In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

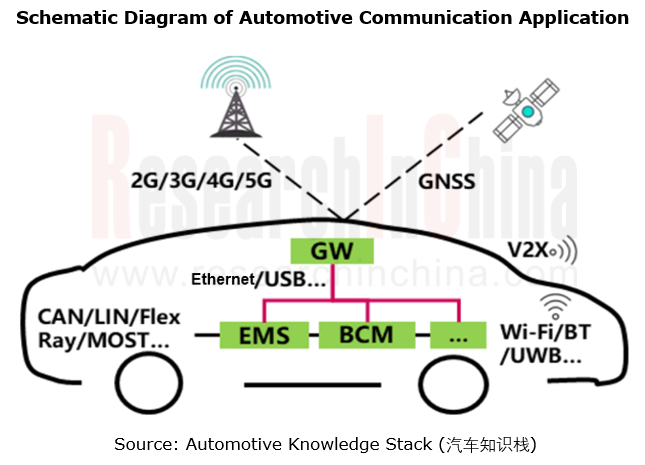

By communication connection form, automotive communication falls into wireless communication and wired communication.

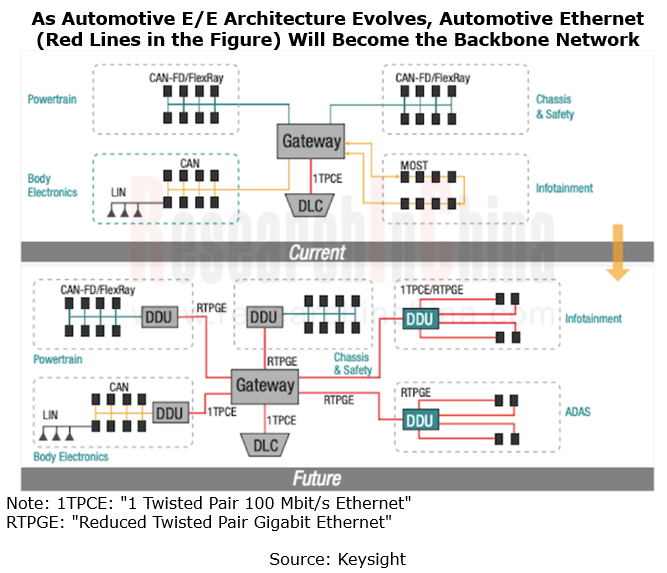

An automotive electronic and electrical system uses a communication network as the carrier to connect electronic devices in a vehicle through wiring harnesses. As automotive E/E architecture evolves and in-vehicle functions become more complex, the increasing number of sensors in a vehicle leads to a surge in vehicle data. This requires very high vehicle real-time communication and data processing capabilities. The automotive Ethernet with high bandwidth, low delay and high reliability therefore will be more suitable for the long-term evolution of future E/E architecture and the high-speed in-vehicle communication.

In the zonal architecture, the centralization of functions allows vehicles to pack far fewer ECUs. At this time, the central computing platform requires extremely high computing power of controllers, but relatively low computing power of zone controllers. To meet vehicle functional safety requirements, automotive Ethernet will become the data backbone link in the zonal architecture for the massive data transmission and migration between central and zone controllers, and the interaction between software and algorithms.

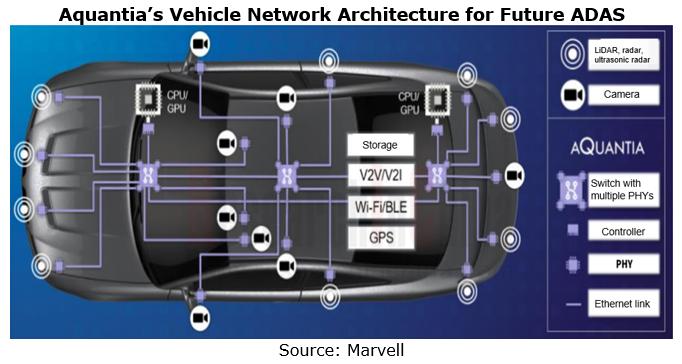

When Ethernet is used as the backbone network for future vehicles, the information interaction between zone controllers is enabled via Ethernet switches. At present, vehicle network communication chip vendors like Marvell, Broadcom and NXP have proposed the next-generation network architecture.

