Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended-range + high-voltage battery-electric” route of in 2023.

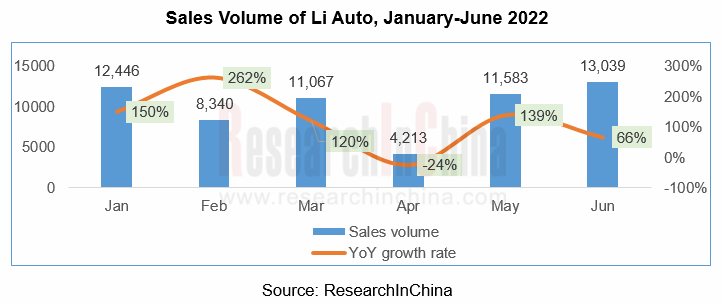

In the first half of 2022, Li Auto sold 60,801 vehicles, up 99.1% year-on-year. In terms of models, Li ONE still played a main role in the first half of the year. With the launch of L8 in September 2022, Li ONE will be gradually withdrawn from the production line, while L8, L7 and L9 will be the focus of production and marketing in the future.

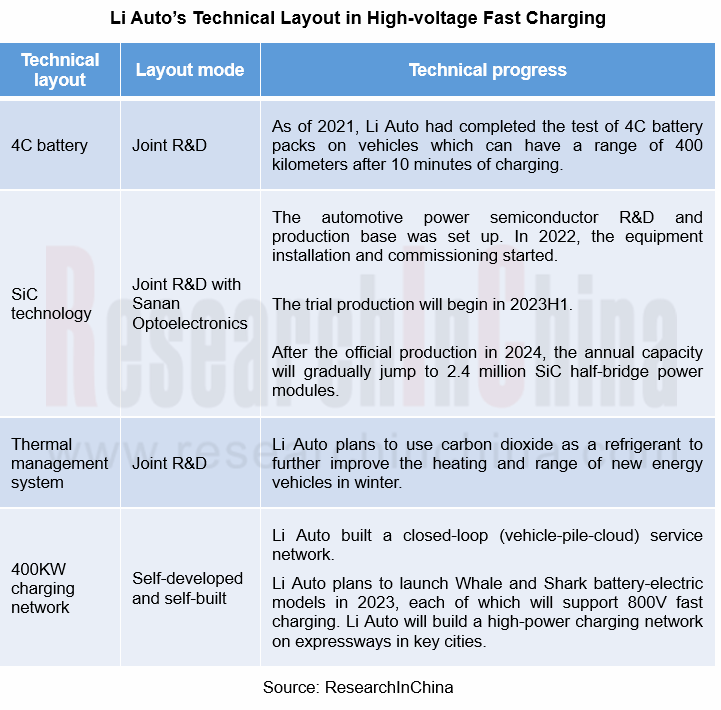

As for product planning, all the models currently being sold by Li Auto are extended-range electric vehicles. However, Li Auto plans to launch at least two high-voltage battery-electric vehicles every year from 2023 onward. For the purpose of high-voltage super-fast charging, Li Auto deploys the following four aspects: First, 4C batteries. Second, application of SiC technology. Third, thermal management system. Fourth, 400KW charging network.

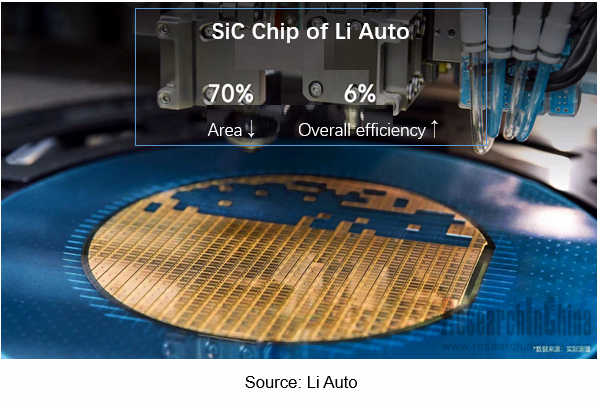

According to its plan, Li Auto will produce the third-generation semiconductor SiC power chip in 2024. At the same current of the high-voltage platform, this chip is 70% smaller than an IGBT chip, with the comprehensive efficiency being improved by 6%. The layout of Li Auto’s 800V high-voltage battery-electric technology reveals that one of the selling points of new cars in the future will be reflected in the charging speed.

