Automotive RISC-V Research: Customized chips may become the future trend, and RISC-V will challenge ARM

What is RISC-V?

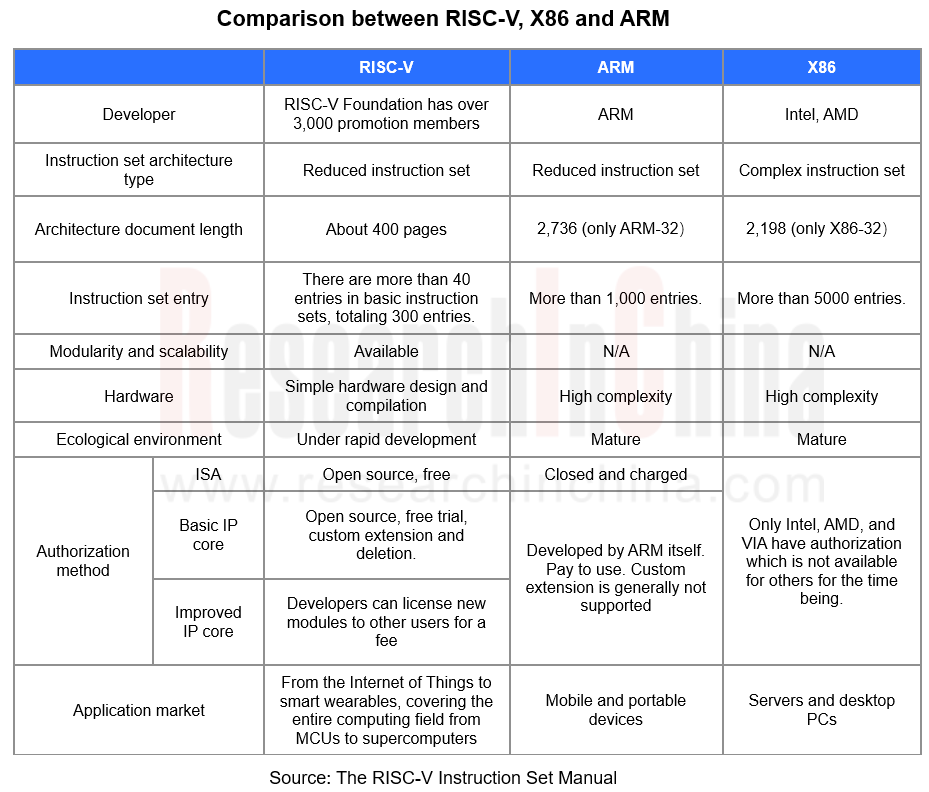

Reduced Instruction Set Computing - Five (RISC-V) is an open standard instruction set architecture (ISA) based on established reduced instruction set computer (RISC) principles. RISC-V can be used to design and implement processor chips and computer architectures. It competes with X86 and ARM globally.

RISC-V’s advantage mainly lies in that its instruction sets and architectures are open source and free. Its modular design allows enterprises to add, expand or remove the instruction sets. In contrast, ARM and X86 are not only complicated in instruction set development, but also difficult to obtain authorization to modify instruction sets.

However, RISC-V’s disadvantage mainly rests in the relatively immature ecosystem. Related compilers, development tools, software integrated development environment (IDE) and other ecological elements are still developing.

RISC-V makes chip customization easier

RISC-V adopts modular ISA, that is, it consists of a basic integer instruction set (the basic integer instruction set is the only mandatory basic instruction set for RISC-V, and other instruction sets are optional extension modules) and multiple optional extension instruction sets. Therefore, a CPU can be customized according to the requirements of a specific application.

In terms of customization, it enables designers to create thousands of potential customized processors, thus speeding up the time to market. The universality of processor IP also shortens software development time.

For example, Codasip can provide users with processor customized IP solutions based on RISC-V. The solution includes basic processor IP and development tool Codasip Studio. The engineering team can realize the integrated design of hardware and software according to project requirements and improve the efficiency of customized processor design. In October 2023, Codasip introduced the highly flexible 700 family for unlimited innovation. With the 700 family and Codasip Custom Compute, designers can push the technology limits by optimizing at the chip or application level for unique gains while keeping costs under control.

SiFive is a semiconductor enterprise based on RISC-V customization. SiFive mainly assists companies to customize processor cores based on RISC-V. Through its customized RISC-V semiconductor, it facilitates IC design and system companies to shorten the time to market and reduce costs.

