Automotive electronics OEM/ODM/EMS research: top players’ revenue has exceeded RMB10 billion, and new entrants have been coming in.?

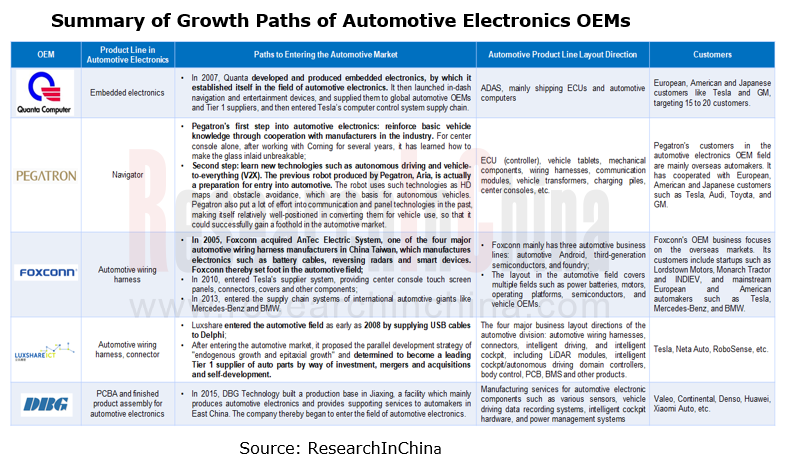

At present, OEMs in the Chinese automotive electronics industry can be roughly divided into three types: those that transform from consumer electronics, including conventional consumer electronics EMS providers such as Luxshare Precision, Flextronics, Wistron and Quanta; assembly manufacturers that focus on automotive electronics, such as Wieson Automotive and Maruhi Electronic; OEM and assembly businesses of Tier 1 suppliers like Joyson Electronic and Hangsheng Electronics.

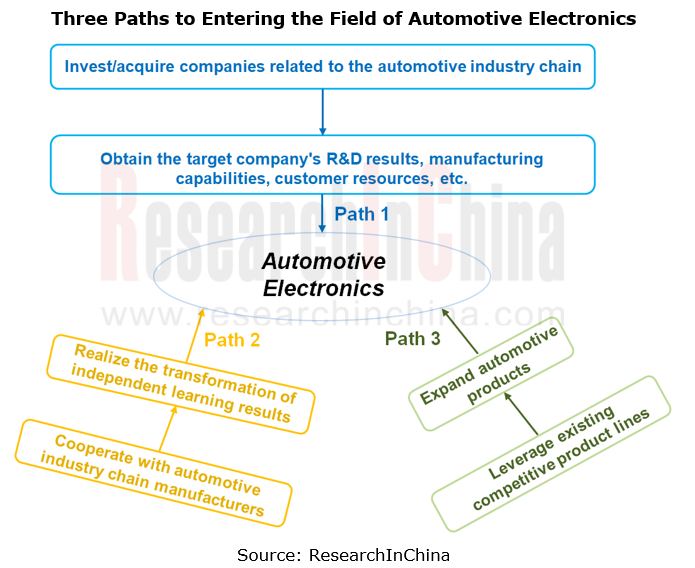

Three paths for OEMs to enter the automotive electronics field

From the summary of the growth paths of some manufacturers entering the automotive electronics field, it can be seen that: most companies participate in the automotive industry chain by acquisition, cooperation and other ways, and acquire core technologies to quicken their pace of entering the automotive industry, make an expansion in the market and improve industry concentration. Manufacturers including Huaqin Technology, Wingtech Technology and Luxshare Precision have established automotive electronics divisions or joint ventures to find new business growth space in the field of automotive electronics.

It takes some time to build up resources required to switch the role from consumer electronics to automotive electronics, and it is unlikely to directly enter the supply of core automotive parts. Therefore most manufacturers that have just begun to dabble in automotive electronics have started with products with low added value and low technical threshold.

Path 1: Take Foxconn as an example. In 2005, Foxconn acquired AnTec Electric System, one of the four major automotive wiring harness manufacturers in China Taiwan, which manufactures electronics such as battery cables, reversing radars and smart devices. Foxconn thereby set foot in the automotive field. In 2010, Foxconn entered Tesla's supplier system, providing center console touch screen panels, connectors, covers and other components. In 2013, Foxconn entered the supply chain systems of international automotive giants like Mercedes-Benz and BMW.

Path 2: Take Pegatron as an example. Pegatron's first step into the automotive electronics field is to cooperate with industry manufacturers to reinforce basic vehicle knowledge. It has then independently learned related new technologies to prepare for a foothold in the automotive electronics market. For instance, Aria, the commercial robot developed by Pegatron, is actually a preparation for entry into automotive, because Aria uses such technologies as HD maps and obstacle avoidance, which are the basis for autonomous vehicles.

