: the boundaries between vehicles and PCs are blurring, and there are several feasible paths for cockpit platforms.

Automotive Intelligent Cockpit Platform Research Report, 2023 released by ResearchInChina highlights the products and plans of 8 overseas and 11 Chinese cockpit platform suppliers, and the installation of cockpit platforms by more than 20 OEMs, and also explores some of key issues, such as:

Cockpit platform supply chains, development paths and strategies of dozens of mainstream Chinese independent automakers, joint venture automakers, and start-up automakers

Cockpit platform supply chains, development paths and strategies of dozens of mainstream Chinese independent automakers, joint venture automakers, and start-up automakers

In the trend for cockpit-driving integration, how cockpit platforms will develop?

In the trend for cockpit-driving integration, how cockpit platforms will develop?

What are the application scenarios of hypervisor and hardware isolation solution in cockpit platforms?

How China’s local cockpit platforms replace foreign ones?

How China’s local cockpit platforms replace foreign ones?

In the evolution of cockpit platforms, what is the status quo of integrated ADAS functions?

In the evolution of cockpit platforms, what is the status quo of integrated ADAS functions?

In the underlying SoC+MCU hardware architecture of cockpit platforms, will MCU be removed?

In the underlying SoC+MCU hardware architecture of cockpit platforms, will MCU be removed?

To meet market demand, players tend to make a multi-form layout of intelligent cockpit platform products.

In recent years, under the wave of vehicle intelligence, intelligent cockpits have enjoyed a boom. Intelligent cockpits, which are no longer a simple riding tool, play a more important role in scenarios that require comfort, entertainment and emotion. The integration of more functions in cockpit software will further facilitate iteration and upgrade of the underlying hardware platform of intelligent cockpits.

As new cockpit SoC products are rolled out, the underlying hardware platform of intelligent cockpits passes through four development phases in general, as follows:

The first phase is cockpit hardware platform products based on SoCs, e.g., NVIDIA Parker, NXP i.MX6 and TI J6, enabling the integration of basic functions of the dashboard and center console dual display;

The second phase is cockpit domain control hardware platforms based on SoCs, e.g., Qualcomm 820A, Intel Apollo Lake, NXP i.MX8 and Renesas R-CAR H3, enabling the single-chip dual-system integration using hypervisor virtualization technology, the introduction of Android-based IVI systems, and the integration of more screens;

The third phase is cockpit hardware platforms based on SoCs, e.g., Qualcomm 8155 and Samsung, and also a generation of domain control products currently produced in quantities, enabling the single-chip multi-system multi-screen control, and the integration of some ADAS functions including HUD, rear seat entertainment, air conditioning control, voice, and even surround view and DMS/OMS on the basis of original dashboard and IVI.

The fourth phase is new-generation cockpit hardware platform products based on higher performance SoCs, e.g., Qualcomm 8295 and AMD, enabling the integration and exploration of more functions such as 3D HMI, car games and cockpit-driving integration on the basis of the previous generation.