RISC-V has spread to high-performance fields with the shipments of 10 billion processor cores in 2022

According to the data of RISC-V Foundation, 10 billion processor cores based on RISC-V were shipped in 2022, and are mainly used in the field of Internet of Things. With the growth of market demand, RISC-V is gradually moving towards high-performance fields such as autonomous driving, artificial intelligence, communication, data centers and other scenarios that require higher computing power.

Tesla developed its own customized chip "D1" in 2021. Based on RISC-V, D1 can train the artificial intelligence network in the data center.

Mobileye (acquired by Intel) released EyeQ Ultra in January 2022, containing 12 dual-threaded CPU cores based on RISC-V. Mass production is expected in 2025.

In September 2023, StarFive unveiled Dubhe-90, a high-performance RISC-V CPU IP. Dubhe-90 is the flagship product of Dubhe Max Performance series, with SPECint2006 9.4/GHz and performance comparable to that of ARM Cortex-A76. Its customers mainly come from high-end application fields such as PC, high-performance network communication, machine learning and data centers.

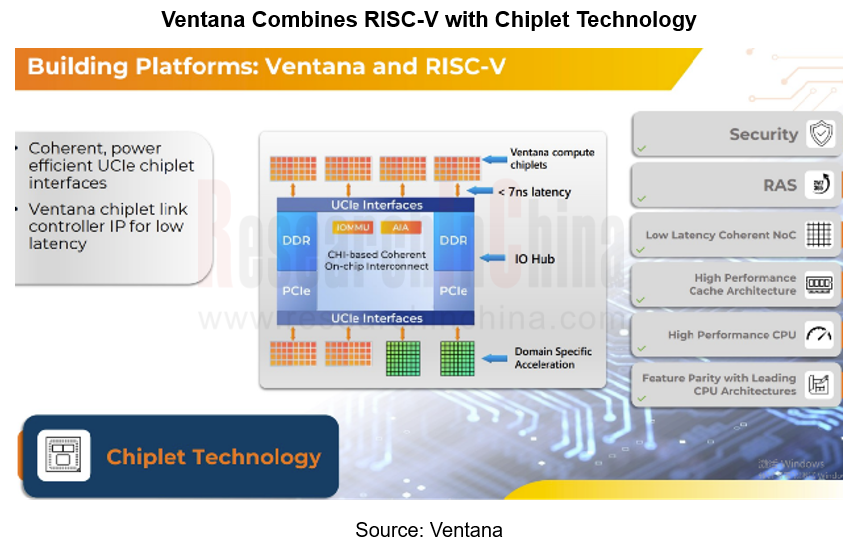

The combination of RISC-V and chiplet technology reduces the cost and threshold of chip design

In order to reduce the cost and threshold of chip design, RISC-V processor development companies and research institutions combine RISC-V with chiplet technology.

Chiplets package specific functional dies into multiple homogeneous and heterogeneous module chips through intra-chip interconnection technology (die-to-die). Chiplet technology can divide a SoC into independent modules and manufacture them separately, thus improving the yield and reducing the design cost.

In November 2023, Ventana Micro Systems Inc. announced Veyron V2, the second generation of its Veyron family of RISC-V processors. The Veyron V2 is the highest performance RISC-V processor available today and is offered in the form of chiplets and IP. The Veyron V2 chiplet features industry leading UCIe chiplet interconnect. Veyron V2’s chiplet-based solutions provide advantages in unit economics, accelerating time to market by up to two years and reducing development costs by up to 75%. Chiplet-based solutions also provide better unit economics by right sizing compute, IO, and memory.

Nuclei System Technology, as a RISC-V CPU IP enterprise, is laying out chiplets. In November 2022, Nuclei System Technology joined the UCIe (Universal Chiplet Interconnect Express) Industry Alliance as China's first RISC-V CPU IP enterprise that did so. Nuclei System Technology will work together with other members of UCIe Industry Alliance around the world to research and apply the specifications of UCIe 1.0 and the next-generation UCIe technical standard, and will carry out hard-core IP R&D based on chiplet interconnection.

On January 9, 2024, the Institute of Computing Technology, Chinese Academy of Sciences (ICT) launched a "big chip" called "Zhejiang". With chiplet design, it includes 16 chiplets with a total of 256 RISC-V cores (each chiplet has 16 RISC-V cores), all of which are programmable and reconfigurable.

