ResearchInChina researched and summarized China’s current mainstream high computing power ADAS domain controller products such as Huawei MDC and DJI ADAS domain controller prototype, and technical information.

This paper will briefly analyze the key components of ADAS domain controller, including CPU, MCU, storage, and interface.

CPU

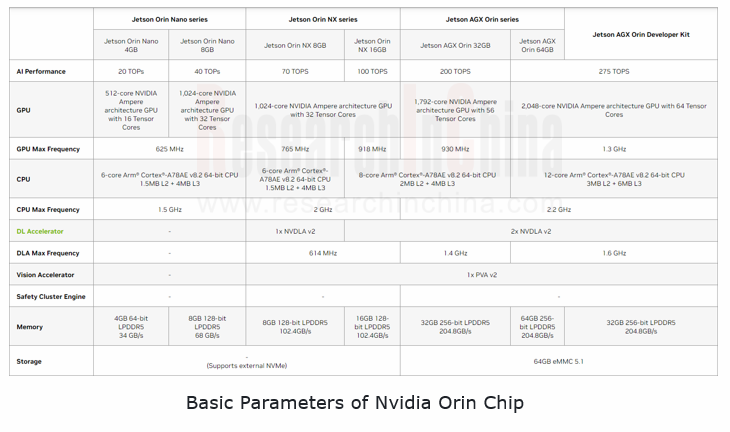

In terms of CPU selection, to enable their domain controllers to achieve L2+ high-level ADAS functions such as NOP/NGP, all vendors are pursuing large computing power chips, among which Nvidia Xavier and Orin are most used. Both NVIDIA Xavier and Orin incorporate stereo camera hardware acceleration, allowing for direct hardwire output of disparity maps, as well as optical flow acceleration module. The optical flow effect of stereo camera is much better than mono camera. For stereo camera companies, the most core software asset is stereo matching algorithms, most of which are for semi-global matching. Yet it still needs time to explore for better performance.

Depth map is often calculated by CPU. After the depth map, the freespace needs to be calculated, mainly by GPU.

MCU in Domain Controller

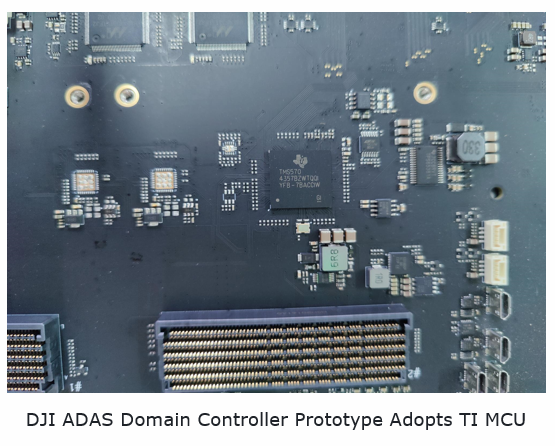

Generally, the MCUs for ADAS domain controllers are provided by Infineon or NXP, especially Infineon TC297X/397X series with a high market share. The mainstream MCUs from Renesas, Infineon and NXP all reach the ASIL-D level. For example, the DJI ADAS domain controller engineering prototype MCU uses TI TMS570LC4357, a chip which was launched in 2014 and has not passed ASIL certification but only AEC Q-100 certification.

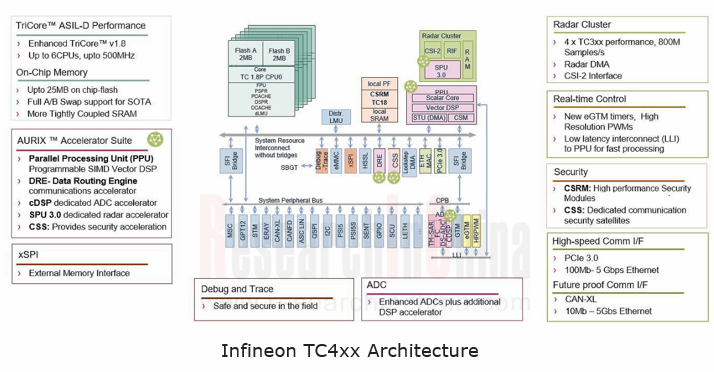

In the second half of 2024, Infineon planned to start mass production of the new AURIX TC4x family of 28 nm microcontrollers (MCUs) for high volume data throughput applications such as advanced driving assistance systems, various domain controllers, new energy and gateway systems.

