Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of vehicle data makes cloud migration an inevitable choice.

From the perspective of companies, the goals of digital transformation are to digitize all elements of the whole process throughout the full life cycle of vehicles, including R&D, production, sale, operation, and after-sales service; upload the data in the local servers and computer rooms of automakers to the cloud; connect the data channels of each link to gradually realize the integrated management of data in the whole industry chain, and the cloud-pipe-terminal integrated real-time interconnection; and build service operation models that span the full life cycle of users to enhance the connections between upstream and downstream partners in the industry and create greater value.

In terms of products, vehicle intelligence and connectivity are booming. For example, starting from L2, every time the autonomous driving functions evolve to a higher level, the consumption of cloud infrastructure platforms, applications, and services will rise by an order of magnitude. As high-level autonomous driving comes into mass production, the number of vehicle sensors and the amount of data multiply, making it difficult for local processing to meet the requirements. Cloud migration thus will be the best choice.

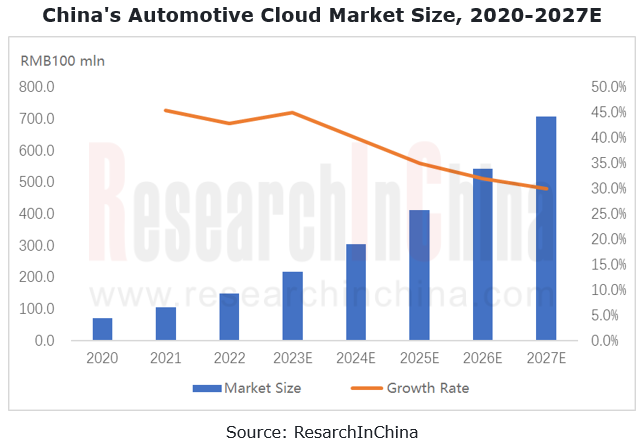

Automakers spend tens of millions of yuan every year building cloud services, which gives a big boost to the market. In 2022, China's automotive cloud service market was valued at over RMB15 billion, and it is expected to sustain the growth rate of 30-40% in the next five years.

