Automotive HUD research: in the "technology battle" in AR-HUD, who will be the champion of mass production?

Automotive head-up display (HUD) works on the optical principle for real-time display of such information as speed, navigation and ADAS in front of the vehicle. Its main role is to avoid potential safety dangers caused by driver's head down and shift of eyesight, and to improve intelligent cockpit experience, enabling more intelligent navigation and displaying more vehicle condition information.

By display, HUD falls into three types: C-HUD (Combiner HUD), W-HUD (Windshield HUD), and AR-HUD (Augmented Reality HUD), of which AR-HUD is the third-generation HUD product behind C-HUD and W-HUD.

1. An increasing number of passenger cars are installed with HUDs.

According to the statistics from ResearchInChina, from January to June 2023, 879,000 passenger cars were installed with OEM HUD in the Chinese market (excluding import and export), surging by 45.6% on a like-on-like basis, with a penetration rate of 9.5%, up 2.7 percentage points. Wherein, in 2023Q2, the passenger cars installed with OEM HUD reached 504,000 units, soaring by 65% from the prior-year period, with a penetration rate of 9.7%, up 3.5 percentage points.

In 2022, there were over 100,000 passenger cars equipped with AR-HUD in China, rocketing by 195.4% versus 2021. From January to June 2023, 63,500 passenger cars packed AR-HUD, an annualized upsurge of 81.4%, and the full-year total is expected to double.

2. Among various light source technologies, TFT and DLP are the first to come into mass production.

By imaging mode, AR-HUD can be categorized into TFT, DLP, LCoS, and MEMS-based LBS. Which one is more suitable for mass adoption remains to be determined.

The mature TFT technology with cost advantages is a mainstream solution at present, having been applied in more than ten models of Volkswagen, Audi, Geely, Changan, Great Wall Motor and Hongqi among others. Many of these models use 3.1-inch TFT technology, offering field of view (FOV) of about 8°×3°. To provide better graphic effects (e.g., 10°×4° FOV and >80 pix/° resolution), the size of LCD is even to be 4.1 inches, but the problem of sunlight inversion needs to be solved.

In June 2023, Jiangcheng Technology first introduced the new-generation proprietary TFT AR-HUD solution, with a 3.6-inch LCD, and 12°x5° FOV, breaking the technical bottleneck of the previous TFT solutions. It is a cost-effective AR-HUD solution that performs well and is easy to deploy in vehicles at a more affordable cost.

The solution adopts Jiangcheng's fully customized dedicated TFT and proprietary backlight coupling lens system. Combined with Jiangcheng's original low dynamic distortion optical simulation software, it offers a big improvement in imaging effect. In the case of 10°x4°, it provides the effective visible pixels more than 50% higher than the 3.1-inch solution. Moreover, it is also an effective solution to the problem of sunlight inversion, with the advantages of small size, good performance parameters, low cost and high cost performance.

With high brightness, DLP is available to large FOV AR-HUDs, and can cope with sunlight inversion. Its disadvantages are TI’s patent limitation, relatively high cost and relatively large size. Mercedes-Benz S-Class carries Nippon Seiki's DLP AR-HUD, with a size of more than 25L. In China, models using DLP solution include GAC Trumpchi GS8, BAIC Mofang and Neta S.

Among them, GAC Trumpchi GS8 is China’s first model equipped with DLP AR-HUD, a solution provided by Foryou Multimedia Electronics. The solution uses TI DLP3030 technology, delivering 10°×4° FOV, up to 8m VID, and 60-inch view; the AR-HUD mounted on BAIC Mofang is also 60 inches, provided by Jiangcheng Technology. Compared with TFT, DLP offers better display effects but is larger in size.

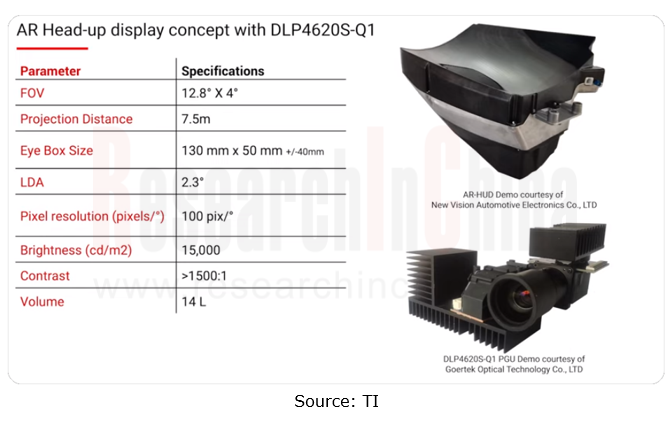

At the Auto Shanghai 2023, TI announced the latest DLP technology for AR-HUD: DLP4620S-Q1, which, compared with the previous-generation DLP5530, provides a larger FOV (12.8°×4°), higher resolution (100 pix/°), and higher brightness (15,000 cd/m2). Supporting a picture generating unit (PGU) of just 0.3L, about 10%-15% smaller than counterparts, DLP4620S-Q1 is expected to overall cost 15% less than the previous generation. In addition, it supports next-generation display technologies such as optical waveguide, holographic optical element (HOE) and different thin-film technologies.