For example, Aquantia (acquired by Marvell) predicts that the vehicle network architecture for future ADAS will have two central computing units (GPU/CPU), and connect all cameras and sensors via three switches, and Ethernet will be adopted for the entire vehicle connection. Each sensor needs to carry a PHY chip, and each switch node also needs to be configured with several PHY chips to input the data transmitted from sensors. Automotive Ethernet involves redundant backup design where hardware functions have a backup or are processed in parallel. Data from cameras and sensors are sent to a central computing unit, while the other central computing unit functions as a backup and take control of the vehicle in case that the former one fails.

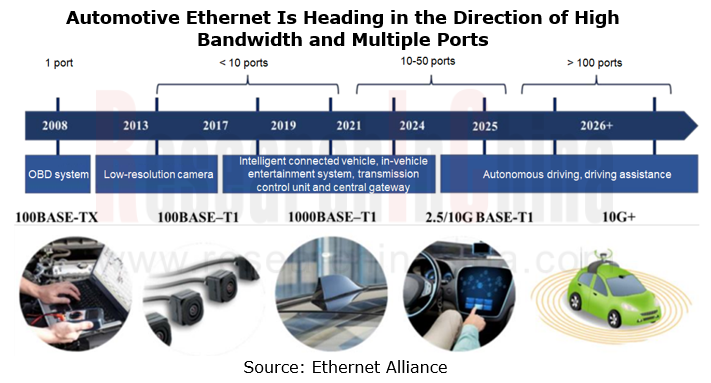

Automotive Ethernet is evolving towards high bandwidth and multiple ports.

Automotive Ethernet chips are led by physical layer (PHY) interface chip and Ethernet switch chip. PHY chips convert digital/analog signals based on the physical layer, and do not process data. Based on the data link layer, switch chips process transmitted data, covering fast forwarding and switching, filtering and classification of data packets.

With the evolution of automotive E/E architecture, automotive Ethernet chips boast an increasing penetration. China’s automotive Ethernet chip market booms. For instance, automotive Ethernet PHY chips are largely used in central computing systems, ADAS and IVI systems. According to the average number of PHY chips per vehicle and the average price of PHY chips, China’s passenger car Ethernet PHY chip market is estimated to be worth RMB5.8 billion in 2022. In the future, as automotive Ethernet penetrates into other vehicle fields, a single vehicle will use more chips, and high-speed PHY chips take a rising share, which will offset the decline in the price of a single chip model. It is conceivable that China’s passenger car Ethernet PHY chip market will be valued at RMB21.87 billion in 2025.

The evolution direction and speed of automotive E/E architecture have an impact on the development direction and speed of future automotive Ethernet. To meet the data transmission requirements (e.g., multi-functional interaction) in intelligent cockpits, automotive Ethernet will head in the direction of high bandwidth and multi-port configurations in the future.

Autonomous driving promotes the development of 10G+ automotive Ethernet.

As autonomous driving technology matures, vehicles have ever higher requirements for real-time performance and sensibility of massive data transmission. In addition, the use of autonomous driving on roads will trigger demand for massive data storage, and the real-time storage of high-definition data from sensors such as cameras and LiDAR requires higher in-vehicle network bandwidth.

The higher the level of autonomous driving, the greater the demand for high-speed vehicle communication network. To meet the requirements of L3 and higher-level autonomous driving, 2.5/5/10G automotive Ethernet will be largely introduced into in-vehicle networks. L4/L5 autonomous vehicles will depend more heavily on automotive Ethernet, and many of them will introduce the 10G+ standard. Therefore, high-speed automotive Ethernet is essential for L3+ autonomous driving.

Most mainstream or emerging automakers have laid out "centralized" E/E architecture in advance, and will apply it in production models during 2023-2025. 10G bandwidth is a must in realization of zonal architecture in 2025. In the 10G automotive Ethernet chip market, only Marvell and Broadcom can provide 10G+ Ethernet switches.