The domestic market is potential, and the automotive electronics market is expected to become the next hotspot of RISC-V

MCUs account for approximately 30% of the semiconductor devices used in a car. A traditional car has about 50-100 MCUs, while the number in a smart car will double.

However, the market share of automotive-grade MCUs made in China is less than 5%, which means enormous potential of such MCUs.

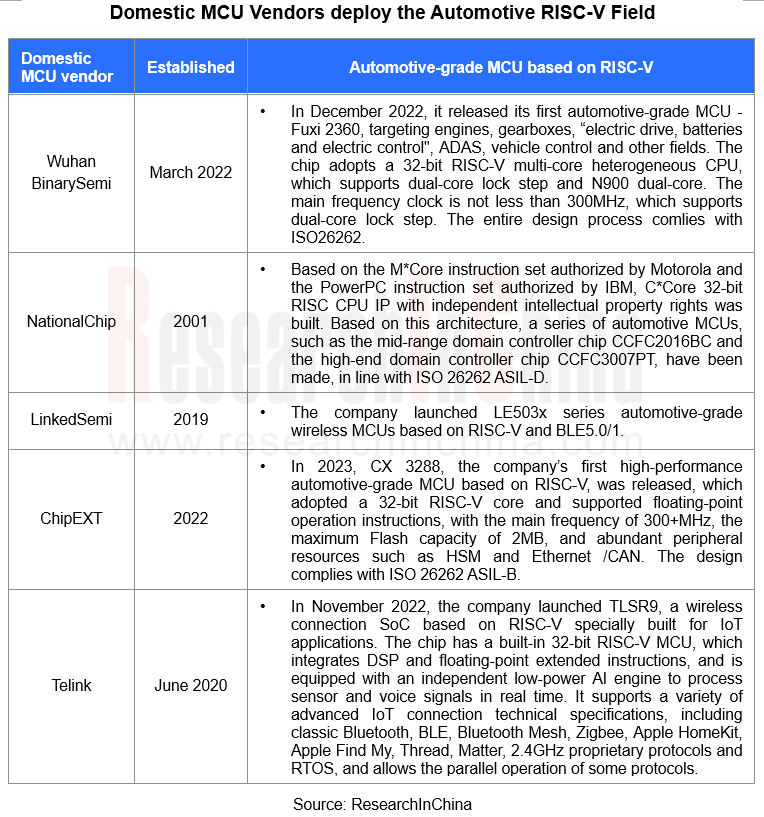

In the past, automotive chips were mainly based on ARM or private architectures of some European chip companies. RISC-V offers more options for the research and development of domestic automotive chips. Its open design enables automotive chip vendors to make specific layout according to their own needs, thus enriching product forms.

In recent years, many domestic automotive-grade MCU vendors have chosen RISC-V to build their own MCUs, including Wuhan BinarySemi, NationalChip, LinkedSemi, and ChipEXT.

Among them, NationalChip will explore the application of RISC-V in medium and high-end MCU chips for automotive electronics. For example, CCFC3010PT, for OBC/DC-DC application in new energy power domain, is NationalChip's first automotive-grade MCU chip based on RISC-V. At the same time, the development of CCFC3009PT, which is an MCU chip designed and developed for the autonomous driving field, will start. It mainly targets the post-processing of ISP and radar signals.

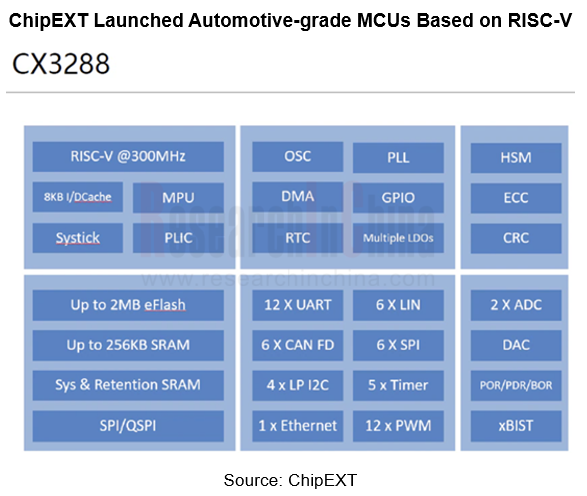

CX3288, the automotive-grade MCU launched by ChipEXT in August 2023, adopts a 32-bit RISC-V core. In line with ISO26262 ASIL-B, it supports SHE (Secure Hardware Extension) and Medium HSM in information and cybersecurity, and bolsters communication encryption and secure startup. It also supports AutoSAR, which can provide MCAL and configuration tool support.

