Despite the chip shortage and the sluggish economy, Bosch’s sales from all business divisions bucked the trend in 2022. Wherein, the Mobility Solutions, still the company’s biggest division, sold EUR52.6 billion, jumping by 16% (12% adjusted for exchange-rate effects) on the previous year.

In the first quarter of 2023, Mobility Solutions saw its sales rise by 3.5% from the prior-year period, and performed very well in North America where it recorded an 18% growth; in Europe as well, the company enjoyed a 7.7% increase.

Adjust the product structure and organizational structure in due time, and lay out "software-defined vehicles"

Bosch’s outstanding performance is owned to its timely strategy adjustment. In 2019, Bosch’s Car Multimedia Division cut off conventional products such as T-boxes, head units and clusters and turned to intelligent cockpits. In July 2019, Bosch Digital Cabin (Shanghai) R&D Center under Bosch Car Multimedia was put into use in Zhangjiang, Pudong District. This facility concentrates on R&D of intelligent cockpit products.

To follow the development trend for electrification, connectivity, intelligence and sharing, in early 2021 Bosch reshaped the organizational structure of its automotive business and set up XC Division, its brand-new division with businesses covering intelligent driving, intelligent cockpits and intelligent connectivity. Headquartered in Suzhou with R&D centers in Suzhou and Zhangjiang of Shanghai (Bosch Digital Cabin (Shanghai) R&D Center), XC China puts focus on autonomous driving, infotainment and body intelligent control domains.

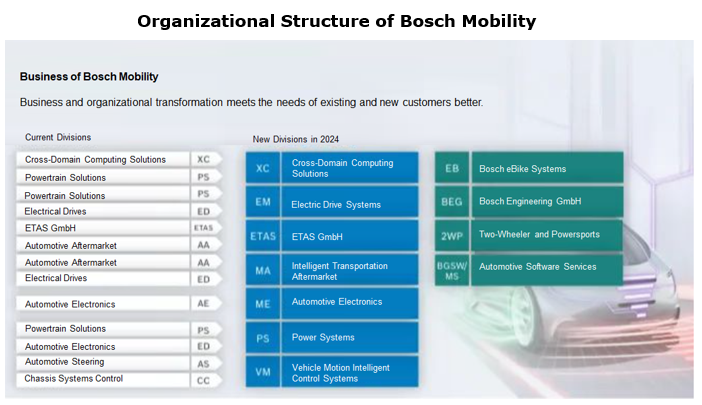

In May 2023, Bosch announced another realignment of its global Mobility business, which will be known as Bosch Mobility. Bosch Mobility will operate its business independently as a subsidiary of Bosch Group. This adjustment further enriches the functions of Bosch’s XC Division established in 2021. XC Division will develop and provide solutions from automated parking to autonomous driving.

It is reported that more than 50% of R&D personnel in Bosch Mobility are engaged in software development. In the drastic reform, Bosch places an unprecedented premium on "software-defined vehicles" so that it not only speeds up the development of software, but also enables software and hardware coupling in development.

Continuous efforts on cockpit domain controllers and cockpit-driving integrated solutions

Cockpit domain controllers

With the higher functional requirements of users, ever more ECUs are used in the automotive entertainment domain. The integration of multiple ECUs into a cockpit domain controller helps to reduce vehicle cost, wirings and weight, simplify software development and shorten vehicle integration verification cycle, so as to achieve better OTA capabilities.

In 2020, Bosch launched Autosee 2.0, a Qualcomm 8155-based cockpit domain controller platform which integrates multiple operating systems and can simultaneously support multiple displays including cluster, center console, copilot seat entertainment, HUD, air conditioner and rear row screens. This platform also integrates driver and occupant monitoring system (DOMS), around view monitor (AVM), face recognition (Face ID), multi-microphone input, active noise reduction and other functions. This 8155-based cockpit domain controller platform has been ordered by several automakers like Great Wall Motor, GAC Trumpchi, GAC Aion, Chery, Geely, Changan and Cadillac.

At the Auto Shanghai in April, 2023, Bosch and Autolink World jointly released an intelligent cockpit solution based on Qualcomm 8295 with 5nm process. It supports the cross-domain function of "cockpit-parking integration".

Cockpit-driving integration

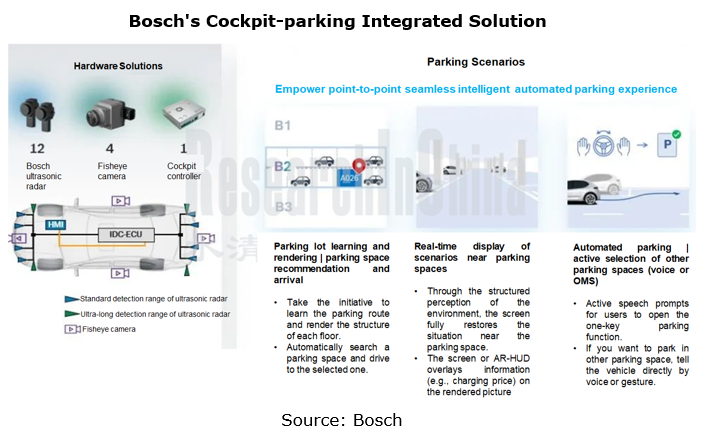

Bosch's cockpit-driving integration technology development path spans through Cockpit-parking Integration 1.0, Cockpit-parking Integration 2.0, Cockpit-driving Integration 1.0 and Central Computer.