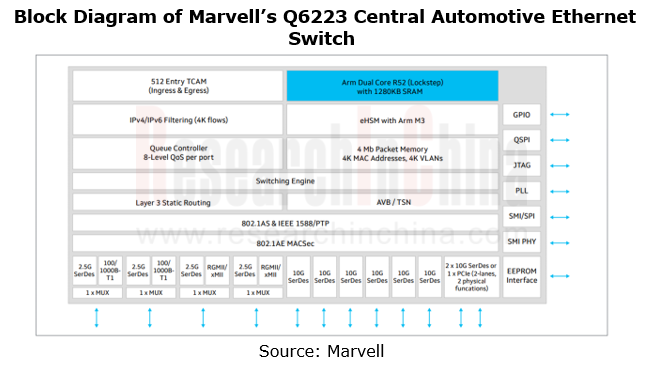

In June 2023, Marvell announced the Brightlane Q622x family of central Automotive Ethernet switches to support the zonal networking architectures of next-generation vehicles. Zonal switches aggregate traffic from devices located within a physical zone of a car like processors, sensors, actuators and storage systems, and is connected to the central computing switch via high-speed Ethernet for information exchange.

Brightlane Q622x switches are single-chip devices, including Q6222 and Q6223:

Brightlane Q6223 delivers 90 Gbps of bandwidth, nearly 2x the capacity of currently available automotive switches. The non-blocking 12-port design can be configured from among the eight integrated 10G SerDes ports, four integrated 2.5G SerDes ports, and two integrated 1000Base-T1 PHYs available.

Brightlane Q6222 contains nine ports for 60 Gbps, with five integrated 10G SerDes ports, four integrated 2.5G SerDes ports, and two integrated 1000Base-T1 PHYs available for selection.

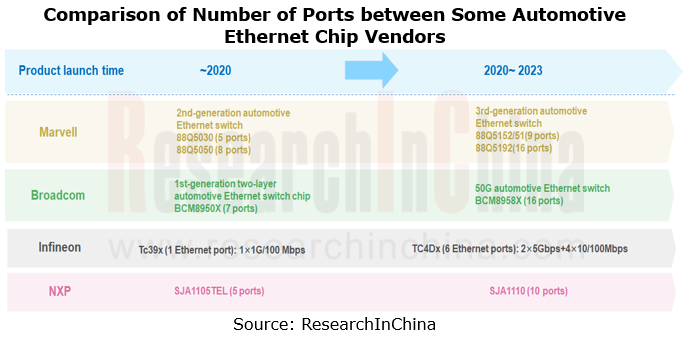

The number of automotive Ethernet ports increases with the evolution of automotive E/E architecture

As automotive E/E architecture evolves, the penetration of automotive Ethernet is on the rise, and the demand for Ethernet node chips will also jump in the future, with over 100 Ethernet ports per intelligent vehicle.

So far, production vehicle do not have many Ethernet ports, which are often used in subsystems such as IVI, in-vehicle communication, gateway, and domain controller. A vehicle network architecture with Ethernet as the backbone has yet to be built. In the future, with the production of models based on zonal architecture, automotive Ethernet will be used much more widely in vehicle network communication architecture, and by then the number of automotive Ethernet communication ports will swell accordingly.

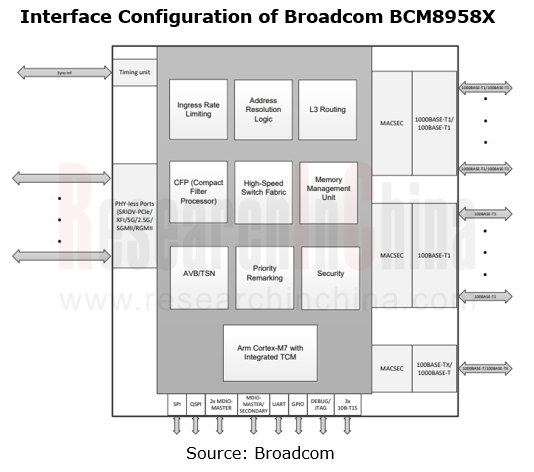

The new products or updated/iterative products released by chip vendors such as Broadcom and NXP tend to have increasing communication ports.

