Passenger Car CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) Integrated Battery Industry Report, 2024

Passenger Car CTP, CTC and CTB Integrated Battery Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of CTP (Cell to Pack), CTC (Cell To Chassis) and CTB (Cell to Body) for passenger cars and the layout of OEMs and suppliers in related products, and predicts the future development trends of passenger car integrated batteries.

1. In 2023, CTP (Cell to Pack) technology was seen in nearly 50% of new energy vehicles sold.

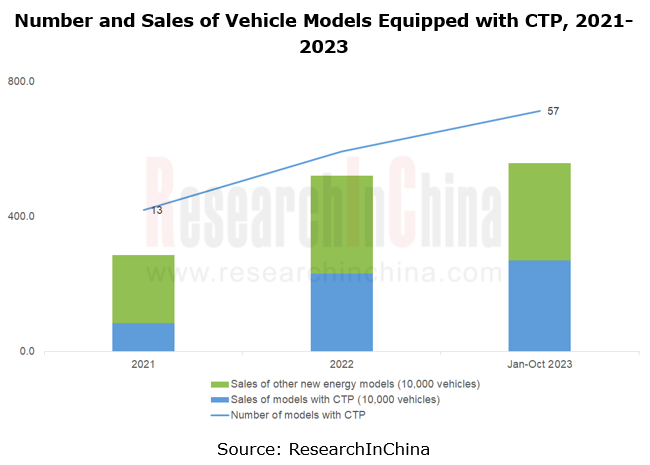

In 2021, there were only 13 vehicle models equipped with CTP in China. As of October 2023, the number had increased to 57. Vehicles equipped with CTP shared 29.6% of the total sales of new energy vehicles (EVs, PHEVs and EREVs) in 2021, and made up 48.6% from January to October 2023, a figure projected to be higher than 50% in the whole year of 2023.

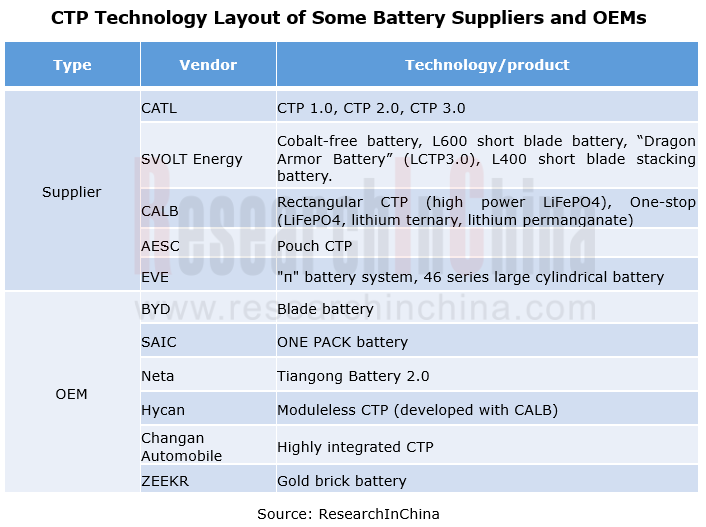

From the perspective of both suppliers and OEMs, CTP technology has entered a mature application stage.

