Passenger car brake-by-wire research: One-box solution takes an over 50% share.

China Passenger Car Brake-by-wire Industry Report, 2023 released by ResearchInChina combs through and summarizes passenger car brake-by-wire market size, installation of OEMs, and product layout of suppliers.

Brake-by-wire can’t develop without vehicle electrification and intelligence. From the perspective of electrification, brake-by-wire uses electronic boosters to solve the problem of lacking vacuum power sources in new energy vehicles, and enables wheel braking energy recovery through motors to improve vehicle cruising range; in terms of intelligence, as the core module for actuation in the "perception, decision, and actuation" link, brake-by-wire system is the basis for realizing advanced intelligent driving.

At present, emerging car brands like NIO, Li Auto and Xpeng have provided brake-by-wire as a standard configuration (from January to June 2023, the installation rate of brake-by-wire in new energy vehicles was higher than 60%). The installations of brake-by-wire in fuel-powered vehicles increase as well, and TANK 300/500, Tiggo 7/8, Tiggo 7 Plus/8 Plus, Cadillac XT4/5/6, and Cadillac CT4/5/6 among others are all equipped. We predict that in 2025, China's brake-by-wire market will be valued at more than RMB16 billion.

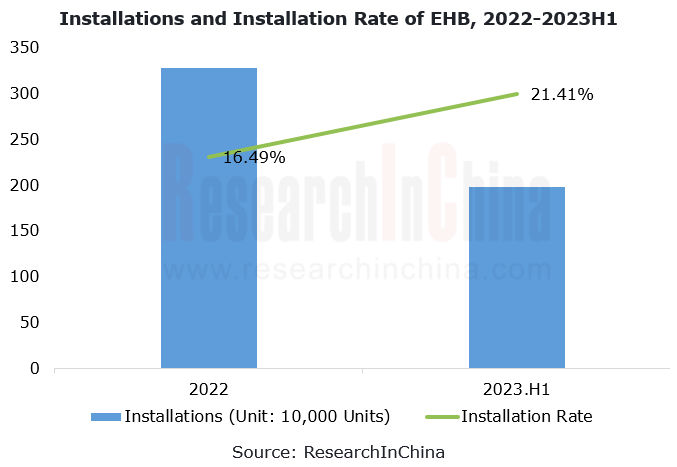

In data’s term, from January to June 2023, the installations of electro-hydraulic brake (EHB) approached 2 million units, a like-on-like jump of 59%; the installation rate exceeded 21%, up 4.92 percentage points compared to the whole year of 2022.

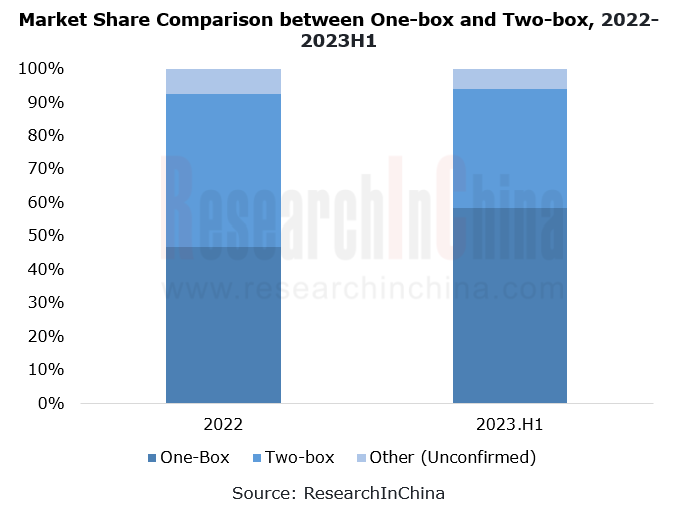

1. One-box has become mainstream among EHB solutions.

In 2022, among EHB solutions One-box boasted a market share 0.66 percentage points higher than Two-box. From January to June 2023, the gap widened to 23.05 percentage points, as the market share of One-box surpassed 50%.