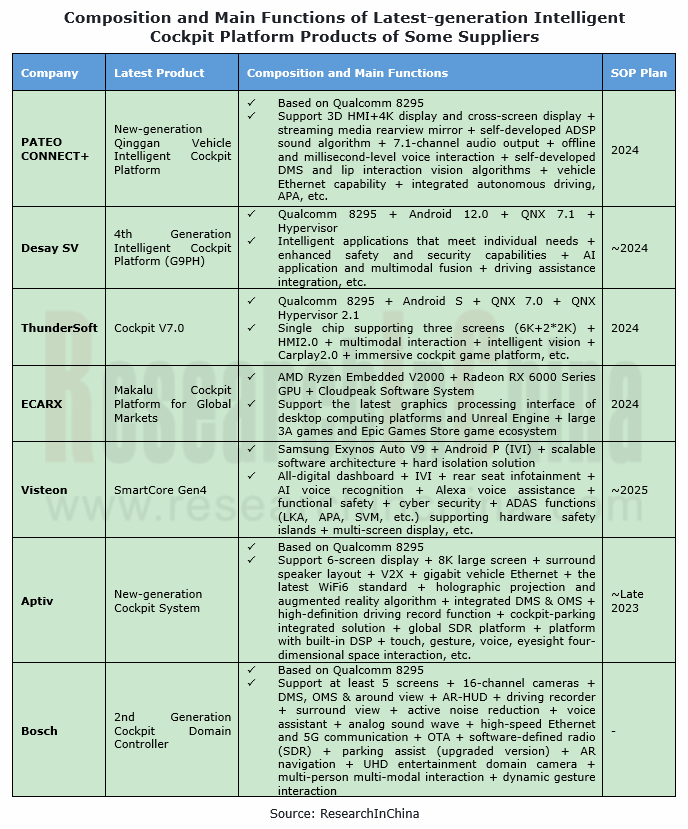

In the process, both foreign suppliers (e.g., Visteon, Aptiv, Bosch and Continental), and Chinese local suppliers (e.g., PATEO CONNECT+, Desay SV and Neusoft Group), play an active part in the cockpit disruption, pulling intelligent cockpit platforms to an ever higher level. In PATEO CONNECT+’s case, with years of technical expertise and product delivery experience, the company has launched a range of intelligent cockpit platform products based on multiple SoCs like NXP i.MX8QM, SemiDrive X9HP, MediaTek MT8666 and Qualcomm 8155, covering the cockpit systems of various mid-to-high-end models, and has had products mass-produced and installed in several models. PATEO is designing and developing new-generation Qualcomm 8295-based intelligent cockpit platforms which are expected to be mounted on related models in 2024.

The introduction of higher-compute cockpit SoC products enhances the performance of the underlying hardware of intelligent cockpit platforms, allowing software to integrate more functions, and enabling the integration of more human-computer interaction modes and more personalized experiences into vehicles, as well as some low-level ADAS functions (e.g., DMS, OMS, surround view and low-speed parking).

To meet the application requirements of intelligent cockpits, intelligent cockpit platforms develop in several typical forms.

One is to comply with EEA evolution. Supported by high-compute chips, intelligent cockpit platforms are heading in the direction of cross-domain integration on the basis of the improving core application functions of cockpit platforms. The typical products are Qualcomm 8295-based intelligent cockpit platforms. In terms of cross-domain application, Qualcomm’s next-generation intelligent cockpit solutions use the AI compute and multi-camera support capabilities of SA8295 for the integration of low-speed driving assistance and cockpit domain, so as to better support 360° surround view and smart parking functions.

For example, PATEO’s new-generation Qinggan Vehicle Intelligent Cockpit Platform is equipped with Qualcomm 8295, a 5nm intelligent cockpit chip with AI compute up to 30TOPS, supporting more powerful voice, map, and visual AI computing features. Compared with the previous generation, the performance of the main computing units like CPU and GPU is improved by more than 50%; the main line capability is increased by over 100%; the 3D rendering capability is increased by up to 3 times, supporting a higher-definition, smoother 3D HMI. The new-generation platform also allows for connection of more 4K high-definition large screens and real-time analysis of multi-channel video contents, and provides support for multi-domain integrated products and capabilities, bringing smoother driving experience.

Using the 8295 vehicle cockpit platform and the next-generation wireless communication technology (SparkLink), PATEO has started a vehicle intelligence layout that centers on intelligent vehicle lights, streaming media rearview mirrors, smart surface interiors and exteriors, OLED screens/special-shaped screens and integrates such modules as multi-level autonomous driving such as L2+ and automated parking.

Another form is to develop cockpit platforms focusing on cockpit entertainment functions and experiences. The typical products are intelligent cockpit platforms based on AMD chips. For example, in March 2023, ECARX introduced Makalu, its latest cockpit platform for global markets. Based on AMD Ryzen Embedded V2000 and Radeon RX 6000 Series GPU, the product with performance comparable to netbook computers supports the newest graphics processing interface of desktop computing platforms, and Unreal Engine, as well as 3D environment rendering and panoramic spatial audio, and also allows users to directly play 3A masterpieces and other games in cars.

In addition, to ensure the best cockpit performance experiences, there are also several car models carrying dual cockpit SoCs, including Li Auto L9, Li Auto L8 Max, Buick GL8 Century, Lotus Eletre and Lynk & Co 08. Wherein, Lotus Hyper OS, a cockpit system released by Lotus, uses two Qualcomm 8155 SoCs, and connects them via the high-speed interconnect interface. It adopts a unique computing power distribution technology to exploit the total computing power (210K DMIPS) and 32G storage of the dual chips, simultaneously supporting 5 cockpit screens, cool 3D desktop engines and applications.