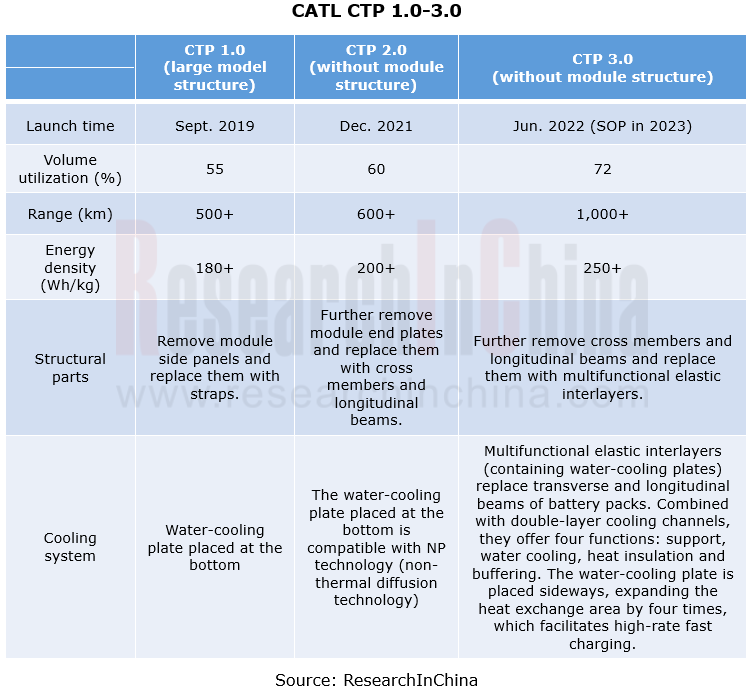

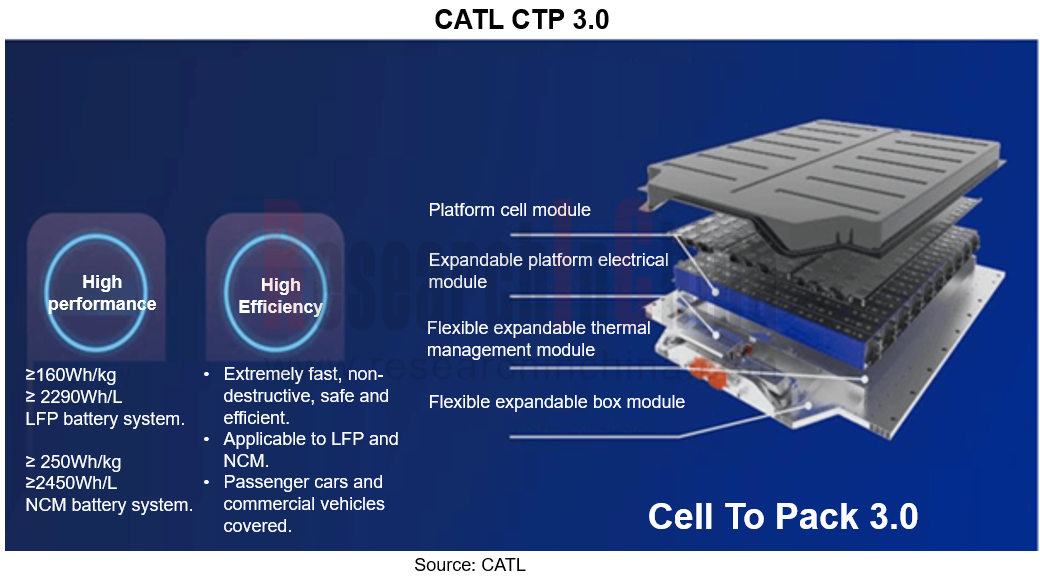

Among suppliers, CATL is a role model. In 2019, CATL released its CTP 1.0. By 2023, the technology has iterated to 3.0, and has been installed by brands such as ZEEKR, Li Auto and AITO.

OEMs are represented by BYD. In 2020, BYD released its blade battery based on CTP technology, which was first mounted on Han EV in June of the same year. In 2023, with higher blade battery capacity, BYD began to supply batteries to other automakers after meeting its own demand. Both Tesla and Hongqi have some models equipped with the blade battery.

According to the statistics of ResearchInChina, there are more than 17 models using blade batteries. By the end of 2023, BYD had deployed 17 blade battery production bases with the planned capacity of over 460GWh.

2. CTC/CTB technology is easier to implement under the leadership of OEMs

2.1 Currently only four automakers Tesla, BYD, Leapmotor and Xpeng have released CTC/CTB technology and applied it in production models.

