In 2015, NXP acquired Freescale for USD11.8 billion, hereby becoming the largest automotive semiconductor vendor. Yet NXP's development progress has not always gone smoothly. In 2021, Infineon replaced NXP as the biggest automotive semiconductor vendor.

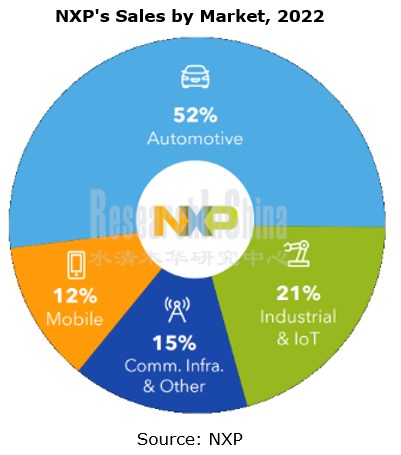

In 2022, NXP’s revenue jumped by 19.4% on the previous year to USD13.205 billion, 52% of which was from the Automotive; its net income hit USD2.833 billion, soaring by 48.6%. Despite a good growth, NXP was still positioned second in the industry.

NXP S32 Automotive Platform is designed for autonomous driving, involving the perception, decision and actuation. Among NXP's main ADAS chips, S32R is used for radars, S32A for L3~L5 CPUs, S32V for visual processing, S32G for automotive gateways, S32Z/S32E for real-time processing and power domain controller systems, and S32K for small domain controllers and small sub-nodes.

NXP once worked hard on S32V vision processor and BlueBox ADAS domain controller, but the result was not as expected. By contrast, it succeeded in S32R and S32G.

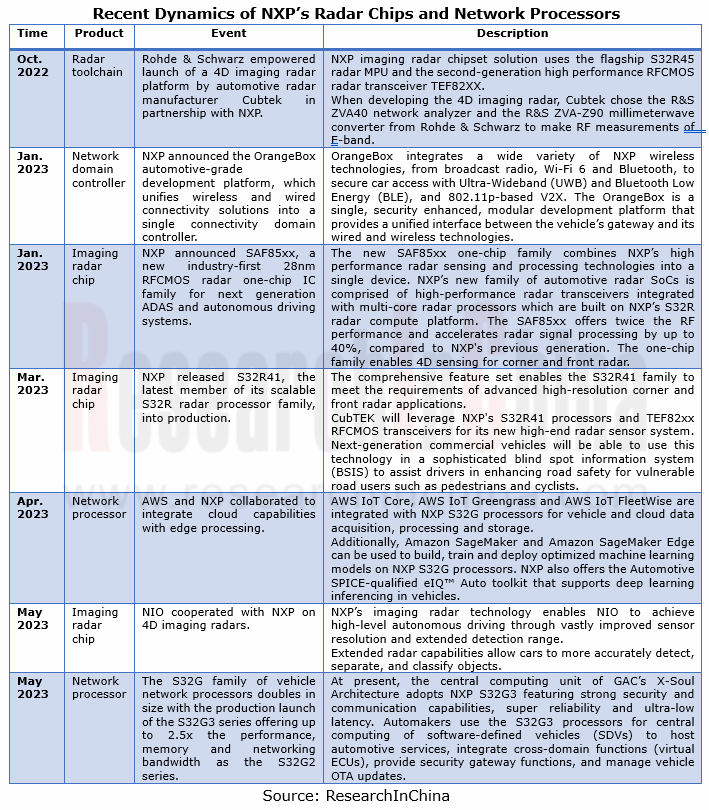

NXP has gambled on 4D imaging radar and network processor since 2022.

NXP has established a solid foothold in automotive radars for more than 20 years. By 2022, it had launched six generations of radar chips, and has transitioned to RFCMOS as early as the fourth generation. NXP has a leading position in the automotive radar market, offering radar technology to the top 20 automotive OEMs in the world.

In early 2022, NXP released the industry’s first dedicated 16nm imaging radar processor, the NXP S32R45, which is also the flagship of NXP’s 6th generation automotive radar chipset family. Additionally, the new NXP S32R41 was introduced to extend 4D imaging radar’s benefits to a much larger number of vehicles including high-end cars, vehicles used for mobility services, and mainstream passenger cars. Together these processors serve the L2+ through L5 autonomy sectors, enabling 4D imaging radar for 360-degree surround sensing.

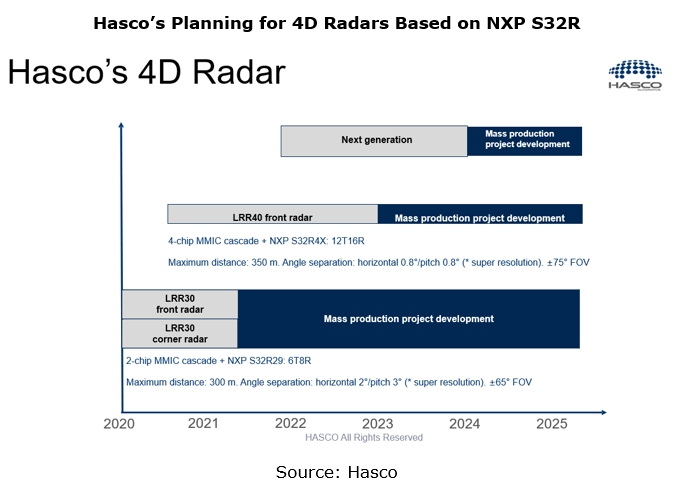

Radar developers such as Hawkeye and Hasco have developed 4D imaging radars based on NXP S32R45.