In the EEA trend, players are working to explore the layout of cockpit-driving fused and even integrated products.

The combination of EEA evolution, high-compute chips, higher software development capabilities, and ever wider adoption of intelligent driving technology helps intelligent cockpits integrate more new functions. Cockpits begin to evolve from single domain to cross-domain integration, that is, first integrate the functions of some domains into a high-performance computing unit, then gradually aggregate more functional domains, and finally form a cockpit-driving integrated central computing mode.

Currently, a number of companies including PATEO CONNECT+, Desay SV, ThunderSoft, Joynext, Neusoft Group, Hangsheng Electronics, ECARX, EnjoyMove Technology, Technomous, UnlimitedAI, ZF, Bosch, Harman and Visteon have set about deploying cockpit-driving integrated central computing platforms by way of first promoting the integration between some vehicle domains and gradually evolving to fully centralized solutions.

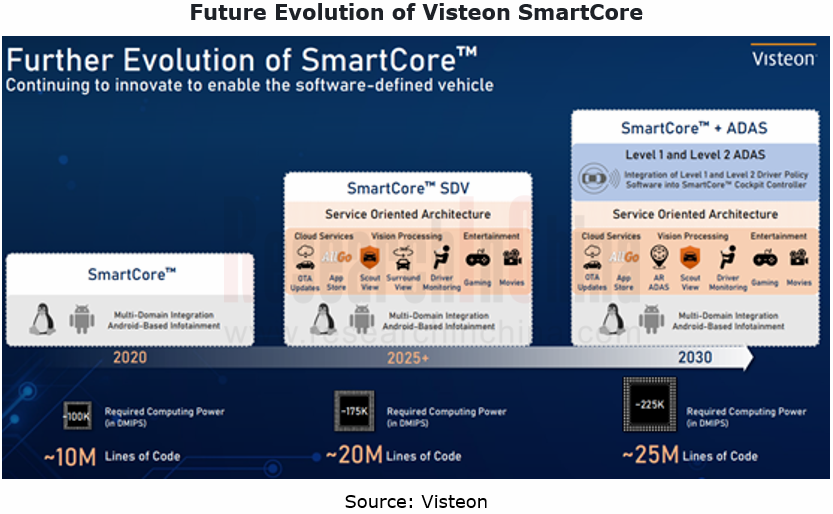

According to its latest plan, in 2025, Visteon will create SmartCore products based on service-oriented architecture (SOA) for software-defined vehicles, enabling multi-domain integration and supporting cloud services, visual processing (surround view, DMS), and game & entertainment; in 2030, Visteon SmartCore will be integrated with L1 and L2 ADAS functions, and at that time, Visteon will seamlessly integrate SmartCore with DriveCore through a set of HMI, and combine the cockpit electronics and autonomous driving domains closely as an intelligent cockpit solution.

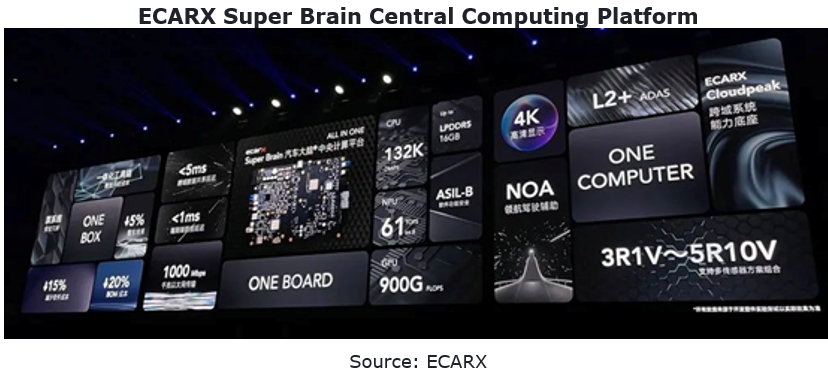

In March 2023, ECARX announced ECARX Super Brain, its first car brain product that integrates Longying No.1 and Black Sesame A1000 chips. This product combines vehicle control MCU and ultrahigh-speed inter-process communication to enable cockpit-driving integrated functions, and supports mainstream intelligent driving solutions (e.g., 3R1V, 5R6V and 5R10V, realizing NOA, etc.), meeting the needs of different vehicle models. Moreover, the product also decreases 5% wiring harnesses for lower vehicle complexity, and cuts down R&D cost by 15% and BOM cost by 20%.