Li Auto has self-developed AEB and NOA and laid out autonomous driving chips to progress on intelligent driving

As for the progress of intelligent driving, Li Auto has developed AEB system by itself as a "latecomer". In the future, Li Auto will provide all open source codes of its AEB system to improve traffic safety.

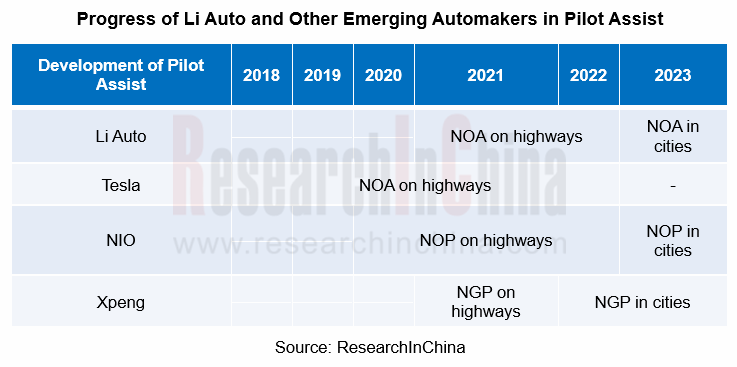

In addition, Li Auto added NOA to 2021 Li ONE in December 2021, improved the performance of AEB, and optimize the detection and fusion of cameras and radar. Since 2022, all new cars have been equipped with Li Auto’s self-developed hardware compatible with L4 autonomous driving as standard. Li Auto plans to make urban NGP functions available in Li L9 through OTA in 2023, and install L4 autonomous driving capability on production vehicles via OTA around 2024.

Regarding the core underlying technology layout of intelligent driving, Li Auto established Sichuan Lixiang Intelligent Technology Co., Ltd. in May 2022 to design chips. In August 2022, Xie Yan, the former vice president of Huawei Software, joined Li Auto as the head of system R&D division. The system R&D division is mainly responsible for R&D of some underlying intelligent technologies, including Li Auto's self-developed operating system and computing platform. Li Auto's computing platform business also includes its self-developed intelligent driving chip project.

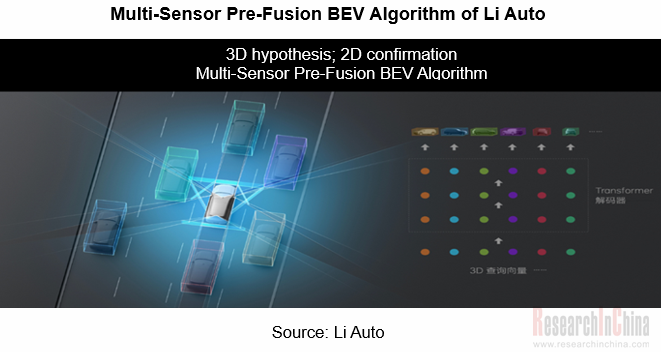

For the intelligent driving algorithm, Li Auto uses BEV framework similar to that of Tesla, that is, it utilizes pure vision for motion perception prediction. On the basis of BEV visual information, Li Auto exploits additional LiDAR and HD map information input to implement the BEV fusion algorithm, and adds a visual security module and a LiDAR security module which are redundant with BEV framework model for the sake of an extra layer of protection.

The cockpit of Li Auto upgrades from 2D interaction to 3D interaction.