2. As dedicated automotive cloud platforms are launched, differentiated competition becomes crucial.

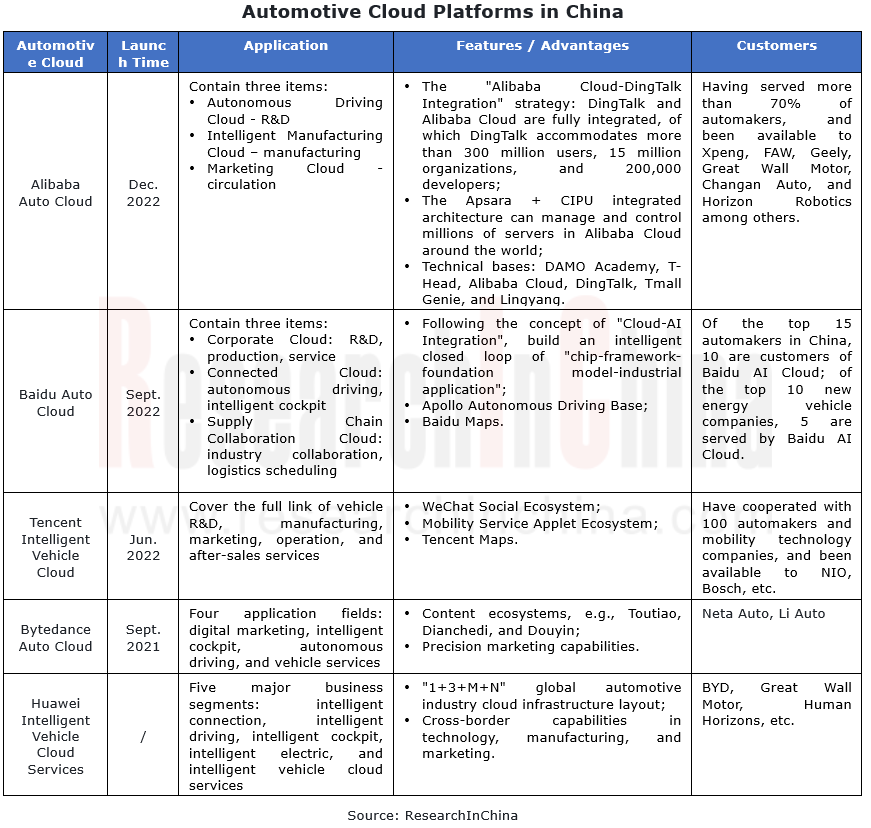

In 2021, ByteDance announced the "ByteDance Auto Cloud", which will provide cloud services in four segments: Digital Marketing, Intelligent Cockpit, Autonomous Driving, and Vehicle Services. In 2022, Tencent Intelligent Cloud Cloud, Baidu Auto Cloud, and Alibaba Auto Cloud became available. All the five giants (BATHD), i.e., Baidu, Alibaba, Tencent, Huawei and Douyin have stepped in the market, and the competition in automotive cloud services built on exclusive automotive cloud has become fiercer.

The service scope of each automotive cloud is much of a muchness, generally covering R&D, manufacture, marketing, and supply chain. The support for R&D is concentrated in the fields of autonomous driving, intelligent cockpit, telematics, and “three electrics” (battery, motor and ECU). How to gain differentiated competitive edges in the competition therefore has become the key to success for companies.

3. The differentiated competitive edges in cloud services are mainly built from two aspects: basic resource layer services and upper-layer R&D tool chains.

In terms of basic resource layer, supercomputing centers are an important indicator for assessing service capabilities, and Alibaba and Baidu are the first to deploy.

In August 2022, Alibaba Cloud launched the two intelligent supercomputing centers located in Zhangbei County and Ulanqab, with total compute of 15 EFLOPS (15 exascale floating-point operations per second). At the same time, Alibaba Cloud also introduced the "Apsara Intelligent Computing Platform", an intelligent computing solution which opens up intelligent computing capabilities by way of "platform + intelligent computing center".

Following the five intelligent computing centers in Yangquan, Jinan, Fuzhou, Yancheng, and Tianjin, Baidu Cloud started construction of the Baidu AI Cloud-Shenyang Intelligent Computing Center in May 2023, a project with a land area of about 2.4 hectares, floor areas of 42,000 square meters, and the total planned computing power of 500P, 200P for Phase I. In the future, Baidu Shenyang Intelligent Computing Center will not only involve physical data center construction capabilities and intelligent computing infrastructure capabilities, but also comprehensive solutions for AI software and hardware ecosystem capabilities such as foundation models, supporting the computing tasks of companies in different business scenarios and meeting the industrial application requirements of foundation models in the era of intelligent computing.

With regard to R&D tool chains, cloud service providers are committed to creating "fully furnished" service experiences for users by offering "full-process" and "fully closed-loop" services.

In Tencent's autonomous driving cloud platform, virtual simulation has become a key link.

In Tencent's autonomous driving cloud platform, virtual simulation has become a key link.

Huawei's autonomous driving cloud platform "Octopus" has built in a dataset with 20 million frame annotations, a library with 200,000 simulation scenes, a complete tool chain, and annotation algorithms, covering the full life cycle businesses such as autonomous driving data, models, training, simulation, and annotation, and helping automakers to build autonomous driving development capabilities on a "zero" basis.

Huawei's autonomous driving cloud platform "Octopus" has built in a dataset with 20 million frame annotations, a library with 200,000 simulation scenes, a complete tool chain, and annotation algorithms, covering the full life cycle businesses such as autonomous driving data, models, training, simulation, and annotation, and helping automakers to build autonomous driving development capabilities on a "zero" basis.