In addition, at the software level, high-performance SoC products are the hardware foundation for cockpit-driving integration, and service-oriented architecture (SOA) is the software foundation, amid the development of central computing platforms like cross-domain integrated platforms. Quite a few companies have launched corresponding cross-domain integrated basic software products to seize the market opportunity.

Localized intelligent cockpit platform products are highly competitive.

Intelligent cockpit platforms play a crucial and decisive role in performance and structure of intelligent cockpit systems. The core components from cockpit chips to underlying operating systems are still dominated by foreign manufacturers, and China’s local products are still on the way to replacing them.

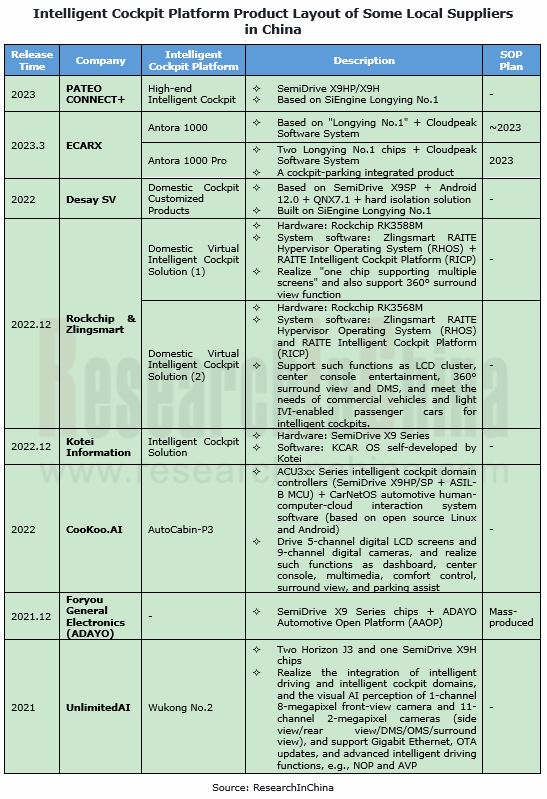

At present, in the context of faster localization of core components such as cockpit SoC and basic software in China, intelligent cockpit platform products have been deployed vigorously by key local intelligent cockpit suppliers including PATEO CONNECT+, Foryou Group, Kotei Information and Neusoft Group, all of which have announced their intelligent cockpit system solutions based on SemiDrive’s chips, with some spawned in 2022. SiEngine, which released the 7nm intelligent cockpit chip "Longying No.1" in late 2021, and ECARX have also inked strategic cooperation agreements with cockpit suppliers like PATEO CONNECT+, Desay SV, Neusoft and BDStar Intelligent & Connected Vehicle Technology (BICV), under which the mass production is expected to be achieved by the end of 2023.

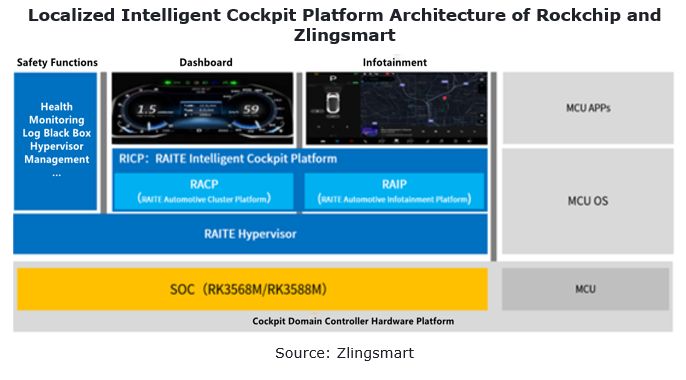

In December 2022, Rockchip and Zlingsmart jointly announced a fully localized solution. With the hardware based on the automotive cockpit chip RK3588M/RK3568M self-developed by Rockchip, and the system software running on RAITE Hypervisor Operating System (RHOS) and RAITE Intelligent Cockpit Platform (RICP) independently developed by Zlingsmart, the solution allows a single RK3588M chip to drive multiple screens including in-vehicle infotainment system, LCD instrument panel, electronic rearview mirror and rear row headrest screens, and also supports 360° surround view function, providing users with safe, reliable and all-scenario interaction experiences.