2. In 2023, the products of Chinese and foreign suppliers have been iterated to One-Box solutions.

Compared with Two-box, One-Box integrates ESC, features high integration, light weight and low cost, and supports expansion of multifunctional parking and autonomous driving, meeting the redundancy requirements of autonomous driving.

Bosch’s mass-produced integrated power brake (IPB) was installed in Cadillac XT4 for the first time in 2019, and was mounted on BYD Han in the following year. Since then, the mass adoption of the brake-by-wire solution One-Box in vehicles has started. During the same period, the foreign mass-produced One-Box products also included Continental MK Cx series and ZF IBC.

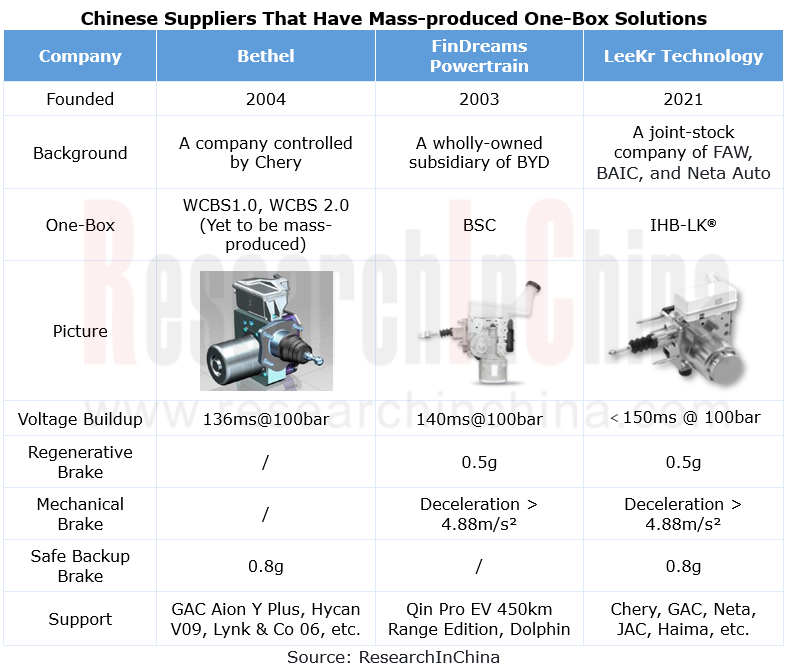

Chinese suppliers like Bethel Automotive Safety Systems mass-produced One-Box products in 2021, during which other suppliers in China were deploying Two-Box solutions. Entering 2023, all suppliers' products have been updated and iterated to One-Box solutions.

In China, suppliers that already mass-produce One-Box products include Bethel, FinDreams Powertrain, and LeeKr Technology. Among them, Bethel is backed by Chery; FinDreams Powertrain is backed by BYD; LeeKr Technology is a technology start-up with shares held by FAW, BAIC, and Neta Auto. At present, the IHB-LK? products of LeeKr Technology have supported OEMs such as Chery, Neta Auto, JAC, and Haima.

LeeKr Technology, established in 2021, mass-produced the decoupled hydraulic brake-by-wire system DHB-LK? (Two-box) and the integrated intelligent brake system IHB-LK? (One-Box) in late 2022, making itself the first technology start-up producing One-box in quantities. IHB-LK? has three versions for OEMs: standard, flagship and lightweight. As concerns redundancy solutions, LeeKr has an IHB-LK?+RBU brake-by-wire redundancy solution, meeting the requirements of L3 and above high-level autonomous driving. In 2022, the annual production capacity of IHB-LK? reached 300,000 sets, and it is projected to be expanded to 1.5 million sets during 2023-2024.