At present, automotive software and tool chains are still fragmented. If an ARM is suitable for all situations, it is difficult to find universality between upper software vendors and operating system and application vendors. Compared with ARM, RISC-V features stronger customization, and its rich extensibility can meet the growing demand of automotive electronic systems in the future. The architecture is free to use, which can reduce the research and development cost and is not restricted by any patent or copyright. Therefore, automotive electronics is expected to become the next hotspot of RISC-V.

Top five automotive chip companies Qualcomm, Bosch, Infineon, NXP, Nordic established Quintauris GmbH in December 2023, focusing on RISC-V. Headquartered in Munich, Germany, the company's CEO is Alexander Kocher (previously served as CEO and president of Elektrobit, an automotive embedded solution provider, and also worked in companies such as Continental, Siemens and Infineon). Initially, the company will pivot on automotive applications, and then gradually expand to mobile devices, Internet of Things chips and other fields.

However, there are two major challenges in making RISC-V get on vehicles. First, it takes a long time to obtain automotive-grade certification. IATF 16949 should be met, chips should comply with ACQ-100, modules should follow ACQ-104 and ISO26262. Second, it is necessary to establish a sound software ecosystem, including a wider range of operating systems and middleware, and more optimization and verification for specific automotive applications.

Domestic OEMs support RISC-V development and actively cooperate with domestic chip vendors

Some domestic OEMs like Dongfeng Motor, BYD and Chery welcome RISC-V and are keenly cooperating with domestic chip vendors.

In May 2022, Dongfeng Motor took the lead in jointly establishing the "Hubei Province Automotive-grade Chip Industry Technology Innovation Consortium" with CICT, Wuhan Lincontrol Automotive Electronic Systems, Wuhan University of Technology, Huazhong University of Science and Technology, Nuclei System Technology, and TKD Science and Technology.

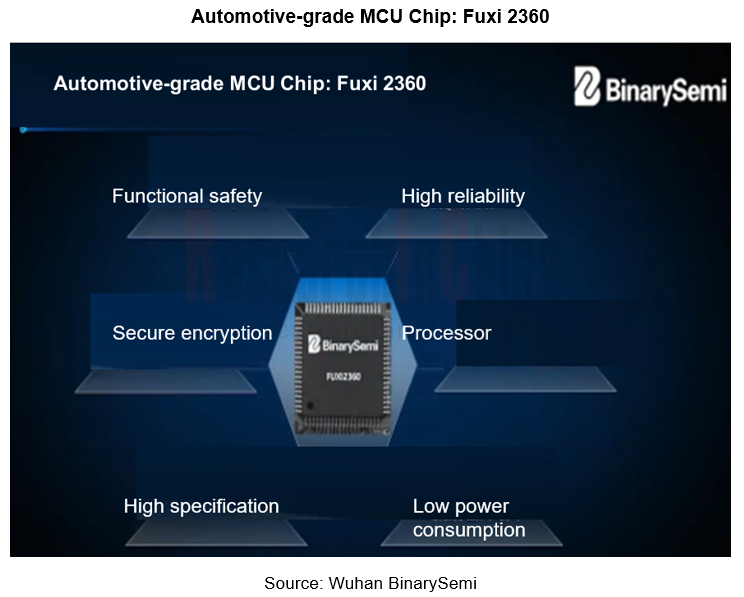

In December 2022, Wuhan BinarySemi, which was invested by Dongfeng Motor, released Fuxi 2360, a high-performance automotive-grade MCU chip based on RISC-V with the NA900 RISC-V multi-core heterogeneous CPU IP from Nuclei System Technology. It can be used in engines, gearboxes, “electric drive, batteries and electric control", ADAS, vehicle control and other fields.

In July 2023, Dongfeng Motor announced that the "Hubei Province Automotive-grade Chip Industry Technology Innovation Consortium”, which was led by it, had realized the trial production of three automotive-grade chips which were rare in China and completed the first domestic automotive-grade MCU chip based on RISC-V.

Chery is cooperating with domestic chip vendors to define the entire test architecture of RISC-V, for example, RISC-V-based clients and RISC-V chip testing standards ensure the reliability of RISC-V chips. In addition to chip testing, Chery conducted safety and reliability tests based on automotive-grade regulations, such as AEC-Q100.