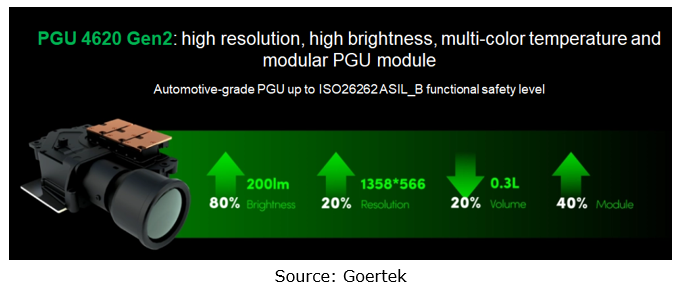

Based on DLP4620, Goertek makes a quick layout. It first unveiled the new-generation automotive AR-HUD PGU module PGU4620 in February 2023, and then iterated to the Gen2 in July. Compared with the Gen1, the PGU4620 Gen2 adds the multi-color temperature adjustment function, increasing the brightness by 80% to 200lm; coupled with the newest DLPC technology, it delivers a high refresh rate of 120Hz and a high contrast ratio of 1800:1, allowing for a better display effect of AR-HUDs.

LCoS can meet the requirements for high resolution, large FOV, and small size, but it is difficult to develop. Currently, Huawei, Jiangcheng and ASU Tech are the main promoters of this solution. In September 2022, Huawei's self-developed LCoS AR-HUD was first applied to Rising R7.

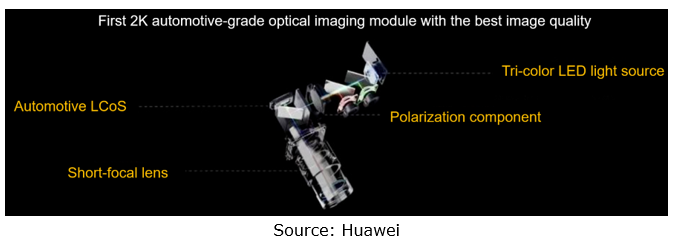

At the Auto Shanghai 2023, Huawei released the HUAWEI xHUD AR-HUD, a solution which adopts the re-upgraded automotive-grade LCoS technology (nanometer-level pixel unit, 2K resolution), tri-color LED light source (brightness: 12,000nits, color gamut: NTSC>85%), short-focal lens (sharper imaging, distortion: <2%), and polarization components (light energy utilization: 90% , contrast ratio: 1,200:1), enabling mass production of the largest format (70 inches at 7.5m, 96 inches at 10m), and the highest resolution (1920x730). The product will be mounted on AITO M9 in 2023, and become available to more models later.

By contrast, LBS is still in the R&D stage, but there have been PGUs launched, such as LM Jade Chip's LM-PGU-1000 and Raythink's mini-laser full-color HD display module Opticalcore?.

It is conceivable that in the next 2 or 3 years, TFT will still be the mainstream mass production solution; DLP may find broad application in the high-end market in the next 5 years; LCoS will continue to iterate, and is expected to "catch up from behind"; LBS may be mass-produced and installed in vehicles in 1 or 2 years.

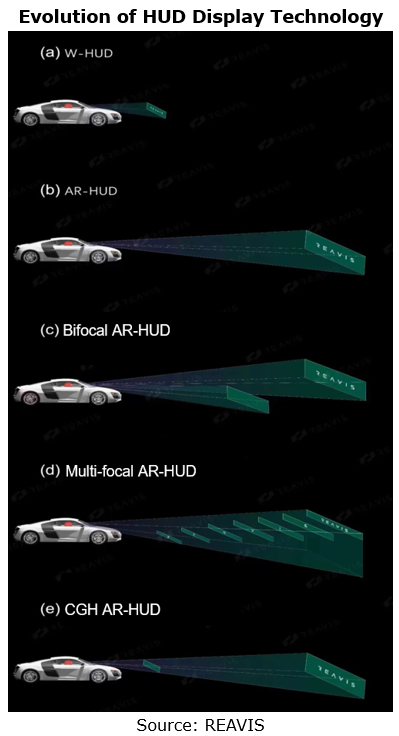

3. As display technology evolves, bi/multi-focal solutions become production-ready.

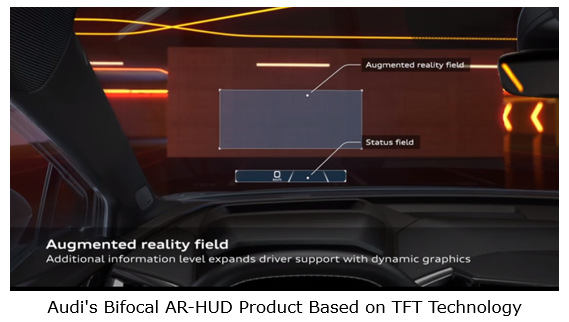

So far, most of the AR-HUD products mass-produced in China have been single-focal 2D displays. To improve display effects, Volkswagen, Audi and other models use a bifocal 3D display solution in which the upper area displays information such as navigation, with a VID up to 10m, and the lower area displays such information as speed and vehicle status, with a VID of about 3m.

