Integrated Die Casting Research: adopted by nearly 20 OEMs, integrated die casting gains popularity.?

Automotive Integrated Die Casting Industry Report, 2024 released by ResearchInChina summarizes and studies the status quo of integrated die casting industry and the industry chain products layout of OEMs and suppliers, and predicts the future development trends of the integrated die casting industry.??

?

1. Multiple breakthroughs have been made in the integrated die casting upstream supply chain (die casting machines, molds and non-heat-treatable materials).

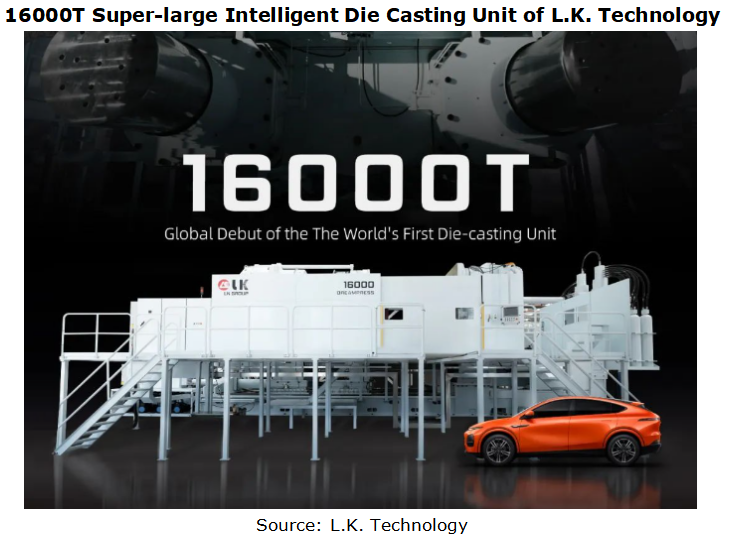

Super-large die casting machine: At present, the tonnage of super-large die casting machines has been increased from 6000T to 16000T, and die casting machine suppliers are developing 20000T die casting machines.

?

Large die casting machines are the basis for automotive integrated die casting. Generally speaking, integrated die casting requires die casting machines with >6000T clamping force. Currently, only IDRA, Brown, Boveri & Cie, L.K. Technology, Haitian Die Casting and YIZUMI can produce 6000T die casting machines. In October 2023, L.K. Technology unveiled a 16000T super-large intelligent die casting unit, making a breakthrough in clamping force increased from 6000T to 16000T in only three years. It is the largest die casting machine in the world so far, and is expected to cover class A0-C and SUV models.???

Now, Tesla, L.K. Technology and Haitian Die Casting among others have started deploying and developing >20000T die casting machines.??

In June 2023, Haitian Die Casting and Chongqing Millison Technologies announced that they would jointly develop 20000T super-large die casting machines.

In December 2023, L.K. Technology and Neta Auto signed a strategic cooperation agreement on joint R&D of >20000T super-large die casting equipment to expand the application of integrated die casting to the chassis of class B vehicles.?

?

Integrated die casting mold: At present, the self-weight of an integrated die casting mold has exceeded 250 tons.

?

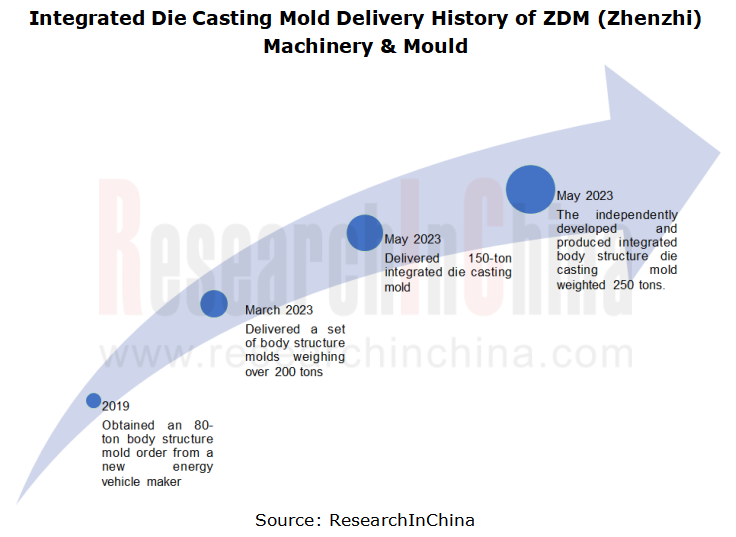

Before 2023, in China only a few mold manufacturers such as GZDM Technology, Ningbo Sciveda Mould (SWD), and ZDM (Zhenzhi) Machinery & Mould had the capacity to produce ultra-large integrated molds. However quite a few companies including Chongqing Millison, Rayhoo Motor Dies, Chongqing Borun Mould Manufacturing and Ningbo Xinlin Mould Technology can produce super-large molds now. Although HLGY and Qixin Mould have yet to mass-produce actual products, they are vigorously making layout.???