BYD collaborates with Huawei to conduct joint research on the chips of Intel or Qualcomm based on RISC-V.

Global and China Skateboard Chassis Industry Report, 2024-2025

Skateboard chassis research: already used in 8 production models, and larger-scale production expected beyond 2025

Global and China Skateboard Chassis Industry Report, 2024-2025 released by ResearchI...

Two-wheeler Intelligence and Industry Chain Research Report, 2024-2025

Research on the two-wheeler intelligence: OEMs flock to enter the market, and the two-wheeler intelligence continues to improve

This report focuses on the upgrade of two-wheeler intelligence, analyz...

Automotive MEMS (Micro Electromechanical System) Sensor Research Report, 2025

Automotive MEMS Research: A single vehicle packs 100+ MEMS sensors, and the pace of product innovation and localization are becoming much faster.

MEMS (Micro Electromechanical System) is a micro devi...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2024-2025

Cockpit-driving integration is gaining momentum, and single-chip solutions are on the horizon

The Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Repor...

Automotive TSP and Application Service Research Report, 2024-2025

TSP Research: In-vehicle connectivity services expand in the direction of cross-domain integration, all-scenario integration and cockpit-driving integration

TSP (Telematics Service Provider) is mainl...

Autonomous Driving Domain Controller and Central Control Unit (CCU) Industry Report, 2024-2025

Autonomous Driving Domain Controller Research: One Board/One Chip Solution Will Have Profound Impacts on the Automotive Supply Chain

Three development stages of autonomous driving domain controller:...

Global and China Range Extended Electric Vehicle (REEV) and Plug-in Hybrid Electric Vehicle (PHEV) Research Report, 2024-2025

Research on REEV and PHEV: Head in the direction of high thermal efficiency and large batteries, and there is huge potential for REEVs to go overseas

In 2024, hybrid vehicles grew faster than batter...

Automotive AI Agent Product Development and Commercialization Research Report, 2024

Automotive AI Agent product development: How to enable “cockpit endorser” via foundation models?

According to OPEN AI’s taxonomy of AI (a total of 5 levels), AI Agent is at L3 in the AI development ...

China ADAS Redundant System Strategy Research Report, 2024

Redundant system strategy research: develop towards integrated redundant designADAS redundant system definition framework

For autonomous vehicles, safety is the primary premise. Only when ADAS is ful...

Smart Car OTA Industry Report, 2024-2025

Automotive OTA research: With the arrival of the national mandatory OTA standards, OEMs are accelerating their pace in compliance and full life cycle operations

The rising OTA installations facilitat...

End-to-end Autonomous Driving Industry Report, 2024-2025

End-to-end intelligent driving research: How Li Auto becomes a leader from an intelligent driving follower

There are two types of end-to-end autonomous driving: global (one-stage) and segmented (two-...

China Smart Door and Electric Tailgate Market Research Report, 2024

Smart door research: The market is worth nearly RMB50 billion in 2024, with diverse door opening technologies

This report analyzes and studies the installation, market size, competitive landsc...

Commercial Vehicle Intelligent Chassis Industry Report, 2024

Commercial vehicle intelligent chassis research: 20+ OEMs deploy chassis-by-wire, and electromechanical brake (EMB) policies are expected to be implemented in 2025-2026

The Commercial Vehicle Intell...

Automotive Smart Surface Industry Report, 2024

Research on automotive smart surface: "Plastic material + touch solution" has become mainstream, and sales of smart surface models soared by 105.1% year on year

In this report, smart surface refers t...

China Automotive Multimodal Interaction Development Research Report, 2024

Multimodal interaction research: AI foundation models deeply integrate into the cockpit, helping perceptual intelligence evolve into cognitive intelligence

China Automotive Multimodal Interaction Dev...

Automotive Vision Industry Report, 2024

Automotive Vision Research: 90 million cameras are installed annually, and vision-only solutions lower the threshold for intelligent driving. The cameras installed in new vehicles in China will hit 90...

Automotive Millimeter-wave (MMW) Radar Industry Report, 2024

Radar research: the pace of mass-producing 4D imaging radars quickens, and the rise of domestic suppliers speeds up.

At present, high-level intelligent driving systems represented by urban NOA are fa...

Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2024

OEM ADAS research: adjust structure, integrate teams, and compete in D2D, all for a leadership in intelligent driving

In recent years, China's intelligent driving market has experienced escala...