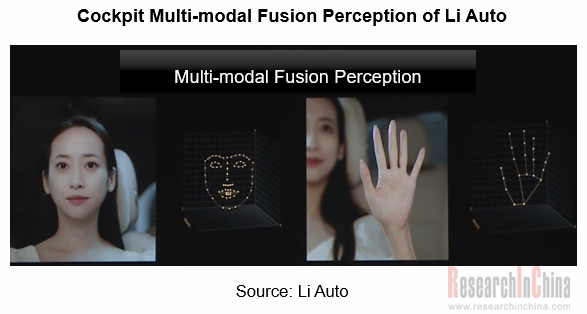

The cockpit multi-modal interaction represents development trend of human-machine co-driving era. As per three new cars launched in 2022, Li Auto upgrades the past four-screen 2D interaction in Li ONE to current five-screen 3D interaction, and realizes “voice+gesture” multi-modal interaction.

For example, the five screens of Li L9 include a safe driving interactive screen, a W-HUD with a projected area of 13.35 inches, a 15.7-inch integrated center console screen and co-driver screen, and a 15.7-inch rear entertainment screen. The in-vehicle 3D ToF sensor perceives the cockpit environment in real time. Plus, 6 microphones, 7.3.4 panoramic sound layout, 5G dual-operator automotive communication network, and multi-modal spatial interaction technology developed by Li Auto based on deep learning enable the three-dimensional interaction in the cockpit.

In terms of perception, Li AI, the intelligent cockpit space, imitates the coordination of human ears and eyes to attain the three-dimensional information perception inside the vehicle under the influence of multi-modal attention technology by a distributed hexasilicon microphone, an IR 3D ToF sensor, MIMO-Net six-vocal-range enhancement network and MVS-Net multinocular & multi-view visual fusion network.

As for understanding and expression, Li AI restores the multi-source heterogeneous data sensed by fusion perception to concrete events in the network, and fulfills further abstract understanding. Ultimately, knowledge linking, knowledge completion and logical reasoning form an event graph, allowing machines to have their own understanding and decision-making capabilities.

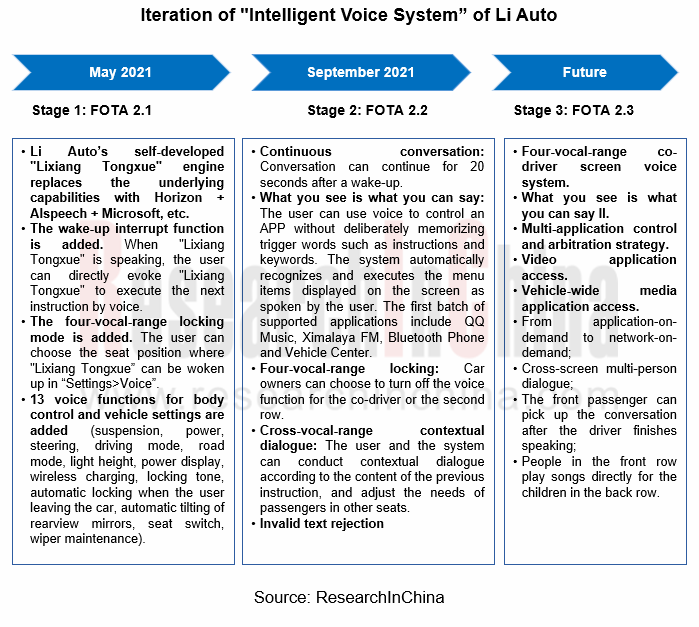

Regarding voice technology, Li Auto defines its voice assistant "Lixiang Tongxue" as the user's housekeeper (current stage) and family (future goal), and plans a three-stage product upgrade. At present, the goals of the first two stages have been achieved through OTA: The first stage: Li Auto’s self-developed "Lixiang Tongxue" engine replaces the underlying capabilities with Horizon + AIspeech + Microsoft, etc.

The second stage: "what you see is what you can say", four-vocal-range locking and other functions.