MCU plays a very important role. It is the most important part to ensure the domain controller to achieve ASIL-C/D certification.

Interface

ADAS domain controller needs abundant interfaces (video interface, Ethernet interface, CAN interface, etc.) to connect various sensor devices, including: camera, LiDAR, radar, ultrasonic radar, integrated navigation, IMU, V2X module, etc. Camera interface often uses protocols like GMSL, LVDS and FPDLink. Radar generally adopts CAN/FD communication. LiDAR that needs to upload large amounts of data uses Ethernet interface.

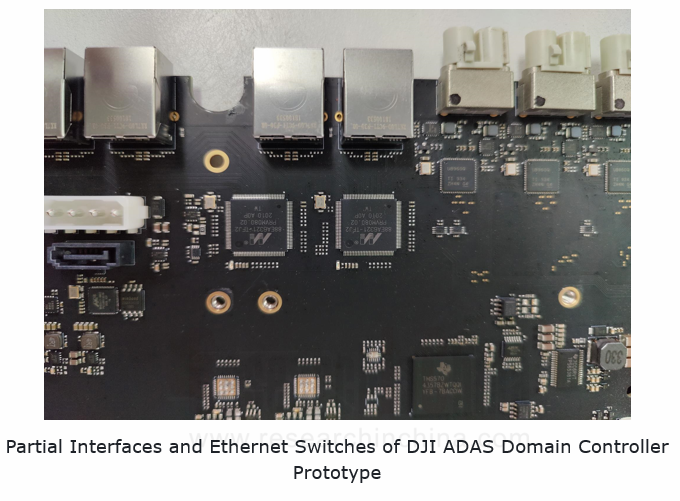

Above the DJI ADAS domain controller carrier board MCU are two Ethernet switches, namely, Marvell 88EA6321. On the left is a hard disk SATA interface, using Marvell 88SE9171 chip to convert SATA to PCIe interface. Most development boards don't carry SATA interface, and usually use USB interface. Next to 88SE9171 is a Winbond W25Q64JV NOR Flash with 64Mb capacity, supposed to store a simple hard disk driver.

Marvell’s first-generation Automotive Brightlane? Ethernet switch, 88EA6321, is a 7-port Ethernet gigabit capacity switch that is fully compliant with IEEE802.3 automotive standard with Audio/Video bridging capabilities and supports Energy Efficient Ethernet for reduced power consumption. The 7-port Ethernet switch offers 2 integrated IEEE 10/100/1000BASE-T/TX/T ports, 2x RGMII/xMII (2 ports can be configured to be 1GMII) ports, and 1 SGMII / SerDes port. The switch offers remote management capabilities, providing easy access and configuration of the device. It often acts as the bridge between the main processor and the MCU, namely Nvidia Xavier and TI TMS570LC4357.

The 88EA6321 is an early product of Marvell. Marvell's Ethernet switches have now evolved to the third generation. Yet Marvell often cooperates with large manufacturers on advanced products. 88EA6321 targets markets with low security requirements, such as body controllers, Infotainment controllers and gateways, and only supports up to 1G. Although Tesla is also using this chip, new products from conventional automakers such as Volkswagen will not use such a low bandwidth switch. The most advanced design currently available already supports up to 10G, that is, Gigabit Ethernet that generally supports up to 2.5G.

For some LIDARs with high point cloud density, the peak rate may exceed 100M per second. 88EA6321 is not suitable for LIDARs with high point cloud density (it is impossible to use CAN with the maximum available bandwidth only up to 0.5M). At present, the mainstream radars deliver CAN or CAN-FD interface. A very few 4D radars offer optional Ethernet output, and generally the default is CAN-FD.