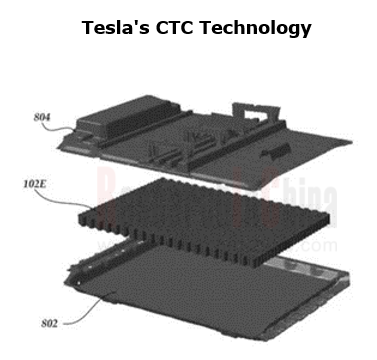

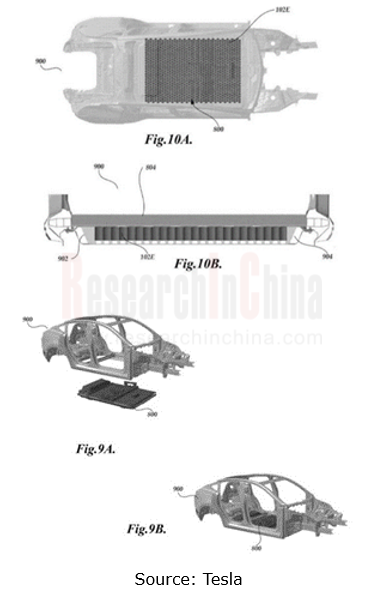

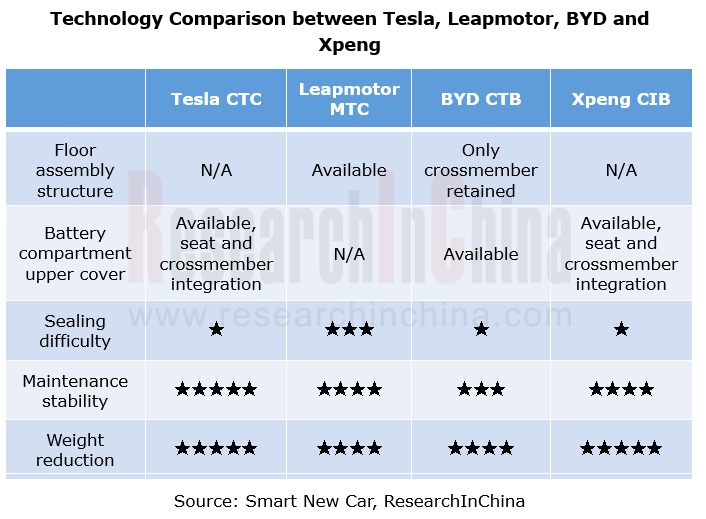

① Tesla: In 2020, Tesla introduced the concept of CTC (Cell To Chassis) for the first time on its Battery Day, which cancels the floor of the vehicle body, integrates the battery frame with the underbody (rocker rail, transverse beam, longitudinal beam, floor, etc.), and then connects the castings at the front and rear ends of the body.

From the point of performance improvement, Tesla's CTC technology offers the benefits: a 10% reduction in vehicle weight, a 14% increase in cursing range, a reduction of 370 parts, 7% lower unit cost, 8% lower unit investment, and far higher automobile manufacturing efficiency. CTC technology has been applied to Model Y produced at Gigafactory Texas.