Based on NXP S32R45, Hasco has developed 4-chip cascaded imaging radar, with a detection range of 350 meters, 1° horizontal resolution, 2° pitch resolution and ±75° FOV, covering more blind spots. Hasco has a high expectation of the prospect that 4D radar will completely replace conventional ordinary radars in the future. LRR30, Hasco’s 4D radar, can output 1,024 4D point clouds and track up to 64 objects. It is one of the first imaging radar sensors to be production-ready in the market. The LRR40 being developed by Hasco can output up to 3,072 4D point clouds and track 128 objects.

The layout in vehicle intelligence in recent year reveals that NXP focuses on deploying radar chips and network processors.

NXP's Thinking on Intelligent Transformation of the Automotive Industry

NXP believes that the automotive industry is building a new triangle value chain. OEMs are mainly responsible for architecture definition and system integration. To this end, they need basic technologies and chip platforms from semiconductor companies, as well as hardware and software integration and software actuation provided by Tier 1 suppliers. NXP aims to gradually step in the triangle value chain as a technical partner. That is to say, a technology company like NXP should have a team that serves Tier 1 suppliers, and another team targeting OEMs. Therefore, in recent years, NXP has been increasing the number of system engineers and software engineers to enhance its complete system-level solutions. In terms of products, NXP is transforming into a chip supplier, that is, it is integrating more software on the basis of chips. NXP’s software engineers have outnumbered hardware engineers. NXP continues system-level investments, in a bid to deeply understand how the automotive architecture develops and evolves.

Obviously, other automotive chip vendors such as Horizon Robotics are following suit, making the chip toolchain and grouped algorithms as perfect as possible to reduce the chip introduction workload for OEMs and Tier1 suppliers.

The automotive industry is heading towards software-defined vehicles, and it requires brand-new automotive software development methods to handle ECU integration, data-driven automotive services, secure cloud connection and service-oriented architectures. Automakers and Tier1 suppliers are confronted with new challenges in multi-tenancy (one MPU supports multiple virtual MCUs), network management, cloud services, functional safety and advanced safety technology. This makes it extremely difficult for automakers and Tier1 suppliers to introduce automotive intelligent chips.

NXP’s S32G Vehicle Integration Platform (GoldVIP) provides a reference vehicle integration platform that accelerates S32G hardware evaluation, software development and rapid prototyping efforts. NXP helps address these challenges with GoldVIP’s pre-integrated software, including from partners Airbiquity, Amazon Web Services, Argus Cyber Security and Elektrobit.

GoldVIP has integrated the following software:

Airbiquity OTAmatic client (for OTA updates)

AWS IoT Greengrass V2 edge runtime (for secure cloud services)

Elektrobit tresos AUTOSAR Classic Platform

Argus Cyber Security Intrusion Detection and Prevention System

Related Reports:

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

NXP’s Intelligence Business Analysis Report, 2022-2023

Jingwei Hirain’s Automotive and Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Cockpit Business Analysis Report, 2022-2023

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Baidu’s Intelligent Driving Business Analysis Report, 2022-2023

Aptiv’s Intelligent Driving Business Analysis Report, 2022-2023

ZF’s Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Driving Business Analysis Report, 2022-2023

Bosch’s Intelligent Driving Business Analysis Report, 2022-2023

Horizon Robotics’ Business and Products Analysis Report, 2022-2023

Desay SV’s Intelligent Driving Business Analysis Report, 2022-2023

Renesas Electronics’ Automotive Business Analysis Report, 2023

Infineon’s Intelligent Vehicle Business Analysis Report

Haomo.AI’s Intelligent Driving Business Analysis Report

SenseTime’s Intelligent Vehicle Business Analysis Report

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...

C-V2X and CVIS Industry Research Report, 2024

C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entere...

Automotive Intelligent Cockpit Platform Configuration Strategy and Industry Research Report, 2024

According to the evolution trends and functions, the cockpit platform has gradually evolved into technical paths such as cockpit-only, cockpit integrated with other domains, cockpit-parking integratio...

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing,2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business...

Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (H...

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Because of burning money and suffering a huge loss, many people thought NIO would soon go out of business. NI...

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens. LiDARs were installed in 173,000 passenger cars in China in Q1 2024...

Autonomous Driving Simulation Industry Report, 2024

Autonomous Driving Simulation Research: Three Trends of Simulation Favoring the Implementation of High-level Intelligent Driving.

On November 17, 2023, the Ministry of Industry and Information Techno...

Mobile Charging Robot Research Report, 2024

Research on mobile charging robot: more than 20 companies have come in and have implemented in three major scenarios.

Mobile Charging Robot Research Report, 2024 released by ResearchInChina highlight...

End-to-end Autonomous Driving (E2E AD) Research Report, 2024

End-to-end Autonomous Driving Research: status quo of End-to-end (E2E) autonomous driving

1. Status quo of end-to-end solutions in ChinaAn end-to-end autonomous driving system refers to direct mappi...