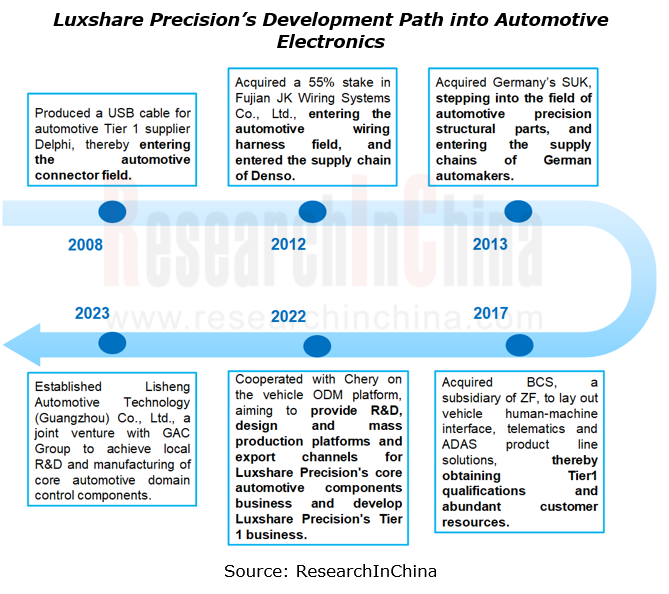

Path 3: Take Luxshare Precision as an example. Luxshare Precision dabbled in the consumer electronics field starting with wire harness OEM and assembly, and gradually expanded to the production of connecting wires, connectors, acoustic and radio frequency devices, wireless charging, electronic modules and other products. Luxshare Precision set foot in the automotive electronics field by the same way as consumer electronics, starting with connectors which it excels at, and then breaking into the automotive electronics field through a range of acquisitions.???

Luxshare Precision stepped into the automotive market as early as 2008 by supplying USB cables to Delphi. After entering the automotive market, it proposed the parallel development strategy of "endogenous growth and epitaxial growth", and has become a Tier 1 supplier of auto parts by way of investment, mergers and acquisitions and self-development. In 2011, Luxshare Precision established Luxshare Precision Industry (Kunshan) Co., Ltd., first developing components businesses like automotive connectors and wiring harnesses; in 2012, Luxshare Precision acquired Fujian JK Wiring Systems Co., Ltd., thereby forging into the automotive connector field, and entered the supply chain of Denso; in 2013, Luxshare Precision further expanded its product lines and customer network and entered the supply chains of German automakers by acquiring Germany’s SUK (SUK is a core supplier of plastic parts for door locks of BMW and Mercedes-Benz).??

The success in the automotive wiring harness and connector product lines has helped Luxshare Precision to expand other automotive products, and has also offered great assistance for it in intelligent cockpit, intelligent driving and other product lines. In recent years, Luxshare Precision has made a gradual expansion from conventional vehicles to new energy vehicles, for example, it collaborated with RoboSense for a foray into the LiDAR market, and teamed up with Chery to enter the vehicle ODM field.

Luxshare Precision's domain controller business mainly adopts OEM (original equipment manufacturer) and JDM (joint design manufacturer) models, with development ideas similar to consumer electronics. In addition, Luxshare Precision dabbles in other automotive products similar to consumer electronics such as wireless charging by partnering with its major clients.?

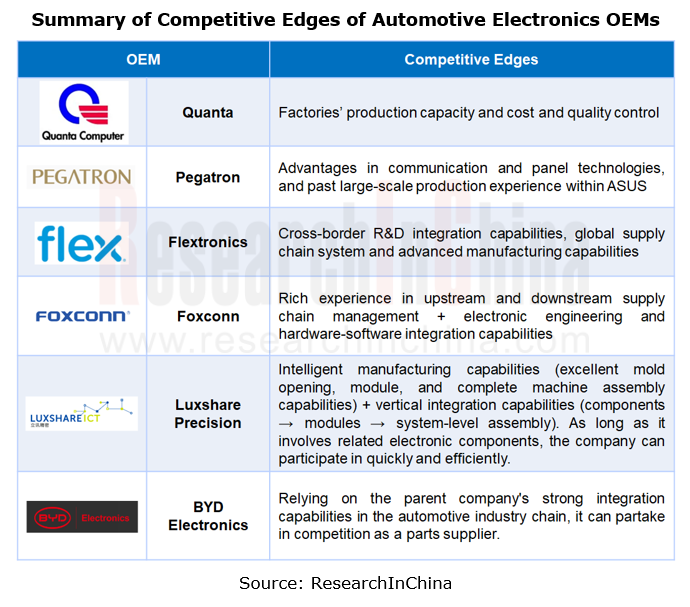

The competitive edges of automotive electronics OEMs: large-scale delivery experience + vertical integration capability.