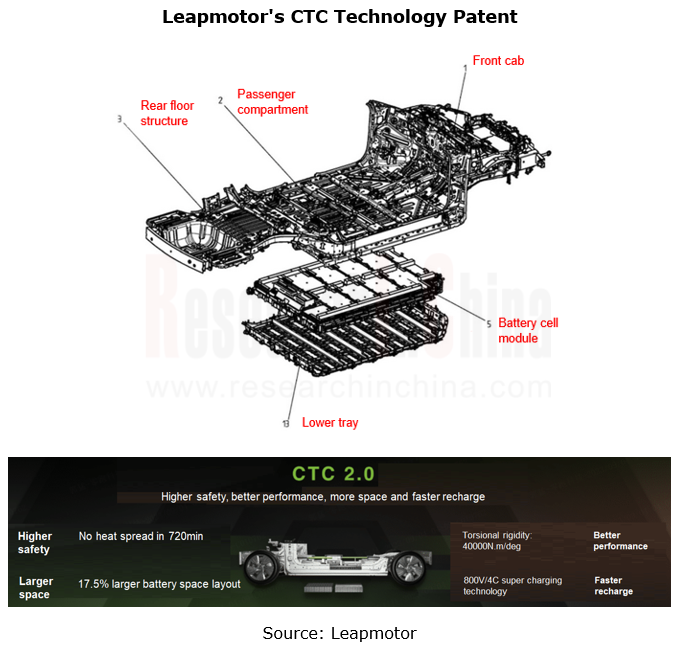

② Leapmotor: In April 2022 Leapmotor released CTC technology, and first applied it to the production model Leapmotor C01. Leapmotor’s CTC solution cancels the battery pack housing and upper cover, and retains the integrated battery module and lower battery tray.

Leapmotor’s CTC technology can increase the vertical space of the vehicle by 10mm, the battery layout space by 14.5%, the cursing range by 10% and the torsional stiffness of the body by 25% to 33897N·m/°, and reduce the number of parts by 20% and the weight by 15kg. CTC 2.0 unveiled by Leapmotor in 2023 enables 10% fewer parts and 5% less weight than CTC 1.0.

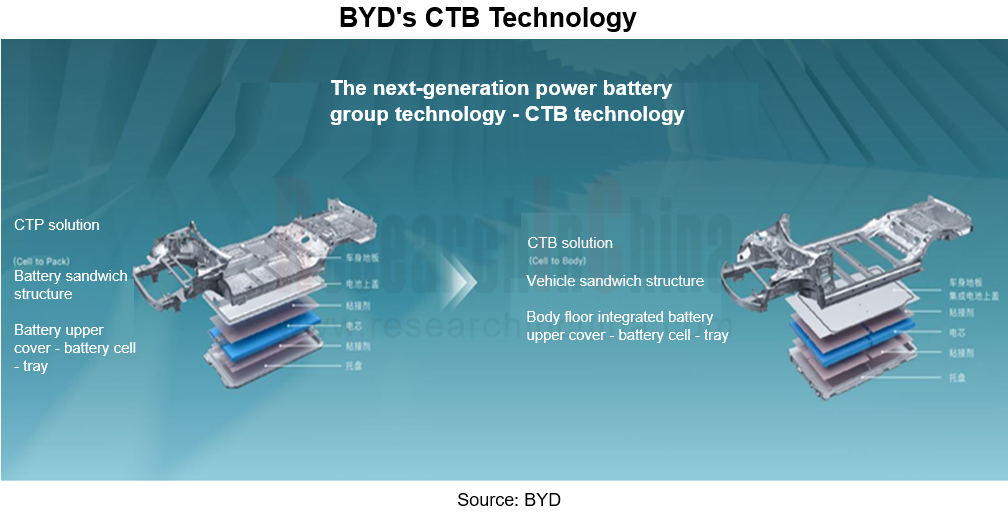

③ BYD: In May 2022, BYD released CTB (Cell to Body), a technology using the upper shell of the battery pack to replace the body floor. It cancels the modules and the upper shell of the battery pack, and sticks the blade battery to the tray and upper cover to form a sandwich structure of "battery upper cover-cell-tray".

The volume utilization rate of BYD’s CTB can be raised to 66%; the torsional stiffness of the vehicle body exceeds 40,000 N m/; the intrusion of the vehicle side column collision is reduced by 45%. The wind resistance of Seal, the first model equipped with CTB, is as low as 0.219, and the 0-100 km/h acceleration of the four-wheel drive edition only takes 3.8 seconds, with energy consumption per 100 kilometers as low as 12.7kWh.