In May 2022, Broadcom announced BCM8958X, a high bandwidth monolithic automotive Ethernet switch device that features 16 Ethernet ports of which up to six are 10 Gbps capable (XFI or PCIe x1 4.0 with SRIOV), as well as integrated 1000BASE-T1 and 100BASE-T1 PHYs.

Research Report on Passenger Car Cockpit Entertainment--In-vehicle Game, 2024

1. In-vehicle entertainment screens are gaining momentum, and Chinese brands rule the roost.

In-vehicle entertainment screens refers to display screens used for entertainment activities such as viewi...

Body (Zone) Domain Controller and Chip Industry Research Report,2024

Research on body (zone) domain controller: an edge tool to reduce vehicle costs, and enable hardware integration + software SOA.

Integration is the most important means to lower vehicle costs. Funct...

China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in ...

Autonomous Driving SoC Research Report, 2024

Autonomous driving SoC research: for passenger cars in the price range of RMB100,000-200,000, a range of 50-100T high-compute SoCs will be mass-produced. According to ResearchInChina’s sta...

Automotive Cockpit Domain Controller Research Report, 2024

Research on cockpit domain controller: Facing x86 AI PC, multi-domain computing, and domestic substitution, how can cockpit domain control differentiate and compete?

X86 architecture VS ARM ar...

Chinese OEMs (Passenger Car) Going Overseas Report, 2024--Germany

Keywords of Chinese OEMs going to Germany: electric vehicles, cost performance, intelligence, ecological construction, localization

The European Union's temporary tariffs on electric vehicles in Chi...

Analysis on DJI Automotive’s Autonomous Driving Business, 2024

Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning syst...

BYD’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Insight: BYD deploys vehicle-mounted drones, and the autonomous driving charging robot market is expected to boom.

BYD and Dongfeng M-Hero make cross-border layout of drones.

In recent years,...

Great Wall Motor’s Layout in Electrification, Connectivity, Intelligence and Sharing and Strategy Analysis Report, 2023-2024

Great Wall Motor (GWM) benchmarks IT giants and accelerates “Process and Digital Transformation”.

In 2022, Great Wall Motor (GWM) hoped to use Haval H6's huge user base to achieve new energy transfo...

Cockpit AI Agent Research Report, 2024

Cockpit AI Agent: Autonomous scenario creation becomes the first step to personalize cockpits

In AI Foundation Models’ Impacts on Vehicle Intelligent Design and Development Research Report, 2024, Res...

Leading Chinese Intelligent Cockpit Tier 1 Supplier Research Report, 2024

Cockpit Tier1 Research: Comprehensively build a cockpit product matrix centered on users' hearing, speaking, seeing, writing and feeling.

ResearchInChina released Leading Chinese Intelligent Cockpit ...

Global and China Automotive Wireless Communication Module Market Report, 2024

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolv...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2024 – Chinese Companies

ADAS Tier1s Research: Suppliers enter intense competition while exploring new businesses such as robotics

In China's intelligent driving market, L2 era is dominated by foreign suppliers. Entering era...

Automotive Gateway Industry Report, 2024

Automotive gateway research: 10BASE-T1S and CAN-XL will bring more flexible gateway deployment solutions

ResearchInChina released "Automotive Gateway Industry Report, 2024", analyzing and researching...

Global and China Electronic Rearview Mirror Industry Report, 2024

Research on electronic rearview mirrors: electronic internal rearview mirrors are growing rapidly, and electronic external rearview mirrors are facing growing pains

ResearchInChina released "Global a...

Next-generation Zonal Communication Network Topology and Chip Industry Research Report, 2024

The in-vehicle communication architecture plays a connecting role in automotive E/E architecture. With the evolution of automotive E/E architecture, in-vehicle communication technology is also develop...

Autonomous Delivery Industry Research Report, 2024

Autonomous Delivery Research: Foundation Models Promote the Normal Application of Autonomous Delivery in Multiple Scenarios

Autonomous Delivery Industry Research Report, 2024 released by ResearchInCh...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies. "Going out”: discussion about regional markets aroun...