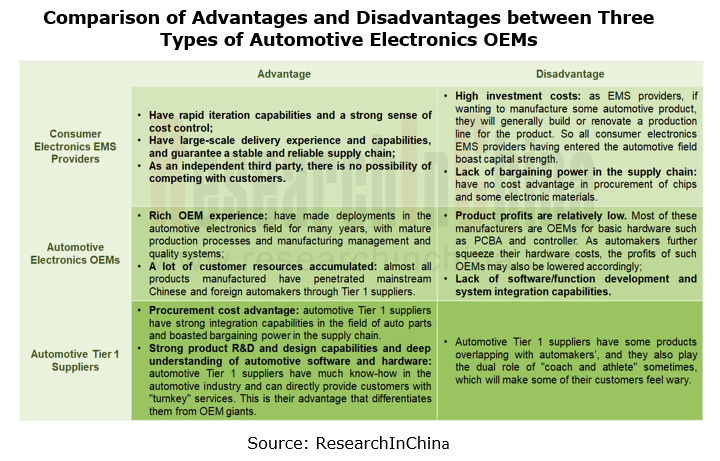

For manufacturers that enter the automotive electronics OEM field from different industries or fields, their original genes determine their competitive edges in the field:

The advantage of consumer electronics EMS providers lies in their large-scale delivery experience gathered in consumer electronics, supply chain management capabilities, and strong sense of cost control;?

Assembly manufacturers that specialize in automotive electronics have mature production processes and manufacturing management and quality systems thanks to their years of deployments in automotive electronics, and have accumulated a lot of customer resources. This is their edge that consumer electronics manufacturers do not have;

For automotive Tier 1 suppliers that are engaged in hardware OEM business, their know-how and product R&D capabilities in the automotive industry are their competitive edges that differentiate them from consumer electronics OEM giants.?

At present, mainstream automakers in China attach ever more importance to companies with experience in consumer electronics when selecting supply chain partners. In particular, the entry of conventional consumer electronics OEM giants has significantly lowered the hardware design and production threshold of auto parts.

These consumer electronics EMS providers with years of efforts have built up rapid iteration capabilities, developed a sense of cost control, gained an edge in supply chain system, and had quick response capabilities and understanding of the ecosystem in consumer electronics. They can well help OEMs to promote and apply new products and new technologies.

The large-scale delivery experience and vertical integration capability are more in favor of manufacturers to secure automotive electronics OEM orders. Moreover the capabilities of supply chain management, quality and cost control, localized quick response, and technology development are all the focus of attention from customers in the automotive industry chain.

In June 2023, Foxconn received orders for electronic control units (ECUs) from Tesla and planned to produce them at the Mexican factory of its Business Group D. The factory of Foxconn (Hon Hai) in Mexico has advantages in mass production scale, personnel, cost and price. Meanwhile nearby supply also allows Hon Hai to better serve the American market and provide stable supply chain support for Tesla in the market. This will also further shorten the delivery time.

?

The growth trend of automotive electronics OEMs: develop from assembly and OEM to high value-added R&D and design links.?

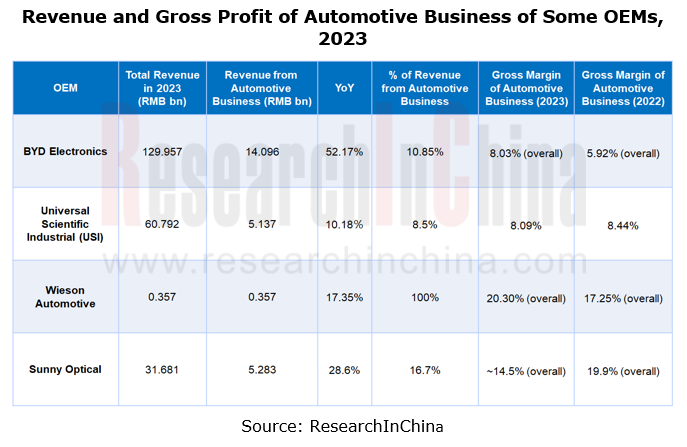

In recent two years, the price war in the Chinese automotive industry has become increasingly fierce, and OEMs have very extremely controlled and squeezed their costs. For OEMs engaged in automotive electronics assembly and processing, their profit margins will be very limited if they only act as hardware OEMs. As seen in the comparison of gross margin of automotive business between some OEMs in 2022 and 2023, the gross margin of each company's automotive business showed a downward trend in 2023.???

For a higher profit margin, some OEMs have worked to develop their product design and R&D capabilities after improving their manufacturing capabilities. They have moved up to the solution design link and even provided overall solutions, thereby gaining more businesses and a say. Because more capabilities are required, they also enjoy a higher gross margin than those which are engaged in OEM business only. Conventional consumer electronics EMS providers such as Flextronics, Quanta, Foxconn, and Luxshare Precision do not stopped at OEM business when making deployments in the intelligent vehicle segment. Instead they improve capabilities and proportion of self-development, and even build in-depth cooperation with automakers.???