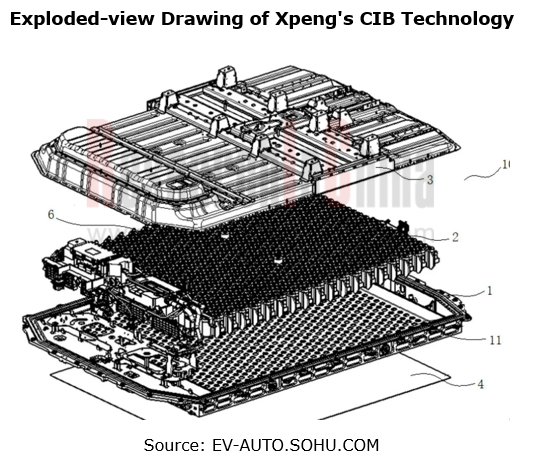

④ Xpeng: In April 2023, Xpeng launched its "Fuyao" architecture, which adopts CIB technology that uses the upper cover of the battery pack as the body floor, thereby saving 5% vertical interior space. As with Tesla, Xpeng integrates the reserved mounting bracket on the battery pack upper cover, and installs seats directly on the battery pack.

2.2 As per the technical features of CTC/CTB, OEMs cannot tolerate less say.

In the conventional new energy industry chain, power batteries account for 30%~40% of the vehicle cost. In the promotion process of CTC technology, the use of CTC makes it easier for battery vendors to dabble in chassis and vehicle development. For automakers, this may lead to less say, which is unacceptable to them.

CTC technology however requires battery cells with high intrinsic safety, and this needs to enhance thermal stability of battery cell materials. As concerns process, it is necessary to ensure the reliability of battery cells in terms of design and manufacturing. These are the advantages of battery vendors. Amid a combination of multiple factors, the model that OEMs play a leading role and suppliers cooperate with them may be the main way to advance CTC technology in the future.

In the case above OEMs that have the ability to develop and produce battery cells by themselves, such as BYD and Tesla, can effectively avoid the technical restrictions from battery vendors and have greater advantages in technology application.

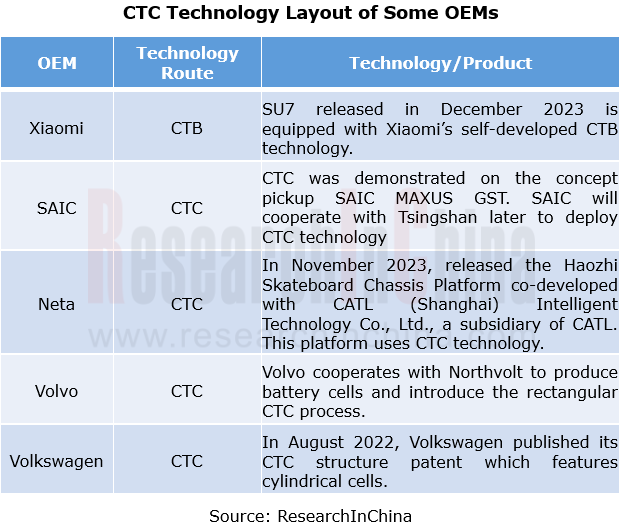

2.3 CTC technology layout of other OEMs

In addition to Tesla, BYD, Leapmotor and Xpeng, Xiaomi, Volkswagen, Volvo, JAC and SAIC all make layout of CTC technology. On December 28, 2023, Xiaomi unveiled SU7, a car that packs its self-developed CTB technology. The innovative designs such as floor-cover two-in-one, battery cell inversion, multifunctional elastic interlayer and minimalist wiring harness enable the volume efficiency up to 77.8% and release an additional height of 17 mm.

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...

Automotive MEMS (Micro Electromechanical System) Sensor Research Report, 2025

Automotive MEMS Research: A single vehicle packs 100+ MEMS sensors, and the pace of product innovation and localization are becoming much faster.

MEMS (Micro Electromechanical System) is a micro devi...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Repor...

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2024

Research on overseas layout of OEMs: There are sharp differences among regions. The average unit price of exports to Europe is 3.7 times that to Southeast Asia.

The Research Report on Overseas Layou...