?

From the perspective of mold technology, significant breakthroughs have been made in R&D of integrated die casting molds. In 2019 when only having experience in producing 50T molds, ZDM (Zhenzhi) Machinery & Mould secured an order from a new energy vehicle company for a body structure mold weighing 80 tons, which was the largest mold in the world at that time. The integrated body structure die casting mold self-developed by Ningbo ZDM in May 2023 weighs 250 tons and can assist OEMs in integrated die casting of front and rear chassis. From 50T and 80T to current 150T, 200T and 250T, ZDM (Zhenzhi) Machinery & Mould has kept breaking records.?????

Non-heat-treatable materials: domestic manufacturers have embarked on non-heat-treatable materials by way of patent licensing, independent R&D, and cooperation with universities or automakers, accelerating localization.

??

The composition of non-heat-treatable materials is complex. First movers have obvious advantages. Alcoa and Rheinfelden announced their non-heat-treatable materials as early as the 1990s, while China’s first entrant Lizhong Group stepped into the market in 2020. Nowadays, many manufacturers and universities in China, such as Shanghai Yongmaotai Automotive Technology, Hubei Xinjinyang, Weiqiao Pioneering, Suzhou Huijin Smart Technology, Xiaomi, Shanghai Jiao Tong University and Guangdong Hongtu Technology, have acquired non-heat-treatable materials patents by way of independent or cooperative R&D.??????

In August 2023, Xiaomi Automobile secured a non-heat-treatable material patent for "Xiaomi Titans Metal", its self-developed alloy material.

?

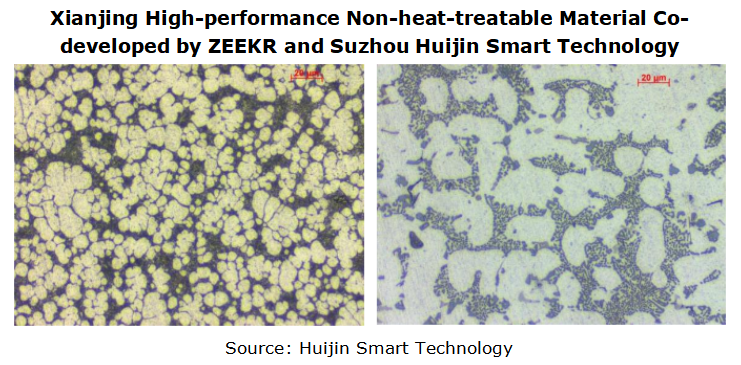

In November 2022, "Xianjing” (fiber crystal), a new non-heat-treatable high-strength high-toughness aluminum alloy material co-developed by ZEEKR and Suzhou Huijin Smart Technology Co., Ltd., officially came into production.??

2. Application of integrated die casting in vehicle body: from rear underbody to front cabins, middle integrated die cast parts and battery trays.?

?

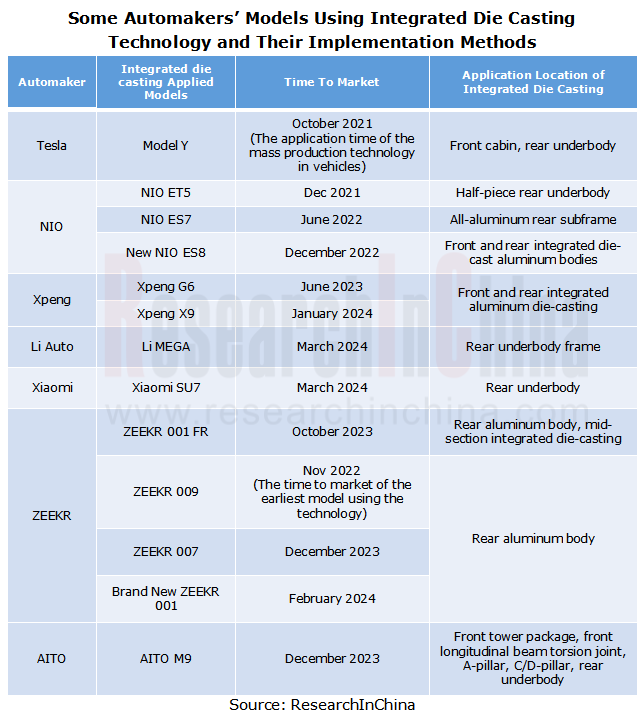

Since Tesla used a 6000T die casting machine to mass-produce the rear underbody assembly for Model Y for the first time in 2020, other automakers in China such as NIO, Xpeng, Li Auto, Xiaomi, ZEEKR, AITO and Neta have also laid out integrated die casting. At present this technology has been adopted in multiple models, and finds application in front cabins and middle integrated die cast parts in addition to rear underbodies.??????

?

As of April 2024, integrated die casting had been used in mass production of rear underbodies, front cabins and middle integrated die cast parts and battery trays, as shown below:???