In the future, the voice system will offer functions such as "from application-on-demand to network-on-demand", cross-screen multi-person dialogue, and "the front passenger can pick up the conversation after the driver finishes speaking".

Passenger Car Radar Industry, 2022-2023

Passenger Car Radar Industry Research in 2023:?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;?Driven by multiple factors such as driving-parking integration, NOA and L3, 5...

Automotive Audio System Industry Report, 2023

Technology development: personalized sound field technology iteration accelerates

From automotive radio to “host + amplifier + speaker + AVAS” mode, automotive audio system has passed through several...

China Intelligent Door Market Research Report, 2023

China Intelligent Door Market Research Report, 2023 released by ResearchInChina analyzes and studies the features, market status, OEMs’ layout, suppliers’ layout, and development trends of intelligent...

Automotive Infrared Night Vision System Research Report, 2023

According to the data from ResearchInChina, during 2022-2023, the installations of NVS (night vision system) in new passenger cars in China went up at first and then down. From January to July 2022, t...

New Energy Vehicle Electric Drive and Power Domain Industry Report, 2023

Electric drive and power domain research: electric drive assembly evolves to integration and domain control

To follow the development trend for electrified and lightweight vehicles, new energy vehic...

Automotive Software Business Models and Suppliers’ Layout Research Report, 2023

From the layout of automotive software products and solutions, it can be seen that intelligent vehicle software business models include IP, solutions and technical services, which are mainly charged i...

Automotive LiDAR Industry Report, 2023

In August 2021, Waymo discontinued its commercial LiDAR business.

In October 2022, Ibeo declared bankruptcy; in November, two listed companies, Velodyne and Ouster, confirmed their merger; and in Dec...

Automotive Power Supply (OBC+DC/DC+PDU) and Integrated Circuits (IC) Industry Report, 2023

Automotive power supply and IC: Chinese chips are promising in the evolution from physical integration to system integration

As the core component of a new energy vehicle, automotive power supply is ...

OEMs’ Model Planning Research Report, 2023-2025

OEMs’ Model Planning Research Report, 2023-2025, released by ResearchInChina, combs through model planning and features of Chinese independent brands, emerging carmakers, and joint venture brands in t...

Leading Foreign OEMs’ADAS and Autonomous Driving Report, 2023

Global automakers evolve to software-defined vehicles by upgrading EEAs.

Centralized electronic/electrical architectures (EEA) act as the hardware foundation to realize software-defined vehicles. At ...

Automotive AI Algorithm and Foundation Model Application Research Report, 2023

Large AI model research: NOA and foundation model facilitate a disruption in the ADAS industry.

Recently some events upset OEMs and small- and medium-sized ADAS companies, as the autonomous driving i...

Intelligent Cockpit Domain Controller and SoC Market Analysis Report, 2023Q2

Cockpit domain controller and chip in 2023Q2: by intelligent cockpit level, L1 surged by 105% on a like-on-like basis, and L2 soared by 171%.On May 17, 2023, the “White Paper on Automotive Intelligent...

Intelligent Vehicle E/E Architecture Research Report, 2023

E/E Architecture Research: How will the zonal EEA evolve and materialize from the perspective of supply chain deployment?Through the lens of development trends, automotive EEA (Electronic/electrical A...

China Passenger Car Brake-by-wire Industry Report, 2023

Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passe...

Smart Car OTA Industry Report, 2023

Vehicle OTA Research: OTA functions tend to cover a full life cycle and feature SOA and central supercomputing.In the trend for software-defined vehicles, OTA installations are surging, and software i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2023

Multi-domain computing research: in the coming first year of cross-domain fusion, major suppliers will quicken their pace of launching new solutions.

As vehicle intelligence develops, electrical/ele...

Automotive Head-up Display (HUD) Industry Report, 2023

Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of s...

Automotive Cloud Service Platform Industry Report, 2023

Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of v...