Auto Shanghai 2025 Summary Report

The post-show summary report of 2025 Shanghai Auto Show, which mainly includes three parts: the exhibition introduction, OEM, and suppliers. Among them, OEM includes the introduction of models a...

Automotive Operating System and AIOS Integration Research Report, 2025

Research on automotive AI operating system (AIOS): from AI application and AI-driven to AI-native

Automotive Operating System and AIOS Integration Research Report, 2025, released by ResearchInChina, ...

Software-Defined Vehicles in 2025: OEM Software Development and Supply Chain Deployment Strategy Research Report

SDV Research: OEM software development and supply chain deployment strategies from 48 dimensions

The overall framework of software-defined vehicles: (1) Application software layer: cockpit software, ...

Research Report on Automotive Memory Chip Industry and Its Impact on Foundation Models, 2025

Research on automotive memory chips: driven by foundation models, performance requirements and costs of automotive memory chips are greatly improved.

From 2D+CNN small models to BEV+Transformer found...

48V Low-voltage Power Distribution Network (PDN) Architecture and Supply Chain Panorama Research Report, 2025

For a long time, the 48V low-voltage PDN architecture has been dominated by 48V mild hybrids. The electrical topology of 48V mild hybrids is relatively outdated, and Chinese OEMs have not given it suf...

Research Report on Overseas Cockpit Configuration and Supply Chain of Key Models, 2025

Overseas Cockpit Research: Tariffs stir up the global automotive market, and intelligent cockpits promote automobile exports

ResearchInChina has released the Research Report on Overseas Cockpit Co...

Automotive Display, Center Console and Cluster Industry Report, 2025

In addition to cockpit interaction, automotive display is another important carrier of the intelligent cockpit. In recent years, the intelligence level of cockpits has continued to improve, and automo...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2025

Functional safety research: under the "equal rights for intelligent driving", safety of the intended functionality (SOTIF) design is crucial

As Chinese new energy vehicle manufacturers propose "Equal...

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025

AI-Defined Vehicle Report: How AI Reshapes Vehicle Intelligence?

Chinese OEMs’ AI-Defined Vehicle Strategy Research Report, 2025, released by ResearchInChina, studies, analyzes, and summarizes the c...

Automotive Digital Key (UWB, NearLink, and BLE 6.0) Industry Trend Report, 2025

Digital key research: which will dominate digital keys, growing UWB, emerging NearLink or promising Bluetooth 6.0?ResearchInChina has analyzed and predicted the digital key market, communication techn...

Integrated Battery (CTP, CTB, CTC, and CTV) and Battery Innovation Technology Report, 2025

Power battery research: 17 vehicle models use integrated batteries, and 34 battery innovation technologies are released

ResearchInChina released Integrated Battery (CTP, CTB, CTC, and CTV)and Battery...

AI/AR Glasses Industry Research Report, 2025

ResearchInChina released the " AI/AR Glasses Industry Research Report, 2025", which deeply explores the field of AI smart glasses, sorts out product R&D and ecological layout of leading domestic a...

Global and China Passenger Car T-Box Market Report 2025

T-Box Research: T-Box will achieve functional upgrades given the demand from CVIS and end-to-end autonomous driving

ResearchInChina released the "Global and China Passenger Car T-Box Market Report 20...

Automotive Microcontroller Unit (MCU) Industry Report, 2025

Research on automotive MCUs: the independent, controllable supply chain for automotive MCUs is rapidly maturing

Mid-to-high-end MCUs for intelligent vehicle control are a key focus of domestic produc...

Automotive LiDAR Industry Report, 2024-2025

In early 2025, BYD's "Eye of God" Intelligent Driving and Changan Automobile's Tianshu Intelligent Driving sparked a wave of mass intelligent driving, making the democratization of intelligent driving...

Software-Defined Vehicles in 2025: SOA and Middleware Industry Research Report

Research on automotive SOA and middleware: Development towards global SOA, cross-domain communication middleware, AI middleware, etc.

With the implementation of centrally integrated EEAs, OEM softwar...

Global and Chinese OEMs’ Modular and Common Technology Platform Research Report, 2025

Modular platforms and common technology platforms of OEMs are at the core of current technological innovation in automotive industry, aiming to enhance R&D efficiency, reduce costs, and accelerate...

Research Report on the Application of AI in Automotive Cockpits, 2025

Cockpit AI Application Research: From "Usable" to "User-Friendly," from "Deep Interaction" to "Self-Evolution"

From the early 2000s, when voice recognition and facial monitoring functions were first ...