Baidu makes a full-stack layout and enables a data closed loop by virtue of from chip (Kunlunxin), deep learning (PaddlePaddle) and training foundation model (ERNIE) to search (Baidu Search), cloud platform (Baidu AI Cloud), autonomous driving (Apollo) and intelligent connection (Xiaodu).

Baidu makes a full-stack layout and enables a data closed loop by virtue of from chip (Kunlunxin), deep learning (PaddlePaddle) and training foundation model (ERNIE) to search (Baidu Search), cloud platform (Baidu AI Cloud), autonomous driving (Apollo) and intelligent connection (Xiaodu).

4. Under the multi-cloud strategy, the need of OEMs has changed from the pursuit of resources to efficiency.

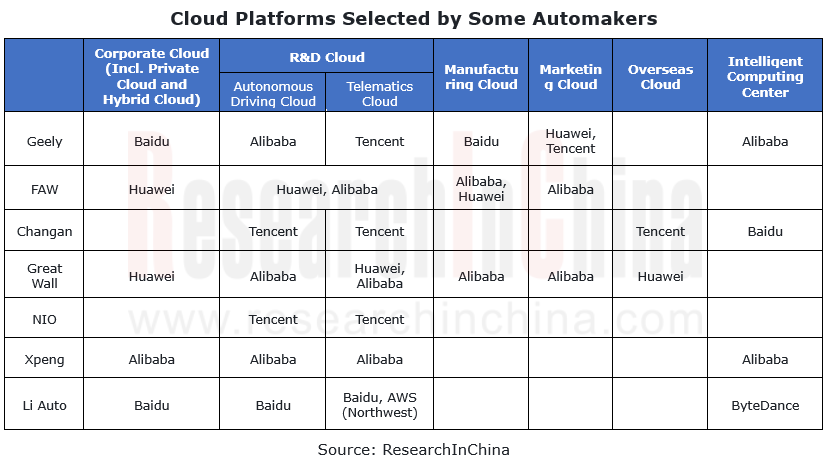

With the in-depth migration to the cloud, the resource needs of OEMs for cloud migration have been overall met, and thus the underlying logic of the cloud strategy of companies has changed from the pursuit of resources to efficiency to finally improve their overall digitization capabilities in production and operation. In this process, OEMs are no longer tightly bound with some cloud platform, but implement a multi-cloud strategy where different business types are put on different cloud platforms.

Examples include:

Based on the "1+6+N" Geely Hybrid Cloud Platform co-built with Baidu, Geely works with Alibaba to build the Xingrui Intelligent Computing Center, and teams up with Tencent on telematics and security solutions.

Based on the "1+6+N" Geely Hybrid Cloud Platform co-built with Baidu, Geely works with Alibaba to build the Xingrui Intelligent Computing Center, and teams up with Tencent on telematics and security solutions.

FAW Group uses Huawei Cloud Stack to build hybrid cloud architecture, and also cooperates with Alibaba Cloud on intelligent manufacturing, digital marketing and other businesses.

FAW Group uses Huawei Cloud Stack to build hybrid cloud architecture, and also cooperates with Alibaba Cloud on intelligent manufacturing, digital marketing and other businesses.

Without a doubt, the multi-cloud strategy offers benefits. It can integrate the advantages of various cloud platforms, enable refined business deployment, and reduce costs for companies, and also helps automakers to gain the core initiative in building cloud platforms and avoid being puzzled by the “soul” dispute. Yet the challenges of the multi-cloud strategy are also unavoidable. How to allocate storage/computing power among multiple clouds, cross-cloud data synchronization’s dependency on bandwidth, and whether costs and network delays will have an impact are all urgent problems to be solved. Hence how to formulate a multi-cloud strategy is a problem for OEMs.

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 - Foreign Companies

Research on foreign ADAS Tier 1 suppliers: make all-round attempts to transform and localize supply chain and teams.

1. Foreign ADAS Tier 1 suppliers fall behind relatively in deve...

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...