Bosch unveiled its cockpit-parking integrated demo solution in November 2022. This solution is a combination of a surround view camera, 12 ultrasonic sensors, SOC integrated with parking algorithms, and MCU for functional safety control, thus enabling cockpit-parking integration. According to its plan, Bosch will launch the Cockpit-parking Integration 1.0 (cockpit + APA + RPA) this year and Cockpit-parking Integration 2.0 next year.

Erase uncertainties in AI with SOTIF

Bosch believes that the challenge to cockpit-driving integration lies in software platforms for software and hardware decoupling, chip decoupling algorithms and AI security.

Given diversified cockpit chips and uncertain chip supply, general software platforms need to be used to deal with all uncertainties. This is the benefit offered by software and hardware decoupling. Bosch has achieved chip algorithm decoupling in the parking field, and is working on the decoupling of chips and cockpit-driving integration algorithms.

In general, ASIL can't evaluate the reliability of AI technology due to the uncertainties of AI technology. Bosch is therefore trying to solve this problem by introducing the safety of the intended functionality (SOTIF) solutions, for example, assess the security of the trained algorithms according to the coverage of training datasets.

Related Reports:

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

NXP’s Intelligence Business Analysis Report, 2022-2023

Jingwei Hirain’s Automotive and Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Cockpit Business Analysis Report, 2022-2023

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Baidu’s Intelligent Driving Business Analysis Report, 2022-2023

Aptiv’s Intelligent Driving Business Analysis Report, 2022-2023

ZF’s Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Driving Business Analysis Report, 2022-2023

Bosch’s Intelligent Driving Business Analysis Report, 2022-2023

Horizon Robotics’ Business and Products Analysis Report, 2022-2023

Desay SV’s Intelligent Driving Business Analysis Report, 2022-2023

Renesas Electronics’ Automotive Business Analysis Report, 2023

Infineon’s Intelligent Vehicle Business Analysis Report

Haomo.AI’s Intelligent Driving Business Analysis Report

SenseTime’s Intelligent Vehicle Business Analysis Report

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...

China Passenger Car HUD Industry Report, 2024

HUD research: AR-HUD accounted for 21.1%; LBS and optical waveguide solutions are about to be mass-produced. The automotive head-up display system (HUD) uses the principle of optics to display s...

Ecological Domain and Automotive Hardware Expansion Research Report, 2024

Automotive Ecological Domain Research: How Will OEM Ecology and Peripheral Hardware Develop? Ecological Domain and Automotive Hardware Expansion Research Report, 2024 released by ResearchInChina ...

C-V2X and CVIS Industry Research Report, 2024

C-V2X and CVIS Research: In 2023, the OEM scale will exceed 270,000 units, and large-scale verification will start.The pilot application of "vehicle-road-cloud integration” commenced, and C-V2X entere...

Automotive Intelligent Cockpit Platform Configuration Strategy and Industry Research Report, 2024

According to the evolution trends and functions, the cockpit platform has gradually evolved into technical paths such as cockpit-only, cockpit integrated with other domains, cockpit-parking integratio...

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing,2023-2024

Analysis on Huawei's Electrification, Connectivity, Intelligence and Sharing: Comprehensive layout in eight major fields and upgrade of Huawei Smart Selection

The “Huawei Intelligent Driving Business...

Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Li Auto overestimates the BEV market trend and returns to intensive cultivation.

In the MPV market, Denza D9 DM-i with the highest sales (8,030 units) in January 2024 is a hybrid electric vehicle (H...

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Analysis on NIO’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2023

Because of burning money and suffering a huge loss, many people thought NIO would soon go out of business. NI...

Monthly Monitoring Report on China Automotive Sensor Technology and Data Trends (Issue 3, 2024)

Insight into intelligent driving sensors: “Chip-based” reduces costs, and the pace of installing 3-LiDAR solutions in cars quickens. LiDARs were installed in 173,000 passenger cars in China in Q1 2024...

Autonomous Driving Simulation Industry Report, 2024

Autonomous Driving Simulation Research: Three Trends of Simulation Favoring the Implementation of High-level Intelligent Driving.

On November 17, 2023, the Ministry of Industry and Information Techno...

Mobile Charging Robot Research Report, 2024

Research on mobile charging robot: more than 20 companies have come in and have implemented in three major scenarios.

Mobile Charging Robot Research Report, 2024 released by ResearchInChina highlight...

End-to-end Autonomous Driving (E2E AD) Research Report, 2024

End-to-end Autonomous Driving Research: status quo of End-to-end (E2E) autonomous driving

1. Status quo of end-to-end solutions in ChinaAn end-to-end autonomous driving system refers to direct mappi...

Monthly Monitoring Report on China Automotive Intelligent Driving Technology and Data Trends (Issue 2, 2024)

Insight into intelligent driving: ECARX self-develops intelligent driving chips, and L2.5 installation soared by 175% year on year.

Based on the 2023 version, the 2024 version of Monthly...