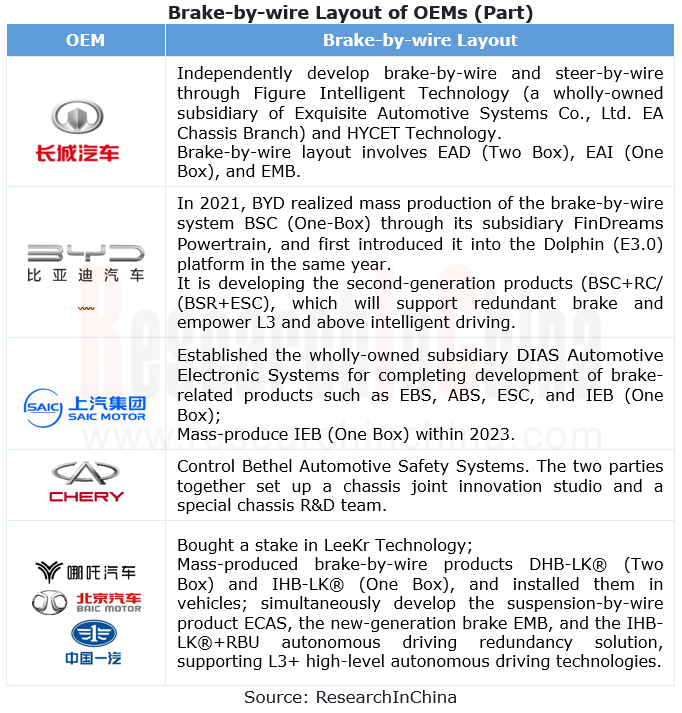

3. OEMs like BYD and Great Wall Motor begin to adopt the self-development + joint development model to develop brake-by-wire and reconstruct the supply chain ecosystem.

In the era of conventional automobiles, Tier 1 suppliers played a "package" role and had a big say in components. Entering the era of intelligent vehicles, OEMs work towards "independent and controllable" key components, and make more independent development layout in key areas such as autonomous driving, IVI OS, and chassis-by-wire.

BYD self-developed the brake-by-wire system BSC (One Box) through its subsidiary FinDreams Powertrain, and installed it on Dolphin and Qin Pro EV;

Great Wall Motor independently develops brake-by-wire through its subsidiary Figure Intelligent Technology, and has deployed multiple products like EAD (Two Box), EAI (One Box), and EMB;

DIAS Automotive Electronic Systems under SAIC has deployed IEB (One-box), and plans to mass-produce it in 2023;

Chery has achieved mass production and installation of brake-by-wire by binding with Bethel;

Neta Auto, FAW, and BAIC have realized mass production of IHB-LK? (One-box) by buying in LeeKr Technology, and have simultaneously deployed several products including EMB, ECAS and redundant brake.

Automotive Smart Exteriors Research Report, 2024

Research on automotive smart exteriors: in the trend towards electrification and intelligence, which exteriors will be replaced by intelligence?

The Automotive Smart Exteriors Research Report, 2024 ...

Automotive Fragrance and Air Conditioning System Research Report, 2024

Research on automotive fragrance/air purification: With surging installations, automotive olfactory interaction is being linked with more scenarios.

As users require higher quality of personalized, i...

Intelligent Vehicle Multi-Domain Computing Industry Report, 2024

Multi-Domain Computing Research: A Summary of Several Ideas and Product Strategies for Cross-Domain Integration

1. Several ideas and strategies for cross-domain integration of OEMs

With the increasi...

Analysis on Xiaomi Auto's Electrification, Connectivity, Intelligence and Sharing, 2024

Research on Xiaomi Auto: Xiaomi Auto's strengths and weaknesses

Since the release of SU7, Xiaomi delivered 7,058 units and 8,630 units in April and May, respectively, and more than 10,000 units in bo...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: make all-round attempts to transform and localize supply chain and teams.

1. Foreign ADAS Tier 1 suppliers fall behind relatively in deve...

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...