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2024 released by ResearchInChina systematically analyzes the iteration process of IVI systems of mainstream automakers in Chin...

Global and China Automotive Lighting System Research Report, 2023-2024

Installations of intelligent headlights and interior lighting systems made steady growth.

From 2019 to 2023, the installations of intelligent headlights and interior lighting systems grew steadily. I...

Automotive Display, Center Console and Cluster Industry Report, 2024

Automotive display has become a hotspot major automakers compete for to create personalized and differentiated vehicle models. To improve users' driving experience and meet their needs for human-compu...

Global and China Passenger Car T-Box Market Report, 2024

Global and China Passenger Car T-Box Market Report, 2024 combs and summarizes the overall global and Chinese passenger car T-Box markets and the status quo of independent, centralized, V2X, and 5G T-B...

AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024

AI foundation models are booming. The launch of ChapGPT and SORA is shocking. Scientists and entrepreneurs at AI frontier point out that AI foundation models will rebuild all walks of life, especially...

Analysis on Geely's Layout in Electrification, Connectivity, Intelligence and Sharing

Geely, one of the leading automotive groups in China, makes comprehensive layout in electrification, connectivity, intelligence and sharing.

Geely boasts more than ten brands. In 2023, it sold a tota...

48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units an...

Automotive Ultrasonic Radar and OEMs’ Parking Route Research Report, 2024

1. Over 220 million ultrasonic radars will be installed in 2028.

In recent years, the installations of ultrasonic radars in passenger cars in China surged, up to 121.955 million units in 2023, jumpin...

Automotive AI Foundation Model Technology and Application Trends Report, 2023-2024

Since 2023 ever more vehicle models have begun to be connected with foundation models, and an increasing number of Tier1s have launched automotive foundation model solutions. Especially Tesla’s big pr...

Qualcomm 8295 Based Cockpit Domain Controller Dismantling Analysis Report

ResearchInChina dismantled 8295-based cockpit domain controller of an electric sedan launched in December 2023, and produced the report SA8295P Series Based Cockpit Domain Controller Analysis and Dism...

Global and China Automotive Comfort System (Seating system, Air Conditioning System) Research Report, 2024

Automotive comfort systems include seating system, air conditioning system, soundproof system and chassis suspension to improve comfort of drivers and passengers. This report highlights seating system...

Automotive Memory Chip and Storage Industry Report, 2024

The global automotive memory chip market was worth USD4.76 billion in 2023, and it is expected to reach USD10.25 billion in 2028 boosted by high-level autonomous driving. The automotive storage market...

Automotive AUTOSAR Platform Research Report, 2024

AUTOSAR Platform research: the pace of spawning the domestic basic software + full-stack chip solutions quickens.

In the trend towards software-defined vehicles, AUTOSAR is evolving towards a more o...

China Passenger Car Electronic Control Suspension Industry Research Report, 2024

Research on Electronic Control Suspension: The assembly volume of Air Suspension increased by 113% year-on-year in 2023, and the magic carpet suspension of independent brands achieved a breakthrough

...

Global and China Hybrid Electric Vehicle (HEV) Research Report, 2023-2024

1. In 2025, the share of plug-in/extended-range hybrid electric passenger cars by sales in China is expected to rise to 40%.

In 2023, China sold 2.754 million plug-in/extended-range hybrid electric p...

L3/L4 Autonomous Driving and Startups Research Report, 2024

The favorable policies for the autonomous driving industry will speed up the commercialization of L3/L4.

In the second half of 2023, China introduced a range of policies concerning autonomous drivin...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024

At present, EEA is developing from the distributed type to domain centralization and cross-domain fusion. The trend for internal and external integration of domain controllers, especially the integrat...

Global and China Automotive Operating System (OS) Industry Report, 2023-2024

Chinese operating systems start to work hard In 2023, Chinese providers such as Huawei, Banma Zhixing, Xiaomi, and NIO made efforts in operating system market, launched different versions with competi...