Storage

Same as consumer electronics, vehicles have started mass adoption of LPDDR DRAM, UFS, eMMC and other high-speed memory devices to meet the needs of the system and software-level algorithm of ADAS domain controllers for data transmission and storage. At present, the mainstream domain controller storage portfolio mainly applies the form of "LPDDR+UFS", which is consistent with the storage portfolio for smartphones.

Micron leads the industry in terms of domain controller storage. In June 2021, Micron introduced the first automotive-qualified portfolio of UFS 3.1 memory devices, offering higher cost/density benefits. UFS 3.1 devices enable two times faster read performance and a 50% improvement in sustained write performance than last-generation UFS 2.1 devices. Micron UFS 3.1 meets the needs of growing sensor and camera data for real-time local storage in L3+ ADAS and black box applications. The ADAS domain controller of Li Auto L9 is equipped with Micron's automotive-grade LPDDR5 DRAM memory and UFS 3.1 memory chips based on 3D TLC NAND technology. To date, Micron LPDDR5 is the only ASIL D-certified memory product in the industry.

The higher intelligent driving assistance level, and the gradual application of highway/urban NGP, automated valet parking (AVP) and other functions will pose higher automotive DRAM capacity, bandwidth and product requirements.

Capacity: according to Micron's data, the DRAM capacity required by a single L1/2 vehicle is about 8GB, while that for L3 and L5 vehicles is increased to 16GB and 74GB respectively.

Bandwidth: the DRAM bandwidth for L2 is generally 25-50GB/s; the bandwidth for L3 can reach 200GB/s; and the bandwidth for L4+ will be increased to 1TB/s.

Product: the L2 mainly adopts the basic DDR2/DDR3. At this stage, as L2 starts upgrade to L3, DRAM will also be gradually switched to DDR4 / LPDDR4/LPDDR5/GDDR5.

As for UFS, it is specifically defined by JEDEC as a high-performance memory replacement for e-MMC. It has become the premiere solution for smartphones, continuing to migrate into automotive and other applications. UFS will ultimately surpass e-MMC as the primary storage solution for automotive applications.

Deserializer

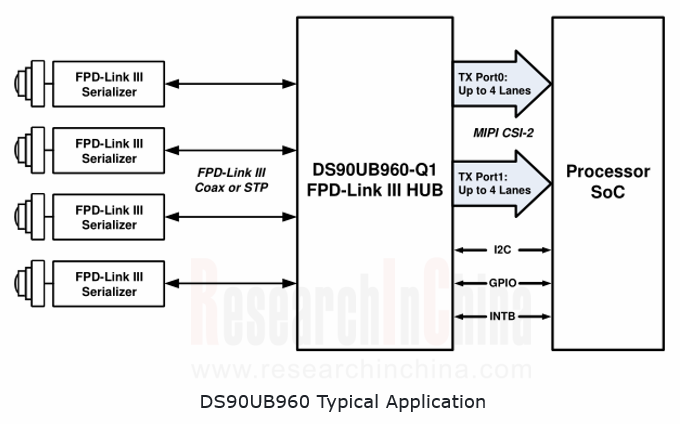

A typical deserializer model is TI DS90UB960. The surround view of the 360° panoramic fisheye camera is usually enabled by Infotainment. The effective distance of the surround view is generally within 10 meters. It is unlikely to be for long distance application in ADAS, and often only for parking. The ADAS domain controller has no requirement for 360° surround view. Besides, one DS90UB960 is enough to correspond to four 360° surround view image sensors.

The above diagram shows typical applications of TI DS90UB960, that is, receiving YUV444 data from four 2-Megapixel imagers at 30Hz frame rates or YUV420 data from four 2-Megapixel imagers at 60Hz frame rates, more probably the latter. DS90UB954 is a simplified version of DS90UB960, with lanes reduced from 4 to 2. It is generally paired with DS90UB953. It is supposed that Tesla's in-car driver status monitoring uses this chip. For the LVDS output of cameras is not suitable for long-distance transmission, generally cameras should be equipped with a deserializer chip to convert parallel data for serial coaxial or STP transmission, so that the transmission distance can be far and the electromagnetic interference (EMI) is easier to meet automotive regulations.