Chinese companies like Foryou Multimedia Electronics, New Vision Electronics, E-LEAD Electronic, Futurus Technology and Jiangcheng Technology have also developed bifocal AR-HUD mass production solutions. Among them, Foryou Multimedia Electronics's bifocal AR-HUD adopts single optical device with dual optical paths. The DLP 5530-based solution offers 12°×1° FOV at a short distance of 2m, and 12°×3° FOV at a long distance of up to 10m. The solution has been designated, and will soon go into volume production.

New Vision Electronics' bifocal AR-HUD is also equipped with the DLP 5530 solution and adopts its self-developed AR Cyber software system. This solution is adaptable to optical systems with differing specifications, data sources, and application scenarios, bringing the visual effect of virtual-real fusion. The product has been ordered and is scheduled to be spawned in 2023.

Jiangcheng's bifocal AR-HUD solution was completed early in 2017. As China’s earliest bifocal AR-HUD solution at that time, it has been applicable to vehicles, with volume below 10L, offering field of view at a long distance of 7.5m and a short distance of 2.2m. Due to the fact that AR-HUD was seldom seen at that time in China, Jiangcheng restarted providing bifocal mass production solutions according to the needs of automakers in the past two years.

In addition to the bifocal plane, some companies set about exploring multifocal plane (>2) display technology. The light-field AR-HUD being developed by Futurus Technology has the multi-focal plane optical imaging capability, and is projected to be mass-produced in 2024; and the spatial light-field AR-HUD under development enables the continuous zooming effect, visually integrating the real objects in different positions with the HUD virtual images.

4. The new-generation optical waveguide HOE+CGH technology will open a new channel of AR-HUD mass production.

At present, domestic mass-produced AR-HUD products in China generally adopt a free-form mirror system. Due to the limitation of the optical principle of off-axis mirror assemblies, it is hard to balance the contradiction between FOV, VID and system volume. Yet the introduction of optical waveguide technology is a solution to this inherent contradiction, allowing for large FOV and VID in a limited volume.

AR optical waveguide technology is divided into geometric optical waveguide and diffractive optical waveguide, of which diffractive optical waveguide is further divided into surface relief grating waveguide and volume holographic grating waveguide. At present, the volume holographic grating waveguide HOE is a promising technology direction in the industry. The leader of this technology is DigiLens having received several rounds of investment from Continental.

Chinese optical waveguide companies such as Tripole Optoelectronics, SVG Tech Group, Greater Tech, Lochn Optics, and Lingxi-AR have also grabbed a wide attention. In September 2022, Foryou Multimedia Electronics and Lochn Optics formed a strategic partnership to jointly facilitate the deep integration of optical waveguide technology with the AR-HUD market.

In addition, WayRay has created Deep Reality Display?, an AR-HUD product composed of DLP laser projector and HOE film. It is smaller in size and offers a larger FOV compared to conventional AR-HUDs. In May 2023, WayRay said that it had successfully applied the holographic technology to Tesla Model 3, which will be available in Switzerland first and the the US.

Unlike optical waveguide and HOE (stationary holography), the computer-generated holography (CGH) technology (dynamic holography) utilizes computers and algorithms to generate holographic images without needing conventional optical structures, and is capable of imaging at any focal plane, with a significant advantage in packaging dimensions.

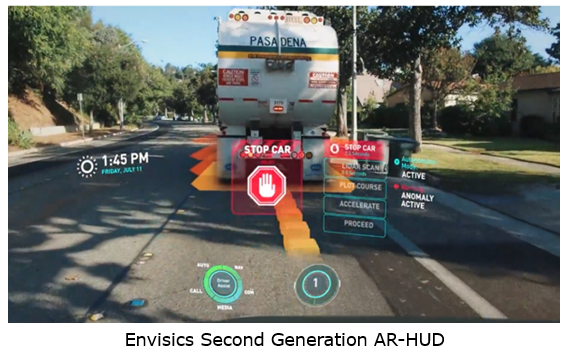

On this basis, quite a few OEMs and suppliers are making layout. Examples include Volkswagen investing in SeeReal, Panasonic and Mobis investing in Envisics, and Denso investing in CY Vision. In China, Lochn Optics and REAVIS are also pushing forward the development of CGH AR-HUD technology.

In March 2023, Envisics raised USD50 million in a Series C funding round in which investors included Hyundai Mobis, InMotion Ventures (a venture capital arm of Jaguar Land Rover) and Stellantis. The 2024 Cadillac Lyriq will integrate Envisics' second-generation AR-HUD (bifocal plane, with brightness up to 25,000 cd/m2).

Analysis on Xiaomi Auto's Electrification, Connectivity, Intelligence and Sharing, 2024

Research on Xiaomi Auto: Xiaomi Auto's strengths and weaknesses

Since the release of SU7, Xiaomi delivered 7,058 units and 8,630 units in April and May, respectively, and more than 10,000 units in bo...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: make all-round attempts to transform and localize supply chain and teams.

1. Foreign ADAS Tier 1 suppliers fall behind relatively in deve...

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...