Rear underbody: Chinese emerging carmakers have gradually realized the mass production of integrated die cast rear underbodies for models such as NIO ET5, Xiaomi SU7, ZEEKR 009/007/ New ZEEKR 001 and AITO M9.?

Front cabin: some automakers can mass-produce front cabin components for models such as new NIO ES8 and Xpeng G6/X9.??

Middle integrated die cast parts: the middle integrated die cast parts for ZEEKR 001 FR has been mass-produced.???

Battery tray: L.K. Technology has mass-produced the world's largest integrated battery tray, which is about 2180*1500*110 in size.

It is expected that integrated die casting will cover battery case upper cover, middle floor, and underbody assembly in 2027. Tesla, FAW and Xpeng already have plans:??

Tesla: it plans to replace the 370-component underbody assembly with 2-3 large die cast parts in 2025. The weight will be reduced by 30% and the manufacturing cost by 40%.?

FAW: in November 2023, the integrated die casting super factory of FAW Foundry Co., Ltd. planned to build a new 9000T die casting unit and processing line. The project mainly produces integrated front cabins, rear underbodies and CTC battery case upper covers for Hongqi's new models E802 and EHS9. With the annual capacity of 85,700 die-cast parts, it is expected to be completed in June 2024.??

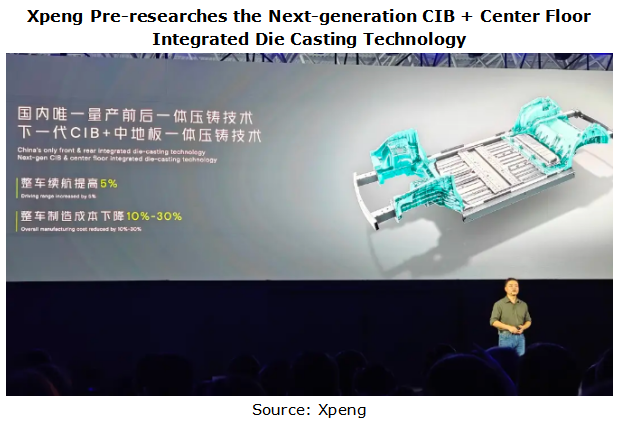

Xpeng: in October 2023, He Xiaopeng revealed that the internal team was pre-researching the next-generation CIB + center floor integrated die casting technology and expanding a 16000T die casting machine which can produce larger die cast parts, such as large-size battery case.

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...

Integrated Battery (CTP, CTB, CTC, and CTV) and Battery Innovation Technology Report, 2025

Power battery research: 17 vehicle models use integrated batteries, and 34 battery innovation technologies are released

ResearchInChina released Integrated Battery (CTP, CTB, CTC, and CTV)and Battery...

AI/AR Glasses Industry Research Report, 2025

ResearchInChina released the " AI/AR Glasses Industry Research Report, 2025", which deeply explores the field of AI smart glasses, sorts out product R&D and ecological layout of leading domestic a...

Global and China Passenger Car T-Box Market Report 2025

T-Box Research: T-Box will achieve functional upgrades given the demand from CVIS and end-to-end autonomous driving

ResearchInChina released the "Global and China Passenger Car T-Box Market Report 20...

Automotive Microcontroller Unit (MCU) Industry Report, 2025

Research on automotive MCUs: the independent, controllable supply chain for automotive MCUs is rapidly maturing

Mid-to-high-end MCUs for intelligent vehicle control are a key focus of domestic produc...

Automotive LiDAR Industry Report, 2024-2025

In early 2025, BYD's "Eye of God" Intelligent Driving and Changan Automobile's Tianshu Intelligent Driving sparked a wave of mass intelligent driving, making the democratization of intelligent driving...

Software-Defined Vehicles in 2025: SOA and Middleware Industry Research Report

Research on automotive SOA and middleware: Development towards global SOA, cross-domain communication middleware, AI middleware, etc.

With the implementation of centrally integrated EEAs, OEM softwar...

Global and Chinese OEMs’ Modular and Common Technology Platform Research Report, 2025

Modular platforms and common technology platforms of OEMs are at the core of current technological innovation in automotive industry, aiming to enhance R&D efficiency, reduce costs, and accelerate...

Research Report on the Application of AI in Automotive Cockpits, 2025

Cockpit AI Application Research: From "Usable" to "User-Friendly," from "Deep Interaction" to "Self-Evolution"

From the early 2000s, when voice recognition and facial monitoring functions were first ...

Analysis on Li Auto’s Layout in Electrification, Connectivity, Intelligence and Sharing, 2024-2025

Mind GPT: The "super brain" of automotive AI Li Xiang regards Mind GPT as the core of Li Auto’s AI strategy. As of January 2025, Mind GPT had undergone multip...

Automotive High-precision Positioning Research Report, 2025

High-precision positioning research: IMU develops towards "domain controller integration" and "software/hardware integrated service integration"

According to ResearchInChina, in 2024, the penetration...