Here it needs to explain the data formats of cameras, generally RAW RGB and YUV. There are three levels of YUV: YUV444, YUV422 and YUV420. The formula for calculating bandwidth for RAW RGB is: Pixel × Frame Rate × Bit × 4. For example, if a camera outputs 2-megapixel images at 30Hz, the bandwidth is 2 megapixels x30x8x4, or 1.92Gbps, which is too wide. YUV444 is Pixel × Frame Rate × Bit × 3, or 1.44Gbps; YUV422 is Pixel × Frame Rate × Bit × 2, or 0.96Gbps; YUV420 is Pixel × Frame Rate × Bit × 1.5, or 0.72Gbps. For ADAS with low requirements for color, YUV420 is enough. YUV422 finds broad application except in vehicles.

Automotive RISC-V Chip Industry Research Report, 2024

Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?Reduced Instruction Set Computing - Five (RISC-V) is an open standard instructio...

Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to ...

Software-defined Vehicle Research Report, 2023-2024 - Industry Panorama and Strategy

1. How to build intelligent driving software-defined vehicle (SDV) architecture?

The autonomous driving intelligent platform can be roughly divided into four parts from the bottom up: hardware platf...

Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring Sys...

Automotive Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2024

As intelligent connected vehicles boom, the change in automotive EEA has been accelerated, and the risks caused by electronic and electrical failures have become ever higher. As a result, functional s...

Autonomous Driving Map Industry Report,2024

As the supervision of HD map qualifications tightens, issues such as map collection cost, update frequency, and coverage stand out. Amid the boom of urban NOA, the "lightweight map" intelligent drivin...

Automotive Vision Industry Research Report, 2023

From January to September 2023, 48.172 million cameras were installed in new cars in China, a like-on-like jump of 34.1%, including:

9.209 million front view cameras, up 33.0%; 3.875 million side vi...

Automotive Voice Industry Report, 2023-2024

The automotive voice interaction market is characterized by the following:

1. In OEM market, 46 brands install automotive voice as a standard configuration in 2023.

From 2019 to the first nine month...

Two-wheeler Intelligence and Industry Chain Research Report, 2023

In recent years, two-wheelers have headed in the direction of intelligent connection and intelligent driving, which has been accompanied by consumption upgrade, and mature applications of big data, ar...

Commercial Vehicle Telematics Industry Report, 2023-2024

The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device ...

Automotive Camera Tier2 Suppliers Research Report, 2023

1. Automotive lens companies: "camera module segment + emerging suppliers" facilitates the rise of Chinese products.

In 2023, automotive lens companies still maintain a three-echelon pattern. The fir...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2023

Intelligent driving is evolving from L2 to L2+ and L2++, and Navigate on Autopilot (NOA) has become a layout focus in the industry. How is NOA advancing at present? What are hotspots in the market? Wh...

Automotive Telematics Service Providers (TSP) and Application Services Research Report, 2023-2024

From January to September 2023, the penetration of telematics in passenger cars in China hit 77.6%, up 12.8 percentage points from the prior-year period. The rising penetration of telematics provides ...

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023

Passenger Car Intelligent Chassis and Chassis Domain Controller Research Report, 2023, released by ResearchInChina combs through three integration trends of brake-by-wire, steer-by-wire, and active su...

Automotive Smart Cockpit Design Trend Report, 2023

As the most intuitive window to experience automotive intelligent technology, intelligent cockpit is steadily moving towards the deep end of “intelligence”, and automakers have worked to deploy intell...

China Automotive Multimodal Interaction Development Research Report, 2023

China Automotive Multimodal Interaction Development Research Report, 2023 released by ResearchInChina combs through the interaction modes of mainstream cockpits, the application of interaction modes i...

Automotive Smart Surface Research Report, 2023

Market status: vehicle models with smart surfaces boom in 2023

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units ...

Passenger Car Intelligent Steering Industry Report, 2023

Passenger Car Intelligent Steering Industry Report, 2023 released by ResearchInChina combs through and studies the status quo of passenger car intelligent steering and the product layout of OEMs, supp...